Quarterly financial statistics for enterprises, fourth quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-02-23

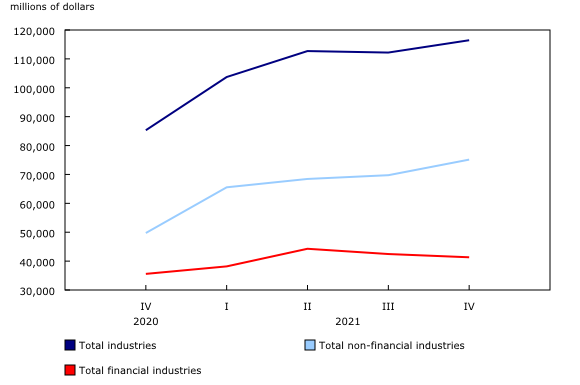

$116.5 billion

Fourth quarter 2021

The last quarter of 2021 saw an increase in pandemic related infections, as well as containment measures. Omicron, the fifth variant of concern of the coronavirus, was identified in Canada at the end of November 2021 and in December the number of COVID-19 cases grew to its highest level since the onset of the pandemic, in March 2020.

Despite this backdrop, Canadian corporations reported a quarterly increase of 3.8% in net income before taxes (NIBT) in the fourth quarter of 2021. The non-financial sector led the increase, recording a growth of 7.7% in NIBT. The financial sector saw a decline in NIBT of 2.7% during the quarter.

Severe flooding in British Columbia disrupts the activities of the Canadian corporate sector

Adverse weather events accompanied by severe flooding in British Columbia affected business activity in the fourth quarter; the market for wood products was among the most impacted. In November, sawmills in Canada increased production as higher construction activities in the United States spurred an increase in the demand for Canadian lumber products; this added upward pressure on prices of logs, pulpwood, natural rubber and other forestry products, which rose 4.3% according to the Raw Materials Price Index.

Despite increased production, sawmills saw their inventories grow as flooding reduced the ability of wood and paper product manufacturers to bring products to market, resulting in a quarterly decline of 15.4% in NIBT.

Manufacturing businesses in the eastern provinces were also affected, as disruptions in rail service from the Port of Vancouver posed a supply constraint. The goods most imported through the west coast include iron and steel products, and refined energy products. As these goods are key inputs to manufacturing processes in the eastern provinces, the disruption affected the supply chains of Canadian manufacturing firms. During the fourth quarter, the NIBT of primary metals and fabricated metal product manufacturers declined 14.7%.

The effect of the flooding was felt by insurance carriers who saw an increase in the number of claims. According to the Insurance Bureau of Canada, 2021 was among the highest loss-years on record as severe weather caused $2.1 billion in insured losses. Of this, $515 million of damages were a result of the flooding in British Columbia. The increased claims prompted a decline in the NIBT of property and casualty insurance carriers in Canada by 13.9% during the fourth quarter.

Supply chain bottlenecks across the globe continue to exert an upward pressure on prices

During the fourth quarter of 2021, Canadian corporations saw an increase in the cost of inputs as prices of industrial products grew 2.4%, and raw materials prices rose 4.0%. The tightening of public health restrictions in response to the Omicron variant threatened to worsen production challenges and push up prices across the country.

Supply chain disruptions exerted an upward pressure on prices of energy products during the fourth quarter. In the previous quarter, certain refineries in the United States were forced to curtail production due to Hurricane Ida. As a result, exports of energy products to the United States increased 15.5% during the fourth quarter to (+63.8% on a year-over-year basis), mainly due to a higher demand for Canadian crude oil.

Furthermore, rising demand for Canadian crude oil impacted the energy and petroleum component of the Industrial Product Price Index, which posted the largest gains (+7.8%) across all products in the fourth quarter.

Increased demand, production, and prices during the quarter fueled a 24.2% increase in NIBT of oil and gas extraction and support services.

The motor vehicle and trailer manufacturing industry curtailed production in the third quarter, as a result of supply chain disruptions. During the fourth quarter, this industry saw an increase in shipment of motor vehicles by 21.0%, and consequently the industry recorded an increase in NIBT of $905 million.

Dashboard now available

The Quarterly Survey of Financial Statistics: Visualization Tool is a comprehensive analytical tool that presents quarterly changes in the financial performance of enterprises.

Note to readers

Data from the Quarterly Survey of Financial Statements (QSFS) include amounts from government programs that support business, such as the Canada Emergency Wage Subsidy. These amounts are considered to be revenue for these businesses.

However, because of response rates lower than the historical averages, the potential delay in businesses releasing this information, and the methodology used to calculate QSFS estimates, use of these government support programs may be underestimated in the data published.

For information on seasonal adjustment, see seasonally adjusted data – Frequently asked questions.

Revisions, benchmarking and back-casting

The release of the QSFS for the fourth quarter of 2021 includes revised estimates for all quarters of 2021. This release includes back-casted estimates for the reference periods starting from the first quarter of 2010 up to the fourth quarter of 2019. The back-cast includes non-seasonally adjusted estimates for a selected number of variables for these reference periods.

The following changes were introduced to the survey starting with the first quarter of 2020:

- New content was implemented in the first quarter of 2020 to align the survey with new accounting standards adopted by corporations starting in 2011.

- New industrial breakdowns were implemented, allowing for more granularity in the dissemination of data. As a result, some industry groupings were merged, others were split, and some remained the same.

- The survey sample was modified to support the new industrial breakdowns. However, a maximum sample overlap with the previous sample was adopted.

- A more automated imputation strategy was implemented to streamline the process and reduce the need for manual intervention.

Back-casting

The back-casted estimates are derived from a process of reconciliation to ensure that the quarterly series are consistent with the levels of a set of information from surveyed and administrative sources and, by applying the quarter to quarter movement of historical QSFS estimates.

Changes in the data from previously released estimates may be due to a number of reasons including survey population updates, industry reclassifications, and revisions to the data.

While considerable effort is made to ensure high standards throughout the reconciliation process, the resulting estimates are inevitably subject to a certain degree of error. Users are encouraged to use caution when making historical comparisons.

Benchmarking

The QSFS estimates for the reference year 2020 have not yet been reconciled to ensure that the quarterly series is consistent with the levels of the annual Financial and Taxation Statistics for Enterprises program. Larger-than-usual revisions may be anticipated in the future, as quarterly revisions, annual benchmarking, back-casting and new survey data received from respondents will be incorporated to improve data quality.

Business performance and ownership statistics portal

The Business performance and ownership statistics portal, accessible from the Subjects module of our website, provides users with a single point of access to a wide variety of information on business performance and ownership in Canada.

Next release

Financial statistics for enterprises for the first quarter of 2022 will be released on May 25, 2022.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: