Industrial product and raw materials price indexes, May 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-30

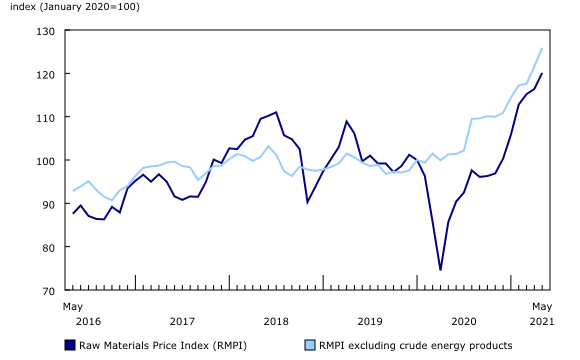

Prices for products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), rose 2.7% month over month in May and were up 16.4% compared with May 2020. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), increased 3.2% on a monthly basis in May and were up 40.1% year over year.

Industrial Product Price Index

In May, the IPPI rose 2.7%, after increasing 1.8% the previous month. This was the strongest monthly gain since February 2021, when prices increased 2.8%. Of the 21 major commodity groups, 14 were up, 6 were down, and 1 was unchanged.

The growth in the IPPI was led by prices for lumber and other wood products (+17.9%), which were up for a fifth consecutive month. The growth in this commodity group was primarily the result of constant price increases for softwood lumber (+27.6%), which posted its largest monthly gain since the beginning of this series in 1956. Compared with May 2020, prices for softwood lumber rose 235.5%. These record price increases largely reflected the continued strong demand for softwood lumber for construction work and renovations, combined with lower supplies and inventories.

Prices for energy and petroleum products rose 5.4%, led upward by higher prices for refined petroleum products, particularly motor gasoline (+6.7%) and diesel and biodiesel fuels (+5.4%). Higher refining margins and crude oil prices were the main contributors to these gains.

Prices for meat, fish and dairy products were up 3.7%, driven mainly by higher prices for fresh and frozen beef and veal (+9.9%) and fresh and frozen pork (+9.8%).

In addition, prices for primary non-ferrous metal products (+3.4%) and primary ferrous metal products (+2.2%) rose from April.

While price increases were widespread among primary non-ferrous metal products, this commodity group was mostly pushed upward by higher prices for unwrought gold, silver, and platinum group metals, and their alloys (+2.6%) and unwrought copper and copper alloys (+5.8%). Growth in the primary ferrous metal product group was led by higher prices for cold-rolled iron or steel products (+2.9%) and iron or steel pipes and tubes (except castings) (+8.8%).

Prices for fruit, vegetables, feed and other food products increased by 2.0%, led mostly by higher prices for grain and oilseed products, not elsewhere classified (+5.2%), other animal feed (+4.1%), and cookies, crackers and baked sweet goods (+3.4%).

Year over year, the IPPI was up 16.4%. This was the 10th consecutive advance and the largest increase since January 1980 (+16.7%). This gain was driven by higher prices for lumber and other wood products (+119.6%) and energy and petroleum products (+76.1%).

Some prices used in the IPPI are reported in US dollars and converted to Canadian dollars using the average monthly exchange rate. From April to May, the Canadian dollar appreciated 3.0% relative to the US dollar. Consequently, this appreciation had a downward effect on the index.

Raw Materials Price Index

The RMPI (+3.2%) was up for an eighth straight month in May, after posting a 1.0% increase in April. Of the six major commodity groups, five were up and one was down.

Widespread price increases for metal ores, concentrates and scrap (+4.7%), especially gold, silver, and platinum group metal ores and concentrates (+3.5%), were the main source of the growth in the RMPI in May. Prices for iron ores and concentrates (+12.1%) and nickel ores and concentrates (+4.7%) also pushed this group upward, but to a lesser extent.

Crude energy product prices were up 2.3%, following a 3.2% decline the previous month. The gain in May was led by higher prices for conventional crude oil (+2.2%). Increased demand and the Organization of the Petroleum Exporting Countries' compliance, as well as that of its partners (OPEC+), with the agreement to limit production contributed to the rise in crude oil prices.

Prices for crop products advanced 5.6%, led by a 7.7% increase in canola prices, which rose for a 15th consecutive month. Year over year, canola prices rose 86.8%, mostly because of an imbalance between supply and demand.

Year over year, the RMPI rose 40.1%, primarily on higher prices for crude energy products (+87.2%). Prices for metal ores, concentrates and scrap (+27.0%) and crop products (+40.4%) also contributed to the advance.

Note to readers

The Industrial Product Price Index (IPPI) and the Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The Industrial Product Price Index reflects the prices that producers in Canada receive as goods leave the plant gate. The IPPI does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all costs that occur between the time a good leaves the plant and the time the final user takes possession of the good. This includes transportation, wholesale and retail costs.

Canadian producers export many goods. They often indicate their prices in foreign currencies, especially in US dollars, and these prices are then converted into Canadian dollars. In particular, this is the case for motor vehicles, pulp and paper products, and wood products. Therefore, fluctuations in the value of the Canadian dollar against its US counterpart affect the IPPI. However, the conversion to Canadian dollars reflects only how respondents provide their prices. This is not a measure that takes into account the full effect of exchange rates.

The conversion of prices received in US dollars is based on the average monthly exchange rate established by the Bank of Canada and available in Table 33-10-0163-01 (series v111666275). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The Raw Materials Price Index reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Products

Statistics Canada launched the Producer price indexes portal as part of a suite of portals for prices and price indexes. This web page provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video Producer Price Indexes is available on the Statistics Canada Training Institute web page. It provides an introduction to Statistics Canada's producer price indexes—what they are, how they are made and what they are used for.

Next release

The industrial product and raw materials price indexes for June will be released on July 30.

Contact information

For more information, or to enquire about the concepts, methods, or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: