Job vacancies, fourth quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-03-22

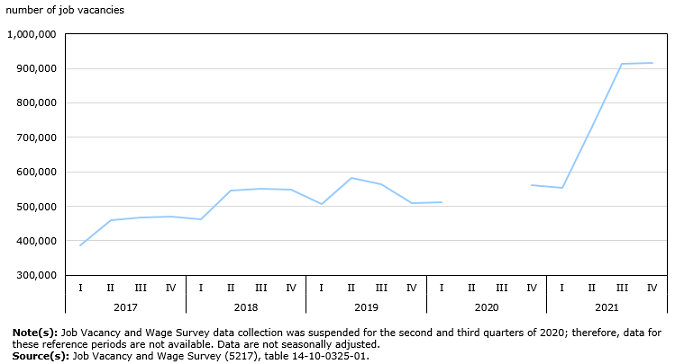

In the fourth quarter of 2021, the number of job vacancies in Canada peaked at 915,500, little changed from the third quarter (912,600). Record-high job vacancies in the fourth quarter coincided with almost full recovery of payroll employment and falling unemployment.

Quarterly data from the Job Vacancy and Wage Survey (JVWS) provides additional information beyond the monthly job vacancy data previously released. While the monthly estimates from the JVWS provide more timely information on the number of job vacancies by province and by industrial sector, quarterly JVWS data provide insights into job vacancies by subsector, vacancies by occupation, offered wages, and trends in the duration of job vacancies.

Job vacancies remain high

Across all 20 sectors, Canadian employers were seeking to fill 915,500 job vacancies in the fourth quarter of 2021, 80.0% more than in 2019 and 63.4% more than in 2020.

The job vacancy rate—which measures the number of vacant positions as a proportion of total labour demand (filled and vacant positions)—was 5.3% in the fourth quarter of 2021, down from 5.4% from the previous quarter but up from 3.0% in the fourth quarter of 2019 and 3.5% in the fourth quarter of 2020.

From the third to the fourth quarter of 2021, job vacancies were little changed in most provinces, with the notable exception of Nova Scotia (+11.9% to 20,300) and Manitoba (+5.9% to 25,800) where vacancies increased. Compared with two years earlier, there were 80.0% more job vacancies at the national level, with the highest provincial increases seen in Prince Edward Island (+87.1%), Quebec (+87.9%), Alberta (+89.0%) and Saskatchewan (+90.1%).

Job vacancies reached an all-time high in eight sectors in the fourth quarter, namely in health care and social assistance (+6.6% to 126,000); retail trade (+9.1% to 113,500); professional, scientific and technical services (+6.6% to 65,500); administrative and support, waste management and remediation services (+14.3% to 63,000); other services (except public administration) (+7.5% to 37,800); educational services (+6.0% to 21,100); real estate and rental and leasing (+16.3% to 10,500); and utilities (+17.4% to 2,300). The number of job vacancies in public administration also increased, up 4.5% from the third quarter to 13,200 in the fourth quarter of 2021.

At the same time, job vacancies in accommodation and food services decreased 12.1% to 143,300 from its record high of 163,000 reached in the third quarter. Most of this decline was expected and can be attributed to seasonal effects, as vacancies in this sector typically decrease from the third to the fourth quarter of the year.

Job vacancies decreased or were little changed in the remaining 10 sectors from the third to the fourth quarter of 2021.

Job vacancies up in all sectors compared with pre-COVID levels

On a two-year basis, job vacancies were up in all 20 sectors in Canada. Five sectors accounted for 65.0% of the overall increase, namely accommodation and food services (20.0%), health care and social assistance (15.2%), retail trade (11.2%), manufacturing (9.6%) and construction (8.9%). In healthcare and social assistance and in construction, payroll employment was higher in the fourth quarter of 2021 than its February 2020 pre-COVID level (Survey of Employment, Payrolls and Hours (SEPH), adjusted for seasonality), suggesting that employment in these two sectors has recovered and the increase in vacancies is a result of increased labour demand.

Employers in construction were actively seeking to fill 69,000 vacant positions in the fourth quarter of 2021, more than double the number (32,900) observed in the fourth quarter of 2019. The largest increases were observed in the specialty trade contractors subsector (+113.7%; +23,600) and in the construction of buildings subsector (+105.4%; +9,900). The increase in vacancies in related construction occupations was spread across different skill levels, with the largest increases in construction trades helpers and labourers (+158.4%; +11,100) and carpenters (+127.2%; +6,100).

Payroll employment in the construction sector was 3.2% higher in the fourth quarter of 2021 than its February 2020 pre-COVID level (SEPH, adjusted for seasonality). Recent Labour Force Survey results indicated that employment in the sector increased by 95,000 from December 2021 to February 2022, after the total value of building permits reached an all-time high during the fourth quarter of 2021.

The unprecedented labour demand in the health care system exacerbated by COVID-19 contributed to the growth in job vacancies in the health care and social assistance sector. There were 126,000 vacancies in this sector in the fourth quarter of 2021, almost double the number of vacancies seen two years earlier (64,000). At the same time, payroll employment in the sector was 5.3% (+109,500) higher than its February 2020 pre-COVID level (SEPH, adjusted for seasonality).

The number of job vacancies grew in all health subsectors over the two-year period, led by hospitals (+91.6%, +18,400) and nursing and residential care facilities (+115.0%; +18,800). Proportionally, the largest increases in vacancies in nursing and residential care facilities were in Ontario (+163.7%; +10,000) while in hospitals, the largest increases were in Quebec (+131.7%, +7,100) and British Columbia (+127.1%; +2,800). With the increases in vacancies in health subsectors, the number of vacancies was up in health occupations. Among those, the largest increases in vacant jobs were observed for registered nurses and registered psychiatric nurses (+117.1% to 23,000); and nurse aides, orderlies, and patient service associates (+81.3% to 20,500). Additionally, the number of job vacancies for licensed practical nurses increased 190.2% to 10,800 over the two-year period.

The accommodation and food services sector was greatly impacted by the COVID-19 pandemic and related public health restrictions. The number of vacant jobs in this sector was 143,300 in the fourth quarter of 2021, up 132.1% (+81,500) compared with the fourth quarter of 2019. Although the sector had the largest increase in vacancies during this period, total labour demand—which includes all filled and unfilled positions—was 7.4% (-106,000) below its level two years earlier. The food services and drinking places subsector accounted for 91.6% of the overall increase in job vacancies in the sector.

There were 81,400 job vacancies in manufacturing in the fourth quarter of 2021, up 93.1% (+39,300) from the same quarter two years earlier. This increase was spread across several subsectors, with the largest increases in transportation equipment manufacturing (+119.9%; +4,200), machinery manufacturing (+102.8%; +4,000) and food manufacturing (+85.1%; +7,500).

In retail trade, job vacancies were up 67.1% (+45,600) to 113,500 in the fourth quarter of 2021 compared with the fourth quarter of 2019, led by food and beverage stores (+75.3%; +11,700) and general merchandise stores (+102.1%; +9,800). Among the occupations prevalent in the sector, retail salespersons had the largest increase in vacancies (+48.9%; +16,800).

Tightened labour market results in longer vacancy durations

The unemployment to job vacancy ratio represents the number of unemployed persons per vacant job. A lower ratio indicates a tighter labour market, as fewer unemployed persons are available to fill the vacant positions, and could result in longer vacancy durations.

At the national level, the unemployment to job vacancy ratio was 1.3 in the fourth quarter of 2021, down from 2.9 in the same period of 2020. (Data on unemployment are from the Labour Force Survey, not seasonally adjusted).

In the fourth quarter of 2021, 49.1% (449,200) of the all-sector job vacancies were open for 60 days or more, up from 35.8% (200,600) in the same quarter of 2020. Over the same period, the proportion of vacant jobs for which employers were expecting to continue looking for other candidates after filling the current vacancies represented 56.2% in 2021, up from 50.4% in 2020. Increase in constant recruitment may signal increase in labour shortages or low employees retention.

The occupation with the largest increase in the number of vacancies open for 60 days or more was food counter attendants, kitchen helpers, and related support occupations, where 60.8% of vacancies were open for 60 days or more in the fourth quarter of 2021, up from 43.3% one year earlier. Other occupations with large increases in the number of vacancies open for 60 days or more were retail salespersons (from 11.8% in the fall of 2020 to 33.3% in the fourth quarter of 2021), cooks (from 41.8% to 65.1%), and food and beverage servers (from 40.7% to 60.7%). Over the same period, the proportion of constant recruitment for retail salespersons increased from 31.5% to 52.3%. Notably, these four occupations feature relatively low offered wages and, aside from retail salespersons, are predominately concentrated in accommodation and food services, the sector that had the largest year-over-year increase in vacancies.

Growth in offered wages surpasses Consumer Price Index growth in business locations with less than 20 employees

According to results from the Canadian Survey on Business Conditions conducted from October to early November 2021, 25.1% of businesses reported having a plan to increase wages offered to new employees to address obstacles related to hiring and recruitment.

The results from the Job Vacancy and Wage Survey show that overall, average offered hourly wages increased 1.8% (0.8 percentage points more than the increase in the Consumer Price Index [CPI]) from the third to the fourth quarter of 2021 and were up 5.5% (on par with the CPI) since the fourth quarter of 2019.

From the fourth quarter of 2019 to the same quarter of 2021, the proportion of total vacancies in small business locations (less than 20 employees) increased from 32.1% to 34.1%, while the proportion of total vacancies in large business locations (with more than 500 employees) decreased from 16.1% to 13.4%.

Over the same period, average offered hourly wages increased 5.6% (to $28.55) in large business locations, almost on par with the CPI (+5.5%), while they increased 8.1% (to $21.15) in small business locations.

Growth in average offered hourly wages in small business locations exceeded the CPI growth over the same period in 11 of the 20 sectors. Among these sectors, those which had the largest percentage increases include construction (+11.1% to $25.55) and retail trade (+11.1% to $17.35).

In accommodation and food services, average offered hourly wages in small business locations increased more than the CPI (+6.8% to $15.55). However, the increase in offered wages was larger in large business locations in this sector (+18.8% to $22.60).

In manufacturing, although average offered hourly wages showed little change overall, they increased 4.3% to $21.10 in small business locations, the highest increase across all business location sizes.

Looking ahead

Statistics Canada will continue to monitor the level of unmet labour demand through monthly JVWS results. January 2022 results will be released on March 29, 2022. Detailed information for the first quarter of 2022, including information on the occupational and skills profile of vacancies, and changes in average offered hourly wages, will be released on June 21, 2022.

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and offered wages by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly.

Estimates by sector are based on the North American Industry Classification System 2017 Version 3.0. Estimates by geographical area are based on the Standard Geographical Classification 2016. Estimates by occupation reflect the National Occupational Classification (NOC) 2016 Version 1.3. The NOC is a four-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: (1) 10 broad occupational categories, also referred to as one-digit NOC; (2) 40 major groups, also referred to as two-digit NOC; (3) 140 minor groups, also referred to as three-digit NOC; and (4) 500 unit groups, also referred to as four-digit NOC.

Because of the COVID-19 pandemic, data collection for the JVWS was suspended for the second and third quarters of 2020.

In January 2020, a new electronic questionnaire was introduced. Minor changes to the content are documented in the most recent Guide to the Job Vacancy and Wage Survey (75-514-G).

Beginning with the reference period of October 2020, preliminary monthly estimates from the JVWS are released on a monthly basis alongside the Survey of Employment, Payrolls and Hours (SEPH) release. These estimates provide information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

The target population of the survey includes all business locations in Canada, excluding those involved primarily in religious organizations and private households. Federal, provincial and territorial, as well as international and other extra-territorial public administrations are also excluded from the survey.

JVWS data are not seasonally adjusted. Therefore, quarter-to-quarter comparisons should be interpreted with caution as they may reflect seasonal movements.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

Labour Force Survey data used in this Daily release are non–seasonally adjusted three-month moving averages of December 2021 (unless otherwise specified).

Next release

Data on job vacancies from the JVWS for the first quarter of 2022 will be released on June 21, 2022.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region, and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: