Survey of Non-Bank Mortgage Lenders, fourth quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-06-02

Throughout the last quarter of 2021, many housing market indicators remained below the record-setting levels reached in the first half of the year. While non-bank lenders saw a decrease in both the value and number of mortgages extended relative to the third quarter, the total value and number of mortgages extended throughout 2021 surpassed the totals registered in 2020.

Non-banks report decrease in the value of residential mortgages extended

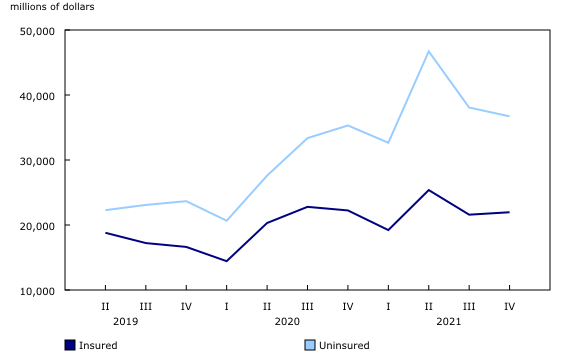

In the fourth quarter of 2021, Canadian non-bank mortgage lenders extended $58.7 billion in mortgages, $1.0 billion less than in the previous quarter and $13.4 billion less than the peak of $72.1 billion registered in the second quarter of 2021. At 221,126, the number of mortgages extended in the fourth quarter represented a decrease of 3.1% relative to the third quarter of 2021 and a decrease of 4.7% year over year. This is broadly consistent with the yearly fluctuations in the number of home sales recorded by the Canadian Real Estate Association for the last quarter of 2021: the number of transactions was down 11.5% in October, 0.7% in November, and 10.9% in December, compared with the same months in 2020.

The quarterly decrease in the value of mortgages extended was driven by uninsured mortgages, which saw a 3.6% decrease. Decreases in the value of uninsured mortgages extended were observed for both credit unions (-5.5%) and other non-bank lenders (-1.1%). This was tempered by a 1.7% increase in the value of insured mortgages extended, primarily driven by other non-bank lenders, who extended $17.3 billion in insured mortgages in the fourth quarter of 2021. This was 5.3% more than they extended in the previous quarter. Credit unions, on the other hand, extended 9.4% less in insured mortgages in the fourth quarter, relative to the third quarter. Quarterly fluctuations in mortgages extended are in part attributable to seasonal variations in mortgage activity.

Despite the moderation observed in the second half of the year, Canadian non-bank lenders extended $242.3 billion in mortgages throughout 2021. This is an increase of $45.6 billion (+23.2%), compared with the value of mortgages extended in 2020.

Shares of insured and uninsured mortgages outstanding continue to diverge

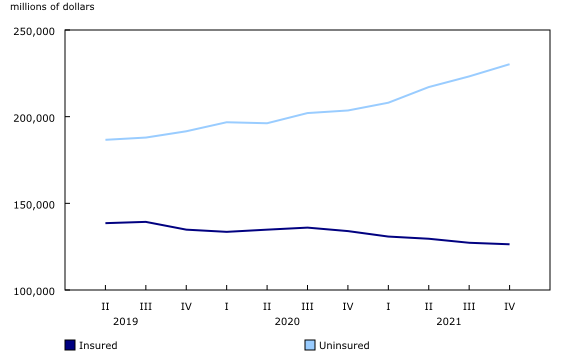

The total value of mortgages outstanding held by Canadian non-bank lenders reached $356.6 billion in the fourth quarter of 2021, which represents roughly one-fifth of the mortgages outstanding held by all Canadian lenders. By comparison, the total value of outstanding residential mortgages held by chartered banks was $1.5 trillion at the end of 2021, more than four times the value of the holdings of non-banks.

The increase in the value of mortgages outstanding was attributable to uninsured mortgages, which saw a quarterly increase in value of 3.2%. Conversely, the value of Canadian non-bank lender holdings of insured mortgages fell by 0.7%. The value of outstanding mortgages increases when mortgages are extended and added to a lender's balance sheet; it decreases when mortgages are repaid or sold to other parties. The insured and uninsured mortgage holdings of non-bank lenders have been diverging since the inception of the survey in the second quarter of 2019—during most quarters, the value of uninsured mortgages grew and that of insured mortgages fell. As a result, the share of uninsured mortgages out of the total value of mortgages outstanding has increased from 57.4% in the second quarter of 2019, to 64.6% in the second quarter of 2021.

The value of mortgages in arrears over 90 days reaches new low

At the end of the fourth quarter of 2021, the value of mortgages in arrears for over 90 days was $677.0 million. This represented a decrease of $137.7 million relative to the previous quarter and the lowest value recorded for this variable since the survey was launched in the second quarter of 2019. The effect of recent increases in the Bank of Canada's policy interest rate may be reflected in the proportion of mortgages in arrears observed in upcoming quarters.

At 0.2%, the proportion of mortgages in arrears for over 90 days out of the total number of outstanding mortgages held by non-bank lenders edged down 0.1% relative to the fourth quarter of 2020. This share is consistent with the 0.2% reported for chartered banks by the Canadian Banker's Association at the end of December 2021.

For more information on housing statistics, visit the Housing Statistics portal.

Note to readers

The Survey of Non-Bank Mortgage Lenders is a recent initiative to collect information at the national level. It will help complete the overall picture of the residential mortgage market in Canada. Until recently, residential mortgage data from non-bank lenders were collected only by some organizations at the provincial level, for certain industries, and in varying levels of detail.

The survey covers non-bank residential mortgage lenders, such as local credit unions, mortgage finance companies, trusts, insurance companies, mortgage investment corporations and private lenders. The entities included are not only those that issue residential mortgages, but also those that purchase them.

Please refer to the Survey of Non-Bank Mortgage Lenders, third quarter 2021 release for quarterly comparisons.

Some figures may not add up to 100% as a result of rounding.

Data are not seasonally adjusted.

Please note that no imputation was performed on the data in Table 2. This information should be associated with Table 1 with caution.

Data from the second quarter of 2019 to the fourth quarter of 2021 are available by request.

Definitions

Outstanding mortgages are the mortgage balances remaining on the lender's balance sheet as of the end of the quarter.

Mortgages extended are the mortgages approved, issued and added to the balance sheet during the quarter.

Mortgages in arrears are mortgage loans with payments overdue at the end of the quarter.

Mortgages deferred are mortgages for which an agreement is in place between the lender and the borrower to pause or suspend a borrower's mortgage payments and other accommodations for a specified period of time. Statistics Canada began to collect data on deferred residential mortgages in the second quarter of 2020.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: