Consumer Price Index, December 2022

Released: 2023-01-17

December 2022

6.3%

(12-month change)

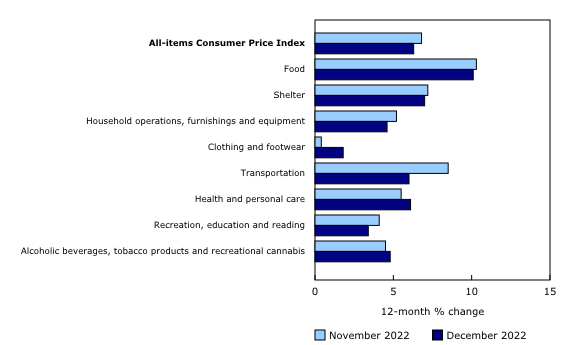

The Consumer Price Index (CPI) rose 6.3% year over year in December, following a 6.8% increase in November.

Excluding food and energy, prices rose 5.3% on a yearly basis in December, following a gain of 5.4% in November.

The headline CPI grew at a slower pace largely due to slower growth in prices for gasoline. Additional deceleration came from homeowners' replacement cost, fuel oil and other owned accommodation expenses, as well as from various durable goods. Slower price growth was offset by increases in mortgage interest cost, clothing and footwear and personal care supplies and equipment.

On a monthly basis, the CPI fell 0.6% in December following a 0.1% gain in November. The monthly decline in December is the largest since April 2020, mostly driven by gasoline prices, which also posted their largest monthly decline since April 2020. On a seasonally adjusted monthly basis, the CPI was down 0.1% in December 2022.

2022 annual review

Today, Statistics Canada publishes the release Consumer Price Index: Annual review, 2022, highlighting the annual average consumer inflation in Canada and the regions in 2022.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

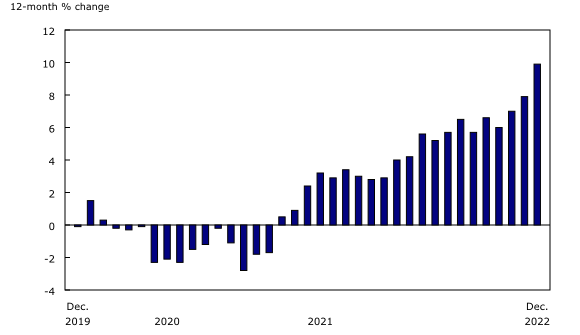

Prices for gasoline and fuel oil fall month over month

Consumers paid 13.1% less at the pump in December compared with November, the largest monthly decline since April 2020. This reflected lower prices for crude oil amid concerns of a slowing global economy, as well as reduced demand following an increase in COVID-19 cases in China. On a yearly basis, prices for gasoline rose 3.0% in December after a 13.7% increase in November.

Lower crude oil prices were also reflected in a 14.8% month-over-month decline in prices for fuel oil and other fuels. On a year-over-year basis, this led to a smaller increase in December (+51.2%) than in November (+73.4%).

Prices for durable goods decelerate

Growth in prices for durable goods slowed to 4.7% year over year in December after a 5.3% increase in November, with prices decelerating for the third consecutive month.

Prices for household appliances rose at a slower pace in December (+2.8%) than in November (+7.4%), the result of the largest month-over-month decline (-4.1%) on record. Similarly, consumers paid 6.4% more, year over year, for furniture, compared with an 8.1% increase in November. These slowdowns in price growth occurred amid easing supply chain pressures and lower shipping costs, as well as softer demand.

For the third month in a row, yearly price growth slowed for passenger vehicles (+7.2%), which may reflect slowing demand for used vehicles.

Homeowners' replacement cost and other owned accommodation expenses continue to grow at a slower pace

On a year-over-year basis, homeowners' replacement cost (+4.7%) and other owned accommodation expenses (+2.5%) continued to slow as the housing market continued to show signs of cooling, putting downward pressure on the CPI.

The mortgage interest cost index continued to put upward pressure on the CPI amid the ongoing higher interest rate environment, rising 18.0% on a year-over-year basis in December following a 14.5% increase in November.

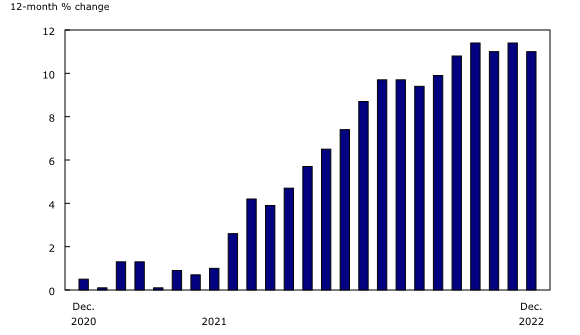

Grocery prices grow at a slightly slower pace

Year over year, prices for food purchased from stores decelerated marginally in December (+11.0%) compared with November (+11.4%), with price growth hovering around 11% for the last five months.

Prices in December rose at a slower pace for a number of food items, including non-alcoholic beverages (+16.6%), bakery products (+13.5%), coffee and tea (+13.2%), other food preparations (+11.5%) and preserved fruit and fruit preparations (+7.2%).

Slowing price growth for groceries was offset by prices for fresh vegetables, which rose 13.6% in December following an 11.2% increase in November. Accelerated price growth was widespread across vegetables, including tomatoes (+21.9%) and other fresh vegetables (+11.7%) amid unfavourable weather in growing regions.

Prices for personal care supplies and equipment continue to grow at a faster rate

Prices for personal care supplies and equipment grew 9.9% year over year in December, the largest increase since February 1983. Price growth has trended upward since April 2021 as a result of broad-based increases among personal soap, toiletry items and cosmetics, oral-hygiene products and other personal care supplies and equipment.

Regional highlights

Year over year, prices rose at a slower pace in December compared with November in all provinces. Prices decelerated the most in Atlantic provinces, largely the result of lower prices for furnace fuel oil, which is commonly used for home heating in Atlantic Canada. Prices for gasoline fell in all provinces but declined the most in Alberta and in Atlantic Canada.

Note to readers

Find the answers to the most common questions about the Consumer Price Index (CPI), including how food prices are collected, how shelter costs are measured, and why revisions to the CPI-common have been larger in recent months.

Upcoming enhancements to CPI-median and CPI-trim

With the release of the January 2023 CPI on February 21, the CPI-trim and CPI-median will be revised back 84 months as per their normal revision policy. Two enhancements are also being made at this time:

1. Statistics Canada will publish, for the first time, index-level data series for the CPI-trim and CPI-median to accompany the year-over-year figures published monthly since December 2016. The change is being made in response to user requests, and to provide users additional flexibility with the data.

2. The seasonal adjustment treatment of step-series indexes that are included in the calculation of the CPI-trim and CPI-median is being enhanced as part of the regular review of methodologies that ensures techniques are improved to produce the most accurate indicators as possible for users.

These enhancements have no impact on the All-items CPI, seasonally adjusted All-items CPI, or the CPI-common.

Additional details can be found in the explanatory note, Enhancements to the publication of core inflation measures based on the trimmed mean (CPI-trim) and the weighted median (CPI-median).

Upcoming enhancement: New approach to estimating the sub-indices of the digital computing equipment and devices index

The computer equipment, software and supplies index and the multipurpose digital devices index, which are sub-indices of the digital computing equipment and devices index, will be updated with an enhanced methodology and new data sources in the coming months. A technical paper describing the new approach will be available on February 21.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on January 30, 2023. For more information, consult the document "Real-time data tables."

Next release

The Consumer Price Index for January 2023 will be released on February 21, 2023.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: