Farm income, 2020 (revised data)

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-11-24

Realized net income for Canadian farmers rose 84.4% to $9.4 billion in 2020, as strong growth in receipts outpaced slightly higher expenses. Excluding cannabis, realized net income was up 73.9% to $9.6 billion.

Realized net income is the difference between a farmer's cash receipts and operating expenses, minus depreciation, plus income in kind.

These revised data for 2020 do not account for challenges faced by Canadian producers in 2021—drought, continued processing backlogs and rising costs. While the COVID-19 pandemic posed its own challenges for Canadian agriculture in 2020, the gains to grain and oilseed producers from rising prices and strong domestic and international demand helped to boost net farm income for the agriculture sector in 2020.

The increase in 2020 followed a 5.1% gain in 2019 and a 32.7% decline in 2018. Rising crop receipts fuelled by strong export demand—combined with lower machinery fuel and fertilizer prices—pushed realized net income higher in 2020.

Saskatchewan accounted for more than two-fifths of the national increase, while realized net income declined in Newfoundland and Labrador, Nova Scotia, New Brunswick, and British Columbia. These four provinces did not benefit as much from robust export demand for grains, oilseeds and specialty crops, nor from lower machinery fuel and fertilizer prices, as agriculture industries in these provinces are not heavily concentrated in crop production.

Largest percentage increase in farm cash receipts since 2012

Farm cash receipts, which include market receipts from crop and livestock sales as well as program payments, rose 8.5% to $72.0 billion in 2020—the largest percentage gain since 2012 (+8.7%).

Market receipts for crops rose 15.0% to $42.2 billion in 2020, while livestock receipts were down 0.7%. Program payments were up 10.8%.

Market receipts are the product of prices and marketings. Marketings refer to quantities sold, using various units of measure, such as metric tonnes for field crops and hundredweight for some livestock.

Canola, lentil and cannabis sales drive the rise in farm cash receipts

The 15.0% increase in crop receipts in 2020 was driven by higher canola, lentil and cannabis receipts, which more than offset lower fruit and vegetable sales. Excluding cannabis, crop receipts would have increased by 13.0%—the largest increase since 2012.

Higher export demand for most Canadian grains and oilseeds boosted receipts. Exports of crops also benefited from greater rail capacity to ship these commodities, as demand weakened for petroleum products because of the COVID-19 pandemic.

Crop receipts were also bolstered by favourable growing and harvest conditions, in stark contrast to conditions in 2019. This, along with robust demand, allowed more of the 2020 harvest to be recorded as sales in the same calendar year.

Canola receipts were up 19.0%, the largest percentage increase since a 38.2% jump in 2011, when high oilseed prices led to a large gain. In 2020, canola prices increased 3.6%, while marketings rose 14.8%. The rise in marketings was driven by exports, despite an ongoing trade dispute with China. As world oilseed demand strengthened in the second half of the year, exports to China increased, while exports to the European Union almost doubled in 2020. Increased domestic crush also boosted canola sales.

Lentil receipts more than doubled in 2020, as both prices (+38.9%) and marketings (+49.6%) posted strong gains. Robust demand from Turkey and India for lentils boosted exports. The reduction of the import tariff imposed by India on Canadian lentils expedited exports to that country.

Farm cash receipts for Canada's largest crop by tonnes produced—wheat, excluding durum—increased by 10.7%, as marketings rose 11.7%.

Feed grain exports to China also rose, as the country sought grain to feed its growing hog herd. Canadian feed grain producers also benefitted from China-Australia trade tensions, the latter being a customary supplier of feed grains to China.

Cannabis receipts rose 52.5% in 2020. The introduction of edibles, cannabis-based drinks and topicals in late 2019 and early 2020, combined with more retail outlets in some provinces, contributed to an increased demand for legal dried cannabis.

Decreases in cattle receipts push livestock receipts lower

Livestock receipts declined by 0.7% in 2020 to $26.4 billion as the pandemic disrupted supply chains associated with meat processing. Temporary closures of processing facilities, as well as the introduction of enhanced public health measures to protect plant workers from COVID-19, presented challenges for the red meat sector.

Cattle receipts were down 3.9% in 2020 on lower prices (-2.9%) and marketings (-1.1%). Slaughter cattle receipts fell 4.1%, accounting for nearly four-fifths of the decrease in cattle receipts. The second quarter was particularly challenging for cattle producers, as cattle receipts fell 18.7% from the same quarter in 2019, as meat processing capacity was severely limited during the first wave of the pandemic. Disruptions in meat-processing plants in the United States and the subsequent work backlogs there contributed to an 8.9% drop in cattle and calf exports for the year.

Hog receipts rose 1.1% in 2020, as strong export demand for pork pushed hog marketings higher (+5.7%), despite pandemic-related disruptions in the North American processing sector. Receipts fell sharply in the second quarter (-15.4%) but rebounded thereafter. For the year, hog prices decreased by 4.4% but showed some strength later in the fourth quarter. Lower levels of domestic production in China, caused by outbreaks of African swine fever that began in 2018, continued to fuel pork exports.

The supply-managed sector (which includes dairy, egg and poultry production) posted a 1.7% gain in receipts. Unprocessed milk receipts, which accounted for over three-fifths of total supply-managed receipts, increased by 2.0%. Egg receipts were up 4.3% on slightly higher prices and marketings. Chicken receipts edged up 0.6%, while turkey receipts fell 4.1% because of lower quantities sold.

Crop insurance and stabilization payments drive increase in program payments

Direct program payments rose 10.8% in 2020 to $3.5 billion, following a 40.6% increase in 2019. Crop insurance payments rose 21.0%, largely the result of payments related to crop damage in 2019, when growing and harvest conditions were especially poor in the Prairies.

Provincial stabilization payments were up 52.0% in 2020. Almost two-thirds of the increase was in Quebec, where lower hog prices triggered payments.

Livestock price insurance program payments tripled in Alberta as cattle prices fell sharply in the second quarter of 2020, during the first wave of the pandemic.

Lower machinery fuel and fertilizer prices moderate the increase in operating expenses

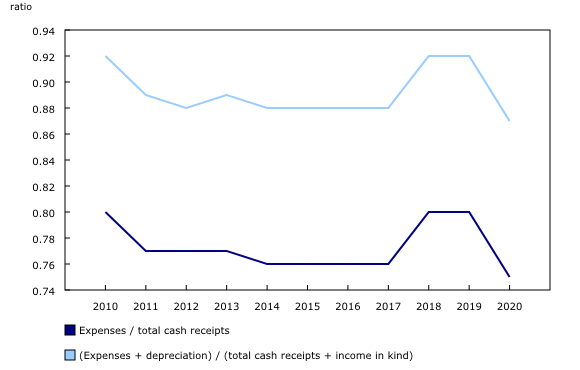

Farm operating expenses (after rebates) increased by 1.9% in 2020 to $54.2 billion—the smallest increase since 2016 (+0.8%).

Expenses associated with legal cannabis production increased by 31.7%, as licensed cannabis producers ramped up production of dried cannabis to serve the market for cannabis-based products like edibles and drinks. Excluding cannabis-related expenses, farm operating expenses edged up 0.6%.

Cannabis production requires a significant amount of labour. Consequently, more than one-half of the 5.2% rise in cash wages was attributable to cannabis. Without it, cash wages would have increased by 2.7%.

Machinery fuel prices fell sharply, as demand for fuel used in transportation declined significantly in the wake of measures taken to curb the spread of COVID-19. Machinery fuel expenses decreased by 15.7% in 2020, the largest decline since 2015 (-16.8%).

Lower prices pushed fertilizer expenses down 2.3%. Oversupply issues had nitrogen prices trending downward before the pandemic began. The 2020 decrease in fertilizer expenses was the largest since 2017 (-3.1%).

Total farm expenses (after rebates), which include operating expenses and depreciation, increased by 2.2% to $62.7 billion in 2020, as depreciation charges were up 4.1%. Total expenses rose in every province except Saskatchewan (-0.3%).

Increase in realized net income pushes total net income higher

Total net income rose $2.4 billion in 2020 to $7.8 billion, following a $547 million increase in 2019. Total net income rose in six provinces, but declined in each of the Atlantic provinces. Increases in Ontario and Saskatchewan accounted for over two-thirds of the national rise.

Total net income is realized net income adjusted for changes in farmer-owned inventories of crops and livestock. It represents the return to owner's equity, unpaid farm labour, management and risk.

While the strong increase in realized net income fuelled the rise in total net income, the value of inventory change had a negative impact on net farm income. Lower on-farm stocks of canola were the major contributor to the negative change, although reduced stocks of wheat, lentils, barley and soybeans also played a role. Excluding cannabis, total net income would have risen $2.1 billion to reach $7.5 billion. Growth in cannabis inventories in 2020 had a negative impact on total net income when cannabis is included.

Note to readers

A summary set of farm income components excluding cannabis-related receipts and expenses is available on request for 2019 and 2020. For confidentiality reasons, the 2019 set is not offered for the Atlantic provinces, Manitoba and Saskatchewan. For the same reason, 2020 non-cannabis estimates for Newfoundland and Labrador and Prince Edward Island are not available.

Realized net income can vary widely from farm to farm because of several factors, including the farm's types of commodities, prices, weather and economies of scale. This and other aggregate measures of farm income are calculated on a provincial basis employing the same concepts used to measure the performance of the overall Canadian economy. They are measures of farm business income, not farm household income.

Additional financial data for 2020, collected at the individual farm business level using surveys and other administrative sources, will be made available later this year. These data will help explain differences in the performance of various types and sizes of farms.

Preliminary farm income data for the previous calendar year are first released in May of each year, five months after the reference period. Revised data are then released in November of each year, incorporating data received too late to be included in the first release. Data for two years prior to the reference period are also subject to revision.

For details on farm cash receipts for the third quarter of 2021, see the "Farm cash receipts" release in today's Daily.

Products

The interactive data visualization tool "Net farm income, by province" is available on the Statistics Canada website.

The Agriculture and food statistics portal, accessible from the Subjects module of our website, provides users a single point of access to a wide variety of information related to agriculture and food.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: