Non-residential capital and repair expenditures, 2018 (revised), 2019 (preliminary) and 2020 (intentions)

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-02-27

Capital spending expected to increase in 2020 for the fourth consecutive year

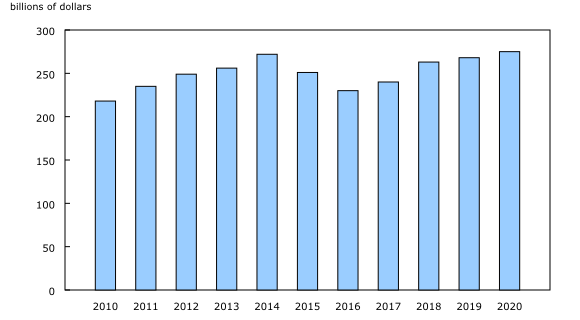

Capital expenditures on non-residential construction and machinery and equipment are expected to rise 2.8% to $275.5 billion in 2020, following a 1.7% increase in 2019 and a 9.8% increase in 2018. The $7.5 billion anticipated increase is expected to come from growth in capital construction (+4.5% to $178.6 billion), while capital spending on machinery and equipment is projected to edge down 0.2% to $96.9 billion.

Highlights

Total 2020 capital investment intentions of $275.5 billion mark the highest ever recorded, surpassing the previous peak of $272.1 billion registered in 2014.

Capital spending by public sector organizations is anticipated to increase by 6.5% following a modest increase of 0.8% in 2019. More modest growth in capital expenditures on privately held non-residential tangible assets of 0.9% is expected in 2020, compared with 2.2% in 2019.

Of the 20 industrial sectors, 12 have indicated plans to increase their capital expenditures in 2020, compared with 13 in 2019 and 16 in 2018.

Leading the way are capital investments in the transportation and warehousing sector, set to reach a record of $44.3 billion in 2020 (+9.3%), following significant gains in 2019 (+13.8%) and 2018 (+22.9%).

Capital spending in the mining, quarrying, and oil and gas extraction sector is set to decline for a third consecutive year. The anticipated investment of $43.7 billion for 2020 is a substantially lower level compared with the high of $90.4 billion reported in 2014.

Increases in spending intentions for Ontario (+4.1%), Quebec (+7.3%) and British Columbia (+7.8%) offset the forecasted decreases in four provinces and two territories. The most notable decrease in 2020 is expected in Newfoundland and Labrador (-$834 million) following an increase in 2019 (+$396 million).

The transportation and warehousing sector leads investment in 2020

Both the private and public sector are expected to be factors in the record $44.3 billion in capital expenditures for the transportation and warehousing sector in 2020. Solid growth in capital construction (+10.1%) and capital machinery and equipment (+7.7%) will make transportation and warehousing the top sector in 2020 in terms of capital expenditures, surpassing the mining, quarrying, and oil and gas extraction sector, which has been the top sector since 2001, for the first time. The largest contributor to growth in the transportation and warehousing sector is a 25.7% (+$2.4 billion to $11.8 billion) anticipated increase in transit and ground passenger transportation. Significant increases are also anticipated in air transportation (+$1.2 billion to $4.5 billion) and support activities for transportation industries (+$1.2 billion to $10.5 billion). The expected increases are largely concentrated in Quebec (+39.8% to $7.6 billion), British Columbia (+16.4% to $13.2 billion), and Ontario (+14.4% to $11.9 billion). Partially offsetting growth is reduced spending across the Prairie provinces as major investment projects come to an end.

Spending in the utilities sector is expected to increase by 9.1% to $33.0 billion in 2020, driven by increases in the water, sewage and other systems subsector (+30.5% to $7.6 billion) as major projects in British Columbia and Ontario get underway. Furthermore, increased investment in electric power generation, transmission and distribution in Alberta and Ontario more than offset the completion of major projects in Newfoundland and Labrador and in Manitoba.

Capital spending in the public administration sector is expected to grow by 2.3% (+$783 million to $34.4 billion), following a drop of 0.6% in 2019. Spending increases in local, municipal and regional public administration (+$2.3 billion to $18.3 billion) are expected to more than offset declines in federal government public administration spending (-$1.5 billion to $4.0 billion).

Capital outlays in the mining, quarrying, and oil and gas extraction sector are anticipated to decrease 1.4% (-$636 million to $43.7 billion) in 2020, after reporting drops of 8.3% (-$4.0 billion) in 2019 and 4.3% (-$2.2 billion) in 2018. The anticipated decline in 2020 is largely attributed to lower spending intentions in the metal ore mining subsector (-$1.1 billion). In contrast, the oil and gas extraction subsector, which represents about 77% of the anticipated spending in 2020 for the sector, reported an expected increase of 1.3%. Within this subsector, the non-conventional oil extraction industry anticipates gains of $1.1 billion in capital spending, which is partially offset by the expected decrease of $633 million in the conventional oil and gas extraction industry.

Manufacturers anticipate a 1.2% increase in capital spending in 2020 to $22.4 billion, due to a 3.1% increase in spending on capital machinery and equipment. Non-residential capital construction is anticipated to decline 3.6% in 2020, following increases of 14.5% in 2019 and 47.0% in 2018. Out of 21 manufacturing subsectors, 11 reported an expected increase in total capital outlays for 2020, compared with 12 in 2019 and 17 in 2018. Quebec is expected to increase its spending by $474 million (+9.8%) in 2020, offsetting anticipated declines in Alberta, Manitoba and Ontario.

British Columbia, Ontario and Quebec expected to lead growth in spending, while Newfoundland and Labrador anticipates the largest decline

British Columbia is among the provincial leaders contributing to the $7.5 billion national increase anticipated in 2020. New capital spending is expected to increase $3.0 billion (+7.8%) for a total of $41.8 billion. Notable advances in investment also took place in 2019 (+21.1%) and 2018 (+10.5%). Increased spending is nothing new for British Columbia: 2020 marks the fifth consecutive year spending is set to increase. Gains in the transportation and warehousing sector (+$1.9 billion) and the utilities sector (+$861 million) will easily offset reduced spending in the agriculture, forestry, fishing and hunting sector (-$185 million) and the mining, quarrying, and oil and gas extraction sector (-$109 million).

Ontario's capital spending is expected to increase by 4.1% to $86.1 billion, following an increase of 1.0% in 2019 and an increase of 18.6% in 2018. Spending is anticipated to increase in several sectors, namely transportation and warehousing (+14.4% to $11.9 billion), utilities (+10.1% to $11.8 billion) and public administration (+6.7% to $12.7 billion). The manufacturing sector in Ontario is expected to decline $102 million (-1.2%) in 2020, after a decrease of $489 million (-5.3%) in 2019. A considerable increase of $3.1 billion (+50.2%) took place in 2018 due to the food, chemical and transportation manufacturing subsectors.

Capital investment in Quebec has been increasing since 2014 and shows no signs of slowing down, with a planned spending increase of 7.3% to $46.4 billion in 2020. Spending in the province is anticipated to increase by $3.1 billion in 2020, with $2.2 billion coming from the transit and ground transportation subsector. The manufacturing, utilities and accommodation and food services sectors are also expecting increases in 2020.

Newfoundland and Labrador (-$834 million to $6.2 billion) is anticipating the largest provincial decline in spending in 2020, following an increase in 2019 (+$396 million to $7.0 billion). Utilities (-$475 million) and the mining and quarrying, except oil and gas subsector (-$389 million) represent the majority of the decrease expected for 2020.

Note to readers

The Capital and Repair Expenditures Survey is based on a sample survey of 25,000 private and public organizations. The preliminary estimates for 2019 and intentions for 2020 survey was conducted from September 2019 to January 2020.

The survey includes intentions for 2020, preliminary estimates for 2019 and revised estimates for 2018.

Data in this release are expressed in current dollars.

Real time data tables

Real time data tables 34-10-0278-01 and 34-10-0279-01 will be updated on March 5.

Infrastructure capital investments

Statistics Canada will release new data tables delineating infrastructure capital investments and their associated sources of funding on April 1.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

For analytical information, or to enquire about the concepts, methods or data quality of this release, contact Pierre-Louis Venne (613-853-2107; pierre-louis.venne@canada.ca), Investment, Science and Technology Division.

- Date modified: