Job vacancies, second quarter 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-09-20

Employers across all sectors in Canada were actively seeking to fill nearly one million (997,000) vacant positions in the second quarter, the highest quarterly number on record. Vacancies were up 4.7% (+45,000) from the first quarter, and 42.3% (+296,500) higher than in the second quarter of 2021 (key indicators from the quarterly Job Vacancy and Wage Survey are seasonally adjusted).

The job vacancy rate—which corresponds to the number of vacant positions as a proportion of total labour demand (the sum of filled and vacant positions)—was 5.7% in the second quarter, also an all-time high. Since the first quarter of 2020, growth in labour demand (+4.2%) has exceeded growth in payroll employment (+1.7%), resulting in record high job vacancies.

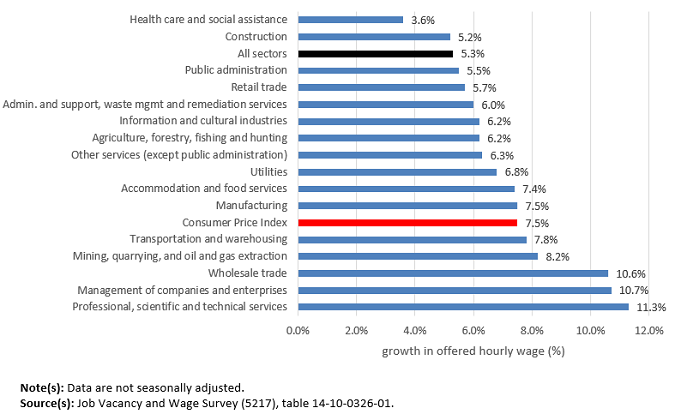

Offered wages increase less than Consumer Price Index

The record-high number of job vacancies in recent months has focused attention on the extent to which unmet labour demand was associated with higher wages. While the Labour Force Survey (LFS) provides information on the wages of employees, the Job Vacancy and Wage Survey (JVWS) includes information on offered wages associated with vacant positions.

Overall, average offered hourly wages increased 5.3% to $24.05 in the second quarter on a year-over-year basis. Over the same period, average hourly wages of all employees (measured in the LFS) rose 4.1%. The Consumer Price Index (CPI) increased 7.5% in the second quarter, compared with the second quarter of 2021.

On a year-over-year basis, offered wages increased more than the CPI in the second quarter in five sectors, including professional, scientific and technical services (+11.3% to $37.05) and wholesale trade (+10.6% to $26.10). In comparison, increases in offered wages were lower than the CPI in the remaining sectors including retail trade (+5.7% to $17.60); construction (+5.2% to $27.30); and health care and social assistance (+3.6% to $25.85). The sectors for which growth in offered hourly wages was on par with or below the CPI accounted for 82.9% of total vacancies in the second quarter of 2022.

Across broad occupations, the highest offered wage growth rates were observed in the service representatives and other customer and personal services occupations (+12.0% to $17.75); professional occupations in natural and applied sciences (+10.6% to $42.85); and occupations in front-line public protection services (+9.7% to $30.40) (not seasonally adjusted).

Job vacancies up in six provinces

On a seasonally adjusted basis, job vacancies rose in six provinces from the first quarter to the second quarter: Ontario (+6.6% to 379,700), Nova Scotia (+6.0% to 22,400), British Columbia (+5.6% to 163,600), Manitoba (+5.2% to 29,300), Alberta (+4.4% to 100,900) and Quebec (+2.4% to 248,100). The number of vacancies decreased in New Brunswick (-6.1% to 15,200) and was little changed in the remaining provinces.

Across the economic regions with more than 10,000 vacant positions in the second quarter, the largest percentage increases in job vacancies from the first quarter were recorded in Banff-Jasper-Rocky Mountain House and Athabasca-Grande Prairie-Peace River (+16.6% to 12,500) in Alberta; Ottawa (+13.1% to 41,300) in Ontario; and Winnipeg (+10.8% to 19,800) in Manitoba.

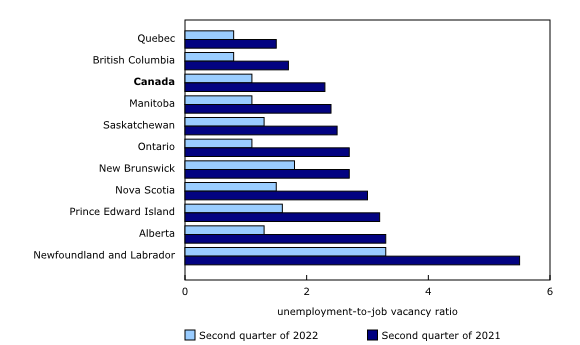

There was an average of 1.1 unemployed people for each job vacancy in Canada in the second quarter, down from 1.3 in the first quarter, and from 2.3 in the second quarter of 2021. While there was less than one unemployed person for every job vacancy in the second quarter of 2022 in Quebec (0.8) and British Columbia (0.8)—the two provinces with the highest job vacancy rates—there were more than three unemployed people for every vacant job in Newfoundland and Labrador (3.3). A lower ratio indicates a tighter labour market and possible labour shortages.

Job vacancies in health care and social assistance remain elevated

There were 136,100 job vacancies in the health care and social assistance sector in the second quarter, little changed from the record high of the previous quarter (135,300), but up 28.8% (+30,500) on a year-over-year basis (seasonally adjusted). The job vacancy rate in the sector was 5.9% for Canada as a whole in the second quarter, and ranged from 3.7% in Saskatchewan to 6.7% in Manitoba (not seasonally adjusted).

Job vacancies held steady across most health occupations in the second quarter. In particular, the number of vacant positions for registered nurses and registered psychiatric nurses (23,600) and licensed practical nurses (10,800) was little changed in the second quarter. The health occupations for which the number of vacancies was virtually unchanged accounted for close to two-thirds (63.0%) of overall vacancies in health occupations (not seasonally adjusted). Lately, staff shortages in the health care sector have led many hospitals to announce temporary reductions in services, including in their emergency rooms.

Job vacancies rise in accommodation and food services

On a quarter-over-quarter basis, vacancies in the accommodation and food services sector rose 12.7% (+16,800) to 149,600 in the second quarter, largely offsetting the decline (-18,800) recorded in the first quarter. While total labour demand in this sector (1,336,800) was 3.6% (-51,600) lower in the second quarter of 2022 than in the first quarter of 2020, payroll employment was down even further (-9.7%; -130,100) over this period, resulting in a large increase (+110.2%; +78,400) in the number of job vacancies in the second quarter of 2022. The job vacancy rate in the sector was 10.9% in the second quarter, the highest across all sectors since the summer of 2021 (seasonally adjusted). Across economic regions, the job vacancy rate was particularly high in Kootenay (19.7%) in British Columbia and relatively low in Edmonton (7.4%) in Alberta (not seasonally adjusted).

The quarter-over-quarter increases in vacancies were spread across many occupations related to this sector, including food counter attendants, kitchen helpers and related support occupations (+29.8% to 79,100); cooks (+37.7% to 29,500); and food and beverage servers (+38.9% to 26,300) (not seasonally adjusted).

Record high number of job vacancies in professional, scientific and technical services

The number of vacant jobs in the professional, scientific and technical services sector reached a high of 74,600 in the second quarter, up 7.9% from the first quarter of 2022 and 79.1% higher than in the first quarter of 2020 (seasonally adjusted). The economic regions of Toronto (21,100) in Ontario, Montréal (10,700) in Quebec, and Lower Mainland – Southwest (which includes Vancouver) (10,500) in British Columbia accounted for over half (56.8%) of vacancies in the sector in the second quarter of 2022 (not seasonally adjusted).

Among occupations related to this sector, vacancies rose in professional occupations in natural and applied sciences (+13.3% to 51,100); technical occupations related to natural and applied sciences (+9.6% to 26,900); and professional occupations in business and finance (+4.5% to 30,300), compared with the first quarter (not seasonally adjusted).

Payroll employment in the sector has been trending upward since the first quarter of 2015, reaching a record high of 1,141,900 in the second quarter of 2022, up 2.3% from the previous quarter and up 15.4% from the first quarter of 2020 (seasonally adjusted).

Job vacancies little changed in retail trade, construction and manufacturing

On a seasonally adjusted basis, the number of job vacancies in the second quarter in retail trade (112,700), manufacturing (85,900) and construction (82,900) was little changed from their respective record highs of the previous quarter. Together with healthcare and social assistance and accommodation and food services, these sectors represented 56.9% of all job vacancies in Canada in the second quarter.

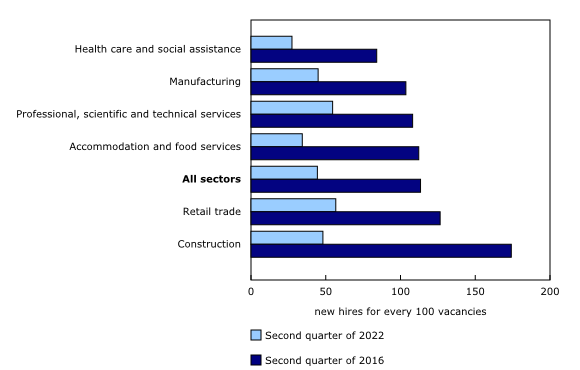

Labour market tightness continues to pose hiring challenges

The ratio of new hires to job vacancies—which corresponds to the number of new hires in a given month measured in the LFS as a proportion of vacant positions at the start of the month measured in the JVWS—can be used as an indicator of the difficulties faced by employers in filling vacant positions, with a lower ratio suggesting a greater degree of difficulty and a lengthier hiring process.

Employers continued to face significant hiring challenges during the second quarter, with 44 newly hired employees for every 100 vacancies. In comparison, there were 113 new hires for every 100 vacancies in the second quarter of 2016 (not seasonally adjusted).

Sectors where the ratio of new hires to vacancies was low in the second quarter of 2022 included health care and social assistance; accommodation and food services; and professional, scientific and technical services.

Next release

July 2022 data for the Survey of Employment, Payrolls and Hours and the JVWS will be released on September 29, 2022. The third quarter of 2022 (July to September) JVWS results, which will provide insights into job vacancies by subsector, vacancies by occupation and offered wages, will be released on December 19, 2022.

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and offered wages by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly.

Estimates by sector are based on the North American Industry Classification System 2017 Version 3.0. Estimates by geographical area are based on the Standard Geographical Classification 2016. Estimates by occupation reflect the National Occupational Classification (NOC) 2016 Version 1.3. The NOC is a four-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: (1) 10 broad occupational categories, also referred to as one-digit NOC; (2) 40 major groups, also referred to as two-digit NOC; (3) 140 minor groups, also referred to as three-digit NOC; and (4) 500 unit groups, also referred to as four-digit NOC.

Because of the COVID-19 pandemic, data collection for the JVWS was suspended for the second and third quarters of 2020.

In January 2020, a new electronic questionnaire was introduced. Minor changes to the content are documented in the most recent Guide to the Job Vacancy and Wage Survey (75-514-G).

Beginning with the reference period of October 2020, preliminary monthly estimates from the JVWS are released on a monthly basis alongside the Survey of Employment, Payrolls and Hours release. These estimates provide information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

The target population of the survey includes all business locations in Canada, excluding those involved primarily in religious organizations and private households. Federal, provincial and territorial, as well as international and other extra-territorial public administrations are also excluded from the survey.

Seasonally-adjusted quarterly job vacancy data are used for the second time in this release and available online (tables 14-10-0398-01, 14-10-0399-01 and 14-10-0400-01). The analyses of the job vacancy levels and rates by sector (10 broad industrial sector groups), one-digit NOC (10 broad occupational categories), province and economic region are based on seasonally adjusted data. However, the analyses of the job vacancy levels and rates by subsector, two-digit NOC, three-digit NOC and four-digit NOC are based on non-seasonally adjusted data.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

Next release

Data on job vacancies from the JVWS for the third quarter will be released on December 19.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region, and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: