Retail trade, October 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-12-20

$50.9 billion

October 2019

-1.2%

(monthly change)

$0.8 billion

October 2019

0.9%

(monthly change)

$0.2 billion

October 2019

-0.4%

(monthly change)

$1.3 billion

October 2019

-2.4%

(monthly change)

$1.1 billion

October 2019

1.7%

(monthly change)

$10.9 billion

October 2019

-1.7%

(monthly change)

$19.2 billion

October 2019

-2.0%

(monthly change)

$1.8 billion

October 2019

1.1%

(monthly change)

$1.6 billion

October 2019

-1.7%

(monthly change)

$6.7 billion

October 2019

0.4%

(monthly change)

$7.1 billion

October 2019

-0.9%

(monthly change)

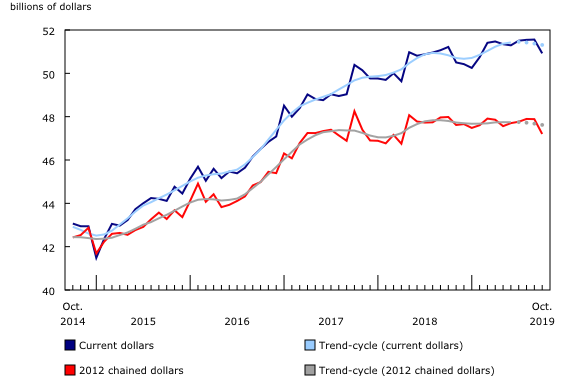

Retail sales decreased 1.2% to $50.9 billion in October. The decline was primarily attributable to lower sales at motor vehicle and parts dealers and at building material and garden equipment and supplies dealers.

Lower sales were reported in 8 of 11 subsectors, representing 81% of retail trade.

After removing the effects of price changes, retail sales in volume terms decreased 1.4%.

Lower sales at motor vehicle and parts dealers and building material and garden equipment and supplies dealers

The largest contribution to the monthly decline came from the motor vehicle and parts dealers subsector (-3.2%). Lower sales were reported at all store types within the subsector, led by new car dealers (-3.0%). Sales also declined at used car dealers (-5.2%), the largest decrease since September 2017.

Sales at building material and garden equipment and supplies dealers (-3.1%) were down for the fourth month in a row.

After increasing 1.3% in September, receipts at food and beverage stores declined 0.4%. Lower sales were reported in three out of four store types, with the declines concentrated at beer, wine and liquor stores (-1.8%).

Following a 2.2% decrease in September, sales at gasoline stations rose 1.5% in October, primarily reflecting higher prices at the pump. In volume terms, sales at gasoline stations were down 0.5%.

Sales down in six provinces

Retail sales were down in Ontario (-2.0%) in October from declines at motor vehicle and parts dealers, following three consecutive months of growth for the subsector. In the census metropolitan area (CMA) of Toronto, sales decreased 2.0% following a 1.9% increase in September.

In Quebec, sales declined 1.7% as a result of lower sales at motor vehicle and parts dealers. In the CMA of Montréal, sales were down 1.9%.

For the second month in a row, retail sales declined in British Columbia (-0.9%). Lower sales at motor vehicle and parts dealers were the largest contributor to the decrease.

In Alberta, retail sales were up 0.4% after falling below levels last reported in August 2017. Despite the gain, the level of retail sales in Alberta remains below all levels recorded in 2018 and most of 2019.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales were $1.8 billion in October, accounting for 3.4% of total retail trade. On a year-over-year basis, retail e-commerce increased 14.4%, while total unadjusted retail sales were up 0.8%.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For information regarding cannabis statistics, consult the Cannabis Stats Hub.

Seasonally adjusted estimates for cannabis store retailers are presented in unadjusted form as there is no seasonal pattern established by official statistics yet. Establishing such a pattern requires several months of observed data. In the interim, the seasonally adjusted estimates for cannabis store retailers will be identical to the unadjusted figures.

Statistics Canada's retail e-commerce figures include the electronic sales of two distinct types of retailers. The first type do not have a storefront. These businesses are commonly referred to as pure-play Internet retailers and are classified to North American Industry Classification System (NAICS) 45411—Electronic Shopping and Mail Order Houses. The second type have a storefront and are commonly referred to as brick-and-mortar retailers. If the online operations of a brick-and-mortar retailer are separately managed, they too are classified to NAICS 45411.

Some common electronic commerce transactions, such as travel and accommodation bookings, ticket purchases, and financial transactions, are not included in Canadian retail sales figures.

For more information on retail e-commerce in Canada, see "Retail E-Commerce in Canada."

Total retail sales expressed in volume terms are calculated by deflating current dollar values using consumer price indexes. The retail sales series in chained (2012) dollars is a chained Fisher volume index with 2012 as the reference year. For more information, see Calculation of Volume of Retail Trade Sales.

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Real-time tables

Real-time tables 20-10-0054-01 and 20-10-0079-01 will be updated soon.

Next release

Data on retail trade for November 2019 will be released on January 24, 2020.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: