Non-bank financial intermediation, 2007 to 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-01-20

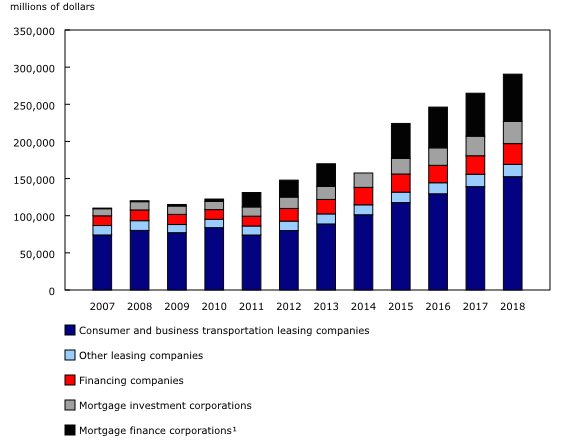

Statistics Canada, in partnership with the Bank of Canada, has continued to develop the Economic Account of Non-Bank Financial Intermediation. With this release, provisional estimates for reference years 2007 to 2018 are now available covering non-bank credit intermediaries (NBCI), which represent a subset of non-bank financial intermediaries. These NBCIs include mortgage investment corporations (MICs), mortgage finance corporations (MFCs), consumer and business transportation leasing companies, other leasing companies, and financing companies.

Non-bank financial intermediaries are becoming an increasingly important source of financing for Canadians. While these selected non-bank financial intermediaries account for a small share of total lending, their overall growth from 2007 to 2018 has outpaced that of traditional lending sectors such as chartered banks.

This release comprises revised estimates for 2007 to 2017 as well as an additional year of data (2018) for the NBCI sectors published in December 2018. Furthermore, 2007 to 2018 estimates for an additional NBCI sector covering financing companies are included for the first time.

Notable growth in the assets of non-bank credit intermediaries over the period from 2007 to 2018

The total assets of the NBCI sectors more than doubled from 2007 to 2018. The largest sector among NBCIs was consumer and business transportation leasing companies with total financial assets of $152.5 billion in 2018, followed by MFCs ($63.7 billion), MICs ($29.9 billion), financing companies ($28.0 billion), and other leasing companies ($16.5 billion). MICs and MFCs had the highest average year-over-year growth (+25.0%), while the financing companies (+7.7%) and leasing companies (+6.5%) grew more slowly.

The total financial assets of the MIC sector have more than tripled from 2007 to 2018, rising from $9.6 billion in 2007 to $29.9 billion in 2018. The sector has grown steadily over the past 11 years, with an average year-over-year increase of 11.1%, primarily due to MIC entities growing their business. Mortgages were the main asset for MICs and reached $26.7 billion in 2018. The primary source of funding was equity and investment fund shares ($22.5 billion in 2018). The assets of MFCs were also mostly comprised of mortgages ($60.0 billion in 2018); however, their principal source of funding was from the issuance of debt securities.

The total financial assets of the consumer and business transportation leasing sector more than doubled over the period, growing from $74.1 billion in 2007 to $152.5 billion in 2018. Non-mortgage loan assets, which include lease receivables, represented the largest component of financial assets and reached $77.7 billion in 2018. On the liabilities side, non-mortgage loans ($102.8 billion in 2018) have been the principal source of funding for companies in this sector.

The financial assets of financing companies increased from $13.1 billion in 2007 to $28.0 billion in 2018, with the largest component being non-mortgage loans ($18.5 billion in 2018).

NBCIs represent smaller share of loan assets, but post faster growth

Total loan assets in the NBCI sectors stood at $198.1 billion in 2018. This represented 6.1% of the total for the financial corporations sector ($3,393.9 billion). However, given the year-over-year growth from 2007 to 2018, NBCIs (+10.9%) increased at a faster rate than that of chartered banks (+8.4%).

Note to readers

Mortgage investment corporations (MICs)

MICs, governed by Section 130.1 of the Income Tax Act, are engaged in mortgage lending. Funds are raised through the sale of shares to investors or via debt and these funds are used to provide financing. The return to investors is typically the interest earned on the MIC's portfolio of outstanding loans. Usually, a MIC has 20 or more shareholders and provides short term loans (6 to 36 months) secured by real estate property. MICs offer advantages over a traditional bank as they are more flexible in their lending terms. One can have a personalized structured loan with a short turnaround time for assessing and providing funds that, when compared to other lenders, allows them to charge a higher interest rate. The structure of a MIC represents a vehicle for those with equity to generate profit from the lucrative residential mortgages loan industry.

Mortgage finance corporations (MFCs)

MFCs are large financial institutions that originate and service residential mortgages (usually insured). These mortgages are typically sourced from brokers, but some are sourced directly from clients. These mortgages tend to be packaged and sold to regulated financial institutions and thus must adhere to mortgage lending rules to satisfy the requirements of both their institutional buyers and the Canada Mortgage and Housing Corporation regarding the public insurance of residential mortgages. Due to these two considerations, MFCs are often considered as quasi-regulated. MFCs have a complex relationship with the major banks that is both co-operative and competitive. According to the Bank of Canada, some banks rely on MFCs to underwrite and service broker-originated mortgages, while MFCs also rely on banks to fund their operating capital and a significant share of their mortgage lending. At the same time, MFCs and banks compete for broker-originated mortgages. (From The Rise of Mortgage Finance Companies in Canada: Benefits and Vulnerabilities (PDF).)

Consumer and business transportation leasing companies

A lease is a long-term contract of one or more years where the lessee pays the depreciation on a good including an associated interest expense and is offered the option at the end of the lease to buy out the good completely or return it. This sector includes all types of transportation vehicles (planes, trains, and automobiles) and fleets, but excludes rentals.

Other leasing companies

Other leasing companies adhere to the same general definition of a lease and cover all other types of leasing, such as equipment, furniture, and machinery. Transportation leasing and rentals are excluded.

Financing companies

Finance companies are financial institutions that supply credit for the purchase of consumer goods and services or grant loans directly to individuals and businesses. Unlike banks, finance companies do not take deposits from the public and are not subject to strict banking regulations. Finance companies profit from interest rates charged on the loans provided to clients. These rates are generally higher than the interest rates on bank loans. Finance companies typically obtain funds from a variety of sources, such as through their own borrowing or from an affiliated corporation.

Products

The Economic accounts statistics portal, accessible from the Subject module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The document, "An economic account for non-bank financial intermediation as an extension of the National Balance Sheet Accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: