Foreign direct investment, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-04-27

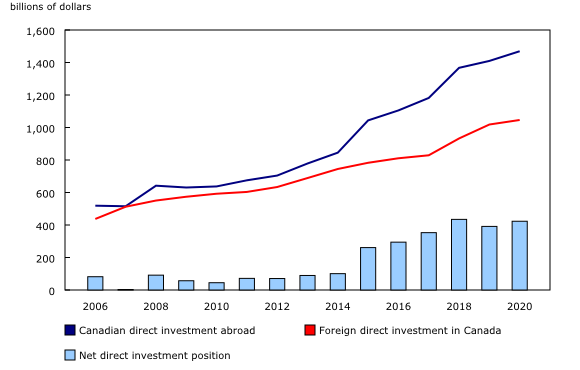

Foreign direct investment activity slowed considerably in Canada and globally in 2020 amid upheavals caused by the COVID-19 pandemic. Nonetheless, the stock of both Canadian direct investment abroad and foreign direct investment in Canada continued to increase, the growth in the investment position abroad exceeding that of investment in Canada.

The stock of Canadian direct investment abroad increased by 4.2% to $1,469.3 billion at the end of the year. Meanwhile, the stock of foreign direct investment in Canada was up 2.7% to reach $1,046.3 billion. As a result, the net foreign direct investment position reached $423.0 billion, up $31.6 billion from 2019.

Direct investment in services-producing industries steadily increases

The stock of foreign direct investment in Canada increased by $28.0 billion in 2020. While the management of companies and enterprises remained the leading industry, the largest growth in 2020 was in the professional, scientific and technical services industry (+$12.8 billion), followed by wholesale trade (+$6.6 billion). Conversely, the largest decrease was observed in the mining and oil and gas extraction industry (-$11.4 billion), reflecting a divestment in this sector over the year.

Meanwhile, the stock of Canadian direct investment abroad was up by $59.6 billion. Of this increase, $26.5 billion was attributable to the finance and insurance industry, followed by the management of companies and enterprises industry (+$9.3 billion), and information and cultural industries (+$9.2 billion). At the end of 2020, more than one-third of the stock of Canadian direct investment abroad, as measured by the industry of the foreign affiliate, was in the finance and insurance industry.

Over the last five years, the growth in services-producing industries has steadily outpaced the growth in goods-producing industries. As a result, the share of Canadian direct investment abroad in services industries has risen from 71.6% in 2015 to 75.6% in 2020. For foreign direct investment in Canada, this share has grown from 54.4% in 2015 to 61.1% in 2020.

The United States remains the principal destination of Canadian direct investment abroad

The largest proportion of the Canadian direct investment position abroad was directed to the United States at the end of 2020, followed by the United Kingdom and Luxembourg. Overall, these three countries represented 60.5% of total direct investment abroad. The majority of the investment in the United States was in affiliates operating in the finance and insurance industry, followed by the transportation and warehousing industry.

Meanwhile, the investment position in the United Kingdom was primarily in affiliates in the finance and insurance industry and in information and cultural industries. Together, these industries represented more than half of the total investment position in this country. For Luxembourg, the management of companies and enterprises industry accounted for the largest share (44.7%).

Europe leads the increase in the stock of foreign direct investment in Canada

In 2020, $20.4 billion of the increase in the stock of foreign direct investment in Canada originated from Europe, led by mergers and acquisitions activity. The share of foreign direct investment from Europe has been steadily increasing over the years and reached 40.0% at the end of 2020.

On a country basis, the leading investors remained the United States, followed by the Netherlands and the United Kingdom. Together, these three countries accounted for 64.4% of total foreign direct investment in Canada.

Canadian direct investment abroad based on the industry of the Canadian parent

Canadian direct investment abroad can also be presented based on the industry of the Canadian parent, in addition to the industry of the foreign affiliate. The finance and insurance industry, which includes banks, pension funds and insurance companies, held 37.7% of the total stock of Canadian direct investment abroad in 2020, followed by the management of companies and enterprises industry (20.0%).

Canadian direct investors tend to invest abroad in the same industry as the one in which they operate. The overall share of Canadian direct investment abroad for which the Canadian parent invested in foreign affiliates of the same industry was 55.8% at the end of 2020. By industry, 66.6% of all direct investment abroad held by the finance and insurance industry was in foreign affiliates of the same industry. The main destination of this investment was the United States. This share was even higher for the mining and oil and gas extraction industry (75.4%), but lower for industries such as manufacturing (59.1%) and transportation and warehousing (64.1%).

Exceptions to this pattern are observed for some specific industries, the most notable being the management of companies and enterprises industry. In 2020, 77.6% of all investments held by this industry were predominantly channelled to foreign affiliates of a different industry and mainly in the United States.

Foreign direct investment in Canada on an ultimate investor country basis

Foreign direct investment can also be measured on an ultimate investor country (UIC) basis, looking through the immediate investing country (IIC) to show the country that ultimately controls the investment in Canada.

Under the UIC presentation, most of the increase in the stock of foreign direct investment in Canada was recorded with Europe (+$24.7 billion) in 2020, pushing this region's share to 26.6% of the total. In comparison, this share is noticeably lower than that measured according to the IIC presentation (40.0%). Some countries in Europe, notably the Netherlands and Luxembourg, often act as intermediaries through which investors channel their investment to other countries.

While Europe's share is smaller on a UIC basis, the importance of the United States in direct investment in Canada is greater. The United States represented 49.9% of the total investment on a UIC basis in 2020, compared with 43.6% as measured on an IIC basis. The Asia and Oceania region also represented a larger share on a UIC basis (14.1%) relative to an IIC basis (10.4%).

Note to readers

This is the annual release of detailed foreign direct investment position data at book value. This release contains country and industry details that are drawn from annual surveys. This detailed information is not available at the time of quarterly international investment position releases. However, aggregates of direct investment positions, both at book and market values, are available as part of the quarterly international investment position release.

Year-end position data for 2020 are projected using the latest benchmark survey data of 2019 and flows collected from the 2020 quarterly surveys. In addition, outstanding positions denominated in foreign currencies are re-evaluated to account for changes in exchange rates. These estimates will be revised next year with the integration of benchmark survey data for the reference year 2020 and will fully reflect the change in the stock of foreign direct investment from one year to the next, including volume changes such as debt or equity write-offs.

The current aggregates will be integrated into the international investment position at the time of the third-quarter 2021 release in December, in line with the Canadian System of Macroeconomic Accounts revision policy.

Direct investment is a component of the international investment position that refers to the investment of an entity in one country (the direct investor) obtaining a lasting interest in an entity in another country (the direct investment enterprise). The lasting interest implies the existence of a long-term relationship between the direct investor and the direct investment enterprise and a significant degree of influence by the direct investor on the management of the direct investment enterprise.

In practice, direct investment is deemed to occur when a direct investor owns at least 10% of the voting equity in a direct investment enterprise. This report presents the cumulative year-end positions for direct investment, measured as the total value of equity and the net value of debt instruments between direct investors and their direct investment enterprises.

New tables

This release includes two new tabulations. Table 36-10-0657-01 provides an industry breakdown of Canadian enterprises investing in foreign affiliates of the same industry, and of a different industry, by region. Table 36-10-0659-01 provides inward and outward investment positions by industry group, for 25 countries.

Foreign direct investment by country and by industry

Following international standards, the main measure of direct investment is based on the country of residence of the direct investor (immediate parent company) for foreign direct investment in Canada and on the country of residence of the direct investment enterprise (the immediate subsidiary) for Canadian direct investment abroad. This implies that direct investment is largely attributed to the first investor or investee country, rather than the ultimate investor or investee country. Direct investment data on an immediate investor basis are available in tables 36-10-0008-01, 36-10-0009-01, 36-10-0657-01 and 36-10-0659-01.

Foreign direct investment in Canada by ultimate investor

A supplementary series on inward foreign direct investment in Canada by ultimate investor is now available in table 36-10-0433-01. This series differs from the standard presentation of foreign direct investment, which is based on the country of residence of the immediate direct investor, by showing the country of the investor that ultimately controls the investment in Canada. Because inward foreign direct investment may be channelled through holding companies or other legal entities in intermediate countries before reaching Canada, the measurement of foreign direct investment on an ultimate investor basis can result in substantial changes in the distribution of inward positions by country when compared with foreign direct investment measured on an immediate investor basis. The timeliness of this table was improved with this release, and data for the most recent year are now available.

Data quality

In general, data for smaller countries and industries (defined as countries with foreign direct investment below $500 million or industries at the three-digit level of the North American Industry Classification System) are subject to higher sampling variability.

Products

The product Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: