Energy statistics, December 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-09

December was marked by some gains in energy production and higher energy prices. Oil sands production and renewable energy generation (including hydro, wind and solar energy) rose, while natural gas, electricity and coal production declined.

Demand for energy products in Canada was impacted by new lockdowns and travel restrictions imposed to tackle the resurgence of the COVID-19 pandemic. In particular, both the Quebec and Ontario governments continued to apply strict measures to curtail the movements of residents in December. In contrast, rising demand for energy products from the United States led to higher exports of crude oil, natural gas and electricity.

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information website and follow #energynews on social media.

Crude oil production exceeds pre-pandemic levels

Production of crude oil and equivalent products edged down 0.2% to 24.4 million cubic metres (153.4 million barrels) in December. Following eight consecutive monthly year-over-year production declines, December posted the smallest year-over-year change since March, signalling a possible easing of the effects of the COVID-19 pandemic on the Canadian oil extraction industry.

Driving the slight overall decline was an 11.5% decrease in heavy, light and medium crude oil extraction. Production of these crude types has been slower to recover compared with oil sands extraction, with December marking the ninth consecutive monthly year-over-year decline.

In contrast, December showed signs of a complete recovery in the oil sands, with production increasing 5.1% year over year to 16.3 million cubic metres—the highest production on record. Synthetic crude production was up 15.3% to 6.7 million cubic metres, while crude bitumen production declined 1.0% from December 2019.

Daily production of crude oil (excluding equivalent products) rose 4.0% from November to 716.9 thousand cubic metres in December. This increase was a direct result of growing demand for crude oil from the United States, combined with the end of the production limits imposed by the Alberta government back in January 2019.

The continued recovery in oil demand, combined with ongoing efforts by the Organization of the Petroleum Exporting Countries to limit oil production, contributed to the increase in crude oil and energy product prices in December. The crude oil and bitumen price index was up 11.8% from November to December—the largest increase since June 2020.

Global consumption of crude oil continued to rise slowly, up 0.2% from November to December, and was almost one-fifth (+19.2%) higher since bottoming out in April. Nevertheless, global consumption remained 5.9% below December 2019 levels, as reported by the US Energy Information Administration.

Following a 2.6% increase in November, exports of crude oil and equivalent products fell 6.1% year over year to 18.5 million cubic metres in December. However, this was the highest level of exports since March 2020, attributable mostly to increased demand for Canadian crude from US-based refineries. Overall, crude oil exports were the main contributor to the Canadian international merchandise trade balance increase in December.

Imports of crude oil rose 5.1% year over year to 3.7 million cubic metres in December. This was the first year-over-year increase since January 2020, driven by higher demand for equivalent products (diluent) in Western Canada. Imports of crude oil by refineries were down in December.

Resurgence of COVID-19 impacts refinery activity

Measures imposed to tackle the resurgence of COVID-19 affected Canadian refinery activities in December.

Inputs of crude oil to refineries fell 9.4% year over year to 7.7 million cubic metres—the lowest level in three months. Net production of finished petroleum products fell 10.3% year over year to 9.2 million cubic metres, primarily because of finished motor gasoline (-18.1%); distillate fuel oil, including diesel and light fuel oil (-2.2%); and kerosene-type jet fuel (-38.5%). Following three consecutive monthly increases, capacity utilization in the petroleum and coal products industry—which includes refineries—was down 2.4% from November to December.

Demand for petroleum products was also reduced in December as a result of the lockdowns implemented in some provinces. Refinery products supplied to Canadian consumers fell 16.8% year over year to 7.4 million cubic metres—the lowest level since May. Finished motor gasoline (-15.3%) and distillate fuel oil (-6.8%) were the main contributors to the overall decline.

Following a 57.7% decrease in November, kerosene-type jet fuel supplied to Canadian consumers fell 60.9% year over year in December, as air travel restrictions remained in place. According to aircraft movement statistics, total movements at Canada's major airports were down 31.1% compared with December 2019.

Despite the decline in volumes supplied, dollar sales of petroleum and coal products (including refinery activity) were up 4.7% from November to December, primarily because of strong prices. The refined petroleum energy products price index was up 10.9% in December—the largest monthly increase since June. Nevertheless, sales in December remained almost one-third (-32.0%) below December 2019 levels.

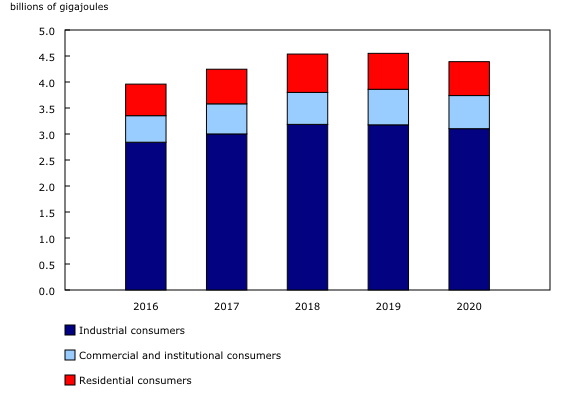

Natural gas production continues to decline, industrial deliveries and exports up

Production of marketable natural gas fell 4.0% year over year to 587.7 million gigajoules in December. This was the largest year-over-year decrease since September 2019, attributable to lower levels of production in Alberta (-4.3%) and British Columbia (-2.3%).

Following a 5.7% decrease in November, deliveries of natural gas to Canadian consumers edged down 0.4% year over year to 464.4 million gigajoules in December. This decline was driven by lower demand from residential (-6.0%) and commercial and institutional (-9.5%) customers. Temperatures in December were milder on average compared with December 2019, according to data on heating degree days.

Deliveries to the industrial sector were up 4.5% to 291.6 million gigajoules in December. This was the highest level since January 2019 and was mainly attributable to increased demand from industrial consumers in Alberta, Ontario and Quebec.

Following nine months of decreases, exports of natural gas by pipeline to the United States increased 5.8% to 285.6 million gigajoules in December. This was the highest monthly export level since January 2019. Imports of natural gas declined 20.6% to 112.2 million gigajoules. Imports of natural gas have been trending downward year over year since February, mostly because of decreased demand from Ontario.

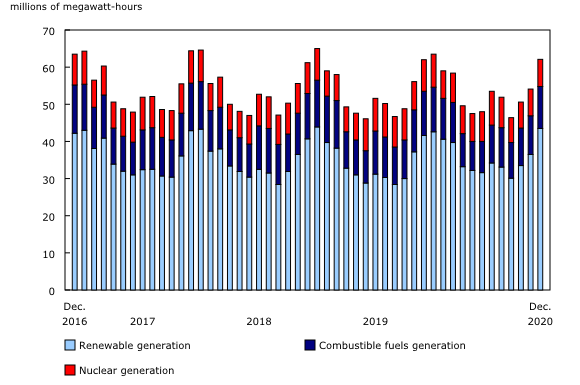

Electricity generation and consumption decline year over year on lower demand

Following a 5.1% decrease in November, electricity generation fell 1.3% year over year to 61.2 million megawatt-hours (MWh) in December. This decline was primarily driven by nuclear generation, down 14.1% year over year to 7.3 million MWh. Electricity generated from combustible fuels (-4.8% to 11.3 million MWh) was also down, mostly because of lower volumes generated in Alberta.

Partially offsetting the overall decrease, electricity generation from renewable energy sources (including hydro, wind, solar and other sources) was up 4.4% to 43.5 million MWh—accounting for 71.0% of Canada's electricity mix in December.

By generation type, hydro was the single largest contributor to Canada's electricity mix, producing 38.5 million MWh of electricity, up 1.4% year over year. Wind (+11.6%) and solar (+5.4%) electricity generation also increased.

Electricity consumption decreased for the sixth consecutive month, down 2.1% year over year to 56.0 million MWh in December. The decrease was mainly attributable to lower demand in Quebec (-3.6%), Alberta (-1.7%) and Ontario (-0.2%), on account of lower seasonal demand for heating and reduced economic activity.

Electricity exports to the United States increased 8.7% year over year to 5.9 million MWh in December. Imports of electricity from the United States were up 8.6% to 0.7 million MWh. This was the second consecutive monthly year-over-year increase, led by higher demand for imported electricity in Alberta, Ontario and Manitoba.

Production of coal continues to decrease year over year

Coal production was down 14.1% year over year to 3.8 million tonnes in December, while coke production decreased 4.5% to 184.9 thousand tonnes.

Energy: year in review 2020

The COVID-19 pandemic greatly impacted the Canadian energy sector in 2020, with both production and consumption of energy products decreasing significantly. From March 2020 onward, government- and industry-enforced lockdowns and stay-at-home orders to prevent the spread of the coronavirus directly contributed to sharply lower demand, reduced economic activity and significant volatility in energy prices.

Following a decade of growth, Canadian production of crude oil and equivalent products was down 4.5% in 2020 to 260.0 million cubic metres—the largest annual decline since 1999.

Crude bitumen (-6.3%) was the main contributor to the overall decline in crude oil production in 2020. Weak demand and delayed maintenance work at some oil sands facilities in northern Alberta contributed to considerable decreases in the second and third quarters. A gradual increase in demand and prices in the fourth quarter partially offset the overall decline for the year.

Extraction of heavy (-9.8%) and light and medium (-7.0%) crude oil also put downward pressure on overall production. In contrast, synthetic crude oil production was up 0.7%, mostly because of higher volumes produced in the fourth quarter. In 2020, crude oil production (excluding equivalent products) fell in all producing provinces except Newfoundland and Labrador.

Crude oil prices reached historic lows in 2020, because of a combination of geopolitical issues and the collapse of demand during the pandemic. The monthly average crude oil and crude bitumen price index was one-third (-33.7%) lower in 2020 compared with 2019.

Following a 3.5% increase in 2019, Canada's exports of crude oil and equivalent products fell 3.6% in 2020 to 211.4 million cubic metres, because of reduced demand caused by the pandemic. Exports by pipeline to the United States were down 1.8% to 184.3 million cubic metres. Pipelines were the main mode of transport, accounting for 87.2% of total exports in 2020, up from 85.5% in 2019. Exports to the United States by other means (rail, truck and marine) declined 24.4% from the previous year, as demand for additional transport capacity to supplement the pipelines remained low.

Despite a gradual recovery in refinery activity in the second half of 2020, net production of finished petroleum products was 11.5% lower in 2020 compared with 2019. Lockdowns and travel restrictions imposed during the year had a significant impact on the demand for transportation fuels. Finished motor gasoline supplied to Canadian consumers fell 14.0% year over year, while distillate fuel oils (diesel and light fuel oil) were down 6.0%. Moreover, the introduction of measures to contain the COVID-19 pandemic affected Canada's air transportation industry harder than prior disruptions such as the events of September 11, 2001, the 2003 SARS outbreak, and the global financial crisis of 2008 and 2009, according to monthly civil aviation statistics. Kerosene-type jet fuel supplied to Canadian consumers fell by more than half (-57.1%) from 2019 to 2020.

Overall, sales in the petroleum and coal product industry (including refineries) fell by over one-third (-37.4%) on low demand during the pandemic. The decline was mostly attributable to lower refinery production and petroleum product prices. The monthly average price index for refined petroleum energy products fell by almost one-third (-29.0%) in 2020.

Following a 3.6% decrease in 2019, marketable natural gas production fell a further 2.2% year over year to 6.8 billion gigajoules in 2020. Total deliveries to consumers decreased 3.5% to 4.4 billion gigajoules, because of lower demand from the commercial and institutional (-6.8%), residential (-5.7%), and industrial (-2.3%) sectors.

Weaker demand by US consumers saw exports of natural gas to the United States fall 7.9% to 2.7 billion gigajoules in 2020, the third consecutive annual decrease. This represented 40.3% of total Canadian production, compared with a high of 47.6% in 2017. Imports of natural gas were down 10.3% to 1.0 billion gigajoules, the lowest level since 2016.

Electricity generation in Canada was down 0.8% in 2020 to 635.6 million MWh—the lowest level of production since 2015. The overall decline was attributable to generation from combustible fuels (-8.0%) and nuclear generation (-3.0%). Over the same period, electricity from renewable sources rose 4.3% to 430.8 million MWh—the highest level of production since the beginning of this series in 2008. In 2020, electricity generation fell in eight provinces and rose in Manitoba, British Columbia and Yukon.

Pandemic-related measures affected electricity consumption (-2.5%) in 2020, which fell for the first time since 2015. Lower demand from industrial and commercial consumers was the main contributor to the overall decline in electricity consumption.

Following three annual decreases, exports of electricity to the United States were up 11.2% to 67.1 million MWh. While Quebec remained the main exporting province, increased volumes originating in British Columbia and Manitoba were the primary contributors to the rise in 2020. In contrast, imports of electricity from the United States fell by over one-quarter (-26.5%)—the first annual decline since 2015.

Total annual production of coal fell by over one-fifth (-21.8%) to 40.5 million tonnes in 2020. This was the largest annual decrease since the beginning of this series in 2008, primarily attributable to reduced demand and mine closures during the pandemic. Meanwhile, coke production fell 10.9% in 2020—the second consecutive annual decline.

Note to readers

New as of March 2021 in the monthly energy statistics release: selected provincial supply and disposition estimates for petroleum and other liquids. These data are now available in a new table (25-10-0081-01), which includes both Canadian and provincial supply and disposition estimates. The former table, 25-10-0076-01 (Petroleum products supply and disposition) has been discontinued as of the December 2020 reference month.

The consolidated energy statistics table (25-10-0079-01) presents monthly data on primary and secondary energy by fuel type in terajoules (crude oil, natural gas, electricity, coal, etc.) and supply and demand characteristics (production, exports, imports, etc.) for Canada. The table uses data from a variety of survey and administrative sources. Estimates are available starting with the January 2020 reference month.

The survey programs that support the energy statistics release include the following:

- Crude oil and natural gas (survey number 2198, tables 25-10-0036-01, 25-10-0055-01 and 25-10-0063-01). Data for November 2020 have been revised.

- Energy transportation and storage (survey number 5300, tables 25-10-0075-01 and 25-10-0077-01).

- Natural gas transmission, storage and distribution (survey numbers 2149, 5210 and 5215, tables 25-10-0057-01, 25-10-0058-01 and 25-10-0059-01). Selected data from January 2016 to November 2020 have been revised.

- Refined petroleum products (survey number 2150, table 25-10-0081-01). National and provincial supply estimates for renewable fuels, including ethanol fuel and biodiesel, are now available in table 25-10-0081-01 starting with the January 2020 reference month. More detailed renewable fuel data are also available upon request. Data from January 2019 to November 2020 have been revised.

- Electric power statistics (survey number 2151, tables 25-10-0015-01 and 25-10-0016-01). Data from October to November 2020 have been revised.

- Coal and coke statistics (survey numbers 2147 and 2003, tables 25-10-0045-01 and 25-10-0046-01). Data for November 2020 have been revised.

Data are subject to revisions. Energy data are revised on an ongoing basis for each month of the current year to reflect new information provided by respondents and updates to administrative data. Historical revisions are also performed periodically.

Definitions, data sources and methods for each survey program are available under their respective survey number.

The Energy Statistics Program uses respondent and administrative data.

Data in this release are not seasonally adjusted.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: