Provincial and Territorial Natural Resources Satellite Account, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-05-27

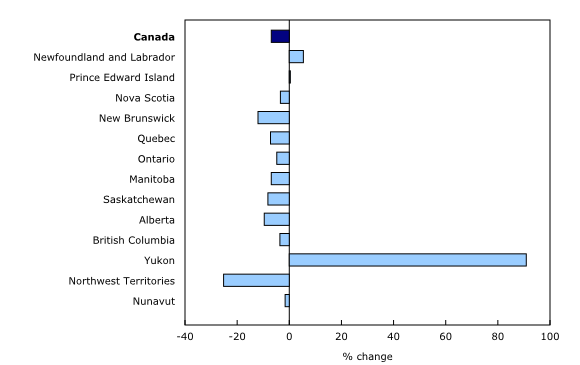

Real gross domestic product (GDP) of the natural resources sector fell in all provinces and territories except Newfoundland and Labrador (+5.4%), Prince Edward Island (+0.5%) and Yukon (+90.8%) in 2020. The large growth in Yukon is due to increased extraction in metallic minerals, influenced by high gold prices and low fuel costs.

Nationally, natural resources real GDP decreased 6.9% compared with a 5.1% decrease in economy-wide real GDP, suggesting that natural resource activities, especially extraction, were more heavily impacted by the COVID-19 pandemic when compared with the total economy.

Natural resources real gross domestic product declines

Real GDP of the energy subsector fell 7.7% due to declines in all provinces except Newfoundland and Labrador. The national decrease was led by a 19.9% fall in services and a 12.0% decrease in refined petroleum products. The decreases were due to pandemic-related restrictions on non-essential businesses and decreased demand due to global travel restrictions.

Real GDP of the forestry subsector fell 5.5%, led by a 10.8% decrease in primary pulp and paper products and a 5.0% fall in primary wood products. Real GDP of the subsector fell significantly in New Brunswick (-12.7%), Quebec (-7.0%), and British Columbia (-5.0%) due to frequent shutdowns of businesses related to the pandemic and weak international demand.

Real GDP of the minerals and mining subsector fell 5.8%, with extraction activities falling by 3.6% led by a 19.5% decrease in coal extraction. This decrease was concentrated in major coal extraction provinces: Alberta (-36.2%) and British Columbia (-17.4%). This decline was related to global shifts away from electricity generation using coal to combat climate change as well as reduced industrial steel output due to the pandemic. The subsector was also impacted by a 10.9% decrease in primary manufacturing, as pandemic-related restrictions disrupted mining supply chains.

Real GDP of the hunting, fishing and water subsector remained steady (-0.0%) in 2020.

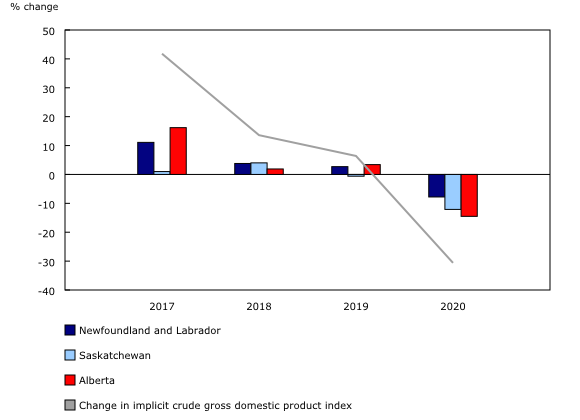

Energy-rich Alberta contributed 31.8% to the overall natural resources nominal GDP. Other top contributors to national natural resources GDP included Ontario (20.2%), Quebec (16.2%), British Columbia (13.3%), Saskatchewan (7.5%), and Newfoundland and Labrador (4.1%). The share of natural resource activity to overall provincial economic activity was 23.1% for Alberta and was similarly important to Newfoundland and Labrador (28.8%) and Saskatchewan (21.3%), while it complemented other industries in British Columbia (9.5%) and Quebec (8.0%). Ontario had a smaller share (5.1%), reflecting the size and scope of its provincial economy.

Among the territories, the natural resources share of GDP was highest in Nunavut (34.4%), followed by Northwest Territories (19.5%) and Yukon (13.8%).

Export and import volumes fall

Natural resources international exports (-19.9%) and imports (-18.0%) fell in 2020. The energy (-34.5%), hunting, fishing and water (-12.8%), minerals and mining (-3.1%), and forestry (-0.4%) subsectors fell due to export transportation constraints from rail blockades erected in February 2020 coupled with weak international demand.

International imports of the energy (-35.6%), hunting, fishing and water (-18.5%) and forestry (-6.6%) subsectors fell, reflecting weak domestic demand resulting from the pandemic.

In the minerals and mining subsector, international imports rose 1.7% due to increased import prices of metallic minerals.

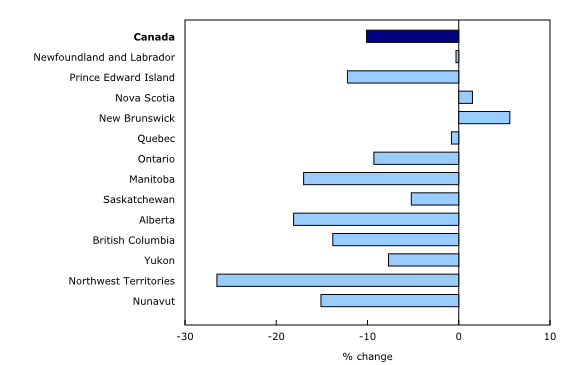

Employment

Employment fell across all subsectors: energy (-35,900 jobs), forestry (-15,500 jobs), minerals and mining (-8,800 jobs), and hunting, fishing and water (-3,000 jobs). These decreases were due to shutdowns of non-essential businesses and very low resource prices in the wake of the pandemic. These losses were led by Alberta (-31,500), Ontario (-14,000), primarily in the energy subsector, and British Columbia (-11,900), with most losses in the forestry subsector. New Brunswick (+900) and Nova Scotia (+100) offset job losses in the forestry subsector, with employment gains in the energy sector related to electricity generation.

2021 Look Ahead

While 2021 provincial data are not available, the estimates from the Quarterly Natural Resources Indicators program indicate a recovery of 7% in Real Natural Resources GDP in 2021, including a 5% increase in the energy subsector. This recovery should be reflected in provinces with significant Natural Resources sectors. This aligns with data published in the Gross domestic product by industry: Provinces and territories, 2021 release, which indicated an average real GDP growth rate in provinces with significant natural resources sectors of 5%.

Note to readers

Data on provincial and territorial natural resources for 2020 and 2019 have been released along with revised data back to 2016.

The natural resource indicators provide annual indicators for the main aggregates in the Natural Resource Satellite Account (NRSA), namely, gross domestic product, output, exports, imports, and employment. The estimates from this account are directly comparable to the estimates in the Canadian System of Macroeconomic Accounts.

Core Natural Resources: The NRSA defines natural resource activities as those which result in goods and services originating from naturally occurring assets used in economic activity, as well as their initial processing (primary manufacturing).

Downstream Activities: Although not part of the core account, natural resources have important downstream effects on other sectors. In general, this production uses a large portion of primary manufactured products as inputs.

Products

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

Additional information can be found in the articles "The Natural Resources Satellite Account: Feasibility study" and "The Natural Resources Satellite Account – Sources and methods," which are part of the Income and Expenditure Accounts Technical Series (13-604-M).

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: