Energy statistics, March 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-08

March 2021 marked one year since the first pandemic-related measures started to affect production and consumption of energy products. Production of natural gas and coal, and renewable energy generation (including hydro, wind and solar energy) increased year over year, while crude oil production approached pre-pandemic levels. In contrast, refinery activity and electricity generation remained below March 2020 levels.

Demand for energy products in Canada continued to be limited by ongoing lockdowns, curfews and travel restrictions. Meanwhile, the demand for energy products from the United States and other countries continued to recover, leading to higher exports of refined petroleum products, natural gas and coal.

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information website and follow #energynews on social media.

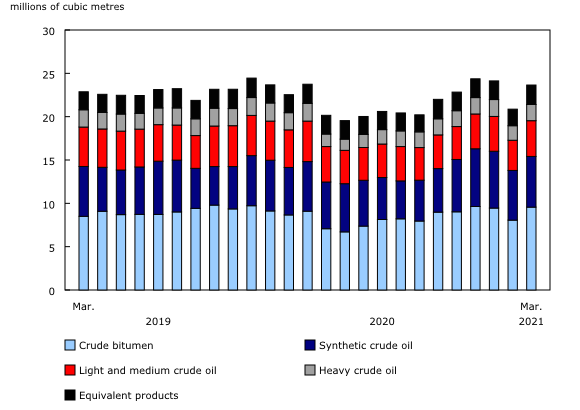

Oil sands drive crude oil production near pre-pandemic levels

Production of crude oil and equivalent products edged down 0.4% year over year to 23.7 million cubic metres (148.8 million barrels) in March. Despite the year-over-year decline, renewed demand from the United States following widespread refinery shutdowns in February, combined with a slow rise in demand from Canadian refineries, brought March production of crude oil to near pre-pandemic levels.

Nevertheless, heavy, light and medium crude oil extraction continued to remain at lower levels, down 10.9% year over year to 6.0 million cubic metres. As March 2020 was the last month during which crude oil production was relatively unaffected by the pandemic, extraction of heavy, light and medium crude oil has yet to recover to the levels seen that month.

Partially offsetting the overall decline, oil sands production was up 4.0% to 15.4 million cubic metres in March. Crude bitumen production increased 5.2% to 9.6 million cubic metres, while synthetic crude production rose 2.2% to 5.8 million cubic metres. Oil sands production rose for the fourth time in five months, fuelled by growing demand and higher crude oil prices. Production of equivalent products (+2.0%) was also up year over year in March.

The crude oil and bitumen price index rose 7.0% from February to March, marking the fifth consecutive monthly price increase. Crude oil and bitumen prices have risen 56.4% since they began their upward trend in November 2020. Both the ongoing recovery in global demand and continued production restrictions by OPEC+ (Organization of the Petroleum Exporting Countries Plus) contributed to the sharp rise in crude oil prices in recent months.

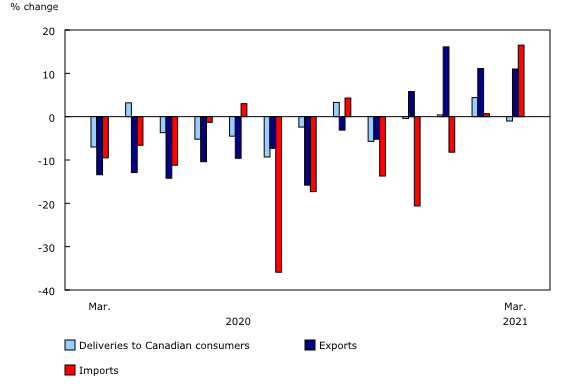

Exports of crude oil and equivalent products decreased 7.8% year over year to 18.1 million cubic metres. Driving the overall decline was a 41.1% fall in exports by rail, marine and truck, as exports of crude oil by these means of transportation have yet to recover to pre-pandemic levels. The monthly average volume exported by rail, marine and truck in the last 12 months was 43.1% lower compared with the same period last year. Crude oil transported by rail declined year over year for the twelfth straight month in March, according to railway carloading statistics. Exports by pipeline to the United States fell 2.5% to 16.2 million cubic metres, while exports to other countries (-15.3%) were also down in March.

Imports of crude oil and equivalent products fell for the third consecutive month, down 20.7% to 3.1 million cubic metres in March. Imports of crude oil by refineries decreased by almost one-quarter (-24.1%) year over year, as Canadian refineries used more domestic crude oil in March. Imports by other entities (-15.0%) were also down year over year during the month.

Decline in refinery production slows year over year in March

March marked one year since the first pandemic-related measures started to affect production and consumption of petroleum products. Although lockdowns and travel restrictions remained in place across the country, the decline in refinery activity slowed in March 2021.

Input of crude oil to Canadian refineries reached 8.3 million cubic metres, while net production of finished petroleum products totalled 9.4 million cubic metres in March, the highest level in the last 12 months; nevertheless, this level was 3.9% below the March 2020 level. Meanwhile, refinery capacity utilization was up 3.0% from February to March after decreasing in the two previous months.

Refinery products supplied to Canadian consumers were down 2.2% in March to 7.7 million cubic metres compared with the already reduced level of March 2020, when the first stay-at-home measures were implemented. Consumption of finished motor gasoline (-5.1%) and distillate fuel oils, including diesel and light fuel oils (-0.3%), declined year over year, while consumption of kerosene-type jet fuel was down by over one-half (-52.4%) compared with March 2020.

Following a sharp increase in February (+10.8%), prices of refined petroleum products were up 4.9% in March—the sixth consecutive monthly gain. Motor gasoline (+6.8%), diesel (+3.5%) and jet fuel (+3.2%) prices were all up compared with the previous month.

Exports of refined petroleum products were up 0.6% year over year to 1.6 million cubic metres in March. Demand from the United States remained high following major disruptions in refinery activity in February caused by extreme cold. Distillate fuel oils, including diesel and light fuel oils (+18.9%), and finished motor gasoline (+2.9%) were the main contributors to the year-over-year increase in exports in March.

Imports of refined petroleum products totalled 0.6 million cubic metres—the highest level since September 2020—but were more than one-third (-35.9%) below March 2020 levels, as lockdowns continued to limit the demand for petroleum products in Canada.

Natural gas production edges up, while exports and imports rise sharply

Production of marketable natural gas edged up 0.1% to 596.8 million gigajoules in March—the first increase after 12 months of consecutive year-over-year declines. Production of natural gas was concentrated in Alberta (68.7%) and British Columbia (29.9%).

Total deliveries of natural gas to Canadian consumers decreased 1.0% year over year to 436.6 million gigajoules in March. This decline was largely attributable to lower demand from commercial and institutional (-7.7%) and residential (-3.7%) customers, as temperatures in March 2021 were milder on average than in March 2020, according to Environment and Climate Change Canada data on heating degree days.

In contrast, deliveries to the industrial sector were up 1.8% to 284.1 million gigajoules in March. This was the fourth consecutive year-over-year increase, which was mainly attributable to higher demand from industrial consumers in Ontario (+13.9%). The rise in demand was met by higher imports and drawing from inventories. Inventories held in Canadian facilities fell 8.8% in March, closing at 561.2 million gigajoules.

Demand for Canadian natural gas in the United States remained high in March. After increasing substantially in January (+16.1%) and February (+11.1%), exports of natural gas to the United States rose again in March, up 11.0% to 263.6 million gigajoules—the fourth consecutive monthly year-over-year increase. Following a sharp rise in February (+12.4%), caused primarily by increased demand during extreme cold weather in the United States, the natural gas price index fell 11.1% month over month in March and returned to levels observed in January.

Imports of natural gas were up 16.5% to 123.6 million gigajoules in March, mostly because of increased demand from Ontario.

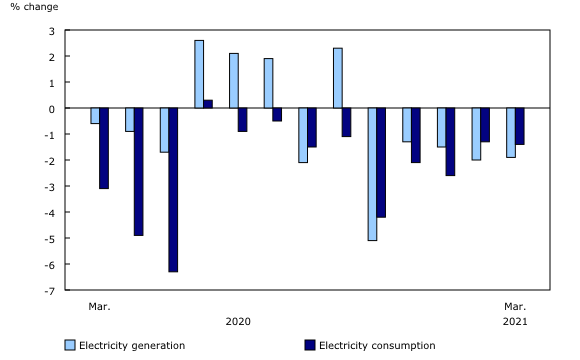

Electricity generation and consumption continue to fall year over year on lower demand

Following a 2.0% decrease in February, electricity generation in Canada fell 1.9% year over year to 56.6 million megawatt-hours (MWh) in March. Nuclear generation was down 16.8% year over year to 6.6 million MWh, as ongoing maintenance and refurbishments at nuclear plants in Ontario continued to limit the overall production. Electricity generated from combustible fuels was down 8.5% to 9.9 million MWh, mostly because of lower volumes produced in Alberta.

Partially offsetting the overall decrease, electricity generated from renewable sources was up 3.0% to 40.9 million MWh and accounted for 72.3% of Canada's electricity generation in March. Wind power generation continued to rise, up 30.5% year over year to 4.4 million MWh—the highest production level since this series began in 2008. Solar generation (+22.5%) and hydro generation (+0.3%) were also up in March.

Electricity consumption decreased year over year for the ninth consecutive month, down 1.4% to 52.7 million MWh in March. The decline was mainly attributable to lower demand in Alberta (-7.5%) and Ontario (-5.4%). Following a 4.7% month-over-month increase in February, the Electric Power Selling Price Index fell 6.0% in March—the largest monthly decline since May 2020 (-6.2%)—due to lower prices in Ontario and Alberta.

Following a 7.8% year-over-year decrease in February, electricity exports to the United States fell 10.1% to 4.8 million MWh in March. Lower quantities originating in Manitoba and Ontario were the main contributors to the year-over-year decline. Imports of electricity from the United States were down 20.0% to 0.9 million MWh, primarily because of lower demand for imported electricity in Ontario.

Coal production continues to rise

Coal production edged up 0.7% to 4.0 million tonnes in March. This was the third year-over-year increase and the highest production level since December 2019. The rise was due primarily to higher demand from external markets. Coal exports increased 5.4% to 2.9 million tonnes. Coke production decreased 2.1% to 179.7 thousand tonnes in March.

Energy production remains weak in the first quarter, despite slow recovery

The quarter ending on March 31, 2021, was marked by ongoing COVID-19-related measures that remained in place in most provinces. Despite the slow growth in economic activity, overall energy indicators remained weak compared with the same quarter a year earlier. In contrast, the prices of energy products, including crude oil, refined petroleum products and natural gas, increased significantly in the first quarter. Increased energy exports and higher energy prices contributed to Canada's merchandise trade balance surplus in the first quarter of 2021.

Production of crude oil and equivalent products fell for the fourth consecutive quarter, down 1.9% year over year to 68.6 million cubic metres. Nevertheless, this was the smallest year-over-year decline in four quarters, indicating the beginning of a return to pre-pandemic levels of production. Light, medium and heavy crude oil extraction (-12.9%) was down year over year, while oil sands extraction (+2.9%) was up for the second consecutive quarter, offsetting the overall decline in crude oil production.

Exports of crude oil and equivalent products continued to decline year over year, down 6.8% compared with the same quarter in 2020, as demand for Canadian crude oil from the United States remained below pre-pandemic levels. Meanwhile, imports of crude oil and equivalent products declined by almost one-fifth (-19.9%), as demand from refineries and other importers remained low.

Despite a slow recovery in refinery activity, production and consumption of refined petroleum products remained limited as lockdowns and travel restrictions continued during the first quarter. Net production of finished petroleum products (-11.2%) was down year over year for the fourth consecutive quarter, with motor gasoline (-18.0%), distillate fuel oils (-6.1%) and jet fuel (-44.1%) the main contributors to the overall decline. Finished petroleum products supplied to domestic consumers decreased 17.9% year over year. Motor gasoline (-19.4%), distillate fuels (-6.7%) and jet fuel (-60.5%) were all down in the first quarter.

Canadian marketable production of natural gas was down 2.1% to 1.7 billion gigajoules in the first quarter—the tenth consecutive quarterly decline. In contrast, total deliveries of natural gas to Canadian consumers were up 1.3% because of higher volumes delivered to industrial (+2.1%) and residential consumers (+1.2%), while deliveries to commercial and institutional consumers were down 1.1%. Demand for Canadian natural gas in the United States also rose in the first quarter. Exports of natural gas were up 13.1% year over year—the first quarterly increase since the fourth quarter of 2019.

Electricity generation fell 1.8% to 175.5 million MWh in the first quarter compared with the same quarter in 2020, mainly as a result of nuclear generation (-16.2%) and electricity from combustibles (-5.1%). Meanwhile, electricity generation from renewable energy sources rose 2.0%. Electricity consumption decreased 1.8% in the first quarter—the seventh consecutive year-over-year quarterly decline—primarily on continued lower demand from industrial and commercial sectors. Exports of electricity to the United States declined 3.5% year over year, while imports were down 11.5%.

Coal production was up 4.3% year over year to 10.9 million cubic metres—the first quarterly increase since the third quarter of 2017—while coke production decreased 1.3% in the first quarter.

Note to readers

The consolidated energy statistics table (25-10-0079-01) presents monthly data on primary and secondary energy by fuel type in terajoules (crude oil, natural gas, electricity, coal, etc.) and supply and demand characteristics (production, exports, imports, etc.) for Canada. The table uses data from a variety of survey and administrative sources. Estimates are available starting with the January 2020 reference month. For more information please consult the Consolidated Energy Statistics Table User Guide.

The survey programs that support the energy statistics release include the following:

- Crude oil and natural gas (survey number 2198, tables 25-10-0036-01, 25-10-0055-01 and 25-10-0063-01). Data from January 2020 to February 2021 have been revised.

- Energy transportation and storage (survey number 5300, tables 25-10-0075-01 and 25-10-0077-01).

- Natural gas transmission, storage and distribution (survey numbers 2149, 5210 and 5215, tables 25-10-0057-01, 25-10-0058-01 and 25-10-0059-01).

- Refined petroleum products (survey number 2150, table 25-10-0081-01). National and provincial supply estimates for renewable fuels, including ethanol fuel and renewable fuels except ethanol, are now available in table 25-10-0081-01 starting with the January 2020 reference month. More detailed renewable fuel data are also available upon request.

- Electric power statistics (survey number 2151, tables 25-10-0015-01 and 25-10-0016-01). Data for February 2021 have been revised.

- Coal and coke statistics (survey numbers 2147 and 2003, tables 25-10-0045-01 and 25-10-0046-01).

Data are subject to revisions. Energy data are revised on an ongoing basis for each month of the current year to reflect new information provided by respondents and updates to administrative data. Historical revisions are also performed periodically.

Definitions, data sources and methods for each survey program are available under their respective survey number.

The Energy Statistics Program uses respondent and administrative data.

Data in this release are not seasonally adjusted.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: