Quarterly financial statistics for enterprises, second quarter 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-08-23

$107.1 billion

Second quarter 2019

5.2%

(quarterly change)

Overall operating profits

Canadian corporations earned $107.1 billion in operating profit in the second quarter, up $5.3 billion or 5.2% from the first quarter, but 0.4% lower compared with the second quarter of 2018.

Non-financial industries

In the non-financial industries, operating profit increased $1.6 billion (+2.2%) from the first quarter to $75.7 billion. Overall, operating profit was up in 13 of 17 non-financial industries.

Compared with the second quarter of 2018, operating profit for Canadian non-financial enterprises increased 2.8%.

Operating profits increase in the oil and gas extraction and support activities industry

Operating profits in the oil and gas extraction and support activities industry were up $325 million (+20.7%) in the second quarter, reaching $1.9 billion. This increase was attributable to a rise in oil prices.

Operating profit up in manufacturing

Operating profit for the manufacturing sector rose $116 million (+0.8%) from the first quarter to $15.3 billion, as 5 of 13 industries reported increases.

Operating profit for petroleum and coal products manufacturing led the increase, rising $702 million (+29.6%) from the first quarter due to higher oil prices.

Conversely, operating profit for wood and paper manufacturing declined, down $249 million (-20.4%) from the first quarter due to weaker market conditions and high log costs.

Motor vehicle and parts manufacturing also saw a decline in operating profit, decreasing $242 million (-17.3%) in the second quarter.

Operating profit up in wholesale and retail trade

In wholesale trade, operating profit rose $214 million (+2.3%), reaching $9.4 billion in the second quarter. This increase was mostly attributable to machinery, equipment and supplies merchant wholesalers, up $221 million (+9.5%).

In retail trade, operating profit rose $68 million (+1.2%) from the first quarter, reaching $5.8 billion. Furniture, home furnishings, electronics and appliance stores led the increase, up $50 million (+13.6%).

Operating profit up in the financial industries

Operating profit in the financial industries increased by $3.7 billion (+13.4%), up from $27.7 billion in the first quarter to $31.4 billion in the second quarter.

Operating profit for depository credit intermediation rose $2.6 billion (+21.0%), to $15.1 billion. Banking and other depository credit intermediation led the increase in operating profit, up $2.5 billion (+22.3%) to $13.9 billion. This is attributable to a decrease in expenses relating to a non-recurrent payment to external business partners that occurred in the first quarter.

Operating profit for insurance carriers and related activities rose $427 million (+25.4%), from an operating loss of $1.7 billion in the first quarter of 2019 to an operating loss of $1.3 billion in the second quarter.

Property and casualty insurance carriers recorded an increase of $52 million (+5.2%) in operating profit due to higher insurance revenue, despite the higher insurance claims expense in the quarter as a result of the April and May floods in Eastern Canada.

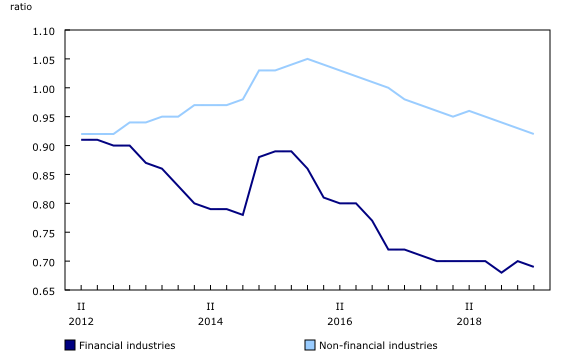

Debt-to-equity ratio decreasing for financial and non-financial Canadian enterprises

The debt-to-equity ratio is a useful indicator of financial performance, measuring the degree to which a company is borrowing money to finance its operations. It is calculated by dividing a company's debt by its shareholder equity. This is a useful measure of risk because if a company has a high ratio of debt to finance its operations, it could be more at risk during a period of financial hardship. Therefore, the lower the ratio, the better a company's finances are deemed to be. However, the characteristics of the ratio and its average levels can differ depending upon the industry.

To get a sense of the evolution of this ratio for financial and non-financial Canadian enterprises in the last few years, data from the Quarterly Survey of Financial Statements have been used. The level of debt for these industries has been determined by aggregating the balances for the following two accounts: Loans and accounts with affiliates, and borrowings. Debt was then divided by the balance in the shareholders equity.

The amount of debt used to finance assets in the financial industries has been falling since the first quarter of 2012. The debt-to-equity ratio saw a temporary upswing starting in the first quarter of 2015, as Canadian banks issued more bonds. However, since the end of 2015, the amount of equity has risen faster than debt for financial industries, leading to a decline in the debt-to-equity ratio.

Meanwhile, the debt-to-equity ratio of non-financial industries had been rising steadily from the first quarter of 2012 with a slight acceleration in its level in the first quarter 2015, and further increases as the year went on. Over this period, an increase in bonds and debentures issuances as well as loans and accounts with affiliates by non-financial enterprises were observed.

Similar to the financial industries, the debt-to-equity ratio of non-financial enterprises started to drop in the first quarter of 2016. The amount of bonds and debentures owed by non-financial enterprises saw a significant decrease in the first quarter of 2016. Though non-financial enterprises' bond and debenture debt has rebounded since then, it has increased at a slower pace than equity has, leading to a decline in the debt-to-equity ratio.

The increased use of debt by both financial and non-financial industries during 2015 coincided with an oil price shock in Canada, which saw oil and gas extraction and support activities enterprises increase their debt-to-equity ratios at a faster pace than in prior years, although remaining stable in a narrow range since the beginning of 2016.

This seems to suggest that as oil prices dropped, more financing was needed by non-financial industries and financial industries had to increase their debt to obtain funds to satisfy these needs.

Note to readers

Data on quarterly profits in this release are seasonally adjusted and expressed in current dollars. Financial data for the first quarter of 2019 have been revised.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Quarterly financial statistics for enterprises are based on a sample survey and represent the activities of all corporations in Canada, except those that are government-controlled or not-for-profit. An enterprise can be a single corporation or a family of corporations under common ownership and/or control, for which consolidated financial statements are produced.

Profits referred to in this analysis are operating profits earned from normal business activities. For non-financial industries, operating profits exclude interest and dividend revenue and capital gains/losses. For financial industries, these are included, along with interest paid on deposits.

In this release, all profits are operating profits unless otherwise stated. Operating profits differ from net profits, which represent the after-tax profits earned by corporations.

For more details on the concept of actuarial liabilities, consult the page Actuarial liabilities.

As of January 1, 2019, a new accounting standard on leases came into effect. Enterprises preparing their financial statements in accordance with International Financial Reporting Standards (IFRS) will start adopting the new IFRS 16 which requires lessees to recognize most leases on their balance sheet. This may translate into increases in their level of assets and liabilities due to the inclusion of existing and new leases in their balance sheet in accordance with the new standard.

Real-time tables

Real-time tables 33-10-0160-01 and 33-10-0161-01 will be updated on September 16. For more information, consult the document Real-time tables.

Next release

Financial statistics for enterprises for the third quarter will be released on November 26.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: