Payroll employment, earnings and hours, and job vacancies, August 2022

Released: 2022-10-27

$1,170.14

August 2022

3.2%

(12-month change)

$1,145.71

August 2022

2.4%

(12-month change)

$975.54

August 2022

2.8%

(12-month change)

$1,027.02

August 2022

4.7%

(12-month change)

$1,066.62

August 2022

5.7%

(12-month change)

$1,120.40

August 2022

4.6%

(12-month change)

$1,198.79

August 2022

2.6%

(12-month change)

$1,070.27

August 2022

4.8%

(12-month change)

$1,143.55

August 2022

2.2%

(12-month change)

$1,257.16

August 2022

2.9%

(12-month change)

$1,170.23

August 2022

2.4%

(12-month change)

$1,348.75

August 2022

-0.3%

(12-month change)

$1,552.27

August 2022

2.2%

(12-month change)

$1,559.50

August 2022

3.6%

(12-month change)

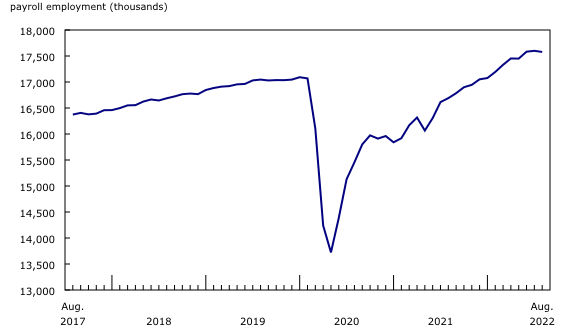

The number of employees receiving pay or benefits from their employer—referred to as "payroll employees" in the Survey of Employment, Payrolls and Hours—fell by 22,200 (-0.1%) in August. The overall payroll employment decline was led by losses in Quebec (-28,100; -0.7%) and Ontario (-13,800; -0.2%), which were partially offset by gains in British Columbia (+8,100; +0.3%) and Manitoba (+2,800; +0.4%).

Payroll employment decreases in the goods-producing sector

Payroll employment in the goods-producing sector fell by 22,400 (-0.7%) in August. Construction (-21,900; -1.9%) recorded the largest decline, followed by mining, quarrying, oil and gas extraction (-1,800; -0.8%). Little change was recorded in the forestry and logging, manufacturing, and utilities sectors.

Meanwhile, payroll employment in the services-producing sector showed little overall change in August. Gains were observed in public administration (+7,300; +0.6%) and professional, scientific and technical services (+5,200; +0.4%), while the largest decline was recorded in retail trade (-8,200; -0.4%).

Payroll employment decreases in construction in August

In the construction sector, payroll employment declined by 21,900 (-1.9%) in August, but was up by 54,900 (+5.2%) compared with August 2021. In total, eight provinces recorded payroll employment declines, led by Ontario (-8,500; -2.1%), Quebec (-5,400; -2.2%), and Alberta (-4,800; -2.7%).

Nationally, 9 of the 10 industries within the sector recorded losses in August, led by foundation, structure, and building exterior contractors (-5,800; -4.3%) and building equipment contractors (-3,700; -1.2%).

Despite the monthly declines, all industries within the construction sector recorded year-over-year gains, with the largest growth observed in building equipment contractors (+12,800; +4.4%) and residential building construction (+10,700; +7.0%).

Payroll employment declines in retail trade

Payroll employment in retail trade decreased by 8,200 (-0.4%) in August, following a slight increase of 1,300 (+0.1%) in July. Ontario (-4,900; -0.7%) and Quebec (-4,100; -0.9%) accounted for the majority of the decline, while British Columbia (+1,300; +0.5%) was the lone province to report an increase.

Nationally, 8 of the 12 subsectors in retail trade recorded payroll employment declines, led by food and beverage stores (-2,800, -0.5%) and clothing and clothing accessories stores (-1,300; -0.7%). Within these subsectors, grocery stores (-2,800; -0.7%) and clothing stores (-1,600; -1.0%) recorded the largest declines.

Payroll employment continues to increase in professional, scientific and technical services

Payroll employment in the professional, scientific and technical services sector increased by 5,200 (+0.4%) in August, following a gain of 7,900 (+0.7%) in July. British Columbia (+2,900; +1.6%) and Ontario (+2,800, +0.6%) recorded the largest gains, while Alberta (-700; -0.5%) and Quebec (-600; -0.2%) posted declines.

Nationally, gains within the sector were concentrated in the computer systems design and related services (+2,900; +0.8%) and management, scientific and technical consulting services (+1,200; +1.1%) industries. Payroll employment in computer systems design and related services has continued to outpace the sector's overall growth rate, bringing the total gain to 65,900 (+21.6%) since September 2021.

Year-over-year growth in average weekly earnings edges up in August, but remains below inflation growth

Average weekly earnings grew 3.2% in August on a year-over-year basis, up slightly from the year-over-year growth of 3.0% in July. Over the same period, year-over-year growth in the Consumer Price Index was 7.0% in August. Growth in average weekly earnings can reflect a number of factors, including changes in wages, in the composition of employment and in hours worked.

In August, on a year-over-year basis, average weekly earnings in both the goods-producing sector (+4.1%) and services-producing sector (+3.2%) increased. In the goods-producing sector, manufacturing (+5.6% to $1,264) and mining, quarrying, oil and gas extraction (+3.7% to $2,317) recorded the largest year-over-year gains, while slower growth was recorded in utilities (+0.1% to $1,943), construction (+3.0% to $1,424) and forestry and logging (+3.0% to $1,343).

In the services-producing sector, finance and insurance (+13.9% to $1,632) and management of companies and enterprises (+10.5% to $1,660) recorded the largest year-over-year growth.

Meanwhile, year-over-year earnings losses were recorded in educational services (-2.4% to $1,149) and information and cultural industries (-1.1% to $1,565). These losses, combined with slower growth in administrative and support, waste management and remediation services (+0.7% to $961), arts, entertainment and recreation (+0.8% to $721), and health care and social assistance (+0.9% to $1,030), moderated the growth in average weekly earnings.

While all provinces recorded year-over-year gains in average weekly earnings in August, the largest increases were seen in New Brunswick (+5.7% to $1,067) and Manitoba (+4.8% to $1,070). National growth in average weekly earnings was slowed down by lower year-over-year gains in Saskatchewan (+2.2% to $1,144), Newfoundland and Labrador (+2.4% to $1,146) and British Columbia (+2.4% to $1,170).

Average weekly hours worked remain unchanged in August

Average weekly hours worked were unchanged in August compared with July and were little changed compared with August 2021. Nationally, arts, entertainment and recreation (-4.5% to 25.5 hours) and management of companies and enterprises (-4.0% to 36.1 hours) recorded the largest year-over-year decreases.

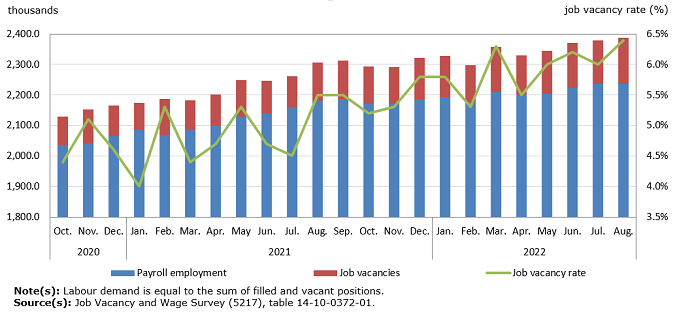

Overall job vacancies little changed in August

In August, job vacancies decreased for the second consecutive month in the professional, scientific and technical services sector, while they held steady in the accommodation and food services, construction and manufacturing sectors. At the same time, the number of vacancies increased in the retail trade sector and reached a new high in the health care and social assistance sector.

Overall, and based on data unadjusted for seasonality, the number of job vacancies across all sectors in August (958,500) was little changed from July (964,000), but remained elevated relative to August 2021 (919,200). Based on data adjusted to remove the effects of seasonal changes, vacancies dropped slightly in the month.

The job vacancy rate, which corresponds to the number of vacant positions as a proportion of total labour demand (the sum of filled and vacant positions), was 5.4% in August, matching the July rate and little changed from August 2021 (5.5%).

Job vacancies decrease in professional, scientific and technical services

The number of job vacancies in the professional, scientific and technical services sector decreased 9.2% (-6,100) to 59,600 in August, the second consecutive monthly decline, and little changed from the previous year. From July to August, the job vacancy rate decreased 0.5 percentage points to 4.8%, its lowest rate since May 2021 (4.6%).

Job vacancies little changed in accommodation and food services, construction, and manufacturing

In the accommodation and food services sector, there were 136,100 vacant positions in August, which is little changed from July, but down 18.0% (-30,000) compared with August 2021. The job vacancy rate was 9.3% in August, the lowest it has been since January 2022 (7.6%), when public health restrictions were in effect to address the outbreak of the Omicron variant of COVID-19. The job vacancy rate in accommodation and food services remained the highest among all sectors in August.

Job vacancies also were little changed in the construction (82,400) and manufacturing (85,600) sectors in August. Job vacancies in these two sectors have remained relatively steady since May 2022.

Job vacancies increase in retail trade

The number of job vacancies in retail trade rose 20.4% (+20,200) to 119,300 in August, largely offsetting the decrease recorded in July (-11.9%; -13,400). Data adjusted to remove seasonal variations indicated that more than half of the increase in vacancies in August was attributable to seasonal patterns. On a year-over-year basis, the number of job vacancies was up 12.5% (+13,200) in August.

Job vacancies reach a record high in health care and social assistance

Employers in health care and social assistance were seeking to fill a record high 152,000 vacant positions in August, up 6.4% (+9,100) from July and up 19.4% (+24,800) from August 2021.

The job vacancy rate in this sector increased to a new high of 6.4% in August, up 0.4 percentage points from July and up 0.9 percentage points from August 2021. While job vacancies increased in August, payroll employment was little changed on a month-over-month basis. Staff shortages in health care and social assistance contributed to many hospitals announcing temporary reductions in some services in July and August, including the temporary closure of some emergency rooms.

Job vacancies little changed in most provinces

While job vacancies were little changed in most provinces in August, they increased in Saskatchewan (+11.2% to 23,800) and New Brunswick (+11.3% to 16,300). Quebec (5.9%) and British Columbia (6.1%) continued to have the highest job vacancy rates among all provinces.

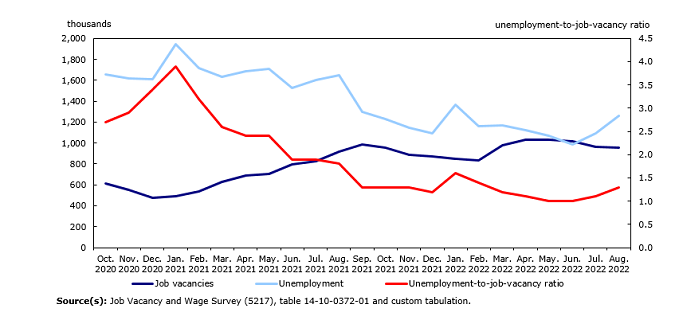

Labour market remains tight in August

While the number of vacancies was little changed in Canada in August, the number of unemployed people increased (+15.4%; +168,100) from July to August 2022. Hence, there were 1.3 unemployed people for every job vacancy in August, compared with 1.1 in July and 1.8 in August 2021.

Due to increases in unemployment in Quebec (+18.5%; +36,700) and British Columbia (+11.7%; +16,800), the unemployment-to-job-vacancy ratio in each of these provinces climbed to 1.0 for the first time since February 2022. In August, the highest unemployment-to-job-vacancy ratio was in Newfoundland and Labrador (3.5).

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Survey of Employment, Payrolls and Hours is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

Survey of Employment, Payrolls and Hours

The key objective of the Survey of Employment, Payrolls and Hours (SEPH) is to provide a monthly portrait of the level of earnings, employment and hours worked, by detailed industry, at the national, provincial and territorial levels.

Payroll employment, as measured by the SEPH, refers to the number of employees receiving pay or benefits (employment income) during a given month. The survey excludes the self-employed, owners and partners of unincorporated businesses and professional practices, and employees in the agricultural sector.

SEPH estimates are produced by integrating information from three sources: a census of approximately 1 million payroll deduction records provided by the Canada Revenue Agency; the Business Payrolls Survey, which collects data from a sample of 15,000 establishments; and administrative records of federal, provincial and territorial public administration employment, provided by these levels of government.

Estimates of average weekly earnings and hours worked are based on a sample and are therefore subject to sampling variability. This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level. Payroll employment estimates are based on a census of administrative records and are not subject to sampling variability.

With each release of SEPH data, data for the preceding month are revised. Users are encouraged to use the most up-to-date data available for each month.

Statistics Canada also produces employment estimates from its Labour Force Survey (LFS). The LFS is a monthly household survey, the main objective of which is to divide the working-age population into three mutually exclusive groups: the employed (including the self-employed), the unemployed and those not in the labour force. This survey is the official source for the unemployment rate, and it collects data on the sociodemographic characteristics of all those in the labour market.

As a result of conceptual and methodological differences, estimates of changes from the SEPH and the LFS differ occasionally. However, the trends in the data are similar. For a more in-depth discussion of the conceptual differences between employment measures from the LFS and the SEPH, refer to Section 8 of the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

Unless otherwise stated, this release presents seasonally adjusted data, which facilitate month-to-month comparisons because the effects of seasonal variations are removed. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Non-farm payroll employment data are for all hourly and salaried employees and for the "other employees" category, which includes piece-rate and commission-only employees.

Unless otherwise specified, average weekly hours data are for hourly and salaried employees only and exclude businesses that could not be classified to a North American Industry Classification System (NAICS) code.

All earnings data include overtime and exclude businesses that could not be classified to a NAICS code. Earnings data are based on gross taxable payroll before source deductions. Average weekly earnings are derived by dividing total weekly earnings by the number of employees.

Job Vacancy and Wage Survey

Beginning with the release of October 2020 data, preliminary monthly estimates from the Job Vacancy and Wage Survey (JVWS) are published on a monthly basis. These estimates provide more timely information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

JVWS collection is done on a quarterly basis. The quarterly sample of business locations is allocated to the three collection months of the quarter, approximately balanced by province and by industrial sector across each of the three months. This allows both quarterly and monthly estimates to be produced.

The JVWS also provides comprehensive quarterly data on job vacancies by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions; offered hourly wages; and job vacancy characteristics. Quarterly data for the second and third quarters of 2020 are unavailable because survey operations were temporarily suspended during the COVID-19 pandemic. More information about the concepts and use of data from the JVWS is available in the Guide to the Job Vacancy and Wage Survey (75-514-G).

Preliminary monthly estimates are produced for job vacancies, job vacancy rates and payroll employment using available responses from business locations sampled in the corresponding reference month. The reference period for the JVWS is the first day of the respective month.

These preliminary monthly estimates are revised and finalized when the corresponding quarterly estimates are released or shortly thereafter. Users are encouraged to use the most up-to-date data available for each month.

Unless otherwise stated, JVWS estimates are not seasonally adjusted. Therefore, month-to-month and quarter-to-quarter comparisons should be interpreted with caution as they may reflect seasonal movements. New experimental data adjusted for seasonality are derived from ongoing work to develop seasonally adjusted JVWS time series. Further information on this ongoing work is available on request.

While JVWS employment is calibrated to the SEPH, SEPH payroll employment and JVWS preliminary monthly employment figures may differ because of calibration grouping and differences in scope and reference period.

Labour Force Survey data used in this Daily release to calculate the unemployment-to-job vacancy ratios are non-seasonally adjusted (unless otherwise indicated).

Real-time data tables

Real-time data tables 14-10-0357-01, 14-10-0358-01, 14-10-0331-01 and 14-10-0332-01 will be updated on November 14, 2022.

Next release

September data for the Survey of Employment, Payrolls and hours (SEPH) and the Job Vacancy and Wage Survey (JVWS) will be released on November 24, 2022.

Products

More information about the concepts and use of the Survey of Employment, Payrolls and Hours is available in the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

The product "Earnings and payroll employment in brief: Interactive app" (14200001) is now available. This interactive data visualization application provides a comprehensive picture of the Canadian labour market using the most recent data from the Survey of Employment, Payrolls and Hours. The estimates are seasonally adjusted and available by province and largest industrial sector. Historical estimates going back 10 years are also included. The interactive application allows users to quickly and easily explore and personalize the information presented. Combine multiple provinces and industrial sectors to create your own labour market domains of interest.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: