Consumer Price Index, November 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-12-15

November 2021

4.7%

(12-month change)

Canadians continued to feel the impact of supply chain disruptions in November, which put upward pressure on prices for durable goods, like passenger vehicles and furniture. Prices for foods commonly seen around dinner tables, including vegetables, meat and pasta, have also increased recently compared with 2020.

Towards the latter half of the month, the impact of the floods in British Columbia and the spread of the Omicron COVID-19 variant created new uncertainties around further potential disruptions to supply chains and oil demand.

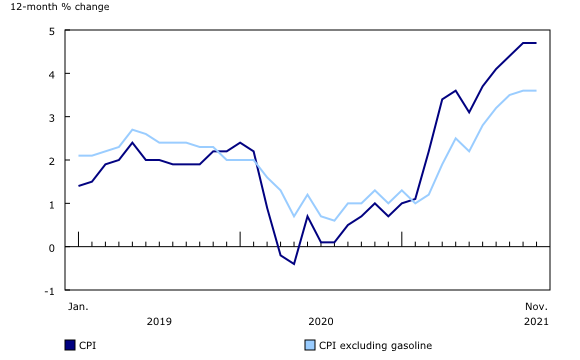

The Consumer Price Index (CPI) rose 4.7% on a year-over-year basis in November, matching the increase in October. Excluding gasoline, the CPI rose 3.6% year over year, also matching the gain in October.

On a monthly basis, the CPI edged up 0.2% in November, following a 0.7% increase in October.

Highlights

The Consumer Price Index (CPI) rose 4.7% on a year-over-year basis in November, matching the increase in October.

Higher prices for gasoline (+43.6%), furniture (+8.7%) and food (+4.4%) were the main drivers of growth in headline CPI. Excluding gasoline, the CPI rose 3.6% year over year, the same as in October.

On a monthly basis, the CPI edged up 0.2% in November, following a 0.7% increase in October.

On a seasonally adjusted monthly basis, the CPI increased 0.3%.

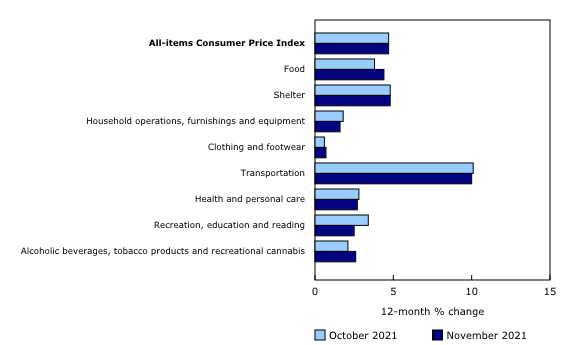

Prices rose in all eight major components on a year-over-year basis in November. Transportation and shelter prices contributed the most to the increase in the CPI.

Year over year, prices for goods (+6.9%) rose at a faster pace in November compared with October (+6.5%). Prices for services (+2.9%), however, grew at a slower pace than in October (+3.2%), moderating the price growth in the CPI. Declines in prices for cellular services (-17.9%) contributed to the slowdown in the increase in service prices.

Inflation is often compared to changes to average wages. In November 2021, the CPI rose 4.7% on a year-over-year basis. Wage data, which maintains employment composition by occupation and tenure, from the Labour Force Survey found that wages rose 2.8% during the same period, meaning that, on average, prices rose faster than wages, and Canadians experienced a decline in purchasing power.

What's new this month?

CPI and inflation perceptions

A new study with the Bank of Canada on "Consumer Price Index and Inflation Perceptions in Canada: Can measurement approaches or behaviour factors explain the gap?" is available through the Prices Analytical Series or available upon request by contacting statcan.cpddisseminationunit-dpcunitedediffusion.statcan@statcan.gc.ca.

StatsCAN Plus

There is no question that prices are rising across Canada overall. In fact, the CPI has been increasing at its fastest pace in almost two decades over the last few months. Some consumers feel that prices may be rising at an even faster pace than captured by the CPI, but rest assured this is not the case. For more information, consult Prices are rising, but by how much? in Statistics Canada's newest publication, StatsCAN Plus!

Explore the CPI tools that can help you make informed financial decisions

Check out the Personal Inflation Calculator! This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Consult the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Drivers see higher gasoline prices at the pumps

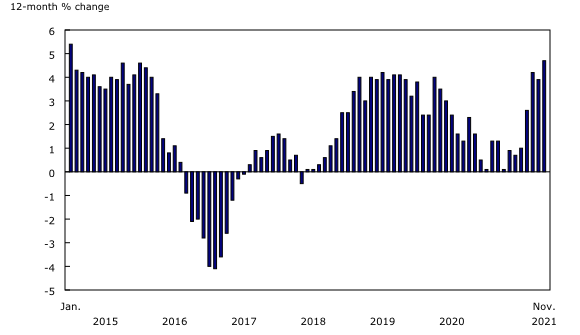

Canadian drivers continued to feel the impact of the largest source of consumer inflation, with gasoline prices 43.6% higher compared with November 2020. Oil production continues to remain below pre-pandemic levels, though global demand has increased.

On a monthly basis, gasoline prices were down 0.1% compared with October 2021, amid volatility in global oil markets because of ongoing uncertainties brought on by COVID-19 variants.

Grocery prices increase at a faster pace

Year over year, shoppers paid more for groceries, as prices for food purchased from stores rose at a faster pace in November (+4.7%) than in October (+3.9%). This is the largest increase since January 2015 when prices went up by 5.4%. Fresh vegetable prices increased 2.3% in November, the first yearly increase since February 2021. Prices for other fresh vegetables, including cucumbers, mushrooms and broccoli, drove the increase, rising 6.4% on a year-over-year basis as a result of higher shipping costs and supply chain disruptions.

Prices for fresh or frozen beef increased 15.4% year over year in November. Poor crop yields resulting from unfavourable weather conditions have made it more expensive for farmers to feed their livestock, in turn raising prices for consumers.

Consumers pay less for cellular phone plans

Consumers who signed on to a cell phone plan in November paid 17.9% less than those who did so in November 2020. Prices for cellular services declined, as a variety of promotions across the industry offered reduced prices for cellular phone plans, as well as bonus data.

Furniture prices continue to rise

Canadians paid more to furnish their living spaces in November, as prices for furniture rose 8.7% year over year amid higher shipping costs. The introduction of tariffs first implemented in early May 2021 may have contributed to the increase in prices for upholstered furniture (+11.2%).

Regional highlights

Year over year, prices rose at a faster pace in November than in October in four provinces, with prices increasing the most in Prince Edward Island (+7.0%), mainly due to higher heating costs. Prices in Saskatchewan grew at a faster rate, largely the result of higher prices for natural gas (+13.4%).

The slowdown in British Columbia, which is unrelated to the flooding as most prices were collected prior to the weather events, is partly due to lower prices for clothing and footwear (-2.4%).

Note to readers

COVID-19 and the Consumer Price Index

In November 2021, all special treatments introduced for good and services that were unavailable due to the COVID-19 pandemic were removed.

With the November Consumer Price Index (CPI), cruise-based travel tours, which represented 0.03% of the 2020 CPI basket, are no longer being imputed and an adjustment factor is applied. The November index level for this component of the travel tours index is obtained by comparing November 2021 and the last observed price in 2020. This procedure removes the impact of all imputations performed in the months where this service was not available for consumption.

This treatment corresponds to the approach used for the re-introduction of seasonal products in the CPI in the first month of their in-season period.

The headline CPI for November 2021 would have been the same with or without the re-introduction of this component.

Users are advised to exercise caution in interpreting the 1-month change for November 2021 and the 12-month change for the next 12 months for the travel tours index.

Floods in British Columbia

Price collection for the November CPI was largely unaffected by the recent floods, as the majority of prices were collected prior to the weather events. Statistics Canada continues to monitor the impacts of the floods in British Columbia on Canada's CPI.

Most prices are now collected from alternative data sources, including point of sale data, administrative data and retailer websites. These advances ensure that the CPI remains an accurate measure of inflation in changing times.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on January 4, 2022. For more information, consult the document "Real-time data tables."

Next release

The Consumer Price Index for December 2021, including the Consumer Price Index Annual Review, will be released on January 19, 2022.

The Consumer Price Index for January 2022 will be released on February 16, 2022.

Products

Please note that the tables available on the website represent a subset of the data available with this release. The full dataset is available upon request by contacting statcan.cpddisseminationunit-dpcunitedediffusion.statcan@statcan.gc.ca.

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: