Study: Co-operatives in Canada

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-03

A non-financial co-operative is a corporation that is legally incorporated under specific federal, provincial or territorial co-operative acts and that is owned by an association of people seeking to satisfy common needs, such as access to products or services, sale of products or services, or employment. Two-thirds (67.3%) of active non-financial co-operatives are consumer co-operatives, 15.8% are producer co-operatives, 9.1% are multi-stakeholder co-operatives, 6.5% are worker co-operatives, and 1.3% are federations.

Co-operatives maintain their influence on the Canadian economy

In 2019, there were a total of 5,812 active non-financial co-operatives in Canada; Quebec had the largest share (44.4%), followed by Ontario (19.0%). In 2019, Canadian co-operatives generated $53.0 billion in total revenue, held $45.6 billion in total assets, employed 104,969 people, and paid $2.5 billion in salaries and wages.

More than half of active non-financial co-operatives operated in real estate and rental and leasing (33.6%), in wholesale and retail trade (14.2%), or in health care and social assistance (8.9%). In 2019, 52.8% of co-operatives were non-employers (0 employees), which were active and run by unpaid members; 44.2% were small enterprises (1 to 99 employees); 2.6% were medium-sized enterprises (100 to 499 employees); and 0.4% were large enterprises (over 500 employees). Non-profits made up about 64.1% of all co-operatives.

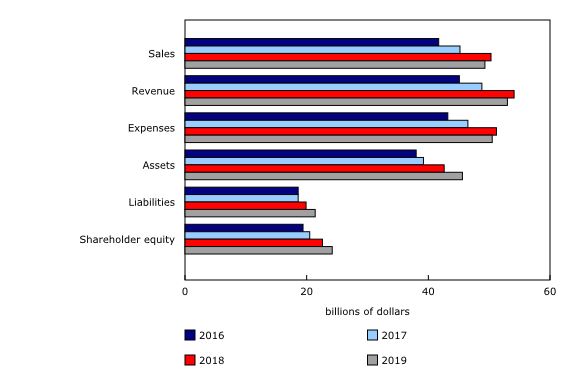

Expenditures and revenue decline slightly, while assets, liabilities and shareholder equity grow

From 2018 to 2019, there were decreases in sales (down 2% to $49.3 billion), revenue (down 2.1% to $53.0 billion) and expenses (down 1.3% to $50.5 billion). From 2018 to 2019, there were increases in assets (up 7.0% to $45.6 billion), liabilities (up 7.3% to $21.4 billion) and shareholder equity (up 6.8% to $24.2 billion).

Note to readers

A co-operative is defined as being "active" if it has positive employment, revenue or expenses in a given year.

Yukon, the Northwest Territories and Nunavut have been grouped as "Territories."

Estimates are based on domestic financial and employment data as reported to the Canada Revenue Agency.

All non-financial co-operatives included are legally incorporated under specific non-financial co-operative acts; they do not include financial co-operatives, such as credit unions and caisses populaires, which are governed by separate legislation.

The 2019 estimates are preliminary and will be revised at a later date.

For additional information, please see Innovation, Science and Economic Development Canada's Information Guide on Co-operatives.

Products

The infographic "Co-operatives in Canada, 2019," part of the series Statistics Canada—Infographics (11-627-M), is also released today.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: