Energy statistics, July 2022

Released: 2022-10-07

Primary energy production rose 5.3% in July. This was the sixth consecutive year-over-year monthly increase, mainly on strength of increases in the production of natural gas (+7.7%) and crude oil (+2.3%).

Production of secondary energy products rose slightly (+1.9%) year over year in July, as the refined petroleum products lead the gain (+1.9%).

Exports of primary energy increased 5.8% compared with July 2021. Exports of natural gas (+10.2%) and crude oil (+1.6%) both posted gains.

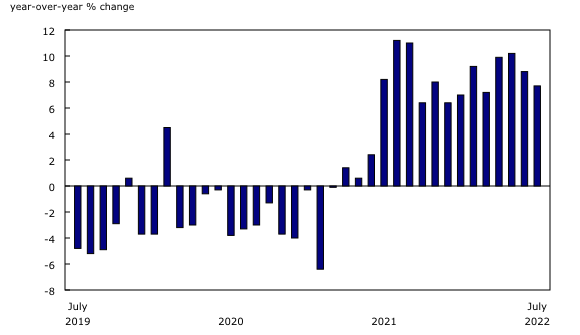

In July, according to the Consumer Prices Index, prices for various energy products continued to rise on a year-over-year basis, albeit at a slower rate compared to the increases seen in previous months. Conversely, month-over-month prices of gasoline posted the largest decline (-9.2%) since the start of the COVID-19 pandemic, based on concerns of a slowing economy and lower demand in the United States.

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information website and follow #energynews on social media.

Crude oil production increases with a new series high for bitumen production

Production of crude oil and equivalent products rose 2.1% year over year to 24.2 million cubic metres in July. Following an intensive maintenance period in the oil sands, turnarounds at most upgraders and mines are now complete.

Oil extraction drove the increase, up 4.4% to 6.1 million cubic metres. This was the sixth consecutive monthly increase in oil extraction as demand for heavy crude at US refineries remained strong. Production of heavy crude rose 8.5%, while light and medium crude oil production was up 2.4% compared with July 2021.

Oil sands extraction also increased, up 1.5% to 15.8 million cubic metres. Following a 2.2% decrease in June due to maintenance at several facilities, production of crude bitumen roared back in July, climbing 6.7% to 10.0 million cubic metres, the highest level since the start of this data series in January 2016. Some bitumen producers likely took advantage of high crude oil prices and spare pipeline capacity to sell more crude oil, due in part to strong demand and lower production of synthetic crude oil (-6.3%) in July, compared with the same month a year earlier.

According to the Raw Material Price Index, prices for crude oil and bitumen rose 49.4% over the month of July compared with a year earlier. While prices remained high, they appear to be easing down from the record-high levels observed earlier in 2022. The war in Ukraine continued to create uncertainty in the global market, forcing many European nations to reevaluate their imports of energy products.

Exports of crude oil and equivalent products remained relatively flat from the previous year, up 1.4% to 19.2 million cubic metres, the highest volume since January. Exports to the United States by pipeline rose 4.0% to 17.2 million cubic metres, while exports to other countries, including some in Western Europe, increased 21.2% to 707,987 cubic metres.

Meanwhile, imports rose to 4.0 million cubic metres (+7.4%) in July, as both input to Canadian refineries (+2.1%) and imports by other sources (+13.8%) were up.

Production and demand for motor gasoline continue to decline

Following a 6.2% year-over-year decline in June, production of finished petroleum products fell again in July, edging down 0.8% to 9.8 million cubic metres. This decline was driven by a 6.8% decrease to finished motor gasoline production from the same month a year earlier, the fourth consecutive monthly year-over-year decline.

On the other hand, production of jet fuel rose 49.4% to 0.6 million cubic metres. Jet fuel production has been sharply increasing in recent months, although representing 82.6% of the level observed before the pandemic in July 2019. Production of distillate fuel oils remained flat, up 0.1% from July 2021. Capacity utilization for petroleum and coal manufacturing was back up to 90.0% following several months of maintenance at various refining facilities.

Production of renewable fuels fell 8.7% in July. Both ethanol (-4.1%) and renewables other than ethanol (-28.1%) observed a decline.

Canadian demand for finished petroleum products rose 3.2% to 8.8 million cubic metres in July. Jet fuel led the increase, up 94.4% to 0.8 million cubic metres. Demand for jet fuel continued to recover from the low volumes observed during the pandemic, and demand was nearly as high (97.6%) as July 2019. Demand for distillate fuel oils was up 7.1% to 2.7 million cubic metres.

Offsetting the overall increase, demand for motor gasoline fell 8.3% to 3.6 million cubic metres. Higher motor gasoline prices due to inflation in 2022 may have led some Canadians to opt out of driving longer distances during the summer. According to the Industrial Product Price Index, the price of motor gasoline was 45.3% higher compared with July 2021. Overall, prices for refined petroleum energy products rose 62.0% from the previous year. While still very high, prices are down from the peak observed in June.

Natural gas production reaches series high

Production of marketable natural gas in Canada rose 7.7% year over year to 643.2 million gigajoules in July, the highest level recorded since this series began in January 2016. High prices and demand continued to drive production, which has increased year over year since March 2021.

Total deliveries to the residential, commercial and institutional, and industrial sectors in Canada increased 1.8% year over year in July to 315.7 million gigajoules. Much of this increase comes from industrial deliveries in Ontario, which saw a 23.7% increase compared with July 2021, when various COVID-19 measures and restrictions were still in place.

Inventories of natural gas held in Canadian facilities rose 16.2% month to month from June 2022. Inventories reached a record low in April 2022 due to cold temperatures during the winter months, and robust export demand which had been diverting some gas that may otherwise have been placed into storage. Although inventory levels continued to be replenished, in July, inventories were 9.3% below their July 2021 level.

Exports of natural gas by pipeline to the United States rose 10.2% to 271.7 million gigajoules. Due to the Russian invasion of Ukraine, the United States has been shipping higher levels of its domestic natural gas to fill demand in Europe. In turn, Canada has been exporting more natural gas to the US. Imports of natural gas from the United States were up 3.3% to 89.4 million gigajoules.

According to the natural gas price index, Canadians paid 31.9% more for natural gas in July compared with a year earlier. At the same time, the price fell 8.3% month over month, the second consecutive monthly decline.

Electricity generation and exports rise year over year

Electricity generation in Canada climbed 3.5% year over year to 51.7 million megawatt-hours (MWh) in July.

Hdroelectricity generation in Canada increased 6.2% in July to 31.1 million MWh compared with the same month a year earlier. The most significant contributor to the overall increase was a sharp increase of 57.1% in hydroelectric generation in Manitoba. This marked the highest level of hydroelectric generation recorded in Manitoba since this series began in January 2016, and it represented a recovery from the drought the province experienced in 2020 and 2021. Higher generation was also reported by Newfoundland and Labrador (+10.9%), Ontario (+3.9%), and Quebec (+0.4%).

Meanwhile, nuclear generation was down in Ontario (-4.4%) and in New Brunswick (-91.2%). In Ontario, the ongoing refurbishment of the Darlington Nuclear Generating Station, scheduled to run until 2026, resulted in lower generation compared with July 2021. In New Brunswick, the Point Lepreau Nuclear Generating Station started to come back online at the end of July, following several months of scheduled maintenance. Nationally, nuclear generation fell 9.4% to 7.4 million MWh compared with July 2021.

Electricity generated from wind turbines (+23.5%) and from solar facilities (+42.3%) also contributed to the overall increase in generation. Although these data series tend to be volatile due to their relatively small size, the rise can be partially attributed to new solar farms and wind turbines in Alberta. The combination of electricity generated from solar and wind accounted for 5.4% of total generation of electricity in Canada.

To compensate for the shortfall in nuclear generation, Ontario recorded a 58.8% climb in its use of non-renewable combustibles, contributing to a national 1.2% increase. Meanwhile, Alberta (-4.4%) and Saskatchewan (-12.7%), which generally rely heavily on non-renewable combustibles for their provincial electricity generation, posted declines in July compared with a year earlier.

Electricity consumption across Canada edged up 0.5% to 45.2 million MWh, as demand rose in Ontario (+2.8%) and Alberta (+3.2%). The overall increase was tempered by a 13.0% drop in demand from British Columbia.

Exports of electricity to the United States sharply increased by 24.8% to 7.5 million MWh. Paralleling the series high for Manitoba's hydroelectric generation, that province's exports rose sharply by 208.9% to reach their highest recorded level since this series began in January 2016, another sign of the recovery from the 2020/2021 drought and Manitoba's return as an electricity exporting province. Ontario (+22.4%) and British Columbia (+15.2%) also increased their exports compared with a year earlier.

In July, imports of electricity were reduced by 3.6% to 966 250 MWh, as Manitoba (-91.2%) and Ontario (-68.3%) imported less, while British Columbia (+18.8%) and Alberta (+21.6%) imported more electricity compared with the same month a year earlier.

According to the electric power selling price index, prices for electricity continued to climb. In July, prices rose 14.9% compared with the same month in 2021. This followed a 6.0% year-over-year increase in June.

Coal production rises

Total coal production was 3.9 million metric tonnes, up 29.1% compared with July 2021. This marked the second monthly year-over-year increase after seven consecutive monthly decreases and the highest level of production since March 2021. Coal exports rose 67.1% to 2.4 million metric tonnes compared with July 2021, which represented 62.1% of total monthly production.

Coke production increased 8.5% year over year to 182 700 metric tonnes in July.

Note to readers

The consolidated energy statistics table (25-10-0079-01) presents monthly data on primary and secondary energy by fuel type in terajoules (crude oil, natural gas, electricity, coal, etc.) and supply and demand characteristics (production, exports, imports, etc.) for Canada. The table uses data from a variety of survey and administrative sources. Estimates are available starting with the January 2020 reference month. For more information, please consult the Consolidated Energy Statistics Table: User Guide.

The survey programs that support the energy statistics release include the following:

- Crude oil and natural gas (survey number 2198, tables 25-10-0036-01, 25-10-0055-01 and 25-10-0063-01). Data from January 2016 to June 2022 have been revised.

- Energy transportation and storage (survey number 5300, tables 25-10-0075-01 and 25-10-0077-01).

- Natural gas transmission, storage and distribution (survey numbers 2149, 5210 and 5215, tables 25-10-0057-01, 25-10-0058-01 and 25-10-0059-01). Data from January 2016 to June 2022 have been revised.

- Refined petroleum products (survey number 2150, table 25-10-0081-01).

- Renewable fuel plant statistics (survey number 5294, table 25-10-0082-01). National estimates of renewable fuel plant statistics are presented by supply and disposition characteristics (production, shipments, inventories, etc.).

- Electric power statistics (survey number 2151, tables 25-10-0015-01 and 25-10-0016-01). Data for June 2022 have been revised.

- Coal and coke statistics (survey numbers 2147 and 2003, tables 25-10-0045-01 and 25-10-0046-01). Data for June have been revised.

Data are subject to revisions. Energy data are revised on an ongoing basis for each month of the current year to reflect new information provided by respondents and updates to administrative data. Historical revisions are also performed periodically.

Definitions, data sources and methods for each survey program are available under their respective survey number.

The Energy Statistics Program uses respondent and administrative data.

Data in this release are not seasonally adjusted.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: