Activities of Canadian majority-owned affiliates abroad, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-09-24

Most regions and sectors report higher foreign affiliate employment in 2017

Employment at Canadian majority-owned affiliates abroad increased 4.4% to 1.45 million in 2017, while sales rose 3.7% to $685.4 billion. The activities of Canada's foreign affiliates represent an important component of the overall activity of Canadian multinational enterprises, with these affiliates' total sales exceeding the total value of Canada's exports of goods and services ($663.7 billion) for the year.

Following two years of strong growth, employment at foreign affiliates in South and Central America increased 8.6% in 2017, led by increases in Argentina, Brazil and Chile. Foreign affiliate employment in this region increased almost 25% over the past three years, mostly as a result of higher employment in the mining and oil and gas extraction and manufacturing sectors.

In Europe, higher employment at foreign affiliates in the United Kingdom (+12.2%), attributable mainly to increased merger and acquisition activities, accounted for much of the 2017 growth in the region (+5.2%). Employment in Ireland also grew at a rapid pace (+27.4%), as a result of an increase in activity in the information and cultural industries.

In the North American and Caribbean region, employment at foreign affiliates in the United States grew 3.4%, a rate similar to that of the previous two years, while employment in Mexico was up 3.1%. While the United States remains the primary destination for Canadian foreign investment, accounting for 45.1% of foreign affiliate employment, its share of overall foreign affiliate employment has been gradually declining in recent years, down from a 52.0% share in 2011.

In Africa, employment fell (-2.7%) for the second consecutive year as a result of lower employment in the mining and oil and gas extraction sector (-4.6%), which accounts for nearly 90% of foreign affiliate employment in the region.

On a sectoral basis, employment growth in the service sector outpaced that in the goods sector for the second consecutive year, rising 6.5%. The growth in service sector employment was widespread in all sectors, led by management of companies and enterprises (+30.6%), information and cultural industries (+11.9%), and professional, scientific and technical services (+10.0%)

In the goods sector, employment growth (+2.4%) was led by a 2.9% increase in the manufacturing sector, while the mining and oil and gas extraction sector was up 1.5%.

Sales up in 2017 despite weakness in Europe

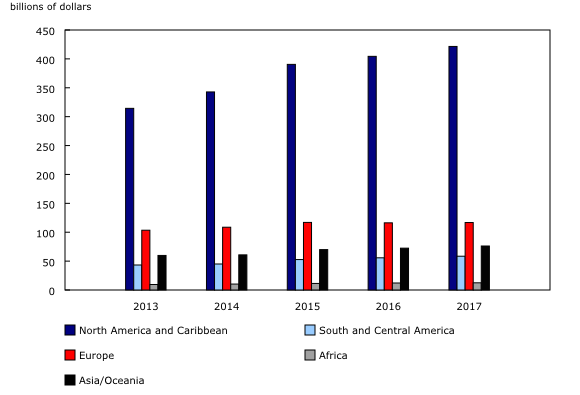

Sales by foreign affiliates grew 3.7% in 2017 to $685.4 billion, following a 3.0% rise in the previous year.

While all regions reported higher foreign affiliate sales in 2017, sales in Europe grew at a more modest pace (+0.4%) after declining by 0.7% in the previous year. Most of the sales decline in Europe over the past two years was in the United Kingdom. This decrease can be attributed in part to the 14% appreciation of the Canadian dollar against the pound sterling during this period.

On a country basis, the most significant increases in sales were in Australia (+14.7%), China (+13.8%), Hong Kong (+13.5%), and Brazil (+8.3%). The growth in China and Brazil was concentrated in the manufacturing sector, while the finance and insurance and professional, scientific and technical services sectors accounted for most of the growth in Hong Kong and Australia.

On a sectoral basis, the increase in sales was concentrated almost entirely in the service sector, where sales were up 6.6% in 2017, compared with a 0.5% increase in the goods sector.

After increasing by 10.5% in 2016, sales in the retail sector grew at an even faster rate in 2017, up 29.6% to $65.9 billion. This growth was due mainly to higher activity in North America. Foreign affiliate sales and employment in this sector doubled over the past five years, primarily as a result of increased merger and acquisition activity.

In the goods-producing sector, the utilities and construction sector recorded a 16.1% gain in sales largely as a result of increased activity in the North America and Caribbean region. Sales growth in most other goods-producing sectors was relatively weak.

Most foreign affiliate sales made to their domestic market

Canadian multinationals can serve foreign markets both through exports from Canada and through sales by their foreign affiliates. These sales can be broken down between sales made to foreign affiliates' domestic markets and those made to international markets, including back to Canada. In 2017, sales by Canadian foreign affiliates to their domestic markets totalled $549.2 billion, representing 80% of their total sales, with the remaining 20% of sales made either to other foreign markets or back to Canada.

The distribution of sales between the domestic market and other markets can vary significantly among sectors. For sectors such as retail trade and transportation and warehousing, foreign affiliate sales are almost entirely to the domestic market, whereas, in other sectors, such as mining and oil and gas extraction, the majority of sales are made to international markets.

Canadian enterprises with foreign parents contribute significantly to foreign affiliate activity

The activities of Canadian multinational enterprises abroad also include the activities of Canadian enterprises ultimately controlled by a foreign parent company. The share of the total sales and the percentage of employment attributable to enterprises ultimately controlled by a foreign parent company typically range from 15% to 20% a year.

The share of total assets attributable to these enterprises is much lower, at around 6% to 7%. This is due primarily to the fact that most of the assets of foreign affiliates are in the finance and insurance sector, which is almost entirely composed of affiliates ultimately owned by Canadian-controlled enterprises.

The share of foreign affiliate activity attributable to ultimately foreign-controlled enterprises can also vary significantly among sectors. Notably, the foreign share of sales and employment is normally much higher for sectors such as manufacturing, mining and oil and gas extraction, and wholesale trade than for sectors such as finance and insurance or transportation and warehousing.

Note to readers

For consistency with international practices for measuring the activities of foreign affiliates abroad, only the figures for Canadian majority-owned foreign affiliates are included in this release. These figures represent the total sales, employment, and assets of those affiliates, including affiliates that have less than 100% Canadian ownership.

Products

The updated Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: