Government finance statistics, third quarter 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2023-01-11

Despite a small deficit, net debt still going down

In the third quarter, the Canadian general government deficit stood at $2.2 billion, following a $10.8 billion surplus in the second quarter.

The net operating balance is the difference between revenues and expenses for a given period and is a summary measure of the sustainability of government operations. When revenues are lower than expenses, a deficit is recorded, while the reverse induces a surplus.

Compared with the third quarter of 2021, revenues were up $16.6 billion (+6.4%) in the third quarter of 2022, mainly due to the increase of $12.0 billion (+6.4%) in tax revenue, while expenses decreased by $0.4 billion despite a $2.7 billion (+15.5%) increase in interest expenses.

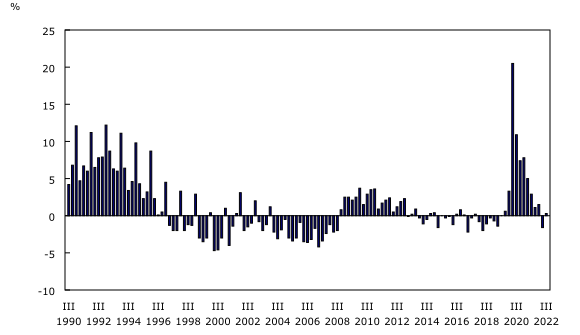

As a percentage of nominal gross domestic product (GDP), the deficit in the third quarter was 0.3%, compared with a surplus of 1.6% recorded in the second quarter. The deficit-to-GDP ratio was lower in recent quarters, following a period of historically high deficits at the height of the COVID-19 pandemic. The sustained nominal GDP growth in recent quarters, combined with the reduction of government spending related to COVID-19 support measures, have both contributed to the improvement in the deficit-to-GDP ratio.

Federal government interest expenses increase

In response to the pandemic, federal government spending surged to historic highs, resulting in large deficits mainly financed by the issuance of new debt securities. In 2022, while COVID-19 transfer expenses decreased significantly, market interest rates rose sharply. Both higher gross debt levels and higher interest rates contributed to the sharp increase in interest expenses. As a result, federal government spending on interest increased to $8.3 billion, up $2.0 billion compared with the third quarter of 2021.

Compared with the same period in 2021, interest expenses incurred by the federal government rose significantly in the first three quarters of 2022 (+24.4%), while the cumulative revenues over this period increased by 4.6%. In the third quarter of 2022, the interest expense to revenue ratio was 8.4%, up from 6.8% a year ago. The interest expense to revenue ratio is nevertheless much lower than what was observed in the early 1990s despite a similar level of gross debt relative to GDP. At that time, the federal government's ratio of interest expense to revenue was around 30.0%, meaning it was devoting 30 cents on interest for every dollar of revenue.

Net debt downward trend continues

Canadian general government net debt, defined as total liabilities less total financial assets, decreased 6.7% from the previous quarter and stood at $607.3 billion at the end of the third quarter. This was the lowest level recorded in almost 30 years.

Compared with the third quarter of 2021, the decrease in net debt was attributable to the increase in the value of financial assets (+$130.8 billion) as well as the decrease in the value of liabilities (-$140.8 billion).

Soaring inflation that led to several hikes in the policy rate in 2022, from 0.25% to 3.25% at the end of the third quarter, also led to a surge in nominal GDP. Therefore, net debt of the Canadian general government as a percentage of GDP was down to 22.2% at the end of the third quarter, from 36.2% in the third quarter of 2021. Excluding social security funds (Canada Pension Plan and Quebec Pension Plan), whose financial assets are intended for the payments of future benefits, the net debt-to-GDP ratio stood at 45.6% in the third quarter of 2022.

Note to readers

Quarterly financial data for the Canadian general government and its subsectors from the first quarter of 1990 to the third quarter of 2022 are now available. These subsectors include the federal government, provincial and territorial governments, local governments and the Canada and Quebec Pension Plans.

Government Finance Statistics (GFS) presents fiscal statistics using the standard developed by the International Monetary Fund. This standard allows consistent aggregation and analysis between participating countries.

Currently, GFS quarterly data are derived by mapping Canada's System of National Accounts data to GFS standards and conventions.

This release of GFS includes revised data from the first quarter of 1990.

Products

Additional information can be found in the Latest Developments in the Canadian Economic Accounts (13-605-X). The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication has been updated with Chapter 9. Government Finance Statistics.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: