Annual civil aviation statistics, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-01-21

Highlights

After 10 consecutive annual increases in air traffic since the 2009 economic downturn, the COVID-19 pandemic severely impacted the airline industry. In 2020, Canadian air carriers transported 28.4 million passengers, less than one-third (30.2%) of the 94.1 million passengers carried in 2019, before the pandemic.

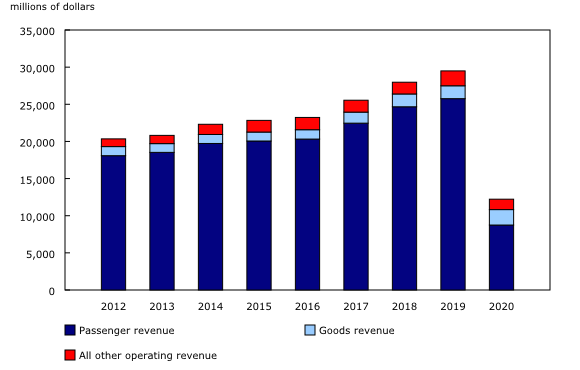

Operating revenue earned by Canadian air carriers in 2020 fell to $12.2 billion, less than half (41.4%) the number reported in 2019. While cargo revenue recorded an increase, up 20.0% to $2.1 billion, the decline in passengers pushed net operating income down by over $5 billion from 2019.

Profits vanish

In 2020, profits vanished in the airline industry as net operating income decreased by $5.1 billion, after a $330.7 million increase in 2019. Total operating revenue generated by Level I to III Canadian air carriers fell 58.6% from a year earlier to $12.2 billion, pushed down by falling passenger demand amid the pandemic. Several airlines suspended their operations or drastically curtailed schedules in response to travel restrictions and border closures implemented around the world.

With declining passenger traffic, airlines relied on freight to grow their revenues. In 2020, cargo revenue increased by 20.0% to reach $2.1 billion, driven by medical, pharmaceutical and consumer goods freight. Over the same year, passenger revenue fell by 66.1% to $8.7 billion. In 2020, revenues from passengers accounted for 71.5 cents of every operating revenue dollar, while goods revenues accounted for 17.0 cents. In 2019, passenger and goods revenues accounted for 87.3 and 5.9 cents, respectively.

Operating expenses exceed operating revenues

The 44.7% decrease in operating expenses in 2020 from 2019 reflected large reductions in expenses on aircraft operations (-54.1%), followed by declines in other operating expenses such as property taxes and building rentals (-49.9%) and maintenance (-22.0%). Airlines took measures to reduce their operating costs, such as deferring maintenance, grounding high-operating cost fleets and laying off staff.

Nevertheless, operating expenses at $15.1 billion outpaced operating revenues ($12.2 billion) in 2020. As such, the operating ratio ballooned to 1.24 in 2020 from 0.93 in 2019. In other words, the industry incurred $1.24 in operating expenses to generate each $1.00 in operating revenue in 2020. Aircraft operations accounted for over one-third (35.2%) of operating expenses, followed by all other operating expenses including general administration (31.3%), and by maintenance (16.1%).

Canadian Level I to III air carriers consumed 3.6 billion litres of turbo fuel in 2020, down 59.1% from 2019. The $2.4 billion spent on fuel costs accounted for 15.9% of total operating expenses, down from 25.0% in 2019. The decline reflected lower aviation fuel prices (-34.7%) from January to December (as reported by the Industrial Product Price Index) and fewer hours flown (-55.8%, to 1.5 million hours).

Total employment in the airline industry fell by nearly one-third (-32.7%) to 47,304 with voluntary furloughs and layoffs. As such, airlines paid $3.5 billion (-31.1%) in wages and salaries. In 2020, 23.3% of the industry's total operating expenses were payments to employees. While some of these air carriers took advantage of the Canada Emergency Wage Subsidy, the amounts are not reported separately.

In 2020, operating revenue per employee decreased by 38.4% from the previous year to $258,397, as labour productivity—measured by tonne-kilometres (both cargo and passenger flights) per employee—declined to 183,267 tonne-kilometres, down 51.6% from 2019.

Total assets of Canadian Level I to III air carriers stood at $39.6 billion in 2020, up 4.1% compared with 2019.

Historic passenger decline

Canadian Level I to III air carriers reported transporting a total of 28.4 million scheduled and charter passengers in 2020, most of whom were carried during the first two months of the year. This total was less than one-third (30.2%) of the record 94.1 million passengers in 2019. In fact, this 2020 figure was the lowest number of total passengers carried since the recessionary years of the early 1990s.

From 2019 to 2020, passengers on scheduled flights decreased by 71.0% to 26.5 million, while the number of passengers on chartered flights fell 32.8% to 1.9 million. The decline in the number of passengers was felt domestically, where passengers fell 66.4% to 16.4 million, and internationally, down 73.4% to 12.1 million. Declines in transborder traffic (travel with the United States) were a little steeper than other international traffic (-76.5% vs. -71.0%).

Canadian Level I to III air carriers recorded 62.0 billion passenger-kilometres flown in scheduled and charter operations during 2020, down 73.4% from the previous year. On average, each passenger travelled 2,182 kilometres, down 11.9% compared with 2019. In 2020, the average trip length in the domestic sector was 1,156 kilometres, compared with 3,573 kilometres in the international sector.

Looking ahead

As travel restrictions eased amid an increasing vaccination rate and declining COVID-19 cases, Canadian airlines started to add flights and restore some routes during the summer of 2021 and into the fall. The airline industry in Canada was entering a recovery phase of sorts, as major airlines carried over 3.1 million passengers on scheduled and charter services in October, surpassing the 3 million mark for only the second time since March 2020. This recovery may be short lived however, as uncertainty returned for the industry when the World Health Organization declared a new variant of concern, Omicron, in late November 2021, prompting Canada to implement new travel restrictions.

Note to readers

This release covers Canadian Level I, II and III air carriers.

Level I air carriers include every Canadian air carrier that, in the calendar year before the year in which information is provided, transported at least 2 million revenue passengers or at least 400 000 tonnes of cargo.

Level II air carriers include every Canadian air carrier that, in the calendar year before the year in which information is provided, transported (a) at least 100,000, but fewer than 2 million, revenue passengers, or (b) at least 50 000 tonnes, but less than 400 000 tonnes, of cargo.

Level III air carriers include every Canadian air carrier that (a) is not a Level I or II air carrier, and (b) in the calendar year before the year in which information is provided, realized gross revenues of at least $2 million for the provision of air services for which the air carrier held a licence.

Net non-operating income and loss are from commercial ventures that are not part of air transportation services, from other revenue and expenses attributable to financing or other activities that are not an integral part of air transportation, and from special recurrent items of a non-periodic nature. Non-operating income can be, for example, capital gains from the sale of aircraft, interest income and foreign exchange adjustment, while non-operating loss can include capital losses and interest on bank loans and other debt.

The average passenger trip length is calculated by dividing the number of passenger-kilometres by the number of passengers. Trips across Canada and the world are included in this calculation.

Data for 2016 to 2019 have been revised.

Because of rounding, components may not add up to the total.

These figures are comparable with the preliminary estimates presented in the Annual civil aviation statistics: First look, 2020.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: