Monthly credit aggregates, June 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-08-19

Household mortgage borrowing rises by record amount

Household sector borrowing is divided into financing in the form of non-mortgage loans, or funds principally for consumption, and mortgage loans, or debt acquired to finance the purchase of a property.

Household mortgage debt continued to climb at a significant rate, increasing 1.4% in June from the previous month. This growth represented a rise of $23.6 billion from May, the largest monthly increase on record. Compared with June 2020, mortgage borrowing was up 9.2%, a pace not seen since October 2008. Over the first half of 2021, households have added $81.6 billion in mortgage debt, compared with $108.6 billion over all 12 months of 2020.

While the rise in mortgage debt accelerated, the volume of housing resale activity and the average resale price have been on a downward trend after reaching peaks in March of 2021. There is normally a time lag between the sale of a home and the actual receipt of mortgage funds; however, borrowers may also be in the market for a new home, or otherwise be taking additional equity out of their home or consolidating debt when refinancing their existing mortgages. Investment in residential building construction displayed sustained growth over much of 2020 and into 2021 and remains elevated despite recent declines, while year-over-year gains in new home prices remained near record highs in June. Additionally, the new OSFI stress test for uninsured mortgages went into effect on June 1, which may have spurred additional borrowing prior to the deadline.

Non-mortgage debt grew 0.4% in June to $789.2 billion; growth in credit card debt (+1.6%) and other personal loans (+2.7%) continued to drive non-mortgage debt. Credit card debt increased for the fourth month in a row as pandemic-related restrictions eased. Lines of credit also rose by $1.7 billion, but this was fuelled by growth in home equity lines of credit.

Overall, the total credit liabilities of households reached $2,529.3 billion in June, a 1.1% increase from May. Real estate secured debt, composed of both mortgage debt and home equity lines of credit, increased by 1.3% to surpass $2.0 trillion for the first time.

Uptick in private non-financial corporation borrowing

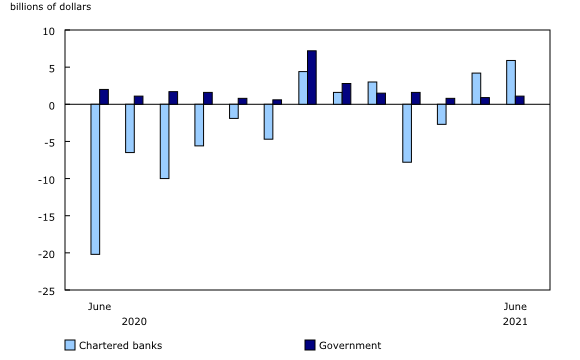

In June, private non-financial corporations' non-mortgage loan liabilities grew for the second consecutive month, increasing 1.2% (+$8.5 billion). Non-mortgage loans from chartered banks again drove the increase with growth of 1.3% (+$5.9 billion), along with new funds provided by the federal government's LEEFF (Large Employer Emergency Financing Facility) program and CEBA (Canadian Business Emergency Account), with growth of 1.6% (+$1.1 billion).

Private non-financial corporations' mortgage debt rose 0.9% (+$2.9 billion) to $346.6 billion.

In terms of debt securities, private non-financial corporations recorded net issuances in debt securities of $12.1 billion in June, fuelled by sizeable net issuances in long-term instruments (i.e., bonds).

Overall, total credit liabilities of private non-financial corporations grew by 2.2% (+$64.4 billion) in June, moving past $2.9 trillion by the end of the month.

Note to readers

Overview of the monthly credit aggregates

The monthly credit aggregates break down a portion of the quarterly National Balance Sheet Accounts (NBSA) by month. They provide details on lending to households and non-financial corporations—in other words, the stock of these sectors' outstanding liabilities from the debtor perspective—across a range of credit instruments, including mortgage loans, non-mortgage loans, and debt and equity securities. The aggregates cover all lending sectors, including chartered banks, non-bank deposit-taking institutions, other financial corporations, government and other lenders. The estimates are presented as booked-in-Canada to capture activity within Canada with either domestic or non-resident lenders. Additionally, amounts are reported on an end-of-period basis (i.e., the value of the stock of an asset on the final day of the month). The third month of each quarter is benchmarked to the corresponding quarterly release of the NBSA.

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA cover all national non-financial assets and all financial asset-liability claims outstanding in all sectors and—similarly—they present stocks as of the end of each quarter.

Estimates are available on a seasonally adjusted basis to improve the interpretability of period-to-period changes in debt. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on the concepts, methodologies and classifications used to compile these monthly estimates, please see the document "Guide to the Monthly Credit Aggregates."

Next release

Data on the monthly credit aggregates for July will be released on September 17, 2021.

Products

The document "Guide to the Monthly Credit Aggregates," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The document "An overview of revisions to the Financial and Wealth Accounts, 1990 to 2020," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Securities statistics," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The Economic Accounts Statistics Portal, accessible from the Subjects module of our website, provides an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: