Canada's 2021 Census of Agriculture: A story about the transformation of the agriculture industry and adaptiveness of Canadian farmers

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-05-11

The agriculture industry is one that must always adapt quickly to multiple challenges, such as extreme weather events, trade disputes and fluctuating prices. More recently, the COVID-19 pandemic added to these challenges in the form of labour shortages, disruptions in the food supply chain, and rising input prices. All of these issues play a role in the well-being of farm operators. In view of these challenges, collecting information about the status and resiliency of the agricultural sector is important.

Today, Statistics Canada is releasing results from the 2021 Census of Agriculture, which provides new information about emerging trends and issues faced by farm operators in Canada. Statistics Canada owes a debt of gratitude to Canadian farmers who took the time to answer the Census of Agriculture questions in these difficult times.

Data from the Census of Agriculture indicate that trends identified in previous census cycles, such as industry consolidation and aging of farm operators, have continued in 2021. At the same time, the agriculture industry is adapting and modernizing, with higher rates of technology adoption, renewable energy production, use of direct marketing solutions, and sustainable farming practices.

In addition, the 2021 Census of Agriculture shows that livestock inventories and acreage for prominent crops have remained quite stable and even increased modestly since 2016, suggesting that farmers have proven to be resilient in the face of COVID-19 challenges. The industry has also been characterized by the emergence of niche sectors, as evidenced by the increase in the total reported area for greenhouses.

In 2021, the Census of Agriculture counted 189,874 farms, a moderate decrease of 1.9% from 2016. While farms in Canada reported a 3.2% decrease in total farm area from 2016, the total area for hay and field crops increased slightly, by 0.3%, to 92.9 million acres in 2021. The number of head reported for major livestock categories has also increased modestly since 2016.

Farms classified as oilseed and grain continue to make up the largest proportion of farms in Canada. In 2021, there were 65,135 oilseed and grain farms, accounting for 34.3% of total farms. This was followed by beef and feedlots (20.9%). Meanwhile, 82.7% of total farm area was accounted for by these two sectors, totalling 127.1 million acres.

Over the next few months, Statistics Canada will continue to present data trends on issues faced by the Canadian agriculture industry, and introduce new ways to access the Census of Agriculture data, including information about local trends.

Change in the farm definition

A significant conceptual change to the main statistical unit used by Statistics Canada's Agriculture Statistics Program has been introduced for the 2021 Census of Agriculture: a "farm" or an "agricultural holding" (i.e., the census farm) now refers to a unit that produces agricultural products and reports revenues or expenses for tax purposes to the Canada Revenue Agency. Before 2021, a "farm" was defined as an agricultural operation that produced at least one agricultural product intended for sale. The change in the new farm definition may result in farms being classified differently across farm types than in previous censuses. As a result, comparisons with earlier census results should be interpreted with caution. Readers are invited to consult the Note to readers for more information on definitional changes since 2016.

Large farms continue to change the face of the agriculture industry

Over time, farms have been evolving to become increasingly sophisticated businesses that harmonize automation, modernization and production operations. As a result, many farms have consolidated and become increasingly larger both in terms of sales and number of employees. Conversely, smaller and mid-sized farms are declining in Canada, thereby impacting the rural landscape and profile of Canadian regions.

Continuing the trend of farm consolidation from the previous census, the proportion of farms in the top two sales classes increased, while the number of smaller farms declined. The proportion of farms with sales of $1 million or more in 2020 was 9.9%, up from 7.2% in 2015.

Farms in the top sales classes also account for the largest share of total farm operating revenues and a larger share of total farm employees. For example, in 2021, farms reporting at least $2 million in sales accounted for 51.5% of total farm operating revenues. This compared with 41.5% in 2016.

Farms preparing to pass on to the next generation

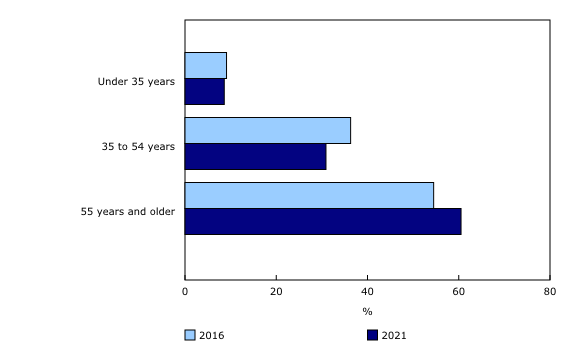

The aging of Canadian farmers is not a new phenomenon and follows general population trends. Recently released data from the 2021 Census of Population indicated that the median age of Canadians was 41.6 years (up from 41.2 in 2016) and that 33.1% of Canadians were at least 55 years old.

The average age of Canada's farm operators increased by 1.0 year, to 56.0 years in 2021. Meanwhile, the median age of farm operators rose by 2.0 years from the previous census, reaching 58.0 years in 2021.

The proportion of farm operators aged 55 and older (older operators) grew by 6.0 percentage points from the previous census. In 2016, 54.5% of operators were aged 55 and older, increasing to 60.5% in 2021. Conversely, Canada's share of young operators was 8.6%, down slightly from 9.1% in 2016.

The challenges associated with the COVID-19 pandemic and the aging of Canadian farmers may have caused some farm operators to consider succession plans for their farms. In 2021, 6,673 more farms reported having a succession plan than in 2016.

The proportion of farms in Canada reporting a succession plan increased from 8.4% in 2016 to 12.0% in 2021. As was the case in the previous census, farms classified as oilseed and grain farming accounted for the largest share (44.5%) of farms reporting a succession plan in 2021.

From 2016 to 2021, intermediate-sized farms reporting operating revenues from $50,000 to $99,999 reported the highest proportional increase (+3.9 percentage points) in succession planning compared with the other sales classes.

Industry consolidation and aging of farmers have led to fewer farms and farm operators

As a result of industry consolidation and aging of farm operators, the number of farms dropped by 1.9% from 2016 (193,492 farms) to 2021 (189,874 farms). The decline in the number of farms, however, was the smallest in 25 years.

The decrease in the number of farms resulted in a 3.5% decline in the number of farm operators reported from the previous census. In 2016, there were 271,935 farm operators, and by 2021 the number decreased to 262,455.

At the same time, the number of female operators has increased for the first time since 1991. In 2021, there were 79,795 female farm operators, up from 77,970 in 2016. In 2021, 30.4% of total farm operators were female, up from 28.7% in 2016.

Higher land values may represent a barrier to entry into the industry

The price of land is an important factor in the investment and management decisions of farms, particularly in an environment increasingly defined by large market players. Strong commodity prices, low interest rates and a growing demand for housing in urban areas have been identified as contributing factors to the rising value of farmland in Canada.

The reported total market value of land and buildings for farms in Canada increased by 22.7% (in constant 2021 dollars) from the previous census, totalling $603.8 billion in 2021. The market value of owned land, buildings and fixed equipment increased by 19.1% from 2016, to $420.9 billion in 2021. The market value of land and buildings rented from others or governments totalled $182.9 billion in 2021, up 32.0% from 2016.

The market value of all farm vehicles, machinery and equipment increased by 3.9% from the previous census, reaching $64.4 billion in 2021.

Sustainable practices becoming a hallmark of the agriculture industry

Another source of transformation in the agriculture sector is the use of sustainable practices to cope with climate change. These adaptations are important, as the frequency of extreme climate events has increased in recent years and such events could represent a challenge for the industry in years to come.

Land practice methods include in-field winter grazing or feeding, rotational grazing, plowing down green crops, planting winter cover crops, and having shelterbelts or windbreaks. In 2020, 64.5% of farms reported land practices, up from 53.7% in 2015.

Another way Canadian farms have adapted to warmer and drier conditions has been by shifting their focus to more drought-tolerant crops, such as barley. From 2016 to 2021, farms in Canada reported a 24.3% increase in barley acreage. This was the biggest percentage increase among the top 10 contributors of hay and field crops reported in Canada. In 2016, farms reported 6.7 million acres of barley, and by 2021 there were 8.3 million acres.

In response to the growing demand for organic products, the number of farms that reported producing organic products increased 31.9% from the previous census. In 2021, 5,658 farms reported growing organic products. These farms made up 3.0% of total farms in 2021, compared with 2.2% in 2016.

Farmers are transitioning towards renewable energy production

Over the past few years, numerous programs and policies have been implemented by governments to encourage farmers to adopt renewable energy production methods, such as solar energy production.

In 2021, there were more than twice as many farms reporting renewable energy production than in the previous census. The number of farms reporting renewable energy production increased from 10,185 in the previous census to 22,576 in 2021.

Expressed as a proportion of total farms, close to 1 in 8 farms in Canada (11.9%) reported some form of renewable energy production in 2021, more than double the rate (5.3%) in the previous census. Solar energy production remained the most common form of renewable energy production on Canadian farms, as the number of farms that reported producing this form of energy increased by 68.5% from the previous census to 2021.

Technology use is another growing trend in the agriculture industry as it improves the accuracy and efficiency of farm processes and helps farms stay competitive in the global trade market. Examples of technologies that became more prominent from 2015 to 2020 include automated guidance steering systems (+28.2%) and geographic information system mapping (+58.6%).

Farmers ensuring that Canada's agricultural outputs are maintained during the pandemic

Data from the 2021 Census of Agriculture show that livestock inventories and acreage for prominent crops have remained quite stable and even increased modestly since 2016. As noted above, total hay and field crop area increased by 0.3% since 2016, to 92.9 million acres.

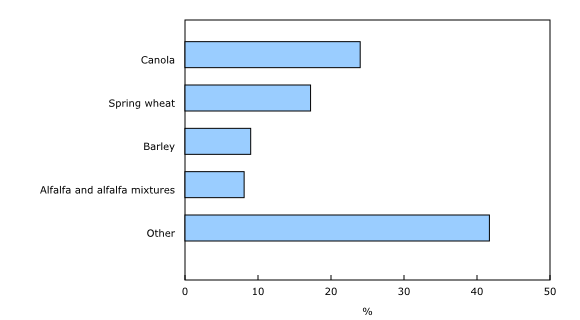

As was the case in 2016, canola remained the top crop acreage in Canada among all types of hay and field crops in 2021, despite a ban from China that restricted total canola exports from Canada in 2018 and 2019. In 2021, farms in Canada reported 22.3 million acres of canola, an 8.1% increase in canola acreage from the previous census. The number of farms reporting canola rose 0.8% from 2016 to 2021.

Canola acreage was not the only field crop to increase from the previous census. For example, farms reported a 2.1% increase in spring wheat acreage from 2016. Spring wheat remained the second-largest crop reported in Canada in 2021, with 16.0 million acres, followed by barley, alfalfa and durum wheat.

Livestock numbers remaining steady despite pandemic and labour challenges

The pandemic posed many challenges to the Canadian livestock sector from 2020 to 2021. One of the more significant challenges was the early shutdown of meat processing facilities in an effort to contain outbreaks of COVID-19. A labour shortage further challenged the meat processing industry.

Cattle and calf inventories increased slightly from the previous census. In 2021, farms in Canada reported 12.6 million total cattle, up from 12.5 million in 2016. The percentage increase in milk cows, steers and beef cows offset declines in heifers for slaughter, heifers for dairy herd replacement, heifers for beef herd replacement and bulls.

Farms in Canada reported a 3.4% increase in the number of hogs and pigs from the previous census. In 2021, there were 14.6 million hogs and pigs in Canada, up from 14.1 million in 2016. During the same period, total exports in Canadian dollars for hogs and pigs to the United States increased 27.7%. While the number of hogs and pigs increased, the number of farms reporting hogs and pigs decreased 11.7%, indicating growing concentration within the industry.

The total number of sheep and lambs edged down 0.2% from the previous census, with a total count of 1.1 million head in 2021. Meanwhile, the number of farms reporting sheep and lambs decreased 9.6% over that period. In 2016, there were 9,390 farms reporting sheep and lambs, and by 2021 the number decreased to 8,487.

The total number of chickens in Canada increased by 4.7% from the previous census, for a total of 152.3 million head in 2021, despite a decrease in the number of farms reporting chickens (-1.5%). The increase in chicken inventories was driven by farms with sales of at least $2 million, where the respective farm numbers rose 27.9%, up from 949 in 2016. Meanwhile, the number of turkeys decreased 27.8%, while the number of farms reporting turkeys declined 17.3% from 2016 to 2021.

Greenhouse sector is emerging as a key industry in Canadian agriculture

One development in the horticulture sector has been the growth of the greenhouse industry, which constitutes an alternative way to provide a steady supply of fresh produce to local communities.

Farms in Canada reported a 23.2% increase in total greenhouse area from the previous census, to 330.5 million square feet in 2021. Meanwhile, the total greenhouse area for fruit and vegetables was 219.7 million square feet in 2021, which accounted for around two-thirds (66.5%) of Canada's total greenhouse area.

Meanwhile, the total area of fruits, berries and nuts increased 0.4%, from 332,812 acres in 2016 to 334,182 acres in 2021. Conversely, the total area of field vegetables decreased slightly to 260,757 acres, down from 270,294 acres in 2016.

Farms incur 83 cents in expenses for every dollar of revenue

Farm operating revenues in Canada totalled $87.0 billion in 2020, while expenses reached $72.2 billion. On average, for every dollar in revenues, farms incurred 83 cents in expenses. The expenses-to-revenues ratio across farm types shows that farms classified as oilseed and grain farming were the most profitable farm type in 2020, with an expenses-to-revenues ratio of 0.76. Conversely, sheep and goat farms had the highest ratio, at 0.97.

Farmers are adapting the ways they sell to people during the pandemic

In response to pandemic-related health measures that limited contacts, direct delivery to consumers became the second most frequently reported direct sales method, behind on-site stands, in 2020. Half (50.2%) of the farms that reported direct sales used direct delivery.

Both the proportion and number of farms reporting direct sales increased from the previous census. In 2020, 13.6% of farms reported direct sales, up from 12.7% in 2015, while the number of farms reporting such sales increased from 24,510 to 25,917 during the same period.

As was the case in the previous census, vegetable and melon farms were the most likely to report direct sales. In 2020, 52.2% of farms classified as vegetable and melon reported direct sales, up from 50.2% in 2015.

Smaller farms are more reliant on direct sales

Direct sales made up a bigger part of smaller farms' total operating revenue. In 2020, farms with less than $10,000 in sales accounted for nearly half (47.9%) of farms in which direct sales represented more than three-quarters of total farm operating revenues. Meanwhile, farms with $2 million or more in sales accounted for 0.8% of farms in which direct sales represented more than three-quarters of total revenues.

More farm operators are turning to off-farm work

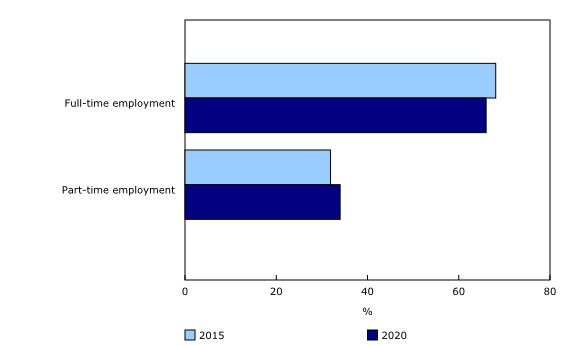

The number of farm operators working off the farm increased by 3.8% from the previous census. In 2020, 47.7% of farm operators in Canada reported off-farm work. In 2015, there were 120,665 farm operators reporting off-farm work, and by 2020 the number increased to 125,280.

Of these farm operators, the proportion who worked off the farm on a full-time basis declined slightly from 68.1% in 2015 to 66.0% in 2020, while the number of those working part time off the farm increased from 31.9% to 34.0%.

Cannabis: A new industry

In response to the legalization of cannabis for non-medical use, Statistics Canada collected data on cannabis for the first time in the Census of Agriculture. Later in 2022, Statistics Canada will release Census of Agriculture data on cannabis operations. These comprehensive data will present the economic contributions of cannabis operations to the agricultural industry in Canada. Note that present release and corresponding data tables exclude cannabis operations. Other sources of information that include cannabis data are farm cash receipts and net farm income.

Note to readers

Today, Statistics Canada is pleased to release information from the 2021 Census of Agriculture. In addition to standard tables and historical trends, a new data visualization tool providing information on key characteristics of farms, farm operators and agricultural workers is also available. Over the next few months, Statistics Canada will publish a series of articles that will provide additional information on key economic, social and environmental issues facing the industry in Canadian Agriculture at a Glance.

The next release, on June 15, will focus on disaggregated data and regional trends, with the release of profiles for all provinces and territories, a mapping tool including 2021 and 2016 Census of Agriculture data, and a new interactive tool that will allow users to quickly access Census of Agriculture data for their local community.

Definitions and concepts

The data displayed by geography have undergone random tabular adjustment. The Canada total data for geographic breakdowns may differ from the Canada total data displayed in tables by North American Industry Classification System (NAICS) category and sales class.

The data for Yukon and the Northwest Territories are not included in the national totals; they are presented separately.

The Census of Agriculture is conducted every five years and is a census of all agricultural operations that produces agricultural products and reports revenues or expenses for tax purposes to the Canada Revenue Agency. Important concepts used in this analysis include:

Total farm area, which is land owned or operated by an agricultural operation, includes: cropland, summer fallow, improved and unimproved pasture, woodlands and wetlands, all other land (including idle land and land on which farm buildings are located).

Farm type is established through a procedure that classifies each census farm according to the predominant type of production. This is done by estimating the potential revenues from the inventories of crops and livestock reported on the questionnaire and determining the product or group of products that make up the majority of the estimated receipts. For example, a census farm with total potential revenues of 60% from hogs, 20% from beef cattle and 20% from wheat, would be classified as a hog and pig farm. The farm types presented in this document are derived based on the 2017 NAICS.

Farm operator refers to any person responsible for the management decisions in operating a farm or agricultural operation. Also known as an agricultural operator, farmer, operator or rancher.

Farm employees include both farm operators and agricultural workers.

Price indexes were used to obtain constant dollar estimates of sales, export values and farm assets in order to eliminate the impact of price change in year-to-year comparisons.

Farm operating revenues

Farm operating revenues come from the Agriculture Taxation Data Program (ATDP). Previously, revenues for agricultural operations were reported to the Census of Agriculture. Caution should be taken when comparing the 2021 Census of Agriculture data with previous censuses.

The Census of Agriculture measures farm operating revenues (in current dollars) for the calendar or accounting year prior to the census. Farm operating revenues (before deducting expenses) in this analysis include: operating revenues from all agricultural products sold, program payments and custom work revenues.

The following are not included in farm operating revenues: sales of forestry products (for example: firewood, pulpwood, logs, fence posts and pilings); sales of capital items (for example: quota, land, machinery); and revenues from the sale of any goods purchased only for retail sales.

Total operating expenses

Total operating expenses come from the ATDP. Previously, expenses for agricultural operations were reported to the Census of Agriculture. Caution should be taken when comparing the 2021 Census of Agriculture data with previous censuses.

The Census of Agriculture measures operating expenses (in current dollars) for the calendar or accounting year prior to the census. Total operating expenses include any expense associated with producing agricultural products (such as the cost of seed, feed, fuel, fertilizers).

The following are not included in total operating expenses: the purchase of land, buildings or equipment, and depreciation or capital cost allowance. Depreciation represents economic "wear and tear" expense. Capital cost allowance represents the amount of depreciation written off by the tax filer as allowed by tax regulations.

Expenses-to-revenues ratio

The expenses-to-revenues ratio is the average amount of operating expenses incurred for a dollar in farm operating revenues. The ratio is calculated in current dollars.

Census Day was May 11, 2021. Farmers were asked to report their operating revenues and expenses for the last complete fiscal or calendar year (2020).

Full-time employment is classified as farm operators who worked 30 hours or more per week; part-time employment is classified as farm operators who worked less than 30 hours per week.

Some data refer to a reference period other than Census Day. For example, for financial data the reference period is the calendar or accounting (fiscal) year prior to the census.

Statistics Canada's ongoing commitment to reduce the response burden of farmers

In an attempt to reduce the response burden on farmers while continuing to provide quality statistical information, Statistics Canada launched an initiative to move beyond a survey-first approach. This was done by using alternative data such as Earth Observation and tax data, and advanced technologies such as modelling and machine learning, to replace traditional surveys.

You can read more about this initiative in the StatCan Blog: Reducing the response burden imposed on farmers and businesses.

Correction: On May 19, the operating revenues and expenses data in Table 4 were corrected; the magnitude of the change was less than 1% and the expenses to revenues ratios are unchanged.

Products

The Guide to the Census of Agriculture, 2021 is available on the Statistics Canada website.

The Census of Agriculture: Farm and Farm Operator Data Visualization Tool is now available on the Statistics Canada website.

For a complete list of our products, visit the Census of Agriculture portal.

For more information on agriculture and food, visit the Agriculture and food statistics portal.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: