Canadian international merchandise trade, October 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-12-07

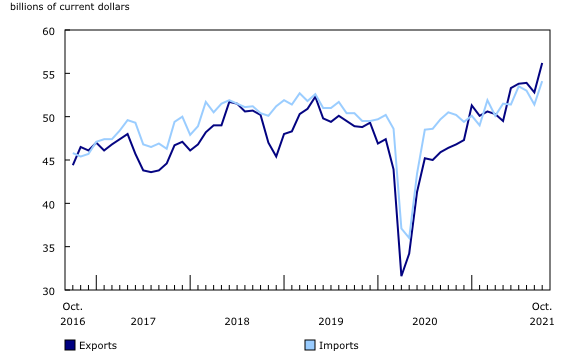

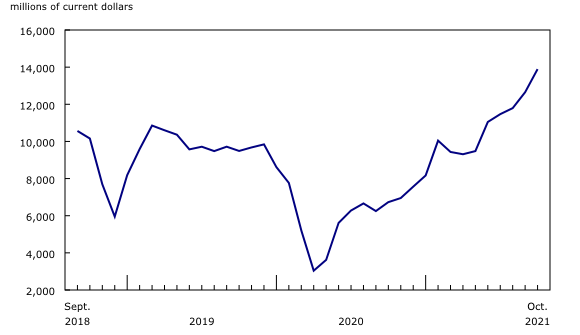

In October, Canada's merchandise exports and imports rose sharply, in large part because of higher trade in motor vehicles and parts as well as energy products. Exports were up 6.4%, while imports rose 5.3%. Canada's merchandise trade surplus widened from $1.4 billion in September to $2.1 billion in October, the largest surplus so far in 2021.

Consult the "International trade monthly interactive dashboard" to explore the most recent results of Canada's international trade in an interactive format.

Impact of British Columbia flooding on merchandise trade data

In November, flooding and landslides caused severe damage to transportation infrastructure in British Columbia, resulting in major disruptions to the transportation of goods to and from key points of entry and exit on the West Coast. Customs data show that, in 2020, more than $92.9 billion worth of goods travelled into and out of the province, representing 8.7% of Canada's total merchandise trade. Exports via marine transportation from British Columbia are particularly significant, amounting to more than $50 billion in 2020, or almost half of the country's exports by sea. The main products exported from British Columbia marine ports include agricultural products; wood pulp; and mining products, such as potash, coal and copper ores. These transportation disruptions are expected to impact international merchandise trade data for the November reference month, to be released on January 6, 2022.

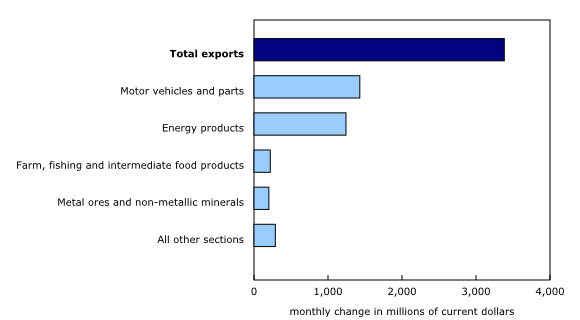

Rebound in exports of passenger cars and light trucks, and a record high for exports of energy products

Total exports rose 6.4% in October to reach a record $56.2 billion. While exports increased in 8 of 11 product sections, the combined gains in exports of motor vehicles and parts and energy products accounted for almost 80% of the total growth. In real (or volume) terms, total exports rose 2.8% in October.

Following a decline of 18.1% in September, exports of motor vehicles and parts increased 30.8% in October. While stoppages related to semiconductor chip shortages still affected Canadian assembly plants in October, they were less significant than those that occurred in September. The October export value of $6.1 billion for the product section was still almost 23% lower than the monthly average observed in 2019, before the pandemic. Exports of passenger cars and light trucks (+44.0%) increased the most, followed by motor vehicle engines and parts (+18.3%).

Exports of energy products increased 9.8% in October to reach $13.9 billion, surpassing the previous record set in 2014 by more than $1 billion. Exports of crude oil (+11.6%) were the largest contributor, reaching $9.8 billion on the strength of higher prices. Exports of coal (+62.8%) also reached a record high; they were up as a result of higher volumes and higher prices. Coal export prices have more than doubled since July. The vast majority of coal exports are shipped from Vancouver terminals, so the recent transportation disruptions in the region could result in lower export levels in November.

Exports of farm and fishing and intermediate food products increased 5.6% in October. Following two consecutive months of low levels, exports of canola more than doubled in October, mainly on higher exports destined to China, Japan and Mexico. Canola is another commodity that primarily shipped from Vancouver terminals.

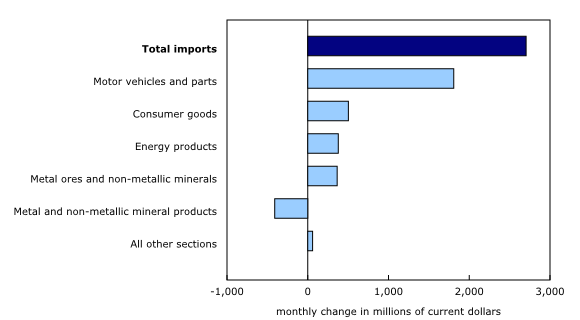

Motor vehicles and parts account for almost two-thirds of import growth

Total imports increased 5.3% in October to reach a record $54.1 billion. This follows a 3.1% decrease in September that was largely attributable to lower imports of motor vehicles and parts. Overall, gains were observed in 7 of 11 product sections in October, with motor vehicles and parts responsible for almost two-thirds of the monthly increase. In real (or volume) terms, total imports rose 7.0%.

After falling 13.8% in September, imports of motor vehicles and parts rose 27.2% in October to reach $8.5 billion, a level similar to those observed before the volatility caused by the supply issues began. Imports of motor vehicles and parts dropped in August and September, as the global shortage of semiconductor chips forced North American automakers to slow their activity with unplanned work stoppages. As was the case with exports, these stoppages had less impact in October, leading to an increase in imports of passenger cars and light trucks (+32.5%), as well as motor vehicle engines and parts (+34.0%), both mainly from the United States.

Imports of consumer goods increased 4.5% in October, a third consecutive monthly increase following large decreases in June and July. Imports of clothing, footwear and accessories (+15.4%) increased the most in October, mainly on higher imports from Asian countries. This product category has been somewhat volatile over the past two years, as the pandemic and international shipping constraints contributed to disruptions in typical import patterns. Imports of pharmaceutical products (+6.6%) also increased in October, partly because of higher imports within the category "vaccines for human medicine other than for influenza," which includes COVID-19 vaccines.

Following a 14.6% decrease in September, imports of energy products increased 14.9% in October. There was a large decline in imports of crude oil by Canadian refineries in September, with Hurricane Ida affecting crude oil production in the United States, and temporary shutdowns at some refineries affecting refining activity in Canada. These recent declines in refinery inputs and production coincided with an increase of 23.8% in Canada's imports of refined petroleum products in October.

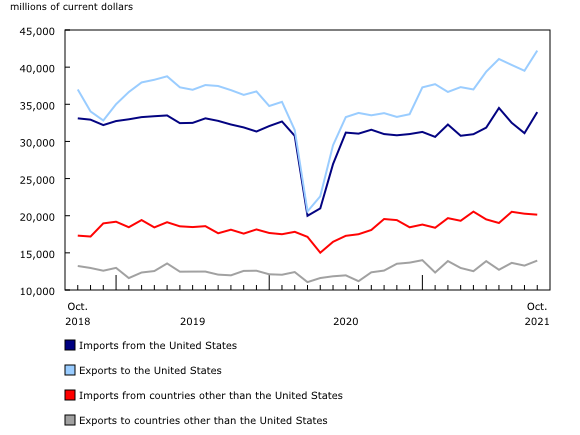

The United States contributes the most to the increase in both exports and imports

Exports to the United States rose 6.9% in October, reaching a record high of $42.2 billion. Meanwhile, imports from the United States were up 9.1% to $33.9 billion. Both increases were largely influenced by the rebound in trade of motor vehicles and parts. Canada's trade surplus with the United States narrowed slightly from $8.4 billion in September to $8.3 billion in October.

When the average exchange rates of September and October are compared, the Canadian dollar gained 1.5 US cents relative to the American dollar. This represents the largest monthly increase since May.

Exports to countries other than the United States were up 5.0% in October. Exports destined to China (canola and coal), the Netherlands (various products), South Korea (iron ore) and Hong Kong (gold) contributed the most to the gain. November exports to non-US countries will likely be affected by the situation in British Columbia.

Imports from countries other than the United States decreased 0.6% in October. Lower imports from Japan (turbines) and Italy (various products) were partially offset by higher imports from China (cell phones). Canada's trade deficit with countries other than the United States narrowed from $7.0 billion in September to $6.2 billion in October.

Revisions to September merchandise export and import data

Imports in September, originally reported at $51.1 billion in the previous release, were revised to $51.4 billion in the release for the current reference month. Exports in September, originally reported at $53.0 billion in the previous release, were revised to $52.8 billion in the current month's release.

Monthly trade in services

In October, monthly service exports were up 2.2% to $11.4 billion. Service imports increased 0.4% to $12.0 billion.

When international trade in goods and international trade in services were combined, exports increased 5.7% to $67.6 billion in October, while imports were up 4.4% to $66.1 billion. As a result, Canada's trade surplus with the world for goods and services widened from $657 million in September to $1.5 billion in October.

Note to readers

Merchandise trade is one component of Canada's international balance of payments (BOP), which also includes trade in services, investment income, current transfers, and capital and financial flows.

International trade data by commodity are available on both a BOP and a customs basis. International trade data by country are available on a customs basis for all countries and on a BOP basis for Canada's 27 principal trading partners (PTPs). The list of PTPs is based on their annual share of total merchandise trade—imports and exports—with Canada in 2012. BOP data are derived from customs data by adjusting for factors such as valuation, coverage, timing and residency. These adjustments are made to conform to the concepts and definitions of the Canadian System of National Accounts.

For a conceptual analysis of BOP-based data versus customs-based data, see "Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners."

For more information on these and other macroeconomic concepts, see the Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) and the User Guide: Canadian System of Macroeconomic Accounts (13-606-G).

The data in this release are on a BOP basis and are seasonally adjusted. Unless otherwise stated, values are expressed in nominal terms, or current dollars. References to prices are based on aggregate Paasche (current-weighted) price indexes (2012=100). Movements within aggregate Paasche prices can be influenced by changes in the share of values traded for specific goods, with sudden shifts in trading patterns—as observed currently with the COVID-19 pandemic—sometimes resulting in large movements in Paasche price indexes. Volumes, or constant dollars, are calculated using the Laspeyres formula (2012=100), unless otherwise stated.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions

In general, merchandise trade data are revised on an ongoing basis for each month of the current year. Current-year revisions are reflected in both the customs-based and the BOP-based data.

The previous year's customs-based data are revised with the release of data for the January and February reference months, and thereafter on a quarterly basis. The previous two years of customs-based data are revised annually, and revisions are released in February with the December reference month.

The previous year's BOP-based data are revised with the release of data for the January, February, March and April reference months. To remain consistent with the Canadian System of Macroeconomic Accounts, revisions to BOP-based data for previous years are released annually in December with the October reference month.

Factors influencing revisions include the late receipt of import and export documentation, incorrect information on customs forms, the replacement of estimates produced for the energy section with actual figures, changes in merchandise classification based on more current information, and changes to seasonal adjustment factors. The seasonal adjustment parameters are reviewed and updated annually, and applied with the October reference month release.

For information on data revisions for exports of energy products, see Methodology for Exports of Energy Products within the International Merchandise Trade Program.

Revised data are available in the appropriate tables.

Real-time data table

The real-time data table 12-10-0120-01 will be updated on December 19, 2021.

Next release

Data on Canadian international merchandise trade for November 2021 will be released on January 6, 2022.

Products

The product "International trade monthly interactive dashboard" (71-607-X) is now available. This new interactive dashboard is a comprehensive analytical tool that presents monthly changes in Canada's international merchandise trade data on a balance-of-payments basis, fully supporting the information presented every month in the Daily release.

The product "The International Trade Explorer" (71-607-X) is now available online.

Customs based data are available in the Canadian International Merchandise Trade Web Application (71-607-X).

Customs-based data are also still available in the Canadian International Merchandise Trade Database (65F0013X). Please note that the Canadian International Merchandise Trade online database will no longer be available as of February 1, 2022.

The updated "Canada and the World Statistics Hub" (13-609-X) is now available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. It provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, Japan, Belgium, Italy, the Netherlands and Spain.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca).

To enquire about the concepts, methods or data quality of this release, contact Benoît Carrière (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca), International Accounts and Trade Division.

- Date modified: