Food services and drinking places, September 2022

Released: 2022-11-23

$7.2 billion

September 2022

1.6%

(monthly change)

$80.0 million

September 2022

-0.9%

(monthly change)

$31.6 million

September 2022

-1.6%

(monthly change)

$166.4 million

September 2022

-1.3%

(monthly change)

$116.7 million

September 2022

-0.9%

(monthly change)

$1,427.7 million

September 2022

6.6%

(monthly change)

$2,777.6 million

September 2022

-0.4%

(monthly change)

$203.5 million

September 2022

0.9%

(monthly change)

$184.4 million

September 2022

1.3%

(monthly change)

$937.1 million

September 2022

0.6%

(monthly change)

$1,277.8 million

September 2022

2.3%

(monthly change)

$7.9 million

September 2022

2.0%

(monthly change)

$6.2 million

September 2022

2.8%

(monthly change)

$1.7 million

September 2022

-0.6%

(monthly change)

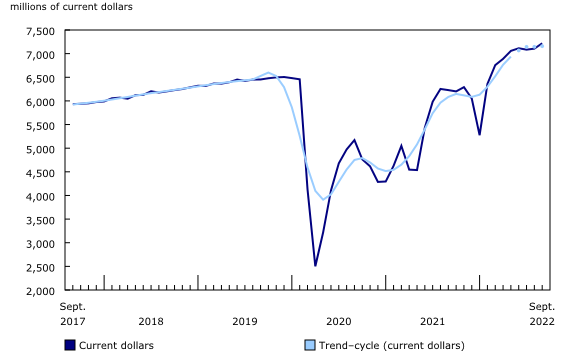

On a seasonally adjusted basis, sales in the food services and drinking places subsector increased by 1.6% to $7.2 billion in September. Higher sales were reported in full-service restaurants (+1.9%), limited-service restaurants (+0.9%), special food services (+4.0%), and drinking places (+1.2%).

Rising inflation in the subsector continues to put upward pressure on menu pricing, causing customers to pay more to dine out. Higher sales in special food services coincided with the increasing trend of returning to work and school, as well as travel.

Five of the provinces reported increased sales. The greatest increase was in Quebec (+6.6%), followed by British Columbia (+2.3%). The largest decrease in dollar terms was in Ontario (-0.4%). The Maritime provinces all had large decreases in percentage terms: Nova Scotia (-1.3%), New Brunswick (-0.9%), Newfoundland and Labrador (-0.9%), and Prince Edward Island (-1.6%).

Further information is available in the "Food Services and Drinking Places Sales" dashboard, where users can consult data on sales in food services and drinking places for Canada and by province and territory. This application allows users to compare provincial and territorial data through interactive maps and charts.

Year-over-year sales in food services and drinking places still increasing

The figures in this section are based on seasonally unadjusted estimates.

Unadjusted sales for September 2022 were up 17.5%, compared with September 2021. Sales were up in each of the sub-sectors, with full-service restaurants (+20.2%) and limited-service restaurants (+10.0%) having the largest increases in dollar terms. Special food services (+48.5%) and drinking places (+28.3%) had the largest percentage increase. Each of the provinces also showed an increase. Ontario (+16.5%) had the largest increase in dollar terms, and Quebec (+20.3%), Alberta (+19.6%), and British Columbia (+19.1%) had the largest percentage increases.

Prices for food purchased from restaurants were up 7.5% in September 2022 compared with September 2021, and prices for alcoholic beverages served in licensed establishments increased by 3.7% over the same period (See Table 18-10-0004-13).

Note to readers

Unless otherwise noted, all data in this release are seasonally adjusted and expressed in current dollars. Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Trend-cycle data are included in selected charts to complement the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Data for the current reference month are preliminary. Usually, unadjusted data are revised for the previous two months, and seasonally adjusted data are revised for the previous three months. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruption.

Find these data and more statistics on the Business and consumer services and culture statistics portal.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: