Energy statistics, August 2022

Released: 2022-11-07

Primary energy production rose 7.7% in August. This was the sixth consecutive monthly year-over-year increase, mainly on the strength of crude oil (+5.1%) and natural gas (+4.8%).

Production of secondary energy products declined slightly by 0.8% year over year in August, as all subsectors posted decreases.

In terms of exports, primary energy increased 5.8% compared with August 2021. Exports of crude oil (+2.9%) and natural gas (+4.2%) both posted gains.

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information website and follow #energynews on social media.

Record crude bitumen production

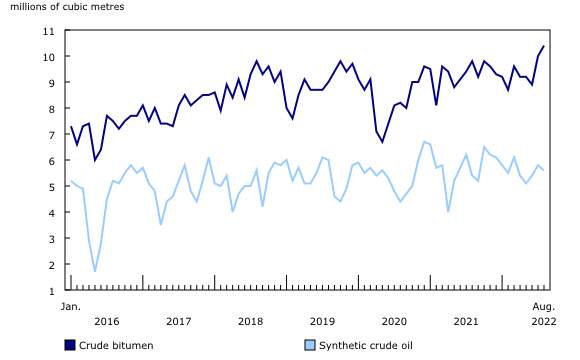

Production of crude oil and equivalent products rose 5.1% to 24.5 million cubic metres in August. This was the second consecutive monthly year-over-year increase, as crude bitumen production reached a new series record.

Driving the overall increase, oil sands extraction grew 4.9% to 16.0 million cubic metres in August. Crude bitumen production sharply increased by 5.7% to 10.4 million cubic metres, the highest level since the start of this data series in 2016. Despite continued maintenance at some upgraders, production of synthetic crude also increased, up by 3.3% to 5.6 million cubic metres.

At the same time, oil extraction rose 5.5% to 6.2 million cubic metres in August. This increase, again driven by production of heavy crude (+11.1%), was the 17th consecutive monthly year-over-year increase. Light and medium crude production also increased, up by 2.7% to 4.0 million cubic metres.

The Raw Material Price Index for crude oil and bitumen was down in August from the previous month, although still up 44.7% from August 2021, as the ongoing war in Ukraine and recent decisions by OPEC to cut global production contributed to higher crude oil prices in the world market.

In August, exports of crude oil and equivalent products rose 2.8% to 18.9 million cubic metres. The overall increase was driven primarily by exports to the United States by pipeline (+4.8%), while exports to the United States by other means (-3.8%) and exports to other countries (-33.0%) were down. Imports of crude were up 8.7% to 3.9 million cubic metres.

Refined petroleum products down despite higher demand for jet fuel

Production of finished petroleum products dropped 1.5% to 9.9 million cubic metres in August. Leading the decline was motor gasoline production (-5.6%) and distillate fuel oil production (-0.8%), resulting in the third consecutive monthly year-over-year decrease. On the other hand, production of kerosene jet fuel rose 13.5% to 0.6 million cubic metres compared with August 2021. The capacity utilization rate for petroleum and coal products was 87.5% in August, down 2.4 percentage points from July.

Production of renewable fuel fell 5.6% to 0.2 million cubic metres in August as ethanol and non-ethanol renewable fuels were down.

Canadian demand for finished petroleum products was up 3.8% to 9.0 million cubic metres in August. The overall increase was driven by higher demand for kerosene jet fuel, which was up 50.1% to 0.8 million cubic metres following a 94.4% increase in July. In August, aircraft movements at Canada's major airports were up 20.0% from the same month a year earlier.

Demand for finished motor gasoline remained nearly flat (+0.1%) in August compared with August 2021, while distillate fuel oil fell 1.7% to 2.7 million cubic metres. Demand for other refined petroleum products rose 7.2% to 1.6 million cubic metres.

According to the Industrial Product Price Index, prices for refined petroleum energy products were up, climbing 51.1% in August from August 2021. The price of most fuel types was up, with jet fuel representing the most significant year-over-year increase.

Imports of finished petroleum products rose 36.9% to 1.0 million cubic metres in August. To meet increased domestic demand, imports of kerosene jet fuel sharply increased by 114.8%. Imports of other refined petroleum products also rose, up 105.0% in August. Exports of refined petroleum products also increased, up 9.5% to 1.6 million cubic metres.

Production and consumption of natural gas increase

Production of marketable natural gas rose 4.8% year over year to 641.6 million gigajoules in August, continuing a series of year-over-year increases which started in March 2021.

Total deliveries of natural gas to the residential, commercial, institutional, and industrial sectors in Canada increased 6.9% year over year to 342.3 million gigajoules in August. A 7.2% rise in industrial deliveries was the main contributor to the increase, totalling 307.9 million gigajoules. Industrial activity continued to rebound from the effects of the COVID-19 pandemic measures, which were in place a year prior. The commercial and institutional sectors (+6.4%) and the residential sector (+2.1%) also contributed to the overall increase in deliveries.

Inventories of natural gas held in Canadian facilities were 4.6% below their level in August 2021 but they had risen 15.0% month over month as inventories continue to be replenished. Injections of natural gas increase the inventory of available natural gas in the warmer months, and withdrawals occur during the colder months to meet the demand for winter heating.

Demand for Canadian natural gas in the United States climbed 4.2% to 264.0 million gigajoules in August, the eighth consecutive month of year-over-year increases. Imports edged up 1.5% to 93.0 million gigajoules.

According to the natural gas price index, Canadians paid 15.4% more for natural gas in August compared with a year earlier. However, prices declined 19.4% from July to August 2022, the third consecutive month-over-month decrease. Prices were at their lowest value since September 2021.

Electricity exports rise to series high

Electricity generation in Canada rose 6.8% year over year to 53.8 million megawatt-hours (MWh) in August. Hydroelectric generation was the most significant contributor to the increase, up 14.5% compared with a year earlier due to higher levels of generation in Manitoba (+109.7%), British Columbia (+34.5%), Newfoundland and Labrador (+11.9%), and Ontario (+10.0%).

In August, hydroelectric generation levels in Manitoba reached their highest level since this series began in January 2016, overtaking the previous high recorded in July 2022. The combination of sharply reduced hydroelectric generation due to drought in 2020 and 2021 and very high levels of generation in 2022 have resulted in the significant year-over-year increases seen in Manitoba in August.

Electricity generated from wind (+4.1%) and solar (+14.4%) also contributed to the overall increase in August, while decreases in generation from combustibles (-5.9%) and nuclear (-0.7%) tempered it slightly.

Electricity consumption across Canada edged up 0.7% in August, as higher demand in Manitoba (+16.8%), British Columbia (+4.1%), and Alberta (+2.9%) was largely counterbalanced by decreases in Ontario (-3.9%), and Quebec (-1.2%).

Exports of electricity to the United States sharply increased by 48.4% to 8.0 million MWh in August. This marked the highest level of exported electricity recorded since this series began in January 2016. Manitoba's exports (+310.1%) reached a series high for the second consecutive month. British Columbia (+77.0%), Ontario (+37.8%), and Quebec (+4.8%) also contributed to the rise. Several American states which rely on imports of Canadian electricity experienced significantly higher than normal temperatures in August. This may have contributed to the strong demand for Canadian electricity.

In August, imports of electricity from the United States fell 37.0% to 827 456 MWh, the lowest level seen since April 2021. A 98.7% drop in imports from Manitoba was primarily responsible for the decrease, as in August 2021, Manitoba had been importing higher levels of electricity to compensate for drought conditions. Imports to British Columbia (-20.5%) and to Ontario (-51.9%) also declined.

Coal production and exports rise

Total coal production in August was 4.4 million metric tonnes. Coal exports numbered 3.3 million metric tonnes, which represented 74.6% of total monthly production.

Coke production fell 11.3% year over year to 143 356 metric tonnes in August.

Note to readers

The consolidated energy statistics table (25-10-0079-01) presents monthly data on primary and secondary energy by fuel type in terajoules (crude oil, natural gas, electricity, coal, etc.) and supply and demand characteristics (production, exports, imports, etc.) for Canada. The table uses data from a variety of survey and administrative sources. Estimates are available starting with the January 2020 reference month. For more information, please consult the Consolidated Energy Statistics Table: User Guide.

The survey programs that support the energy statistics release include the following:

- Crude oil and natural gas (survey number 2198, tables 25-10-0036-01, 25-10-0055-01 and 25-10-0063-01). Data from January 2016 to June 2022 have been revised.

- Energy transportation and storage (survey number 5300, tables 25-10-0075-01 and 25-10-0077-01).

- Natural gas transmission, storage and distribution (survey numbers 2149, 5210 and 5215, tables 25-10-0057-01, 25-10-0058-01 and 25-10-0059-01). Data from June to July 2022 have been revised.

- Refined petroleum products (survey number 2150, table 25-10-0081-01).

- Renewable fuel plant statistics (survey number 5294, table 25-10-0082-01). National estimates of renewable fuel plant statistics are presented by supply and disposition characteristics (production, shipments, inventories, etc.).

- Electric power statistics (survey number 2151, tables 25-10-0015-01 and 25-10-0016-01). Data for July 2022 have been revised.

- Coal and coke statistics (survey numbers 2147 and 2003, tables 25-10-0045-01 and 25-10-0046-01).

Data are subject to revisions. Energy data and other supporting data used in the text are revised on an ongoing basis for each month of the current year to reflect new information provided by respondents and updates to administrative data. Historical revisions are also performed periodically.

Definitions, data sources and methods for each survey program are available under their respective survey number.

The Energy Statistics Program uses respondent and administrative data.

Data in this release are not seasonally adjusted.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: