Commercial rents in key Canadian economic markets, first and second quarters 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-09-10

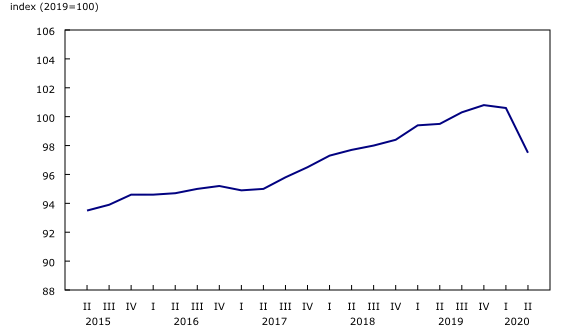

Commercial rents edged down 0.2% nationally in the first quarter of 2020 during the early stages of the global pandemic. A further decline of 3.1% was registered in the second quarter when COVID-19 and its accompanying economic and social disruptions took hold across Canada.

For the first time, commercial rents indexes for retail, office, industrial buildings and warehouses are now available for Montréal, Toronto, Calgary and Vancouver. Prices collected are average rents measured in price per square foot for a sample of commercial buildings. The indexes track commercial rents at the national level, at the provincial and territorial level, and for selected census metropolitan areas (CMAs) across Canada.

Pandemic pulls down commercial rents across Canada

Commercial rents edged down 0.2% from the fourth quarter of 2019 to the first quarter of 2020 during the early stages of the global pandemic. The decrease in the first quarter was primarily caused by lower average rents in retail buildings as a result of store closures that took place in the latter part of March. Retail rents come from a base rent combined with a percentage rent that is based on retail sales.

With physical distancing measures in place across much of Canada for most of the spring, commercial rents fell a further 3.1% in the second quarter because of lower rent prices for offices (-3.1%), retail (-3.0%), and industrial buildings and warehouses (-3.2%).

Commercial rents decline in the majority of the census metropolitan areas covered by the survey in the second quarter

Commercial rents were down in every province and territory in the second quarter.

Average commercial rents declined in most of the 13 CMAs covered by the survey in the second quarter, led by lower prices in Edmonton (-9.6%), Ottawa (-7.6%) and Calgary (-6.7%). Rents were also down in Montréal (-4.8%), Vancouver (-3.3%) and Toronto (-2.7%).

Commercial rents were down for all three building types covered by the survey in Montréal, Calgary and Vancouver in the second quarter. In Toronto, rents declined for retail and for industrial buildings and warehouses, but increased 0.8% for office buildings.

In the second quarter, average rental rates for retail buildings fell the most in Calgary (-13.3%). The largest rent decline in Montréal was for office buildings (-11.3%), while in Toronto it was for industrial buildings and warehouses (-5.7%).

Commercial rents are down year over year in the second quarter

Nationally, commercial rents fell 2.0% year over year in the second quarter, following a 1.2% increase in the first quarter.

Average rents increased 1.1% year over year in British Columbia and declined in every other province and territory during the second quarter. The largest contributors to the national year-over-year drop in commercial rents were Alberta (-6.2%), Ontario (-1.7%) and Quebec (-2.1%).

Commercial rents were down year over year in 10 of the 13 CMAs covered by the survey. Québec, Saint John and Charlottetown reported year-over-year rent increases for the buildings surveyed, while Ottawa (-8.9%) and Edmonton (-8.8%) had the largest average rent declines for all building types combined.

Rents were also down year over year in four of the largest CMAs in Canada, led by Calgary (-7.8%) and Montréal (-2.6%). Commercial rents declined by 1.9% in Toronto and edged down 0.4% in Vancouver.

By building type, retail rents dropped the most year over year in Calgary (-14.7%), while Montréal (-10.3%) saw the largest decrease for office building rents. Average rents for industrial buildings and warehouses declined in Toronto (-4.5%) and Calgary (-1.7%), but increased in Montréal (+1.9%) and Vancouver (+1.1%).

Canada Emergency Commercial Rent Assistance for small businesses

As of the end of the second quarter, a small percentage of commercial property owners covered by the survey indicated that they applied for the Canada Emergency Commercial Rent Assistance (CECRA) program on behalf of their tenants. Because of the timeline (application deadline of September 14, 2020) and complexity of the CECRA subsidy, the second-quarter calculation for the Commercial Rents Services Price Index is based on the reported net effective rent before CECRA funding. The CECRA subsidy and its impact will be assessed once all the information becomes available.

For details on the CECRA program, please refer to Canada Emergency Commercial Rent Assistance for small businesses.

Outlook for the commercial rents market during COVID-19

With the further easing of physical distancing measures and the continued reopening of the economy, the decline in commercial rents slowed from a 1.1% monthly decrease in May to a 0.2% decrease in June.

Nevertheless, the long-term outlook of the commercial real estate market remains in flux in the wake of the pandemic. Many businesses have adapted to employees working from home, and some office building tenants are assessing their future office space needs. This could put further pressure on the new office building lease rates. Retail building lessors have also been affected by the loss of rental income since March. Retail building lessors and tenants have also been working together to respond creatively to the sudden expansion of e-commerce during the pandemic, and to the growing demand for industrial and warehouse space going forward.

Note to readers

With the release of the first and second quarter data for 2020, a number of important changes have been introduced to increase the relevance of the Commercial Rents Services Price Index (CRSPI).

Previously, the index was available at the Canada level only for all buildings combined. With this release and going forward, the aggregation of retail, office, and industrial buildings and warehouses is available for 13 selected census metropolitan areas (CMAs) across Canada, for all provinces and for the combined territories. Indexes by building type are available at the national level, for the four largest provinces (Ontario, Quebec, Alberta and British Columbia), and for Montréal, Toronto, Calgary, and Vancouver. These additions provide a more accurate representation of commercial rents services prices nationally.

The Commercial Rents Services Price Index has a 2019=100 base year.

The weights used for the 2019=100 index are based on the 2018 revenue of the establishments in the sample.

The historical continuity of the total Commercial Rents Services Price Index has been maintained by linking the new Canada index series with the Canada historical index series published in the archived tables 18-10-0040 and 18-10-0065. The new indexes will be included in two tables, 18-10-0255 (monthly) and 18-10-0260 (quarterly), beginning with the first quarter of 2019.

With each release, data for the previous quarter may be revised.

The CRSPI is not seasonally adjusted.

Products

A detailed methodology for the CRSPI is available in the Prices Analytical series.

Statistics Canada has launched the Producer Price Indexes Portal as a part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video "Producer price indexes" is available on the Statistics Canada Training Institute webpage. It provides an introduction to Statistics Canada's producer price indexes—what they are, how they are produced and what they are used for.

Next release

The Commercial Rents Service Price Index for the third quarter of 2020 will be released on November 19.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: