Quarterly financial statistics for enterprises, first quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-09

$74.4 billion

First quarter 2020

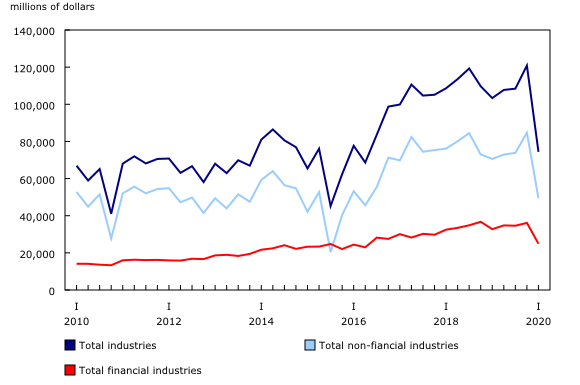

Canadian corporations reported net income before taxes of $74.4 billion in the first quarter, on a seasonally adjusted basis, down $46.5 billion from the fourth quarter of 2019.

Physical distancing measures and provincial shutdowns were announced in Canada during the last two weeks of March. COVID-19 had little impact on first quarter results since data collected only includes information until the end of March; however, these data will provide a valuable benchmark on how COVID-19 has affected the financial health of all areas of the economy, ranging from the banking sector and the housing market, to manufacturing and retail trade.

Changes to the Quarterly Survey of Financial Statements

Starting with the first quarter of 2020, the Quarterly Survey of Financial Statements (QSFS) underwent a planned content update to better align it with International Financial Reporting Standards (IFRS), which were adopted by Canadian enterprises starting in 2011.

In addition, the QSFS migrated its operations to a new processing system. This migration required an update to the survey's methodology to make operations more efficient and standardized.

The variable used by the QSFS to measure an enterprise's financial performance changed from operating profit to net income before taxes (see note to readers).

These changes may impact the comparability of the first quarter 2020 estimates with those for previous quarters. Efforts will be made to back-cast these data to the first quarter of 2010, to allow for historical comparisons. However, more than one cycle of collection under the new content and methodology is required before starting this exercise and as such, it is expected that back-casted data will be available at the end of 2021.

Data users should therefore exercise caution when making historical comparisons.

A seasonally adjusted series was created for net income before taxes only for analytical purposes, and the estimates for this variable may change once a formal back-casting exercise is undertaken.

Net income for Canadian corporations declines

Canadian corporate net income before taxes decreased by $46.5 billion (-38.4%) from the fourth quarter of 2019 to $74.4 billion in the first quarter, mainly driven by the non-financial sector.

Compared with the same quarter a year earlier, net income before taxes for Canadian corporations decreased 28.0%.

Net income before taxes in the non-financial sector decreases

Net income before taxes in the non-financial sector fell by $35.3 billion from the fourth quarter of 2019 to $49.4 billion in the first quarter.

Oil and gas extraction and support activities led the decline, reporting a net loss before taxes of $17.2 billion, down $17.9 billion from the fourth quarter on lower oil prices.

Pharmaceutical and medicine manufacturing, and soap, agricultural chemicals, paint and other chemical product manufacturing reported $1.2 billion of net income before taxes, down $16.3 billion from the previous quarter. The decline was due to a large foreign exchange gain reported in the fourth quarter of 2019.

Petroleum and coal products manufacturing reported a decrease of $5.3 billion in net income before taxes when compared with the fourth quarter, mainly on lower oil prices.

Financial sector sees lower net income before taxes

Net income before taxes for the financial sector decreased $11.2 billion in the first quarter of 2020 to $24.9 billion.

Life, health and medical insurance carriers' net income before taxes declined by $2.0 billion from the fourth quarter, mainly due to losses from foreign exchange.

Net income before taxes for banking and other depository credit intermediation decreased by $1.4 billion to $9.7 billion due to labour-related expenses.

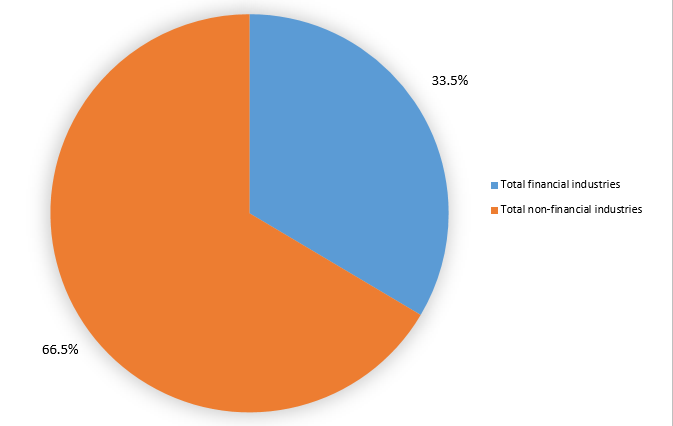

In terms of contribution to total net income before taxes, the non-financial sector accounted for two-thirds (66.5%) of the total net income before taxes in the Canadian corporate sector, while the financial sector accounted for one-third (33.5%) of the total.

Note to readers

Data on quarterly net income before taxes in this release are seasonally adjusted and expressed in current dollars, unless otherwise stated.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Quarterly financial statistics for enterprises are based on a sample survey and represent the activities of all corporations in Canada, except those that are government-controlled or not-for-profit. The survey collects data on balance sheet, income statement and additional disclosures of enterprises.

An enterprise can be a single corporation or a family of corporations under common ownership and/or control, for which consolidated financial statements are produced.

Survey changes

The following changes were introduced to the survey starting with the first quarter of 2020:

- New content was implemented this quarter to align the survey to new accounting standards adopted by corporations starting in 2011.

- New industrial breakdowns, which allow for more granularity in the dissemination of data, were implemented. As a result, some industry groupings were merged, others were split and some remained the same.

- The survey's sample was modified to support the new industrial breakdowns; however, a maximum sample overlap with the previous sample was adopted.

- A more automated imputation strategy was implemented to streamline the process and to reduce the need for manual intervention.

Analytical focus change

Up to the fourth quarter of 2019, the Quarterly Survey of Financial Statements (QSFS) focused primarily on operating profit/losses to track the financial performance of enterprises. Operating profit are profits an enterprise earns from its core business operations and is the difference between operating revenues and operating expenses.

The content for the QSFS questionnaire, up until the fourth quarter of 2019, did not include a distinction between operating revenue and expenses. To calculate an enterprise's operating profit, additional information on expenses, in particular, cost of goods sold (COGS), was collected and included in the calculation.

Over time, the response rate for the COGS variable declined. As well, the accounts used by financial industries and non-financial industries were different due to the nature of their activity, with some enterprises no longer reporting operating profits in their financial statements.

Changes to accounting standards in 2006 (new financial instruments standards), and in 2011 (adoption of International Financial Reporting Standards) included the introduction of gains/losses in asset revaluations, which further complicated the calculation of operating profits.

Asking respondents to report categories of revenue and expenses as well as a breakdown, within each of those two categories, between operating and non-operating amounts would have increased response burden.

Being an economy-wide program, the QSFS requires a certain degree of comparability in the concepts used to assess financial performance across enterprises and industries.

To overcome some of the difficulties in terms of comparability at the operating profit level, and to avoid increased response burden, starting with the first quarter of 2020, the focus of QSFS analysis will change from operating profit to net income before taxes to better assess an enterprise's financial performance. Net income before taxes is income earned from normal business activities.

Net income before taxes is a more inclusive measure, and its calculations are more standardized between enterprises and industries.

Revisions, benchmarking and back casting

The first quarter 2020 release of the QSFS includes revised estimates from the fourth quarter of 2017 to the fourth quarter of 2019, reconciled to the 2017 and 2018 annual series. Additional revisions have been made to the fourth quarter estimates of the previous year as a result of receipt of new survey data from respondents. However, changes in methodology and content, have made it difficult to compare first quarter 2020 to historical data.

Efforts are being made to back-cast these data to the first quarter of 2010 to allow for better historical comparisons. However, as more than one cycle of the new content is required before being able to start this exercise, users are cautioned to be careful when making historical comparisons.

It is expected that the back-casting work will be completed and results released at the end of 2021.

Larger than usual revisions may be anticipated in the future, as quarterly revisions, annual benchmarking, back casting and receipt of new survey data from respondents will be incorporated in order to improve data quality and include the most up-to-date data.

Next release

Financial statistics for enterprises for the second quarter of 2020 will be released on August 25.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: