Outlook of rural businesses, fourth quarter 2022

Released: 2022-12-20

Inflation continues to be a top concern for rural businesses across Canada, as over 6 in 10 (62.4%) reported that it remained an obstacle in the fourth quarter of 2022. Despite this, the proportion of rural businesses reporting a positive outlook increased since the beginning of the year.

This analysis is based on data from the Canadian Survey on Business Conditions, fourth quarter of 2022, which examines the changing conditions of rural businesses and their expectations for the future.

Rural businesses are more optimistic about their future

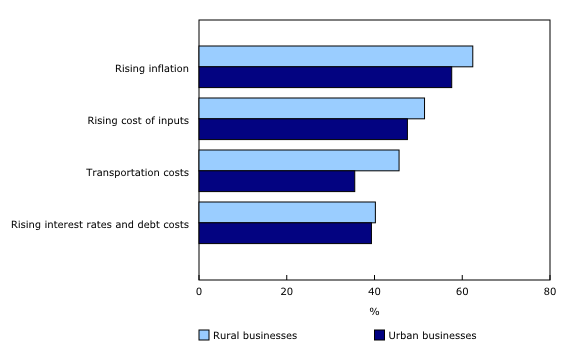

Inflation and supply chain issues continued to be top concerns for businesses across rural Canada in the fourth quarter of 2022. Over three-fifths (62.4%) of rural businesses expected rising inflation to be an obstacle over the next three months. Other short-term obstacles commonly cited by rural businesses included the rising cost of inputs (51.4%), transportation costs (45.6%) and rising interest rates and debt costs (40.2%).

These obstacles were more commonly cited by rural businesses than urban ones, with just over one-third (35.5%) of urban businesses citing transportation costs as a short-term obstacle compared with just under half (45.6%) of rural businesses.

Despite these ongoing obstacles, the share of rural businesses in the fourth quarter of 2022 that reported a very optimistic outlook over the next 12 months increased compared with earlier in the year, climbing from 22.5% in the first quarter of 2022 to 27.6% in the fourth quarter. By comparison, the share of urban businesses that reported a very optimistic outlook was stable, at 22.8% in the fourth quarter compared with 20.8% in the first quarter.

Rural businesses expect to raise prices in response to increasing wages and costs

In the fourth quarter of 2022, more than half (52.1%) of rural businesses expected their average wages to increase over the next 12 months, with 21.2% expecting them to increase by 10% or more. Faced with higher costs, over one-third (34.8%) of rural businesses expected that the selling price of the goods and services they offered would increase over the next three months.

Over half of rural businesses expect supply chain obstacles to continue

In the fourth quarter of 2022, over half (51.9%) of rural businesses reported that supply chain challenges had worsened over the previous three months, with a smaller number reporting that those challenges had stayed the same (44.3%) or improved (3.9%).

Of those businesses that reported that supply chain obstacles had worsened, the majority attributed this to increased delays in deliveries of inputs, products or supplies (84.1%), increased prices of inputs, products or supplies (76.4%), and supply shortages that resulted in fewer inputs, products or supplies (74.2%).

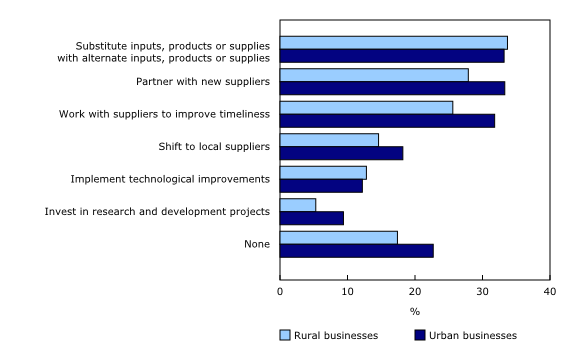

The most common responses rural businesses planned in response to supply chain issues were substituting with alternate inputs (33.7%), partnering with new suppliers (27.9%) or working with suppliers to improve timeliness (25.6%).

Note to readers

This analysis focuses on businesses in rural areas, using fourth quarter 2022 results from the Canadian Survey on Business Conditions. The 2016 Census Subdivision Boundary File was used to identify all businesses' census subdivisions (CSDs) based on location. Businesses located in CSDs classified as either census metropolitan areas or census agglomerations were classified as urban. All businesses in other locations were classified as rural.

This survey was conducted by Statistics Canada from October 3 to November 7, 2022, to develop an understanding of the current practices of businesses and of their expectations moving forward. When respondents were asked questions pertaining to their expectations over the next three months, that three-month period could range over the period from October 3, 2022, to February 7, 2023, depending on when the business responded. Similar date ranges apply to questions pertaining to expectations over the next 12 months.

Products

The full article "The outlook of rural businesses, fourth quarter of 2022" is now available as part of the Rural and Small Town Canada Analysis Bulletin (21-006-X).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: