Survey on Savings for Persons with Disabilities, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-04-01

Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability Savings Plan (RDSP)—about 31.5% in 2020.

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP.

An RDSP is not tax deductible, but it offers several advantages to beneficiaries. Up to the age of 49, the Government of Canada matches contributions to the savings plan at up to 300% and invests up to $1,000 a year for eligible residents in Canada with low income. Beneficiaries also do not pay tax on RDSP contributions when withdrawn.

To understand why more eligible residents in Canada do not have an RDSP, Employment and Social Development Canada asked Statistics Canada to conduct the Survey on Savings for Persons with Disabilities. Its goal was to collect data from residents in Canada who were eligible for an RDSP but did not open one.

These respondents included both persons with disabilities and family members or others who care for persons with disabilities, since the holder of the plan may not be the same person as the beneficiary in all cases.

These data show that, in general, eligible residents in Canada lack information about the RDSP, with many not being aware it exists and a substantial portion reporting not having enough information or money to open one.

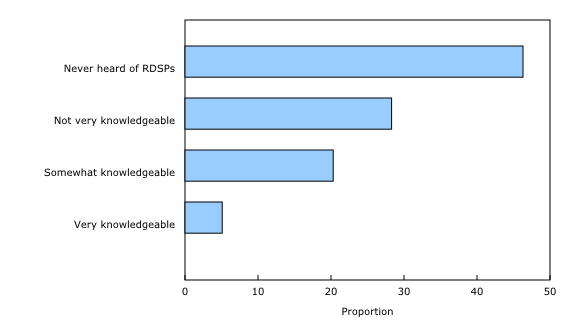

Among eligible residents in Canada who have not opened a Registered Disability Savings Plan, almost half know that it exists

To take advantage of the RDSP, residents in Canada have to know about it. In 2020, almost half of eligible residents in Canada who had not opened an RDSP had never heard of the savings plan. Almost one-third said that they were not very knowledgeable about RDSPs, 20% said that they were somewhat knowledgeable and 5% said that they were very knowledgeable.

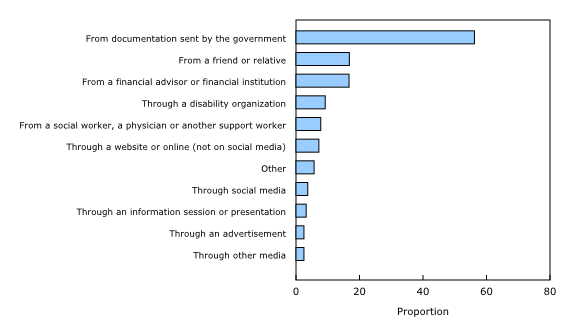

Respondents who know about the Registered Disability Savings Plan mostly learn about it through government documentation

Respondents who knew about and were eligible for the RDSP were asked how they had learned about it.

The majority, almost 60%, learned about it through government documentation. The next most common sources were a friend or relative, or a financial advisor or financial institution, both at about 17%.

Almost 10% of respondents heard about RDSPs through a disability organization or a social worker, a doctor, a therapist, an advocate or another support worker. Meanwhile, social media, information sessions or advertisements did not seem to play a significant role, each accounting for less than 5%.

Respondents with lower incomes or less education are less likely to know about the Registered Disability Savings Plan

Certain population groups were less likely to be aware of RDSPs.

Respondents with household incomes lower than $20,000 were less likely to know about RDSPs, at 46%. By comparison, 63% of those with household incomes of $100,000 or more were aware of RDSPs.

Respondents with lower levels of education were also less likely to have heard of RDSPs. The contrast in awareness is especially sharp between respondents who do not have a high school diploma (46%) and those with a university certificate, diploma or degree (79%).

Indigenous respondents were less likely to have heard about RDSPs (41% of Indigenous respondents, compared with 55% of non-Indigenous respondents). In the Survey on Savings for Persons with Disabilities, information for Indigenous persons reflects the experiences of those who identify as First Nations persons, Métis or Inuit, and who live off reserve in the provinces.

Awareness of RDSPs varied by respondents' main activity. Respondents who were working were more likely to have heard of RDSPs (57%), especially compared with those looking for work (41%). But individuals caring for a person with a disability or chronic illness (71%) were the most likely to know about RDSPs.

Younger respondents, especially those aged 15 to 19, were significantly less likely to say that they had ever heard of RDSPs, at a rate of 36%. This is a marked difference compared with respondents aged 25 or older, who had awareness rates from 52% to 56%. This may be partially explained by some beneficiaries being minors or being in circumstances where an adult is required to be the holder of the plan for the beneficiary.

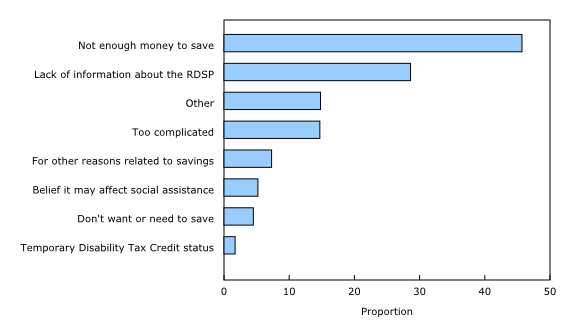

Many eligible residents in Canada have not opened a Registered Disability Savings Plan because they do not have the money to save or lack information about the plan

Eligible residents in Canada who were already aware of RDSPs but did not open one were asked why they did not do so. The most common reason offered for not opening an RDSP was not having enough money to save (46%). The next most common response was that they lacked information about the RDSP (29%), while 15% said that it was too complicated. The latter group gave the following two reasons most often: 29% had complications filling in the tax forms and 44% had complications visiting the bank to open a plan.

About 7% of respondents said that they did not open an RDSP for other reasons related to savings. Of this group, 76% said that they were saving money elsewhere.

How else did respondents save for the future?

To better understand savings patterns among persons approved for the DTC, those who had not opened an RDSP were asked whether they have saved any money for the future. Just over one-third (35%) said that they had saved money for the future.

Of those who saved money for the future for persons with disabilities, about two-thirds (68%) said that it was in a savings or chequing account. The next most popular way to save was a Tax-Free Savings Account (36%), followed by a Registered Retirement Savings Plan (32%). Just over 2 in 10 (22%) said that their savings came from their employer's pension plan.

Note to readers

The objective of the Survey on Savings for Persons with Disabilities (SSPD) was to collect information on the knowledge and behaviours of Canadians with disabilities and their caregivers, with respect to savings.

The SSPD was conducted as part of the RapidStats Program offered by Statistics Canada's Centre for Social Data Integration and Development to respond more quickly to pressing data needs.

The data were collected in the provinces from October 19 to November 30, 2021. The response rate was 50%, which is similar to other RapidStats Program surveys.

The target population was Canadians aged 49 and younger who are approved for the Disability Tax Credit but do not have a Registered Disability Savings Plan.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) Or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: