Survey of Non-Bank Mortgage Lenders, second quarter 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-01-28

Increase in residential mortgages extended by non-bank lenders

The value of residential mortgage loans extended by non-bank lenders grew by 25.4% to $41.1 billion in the second quarter of 2019. The total number of extended residential mortgages also increased during the quarter to 166,482—an increase of 34.1%.

Mortgages extended during the second quarter of 2019 represented 12.6% of the total value and 9.8% of the total number of outstanding residential mortgages.

The average value of mortgages extended during the quarter was $246,802, down 6.5% from the previous quarter, as the number of mortgages extended grew at a faster rate than the value. Increased sales in key housing markets of condominiums and townhouses, which are often more affordable than other property types, could be responsible for the lower average mortgage value.

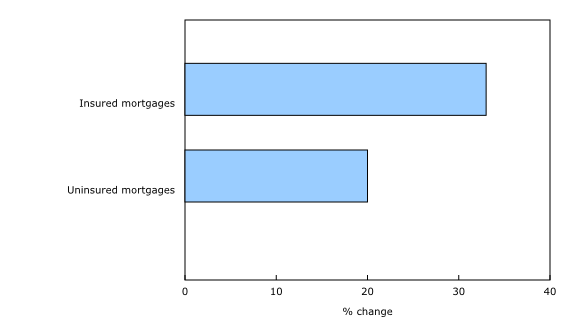

Although the majority of mortgages extended by non-bank lenders was uninsured, insured mortgages grew faster (+33.0%) than uninsured mortgages (+19.6%) in the second quarter of 2019. In terms of number of mortgages, both insured and uninsured mortgages extended posted growth above 30% (+34.9% and +33.5%, respectively).

Value of outstanding mortgages rises slightly

Despite a pickup in the mortgages extended during the quarter, the total value of outstanding mortgages edged up 0.1% to $325.2 billion, and the overall number of outstanding mortgages edged down 1.5% to 1.7 million.

The average value of outstanding mortgages was $191,909, up from $188,820 in the first quarter.

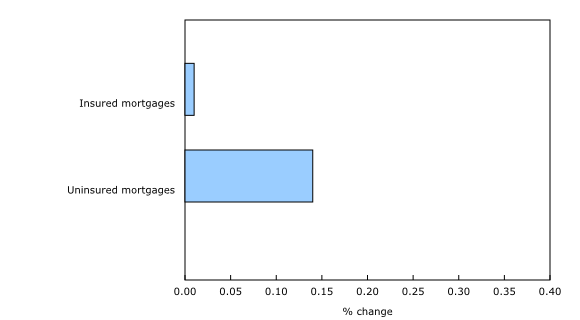

Growth in the value of both insured and uninsured outstanding mortgages was relatively stable, while the number of outstanding mortgages decreased by 2.0% and 1.3%, respectively.

The average value of insured outstanding mortgages was $227,354, which was higher than the average value of uninsured outstanding mortgages ($172,002). Although the average value of uninsured outstanding mortgages was lower, they made up the majority of the total value of outstanding mortgages held by non-bank mortgage lenders.

The number and value of residential mortgages in arrears over 90 days decrease

In the second quarter of 2019, the total value of mortgages in arrears over 90 days decreased by 9.4% to $818.0 million. The total number of mortgages in arrears over 90 days also decreased, down 12.2% to 3,656, which suggests that more borrowers are making their payments on time.

These mortgages represented 0.3% of the total value and 0.2% of the total number of outstanding mortgages at the end of the quarter, in line with national delinquency rates. Stronger labour market conditions and lower unemployment rates may have aided borrowers in repaying their mortgage debt.

The average value of mortgages in arrears over 90 days was $223,749 in the second quarter of 2019, up from $216,924 in the first quarter.

For more information on housing statistics, visit the Housing Statistics Portal.

Note to readers

The Survey of Non-Bank Mortgage Lenders is a recent initiative to collect information at the national level. This initiative will help complete the overall picture of the residential mortgage market in Canada. Until recently, residential mortgage data from non-bank lenders were collected only by some organizations at the provincial level, for certain industries, and at varying levels of detail.

The survey covers non-bank residential mortgage lenders, such as local credit unions, mortgage finance companies, trusts, insurance companies, mortgage investment corporations, and private lenders. The entities included are not only those that originate residential mortgages, but also those that purchase them.

Please refer to the Survey of Non-Bank Mortgage Lenders, first quarter 2019.

Some figures may not add up to 100% as a result of rounding.

Definitions:

Mortgages outstanding refers to the mortgage balances remaining on the lender's balance sheet as of the end of the quarter.

Mortgages extended are the mortgages approved, issued and added to the balance sheet during the quarter.

Mortgages in arrears are mortgage loans overdue at the end of the quarter.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: