Monthly credit aggregates, May 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-07-20

Household mortgage borrowing continues strong growth

Household sector borrowing is divided into financing in the form of non-mortgage loans or funds principally for consumption, and mortgage loans or debt acquired to finance the purchase of a property.

Household mortgage debt expanded 1.0% in May, rising $16.3 billion from April. The trend of strong year-over-year growth continued, with household mortgage debt up 8.3% compared to May 2020. Housing resale activity fell for a second consecutive month in May, but has shown notable strength so far this year. Over the first five months of 2021, households added $57.5 billion in mortgage debt, compared with $34.3 billion over the same period in 2020.

Non-mortgage debt edged up 0.4% to $786.2 billion in May; growth in credit card debt and other personal loans was the main driver. Credit card debt recorded a rise for the third month in a row in May, but was down 3.3% from May 2020.

Overall, the total credit liabilities of households nudged past $2.5 trillion in May, up 0.8% for the second consecutive month. Real estate secured debt, composed of both mortgage debt and home equity lines of credit, stood at $1,979.9 billion.

Private non-financial corporation borrowing rises

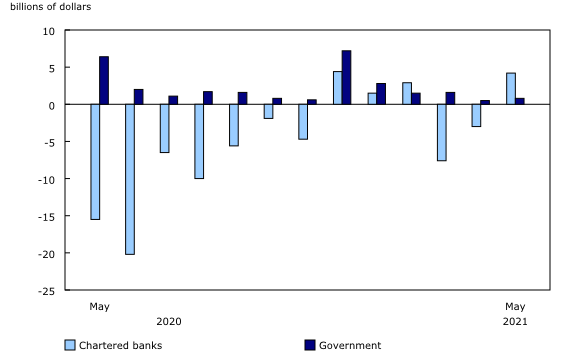

In May, the non-mortgage loan liabilities of private non-financial corporations grew by 0.5% (+$3.9 billion). Non-mortgage loans from chartered banks drove the increase with growth of 0.9% (+$4.2 billion), along with new funds provided by the federal government's Large Employer Emergency Financing Facility program and Canadian Business Emergency Account, which contributed to the growth of 1.1% (+$0.8 billion) in overall government lending.

While private non-financial corporations account for a much smaller share of residential mortgage debt, they have added $14.8 billion since April 2020, an increase of 16.3%, through activities such as financing the construction and sale of homes with mortgage debt.

In terms of debt securities, private non-financial corporations recorded net issuances in debt securities (+$780 million), as net retirements of short-term instruments were offset by net issuances of bonds in May.

Overall, total credit liabilities of private non-financial corporations grew by 0.5% (+$13.9 billion) in May totalling $2,844.9 billion by the end of the month.

Note to readers

Overview of the monthly credit aggregates

The monthly credit aggregates break down a portion of the quarterly National Balance Sheet Accounts (NBSA) by month. They provide details on lending to households and non-financial corporations—in other words, the stock of these sectors' outstanding liabilities from the debtor perspective—across a range of credit instruments, including mortgage loans, non-mortgage loans, and debt and equity securities. The aggregates cover all lending sectors, including chartered banks, non-bank deposit-taking institutions, other financial corporations, government and other lenders. The estimates are presented as booked-in-Canada to capture activity within Canada with either domestic or non-resident lenders. Additionally, amounts are reported on an end-of-period basis (i.e., the value of the stock of an asset on the final day of the month). The third month of each quarter is benchmarked to the corresponding quarterly release of the NBSA.

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA cover all national non-financial assets and all financial asset-liability claims outstanding in all sectors and—similarly—they present stocks as of the end of each quarter.

Estimates are available on a seasonally adjusted basis to improve the interpretability of period-to-period changes in debt. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on the concepts, methodologies and classifications used to compile these monthly estimates, please see the document "Guide to the Monthly Credit Aggregates."

Next release

Data on the monthly credit aggregates for June will be released on August 19, 2021.

Products

The document "Guide to the Monthly Credit Aggregates," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The document "An overview of revisions to the Financial and Wealth Accounts, 1990 to 2020," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Securities statistics," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, provides an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: