Building construction price indexes, fourth quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-02-04

National Overview

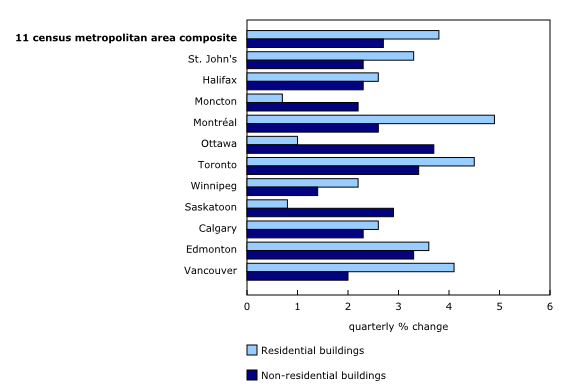

Residential building construction costs increased 3.8% in the fourth quarter of 2021, following a similar rise in the third quarter. Non-residential building construction costs were up 2.7% in the fourth quarter, decelerating slightly from the previous quarter.

Moderating price growth for most census metropolitan areas

Of the 11 census metropolitan areas (CMAs) covered by the survey, 8 witnessed moderating growth in residential building construction prices during the fourth quarter, some recording their lowest quarterly increases seen in 2021.

Costs to construct residential buildings increased the most in Montréal, followed by Toronto and Vancouver. In the fourth quarter, the cost to build low-rise apartments grew the most out of all of the buildings in scope for the survey in both Montréal and Vancouver, while single-detached houses led the growth in Toronto.

Moncton experienced the smallest quarterly price increase in the cost of construction of residential buildings, followed by Saskatoon and Ottawa.

Non-residential building construction costs rose the most in Ottawa, Toronto, and Edmonton. However, for both Ottawa and Toronto, the quarterly growth decelerated compared with the previous quarter.

While growth in non-residential building construction prices across some of the CMAs surveyed slowed in the fourth quarter, Saskatoon recorded its highest quarterly price growth of the year. The cost of building bus depots with maintenance and repair facilities, as well as factories, increased the most in this CMA.

Higher costs for lumber and steel continue to support price growth

Wood, plastics and composites continued to be the largest contributor to the price increase in residential building construction. Softwood lumber prices rose again in October and November, but not enough to offset the large decrease observed from May to August. Despite this uptick, contractors reported a slower increase rate in the prices of wood products, compared with the third quarter, with some noting a decline in prices. This was offset by stronger price growth for other important residential construction inputs, including finishes (drywall, paint, etc.), windows and doors, as well as thermal and moisture protection elements.

Increases in the costs to construct non-residential buildings was mostly driven by a rise in prices for metal fabrication products and concrete elements (including steel reinforcement). Contractors mainly attributed the higher costs to rising labour costs resulting from skilled labour shortages and rises in the price of steel products, which was impacted by supply constraints.

Year-over-year growth in construction costs surpass previous highs

Building construction costs for residential construction in the 11-city composite rose 21.7% year over year in the fourth quarter, surpassing the previous high registered in the third quarter. The largest increases were in Calgary, Toronto, Edmonton, and Ottawa.

Non-residential construction building costs rose 11.2% year over year in the fourth quarter which was the largest increase since the third quarter of 2008. Construction costs increases were the largest in Ottawa, Toronto and Edmonton, with both Ottawa and Toronto recording new year-over-year highs in the fourth quarter.

The year 2021 in review

Shortages in labour and building material persist in 2021

The COVID-19 pandemic continued to have an impact on the construction sector, as contractors once again cited that increases in labour costs and in building material prices were still pushing up their costs. This led to record yearly price increases for both residential and non-residential building construction costs.

The number of building permits and permit values were up for both the residential and non-residential sector in 2021 compared with 2020, further confirming the growth of the demand for labour and building materials. The increase in value of the building permits issued was also a factor driving the demand for heavily used construction materials, such as lumber and steel products. These materials have been impacted by supply chain issues throughout 2021 as a result of the pandemic, causing price increases.

Job vacancy rates in the Canadian construction industry increased at a faster rate in the second half of 2021 compared with the first half, showing a rise in the need for skilled labour during a time of growing demand. This put upward pressure on costs Canadian builders had to pay for labour.

Cost increases in residential building construction surpasses previous highs

In 2021, the 11-city composite for residential building construction costs rose 18.1%, which represents its largest annual increase since its inception in 2017.

Yearly construction costs for residential buildings rose the most for townhouses and single-detached houses (both up 22.5%) from 2020 to 2021.

Growth in the residential building construction costs in 2021 surpassed previous highs in every CMA surveyed. Cost increases hit double digits in all CMAs, except for Vancouver (+9.5%), showing the largest annual growth in Calgary and Ottawa.

Non-residential construction cost increase the highest in over a decade

The 11-city composite for non-residential construction cost increased 6.9% in 2021 compared with 2020. This was the highest yearly increase since 2008. Factories and bus depots with maintenance and repair facilities saw their construction costs rise the most on an annual basis.

Non-residential construction costs increased the most in Ottawa and Toronto, with Ottawa registering the largest annual growth since the beginning of the index in 1981.

Note to readers

The building construction price indexes are quarterly series that measure the change over time in the prices that contractors charge to construct a range of commercial, institutional, industrial and residential buildings in 11 census metropolitan areas: St. John's, Halifax, Moncton, Montréal, Ottawa–Gatineau (Ontario part), Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, and Vancouver.

These buildings include six non-residential structures: an office building, a warehouse, a shopping centre, a factory, a school, and a bus depot with maintenance and repair facilities. In addition, indexes are produced for five residential structures: a bungalow, a two-storey house, a townhouse, a high-rise apartment building (five storeys or more) and a low-rise apartment building (fewer than five storeys).

The contractor's price reflects the value of all materials, labour, equipment, overhead and profit to construct a new building. It excludes value-added taxes and any costs for land, land assembly, building design, land development and real estate fees.

With each release, data for the previous quarter may have been revised. The index is not seasonally adjusted.

Products

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a wide variety of statistics and measures related to producer prices.

The video "Producer price indexes" is available on the Statistics Canada Training Institute webpage. It provides an introduction to Statistics Canada's producer price indexes—what they are, how they are made and what they are used for.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: