Survey of Innovation and Business Strategy, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-09

Long-term strategies and business processes: 2020 to 2024

The majority of businesses (53.5%) reported that focusing on good or service positioning (such as good or service leadership, market segmentation, good or service diversification, and quality improvement) is their most important long-term strategy over the 2020-to-2024 period. Comparatively, 3.9% of businesses reported that low-price and cost leadership is their main focus. The remainder (42.6%) reported that both are equally important.

The priority for the majority of businesses (57.5%) over the 2020-to-2024 period is to expand their sales of existing goods or services, as opposed to maintaining sales or introducing new or improved goods or services.

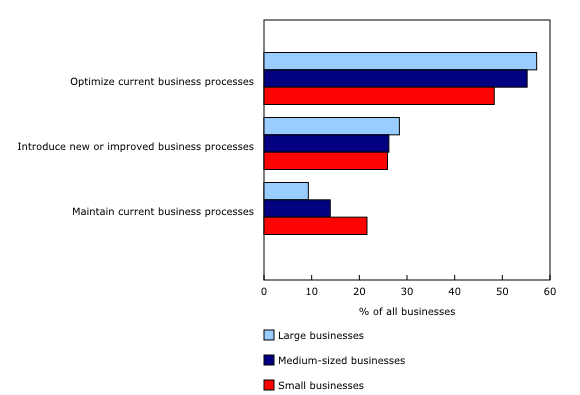

In addition, a larger proportion of businesses planned to optimize their current business processes (49.5%) over the 2020-to-2024 period, compared with introducing new or improved business processes (26.0%) or maintaining current business processes (20.2%). However, there are significant differences between businesses of varying sizes. Nearly three-fifths (57.2%) of large businesses (with 250 or more employees) reported that optimizing their current business processes best describes their strategic focus. Less than 1 in 10 (9.3%) aimed to maintain their current business processes.

In comparison, optimizing business processes is a priority for less than half (48.3%) of small businesses (20 to 99 employees), while one in five wished to maintain their current business processes.

Lack in skilled trades is the most common type of skill shortage

Fundamental to the success of any business strategy is the acquisition of key skills. However, finding workers who possess specialized skills can be challenging for businesses.

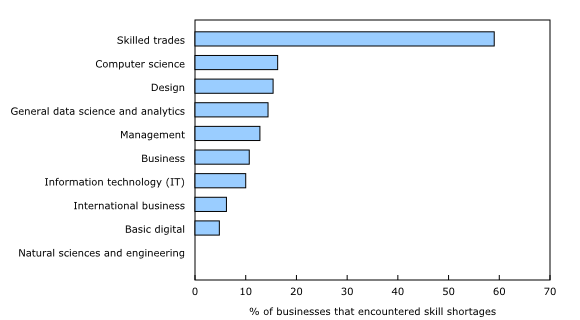

In 2019, almost 6 in 10 businesses identified skill shortages related to the area of skilled trades. These were followed by shortages in areas related to computer science (16.3%), design (15.4%), and general data science and analytics (14.4%).

In terms of region, 7 in 10 businesses in Quebec (70.6%) noted skill shortages related to skilled trades, followed by businesses in Ontario (59.0%).

Businesses took a variety of measures to overcome skill shortages in 2019. The most common was training staff (56.2%), followed by conducting targeted recruitment processes (45.5%), using retention strategies (36.2%) and outsourcing work (36.0%).

The Atlantic region had the highest proportion of businesses that reported using government programs to address skill shortages (16.6%). Meanwhile, 54.6% of businesses in Quebec used targeted recruitment processes, and 40.2% of businesses in Ontario outsourced work.

In terms of training provided by businesses, over three-quarters (77.7%) of businesses provided job-specific training to their employees, followed by managerial training (31.1%) and training in new technology (29.7%).

Nearly half of businesses use advanced or emerging technology

In 2019, 45.2% of businesses used at least one type of advanced or emerging technology. Advanced technologies are new technologies (equipment and software) that perform a new function or perform a function significantly better than the technologies commonly used in the industry or by competitors. The adoption of advanced or emerging technologies can serve as an indicator of how innovative a business is.

Businesses in the professional, scientific and technical services sector (67.4%) had the highest adoption rate of advanced or emerging technologies, in addition to having the highest proportion of innovative businesses (89.1%). The use of advanced or emerging technologies was also prevalent in several other sectors, including information and cultural industries (59.2%); utilities (58.2%); and finance and insurance, excluding monetary authorities (57.9%).

Over half of all businesses indicated that they did not adopt or use advanced or emerging technologies in 2019. The principal reason noted was that the technology was not applicable to their business (49.3%). Conversely, a lack of technical skills was a barrier for almost 1 in 10 businesses (8.1%) in using advanced or emerging technologies.

Less than 10% of businesses use clean technologies

In 2019, 8.6% of all businesses in Canada used clean technologies. Clean technology, a form of advanced technology, refers to goods or services that reduce environmental impacts through environmental protection activities or through the sustainable use of natural resources.

Businesses in the utilities sector had the highest rate of clean technology use (25.8%), followed by the mining, quarrying, and oil and gas extraction sector (15.3%) and the agriculture, forestry, fishing and hunting sector (12.8%).

Among businesses that used clean technologies in 2019, 93.3% reported that this was related to environmental protection, while 72.8% stated that this was linked to sustainable resource management.

Note to readers

The 2019 Survey of Innovation and Business Strategy (SIBS) is a joint initiative of Statistics Canada; Innovation, Science and Economic Development Canada; the Atlantic Canada Opportunities Agency; the Institut de la statistique du Québec; and the Ontario Ministry of Economic Development, Job Creation and Trade.

Because of changes in terminology and content between the 2019 SIBS and previous iterations, caution is recommended in making comparisons at more detailed levels of aggregation.

Data for the 2015-to-2017 and 2017-to-2019 reference periods are available by sector, according to the North American Industry Classification System; by enterprise size; and by economic region, according to the Standard Geographical Classification.

Data from the 2009 and the 2012 SIBS are available in archived tables (12-604-X).

Definitions

Small businesses: Interchangeable with small enterprises, firms with 20 to 99 employees.

Medium-sized businesses: Interchangeable with medium-sized enterprises, firms with 100 to 249 employees.

Large businesses: Interchangeable with large enterprises, firms with 250 or more employees.

Atlantic region: Newfoundland and Labrador, Prince Edward Island, Nova Scotia, and New Brunswick.

Rest of Canada: Manitoba, Saskatchewan, Alberta, British Columbia, Yukon, the Northwest Territories and Nunavut.

Good or service positioning: E.g., good or service leadership, market segmentation, good or service diversification, quality improvement.

Low-price and cost leadership: E.g., mass market.

Basic digital skills: E.g., email, word processing, spreadsheets.

Computer science skills: E.g., software engineering, artificial intelligence.

Business skills: E.g., marketing, accounting.

General data science and analytics skills: E.g., data modelling and visualization.

Information technology (IT) skills: E.g., IT security, database administration.

Advanced technologies: New technologies (equipment and software) that perform a new function or perform a function significantly better than the technologies commonly used in the industry or by competitors.

Clean technologies: Any goods or services that reduce environmental impacts through environmental protection activities or through the sustainable use of natural resources.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: