Income of families and individuals: Subprovincial data from the T1 Family File, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-07-15

Median after-tax income edges up in 2019

Median after-tax income of families and individuals edged up 0.3% from a year earlier, to $54,650 in 2019. Median after-tax income grew at the fastest pace in census metropolitan areas (CMAs) in Quebec, while the largest decline was in the CMA of St. John's, Newfoundland and Labrador. Nationally, the share of individuals living in low income was almost unchanged from a year earlier.

Data for 2019 income of families and income of individuals not in families are now available from the T1 Family File for Canada, provinces, territories, and various subprovincial and subterritorial geographic areas.

While the data in this release pre-date COVID-19, they will serve as an important benchmark to measure the full impact of the pandemic on the median after-tax income of families and individuals. Information on the annual incomes of families and individuals in 2020, the first year of the COVID-19 pandemic, will be released, starting in early 2022.

Median after-tax income of families and individuals increased in 12 of the 35 CMAs in 2019. In Quebec, median after-tax income grew at over twice the pace of the national average in Trois-Rivières (+1.6%), Saguenay (+1.6%), Sherbrooke (+1.5%), Montréal (+1.4%) and Québec (+1.3%), and was slightly higher in Gatineau (+0.7%).

Victoria (+0.9%) was the lone CMA outside of Quebec where median after-tax income rose by close to 1.0% or more, while the increase in Vancouver (+0.6%) was two times greater than the national growth rate.

The increases in Quebec and British Columbia may be partially attributable to higher weekly earnings and lower annual average unemployment rates in these two provinces in 2019, compared with the national average.

Median after-tax income also edged up in Toronto (+0.1%), while the largest decline was in St. John's (-1.7%).

Median income increases at the fastest pace in British Columbia and Quebec from 2014 to 2019

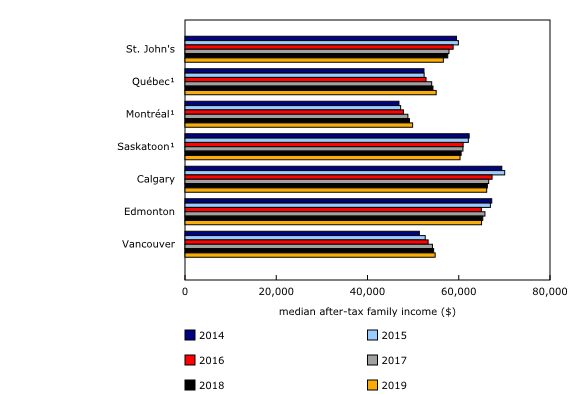

After-tax income was rising for families and individuals in the years leading up to 2020, the first year of the COVID-19 pandemic. The median after-tax income of families and individuals increased 3.1% over a five-year period, rising from $53,010 in 2014 to $54,650 in 2019. Over the same period, median after-tax income increased in 27 CMAs, fell in 7 and was relatively unchanged in 1.

The largest increases over the five-year period were in British Columbia and Quebec. Median after-tax income rose at the fastest pace in Vancouver (+6.8%) and Montréal (+6.4%), followed by Victoria (+6.1%) and Québec (+5.1%).

Conversely, the largest longer-term declines in median after-tax income occurred in cities where the oil and gas industry play an important role in the local economy. St. John's (-4.9%) and Calgary (-4.8%) reported the largest drops in median after-tax income, followed by Edmonton (-3.3%) and Saskatoon (-3.2%). Despite these declines, Calgary ($66,120) and Edmonton ($65,000) continued to report the highest median after-tax income nationally in 2019.

The share of Canadians in low income almost unchanged in 2019

Statistics Canada uses several approaches to track changes in low income. The after-tax Census Family Low Income Measure compares the family income of each individual in a specific geographic area with the overall national threshold. Those with a family after-tax income (adjusted for family size) below 50% of the national median are deemed in low income (see Note to readers). Since this measure is available for all Canadian tax filers, it is possible to track annual low-income data for all 35 CMAs and 117 census agglomerations.

According to this measure, 16.4% of Canadians were in relative low income in 2019, almost unchanged from 2018 (16.5% of Canadians). Three of the largest declines in the low-income rate were in the Quebec CMAs of Saguenay (down 0.4 percentage points to 12.2%), Trois-Rivières (down 0.4 percentage points to 16.2%) and Montréal (down 0.4 percentage points to 16.8%). Similarly, the low-income rate in Vancouver fell 0.3 percentage points to 19.4%, but remained well above the national average.

Conversely, the share of Canadians living in low income rose at the fastest pace in Regina (up 0.7 percentage points to 16.0%) and Kitchener–Cambridge–Waterloo (up 0.5 percentage points to 14.6%).

The after-tax Census Family Low Income Measure reported here differs from Canada's official poverty rate, which is generated using the Market Basket Measure. About 3.7 million Canadians, or 10.7% of the population, lived below Canada's official poverty line in 2019 down from 11.0% in 2018 (see Why are trends in the Market Basket Measure sometimes different from trends in the low-income measure?).

Why are trends in the Market Basket Measure sometimes different from trends in the Low Income Measure?

Trends in the Market Basket Measure (MBM) and Low Income Measure (LIM) rates sometimes differ. This is because of differences in the way the two measures calculate low income.

The MBM is based on the concept of an individual or family not having enough income to afford the cost of a basket of goods and services. Therefore, when the incomes of lower-income people rise relative to local prices, the MBM rate tends to fall, because more people can afford this basket of goods.

The LIM is a relative measure, based on the concept of an individual or family having low income relative to the Canada-wide median. In general, for the LIM rate to fall, the income gap between lower-income people and other people has to narrow.

Canada Workers Benefit recipients in 2019 outnumbered Working Income Tax Benefit recipients in 2018

Since data from this release cover all individuals who filed taxes, it makes it possible to look at the impact of specific programs administered through the tax system. In 2019, the Canada Workers Benefit (CWB) was introduced as a replacement to the Working Income Tax Benefit (WITB). The CWB is a refundable tax credit that is intended to supplement the earnings of low-income workers and improve work incentives for low-income Canadians. Unlike the WITB, the CWB is calculated automatically by the Canada Revenue Agency for all eligible tax filers. Other changes in this program included an increase in the benefit amounts and a lower clawback rate combined with a higher income threshold for the clawback.

Accordingly, a larger proportion of tax filers received CWB in 2019, compared with WITB in 2018, and benefits received were also larger. In 2019, 7.3% of tax filers 19 years of age and older received CWB and the average payout was $970, while in 2018, 4.7% received WITB, with an average payout of $830.

More Canadians received the Climate Action Incentive in 2019, as Albertans start to receive this program

The Climate Action Incentive (CAI) is another government program that saw significant changes from 2018 to 2019. The CAI is a refundable tax credit intended to offset the cost of a federal fuel surcharge in specific provinces. Initially, this credit applied only to residents from New Brunswick, Ontario, Manitoba and Saskatchewan. For the 2019 tax season, Alberta was added to the list of eligible provinces and New Brunswick was removed. The addition of Alberta recipients and an increase in the benefit amount led to a rise in the number of recipients (10.9 million in 2019; +21.8% over 2018) and in the average amount paid for this credit ($370 in 2019; +68.2% over 2018).

A snapshot of median after-tax income of individuals and families in census agglomerations

A new subset of indicators are now available in an interactive format for all 35 CMAs and 117 census agglomerations in the Income of men and women, sub-provincial regions, T1 Family File: Interactive tool and the Sources of family income by family type, sub-provincial regions, T1 Family File: Interactive tool.

A census agglomeration is an urban centre with a population ranging from 10,000 to 50,000 people. To provide an example of how these interactive tools work, two census agglomerations are examined in detail.

In Baie-Comeau, Quebec, the average after-tax income of individuals totalled $40,860 in 2019. The average after-tax income of men ($48,690) was 47.2% higher, compared with the median average for women ($33,080). Seniors had an average after-tax income of $31,140. For families and individuals in Baie-Comeau, approximately two-thirds (68.0%) of their income was derived from employment, while one-quarter came from government transfers (15.9%) or private pensions (11.8%).

In Grande Prairie, Alberta, the average after-tax income of individuals totalled $51,450 in 2019. The average after-tax income of men ($63,920) was 65.0% higher, compared with the median average for women ($38,750). Seniors had an average after-tax income of $43,210. For families and individuals in Grande Prairie, over 4/5 (81.8%) of their income was derived from employment, while just over 1/10 came from government transfers (8.6%) or private pensions (2.3%).

Note to readers

Individual and family income data for 2019 are now available from the T1 Family File (T1FF). Data are derived from personal income tax returns filed in spring 2020, and are available for Canada, the provinces and territories, and various sub-provincial and sub-territorial geographic areas. Data are not adjusted on the basis of Statistics Canada's population estimates.

In this release, the term families and individuals refers to census families and persons not in a census family. A census family refers to a married or a common-law couple, with or without children at home, or a lone-parent family.

In this release, income has been adjusted for inflation, as measured by the Consumer Price Index, and all dollar amounts are expressed in 2019 dollars.

After-tax income refers to total income less income taxes. Income taxes refer to the sum of federal income taxes, provincial and territorial income taxes, less abatement, where applicable. Total income includes employment income, dividend and interest income, government transfers, pension income and other income. In accordance with international standards, capital gains are excluded from total income.

This release reports on low-income statistics using the after-tax Census Family Low Income Measure (CFLIM-AT). Individuals are deemed in low income if their adjusted after-tax income falls below 50% of the national median adjusted after-tax income. Adjusted after-tax income is derived by dividing census family income by the square root of census family size and assigning this to all members of the census family. Persons not in census families are treated as census families of size 1. Data based on the CFLIM-AT methodology can be found in tables 11-10-0018-01 and 11-10-0020-01.

Low-income estimates reported in this release differ from those reported in other sources, such as the Census of Population or the Canadian Income Survey (CIS). Reasons for this include differences in the unit of analysis and the data coverage. The low income measure presented in the census and CIS uses the household unit of analysis (instead of census family), and currently excludes those living in the territories, in collective dwellings and on reserves. Users interested in more details can refer to the paper "Low Income Measure: Comparison of Two Data Sources, T1 Family File and 2016 Census of Population." The census and CIS also produce low-income estimates based on other approaches such as the Market Basket Measure (MBM), which was adopted as Canada's official poverty line in 2019. It is not possible to compute the MBM for the T1FF. In addition to income, the MBM relies on data that is obtained through survey questions and not available for this release.

In standard data tables associated with this release, the Canada Workers Benefit (which replaced the Working Income Tax Benefit) and the Climate Action Incentive are included in the source of income category called Other Government Transfers.

The median is the point at which half of the observations are higher and half are lower.

The average is the sum of the observations divided by the number of observations.

All data in this release have been tabulated according to the 2016 Standard Geographical Classification used for the 2016 Census.

A census metropolitan area (CMA) is formed by one or more adjacent municipalities centred on a population centre (also known as the core). A CMA must have a total population of at least 100,000, of which 50,000 or more must live in the core.

Correction note

On August 11, 2021, a correction was made to the values associated with the concepts of total income, after-tax income and census family Low Income Measure for 2019.

Products

The Technical Reference Guide for the Annual Income Estimates for Census Families, Individuals and Seniors, T1 Family File, Final Estimates (72-212-X), presents information about the methodology, concepts and data quality for the data available in this release.

The free tables linked to this release are available for Canada, provinces and territories, census metropolitan areas, and census agglomerations. Versions of these tables are also available as a custom service, upon request, for lower levels of geography. The tables are grouped in three categories (Income of Families 13C0016, various prices; Income of Individuals 13C0015, various prices; and Income of Seniors 89C0022), various prices) and are available for Canada, provinces and territories, federal electoral districts, economic regions, census divisions, census subdivisions (new; starting with 2019 data), census metropolitan areas, census agglomerations, census tracts, and postal-based geographies.

The most recent sub-provincial income information for families and individuals for metropolitan areas can also be explored in an interactive format by visiting the Income of men and women, sub-provincial regions, T1 Family File: Interactive tooland the Sources of family income by family type, sub-provincial regions, T1 Family File: Interactive tool.

The Income, pensions, spending and wealth portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to revenue, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: