Business innovation and growth support, 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-12-03

The federal government manages program streams offering Business Innovation and Growth Support (BIGS) through its departments and agencies. This support can vary by enterprise size, industry and other characteristics.

Over four-fifths of the businesses that received support from the Government of Canada's BIGS in 2018 were small enterprises. While relatively few large enterprises received innovation and growth-related federal support, they accounted for over two-fifths of the total value of support in 2018.

The data show that, in general, the larger the enterprise, the higher the average value of support received per enterprise.

By sector, manufacturing businesses received the largest share (29.0%) of the total value of support in 2018, while professional, scientific and technical services accounted for the largest share of businesses (28.0%) that received support.

In this analysis, BIGS program streams administrative data are linked to the Linkable File Environment. The Linkable File Environment facilitates the creation of microdata files that pertain to Canadian enterprises. In order to better understand the beneficiaries of this support, the following analysis presents the distribution of federal support in 2018 by enterprise size and industry.

Over four-fifths of the businesses that received support were small enterprises

Small enterprises received over two-fifths (45.8%) of the total value of support. As for large enterprises, these accounted for 5.4% of the businesses that received support and received two-fifths (42.7%) of the total value of federal support in 2018.

Medium-sized enterprises accounted for 9.9% of the businesses that received support and 11.4% of the total value of support.

The average value of support received in 2018 ranged from $71,925 for small enterprises, to $153,372 for medium-sized enterprises and $1,055,990 for large enterprises.

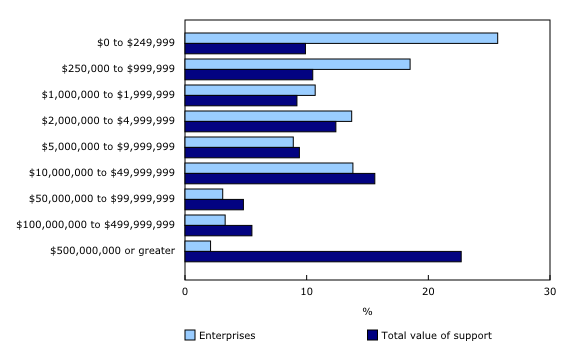

Over half of businesses that received support had annual revenue of less than $2 million

Over half (54.9%) of the businesses that received support had annual revenue of less than $2 million in 2018. However, they received less than one-third (29.6%) of the total value of support.

In contrast, 8.6% of the businesses that received support had annual revenue of $50 million or more and they received one-third (33.0%) of the total value of support in 2018.

On average, businesses with annual revenue of less than $2 million received $52,885 in 2018, while those with annual revenue of $2 million to $49,999,999 received $100,701 and those with annual revenue of $50 million or more received $376,969.

Businesses in the manufacturing sector received almost one-third of the total value of support

Over two-thirds (69.8%) of the total value of support in 2018 went to three sectors: manufacturing; professional, scientific and technical services; and educational services.

Just under one-quarter (24.1%) of the businesses that received support were in the manufacturing sector, and under one-third (29.0%) of the total value of federal business innovation and growth support in 2018 went to businesses in this sector.

Transportation equipment (29.2%) and machine (18.4%) manufacturers received almost half of the value of support within the manufacturing sector. Over one-fifth of the manufacturing businesses that received support were machine (14.7%) and transportation equipment (6.6%) manufacturers. Over one-tenth of the manufacturing businesses that received support were food enterprises (12.1%) and they received 8.8% of the value of support within the sector.

Although educational services accounted for 3.1% of the enterprises that received federal support for innovation and growth in 2018, they received over one-fifth (22.3%) of the total value of support.

In contrast, over one-quarter (28.0%) of the businesses that received support were in the professional, scientific and technical services sector, but they received less than one-fifth (18.6%) of the total value of support.

In the professional, scientific and technical services sector, almost one-fifth (19.3%) of businesses that received support were involved in scientific research and development services and they received over two-fifths (44.3%) of the value of support within the sector. The computer systems design and related services industry accounted for approximately one-third of businesses that receive support (38.6%) and the value of support (34.0%) within the sector in 2018.

Note to readers

Small enterprises are enterprises with fewer than 100 employees in a given year. Medium-sized enterprises have between 100 and 499 employees annually, while large enterprises have 500 or more employees in a given year.

The average value of support per enterprise in an employment or revenue category is expressed as the value of support in an employment or revenue category divided by the number of enterprises in the same category.

The Business Innovation and Growth Support database comprises a large number of advisory services as well as enterprises in a consortium with no reported value of support. Some industries may have more enterprises that received services, which could affect the average support per enterprise.

This analysis covers the 2018 reference year. However, data from 2007 to 2018 are available in the tables. Year-over-year comparisons should be made with caution, since year-over-year differences in the number of enterprises or support values may be the result of changes in departmental financial systems and unavailability of data rather than changes to the program streams. Overall, data from the most recent years are of better quality and more complete.

The tables presented include only enterprises, as defined in Statistics Canada's Business Register (BR), that could be linked to the BR and that are the ultimate beneficiaries. An enterprise is considered an ultimate beneficiary when it benefits from the activities of a program stream. Support provided to an ultimate beneficiary may come directly from a federal department or indirectly through an intermediary. For a given program stream, an intermediary cannot be an ultimate beneficiary. For example, ultimate beneficiaries can be for-profit and non-profit enterprises as well as government organizations or educational institutions.

In this release, the total value of support excludes enterprises with no available data on employment, revenue or industry classification. However, in the data tables, these enterprises are included in the total value of support.

Products

The infographic "Beneficiaries of federal business innovation and growth support programs, 2018" is now available as part of the series Statistics Canada — Infographics (11-627-M).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: