Trade by exporter and importer characteristics: Goods, 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-05-14

Almost 180,000 Canadian enterprises imported or exported over $1 trillion in goods in 2018. Nearly 90% of this activity was attributable to a relatively small number of enterprises (30,369) that both export and import goods.

In 2018, 45,081 Canadian enterprises or 0.7% of the total Canadian business population exported goods. The number of Canadian enterprises importing goods was almost four times higher—at 164,553 or 2.6% of the business population.

Exports of goods rose 8.1% in 2018 to a record $522.8 billion. Canadian firms from the oil and gas extraction (+$15.4 billion), chemical manufacturing (+$4.3 billion) and petroleum product wholesale (+$4.2 billion) industries led the increase in export sales.

Imports of goods totalled $564.3 billion in 2018, up 6.0% from 2017. Major contributors were firms from the petroleum product wholesale (+$5.7 billion), the machinery, equipment and supplies wholesale (+$5.4 billion) and the petroleum and coal product manufacturing (+$4.0 billion) industries.

Enterprises that both import and export account for the majority of Canada's international merchandise trade

Overall, 179,265 enterprises or 2.8% of the Canadian business population traded goods with foreign markets in 2018. Of these enterprises, 134,184 were importers only, 14,712 were exporters only and 30,369 both imported and exported.

Although relatively small in number, two-way traders (enterprises that both import and export goods) generated 88.7% of Canada's total international merchandise trade in 2018, exporting $497.9 billion and importing $466.3 billion worth of goods.

On a sector basis, over 40% of all two-way traders were manufacturing firms, while one-third were operating in the wholesale and retail trade sectors.

Their trading pattern suggests that these firms are active participants in the global supply and value chain. Almost 70% imported goods from multiple countries in 2018, but more than half only exported goods to the US market.

On a provincial basis, Quebec and Ontario had the highest share of two-way traders relative to their trading population. In contrast, the territories, Saskatchewan and Newfoundland and Labrador had the lowest shares.

A profile of Canadian exporters, 2010 to 2018

You can learn a lot about a country, its people and its businesses from the goods they import and export. Canadian exports reveal a country with abundant natural resources but also with an increasing number of exporters emerging from less traditional exporting sectors.

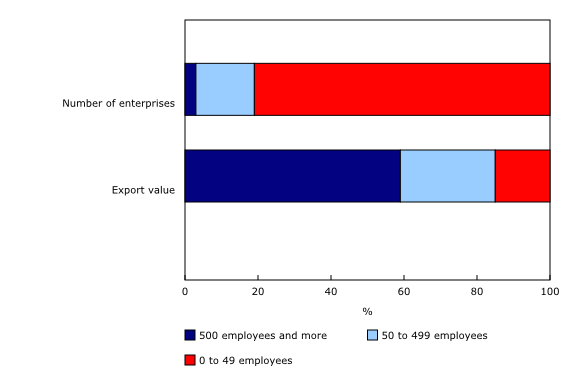

Most exporting enterprises employ less than 50 employees

Overall, a small number of large firms are responsible for most of the export activity in Canada. Small firms (less than 50 employees), while numerous, account for a small share in dollars of total annual exports.

Large enterprises (500 or more employees) accounted for 2.7% of all exporting firms in 2018 but 58.9% of all export value. On the other hand, enterprises with less than 50 employees accounted for 81.2% of exporting firms but 14.9% of all exports. These trends have been consistent every year since 2010.

Large enterprises reach more foreign markets

Large enterprises also tend to have more diversified export markets than small and medium-sized enterprises (SMEs). In terms of number of exporters, 56.5% of all large firms had export activities with two or more partner countries in 2018, compared with 28.7% of SMEs.

Large enterprises trading goods with two or more partner countries have contributed the most to export growth since 2010. Their exports totalled $294.4 billion in 2018, up 57.1% from 2010.

During the same period, the number of large enterprises exporting to multiple countries (+8.5%) increased at a much faster pace compared with SMEs (+3.5%).

Three-quarters of Canadian exporters sell less than one million dollars of goods abroad per year

In general, three-quarters of all Canadian exporters generate less than $1 million of export sales each year, including the large enterprises.

This relatively low level of exports reveals that export activity is highly concentrated among a small number of large enterprises in the country. Of the $522.8 billion goods exported in 2018, almost half of the sales were conducted by the top 50 exporting enterprises.

The concentration of exports is much higher for large enterprises than for small and medium-sized enterprises. Within the large enterprise group, the top 50 enterprises accounted for 70.1% of export sales. Among small and medium-sized enterprises, the top 50 were responsible for 34.8% of export sales.

More exporters of goods emerge in the services-producing sector

Canadian firms in both the goods- and services-producing sectors are very active in exporting goods. The number of goods exporters in the services sector exceeded that in the goods sector every year from 2010 to 2018, with the largest increase in the retail trade industry. However, in terms of export value, firms in the services sector tend to sell less than in the goods sector.

At the regional level, Ontario, Quebec and the Prairie provinces had the largest increases, in absolute terms, in the total number of exporters during this period.

For Ontario and Quebec, the growth in the number of exporters of goods came mainly from the services sector. In Ontario, the retail and wholesale sectors led the growth in the number of exporters of goods in the services sector from 2010 to 2018.

Conversely, in the Prairie provinces, the largest growth in the number of exporters of goods occurred in the goods sector.

The Prairie provinces see large increase in non-energy product export activity

Firms from the Prairie provinces diversified the types of products they exported from 2010 to 2018, especially non-energy products. This was evidenced by the growth in the number of exporters of non-energy products (+1,223), which was slightly offset by fewer exporters of energy products (-156). In terms of value, exports of non-energy products were up 57.5% from 2010, compared with a 41.9% increase for energy products.

Firms engaged in the export of non-energy and energy products in the Prairie provinces show a very different profile. Firms selling non-energy products are mostly small and medium-sized, with two-thirds located in Alberta and one-third in Saskatchewan and Manitoba. The main products they export include oilseeds and fruits, cereals, fertilizers, organic chemicals, and meat with relatively low export sales (an average of $7.6 million per firm in 2018).

Notably, the number of exporters for certain non-energy products such as cereals almost doubled from 2010 to 2018. This activity occurred against the backdrop of the privatization of the decades long publicly held Canadian Wheat Board in 2012.

On the other hand, 173 firms in the Prairie provinces exported energy products (crude oil and natural gas related products) in 2018, with most located in Alberta (85%). The export sales of these firms averaged $548.8 million annually. The vast majority (83.2%) of these sales went to the US market exclusively, mainly Illinois and Michigan.

Note to readers

The Trade by Exporter Characteristics: Goods and Trade by Importer Characteristics: Goods programs are an initiative at Statistics Canada undertaken to analyze the business characteristics of exporters and importers in Canada. These estimates are formed by linking customs trade data records to business entities in Statistics Canada's Business Register.

Data on exports to the United States are collected by the US Census Bureau and transmitted to Statistics Canada as part of the Canada–US data exchange, while data on exports to the rest of the world are collected jointly by Statistics Canada and the Canada Border Services Agency.

Customs import data are collected jointly by Statistics Canada and the Canada Border Services Agency.

The Business Register contains the complete operating and legal structure of enterprises operating in Canada, as well as their key characteristics such as employment and North American Industry Classification System code.

Survey definitions

This release contains information at both the enterprise and establishment levels. An enterprise is defined as the statistical unit that directs and controls the allocation of resources relating to its domestic operations, and for which consolidated financial statements are maintained. An establishment or firm is defined as the statistical unit where the accounting data required to measure production are available. The two measures generate a different number of exporting units as well as a different industry allocation of these units.

Small and medium-sized enterprises have fewer than 500 employees, including those that did not report any employment. Large enterprises have 500 or more employees.

Country of origin is the country of production or the country in which the final stage of production or manufacture occurs.

Country of export is the country from which the goods were exported or sold to Canada. The country of export is different from the country or place of transshipment. Many goods which are shipped to Canada may stop at some place along their route to either change carriers, or to be consolidated or deconsolidated to make shipping easier. This type of stoppage is considered a transshipment point, but it will not change the country of export.

Domestic re-imports are goods of Canadian origin, whether grown, extracted, or manufactured in Canada, that are exported to another country and then returned to Canada in 'the same state' as they were sent out.

A related party is defined as a party that holds or controls 5% or more of the outstanding voting stock or shares of the other party it is transacting with.

In this release, data disseminated at the provincial level is conceptually different from customs-based merchandise export and import data. Provincial data for the Trade by Exporter Characteristics: Goods and Trade by Importer Characteristics: Goods programs are based on the province where the exporter and the importer are located. Goods can be shipped to other provinces for final consumption or can be shipped from other provinces when leaving Canada. Customs-based merchandise imports are based on the province of clearance; this is the province where the goods are cleared at customs, but this may not always be the province in which the importer is located. Customs-based merchandise exports are based on the province of origin; this is the province where the goods are grown, produced, extracted or manufactured.

An exporting firm is included in all different countries it exported to during the reference year. For example, a firm that exported to the United States and China is counted once for the United States and once for China. A firm can also export both energy and non-energy products. As such, the numbers of exporting firms by country of destination and by product are non-additive.

Detailed information on concepts and methodology relating to this release is available on the Trade by Exporter Characteristics: Goods survey page and the Trade by Importer Characteristics: Goods survey page.

Survey coverage

In this release, the total value of exports and imports refers to the part of the annual domestic export and import value (customs basis) that can be linked to specific entities in the Business Register each year. Annual domestic export and import values (customs basis) can be obtained from Canadian International Merchandise Trade Database and Table 12-10-0119-01. Additional information and definitions related to domestic merchandise exports and imports are available on the survey page for Canadian International Merchandise Trade (Customs Basis).

Each year from 2010 to 2018, the total number of identified exporting and importing enterprises accounted for 96% to 98% of the total domestic export and import value, respectively. Throughout this release, the percentage share of export sales and import purchases corresponds to the share of the annual domestic export and import value for which there was an identified exporter and importer. The number of exporters and importers corresponds to the number of exporters and importers identified within the Business Register by the Trade by Exporter Characteristics: Goods and Trade by Importer Characteristics: Goods programs.

The Canadian business population quoted in this text represents all the alive enterprises that are found on the Business Register in reference year 2018 without any threshold on the revenue or number of employees.

Revisions

The linkage methodology to associate customs declarations to their proper units on the Business Register has been enhanced from reference year 2017. The more automated and efficient approach resulted in the number of importers being revised up by approximately 5% in 2017 compared with the figures previously released. Data for reference years 2010 to 2016 will be revised and published in September 2019. In the meantime, the growth between 2016 and 2017 should be used with caution.

Products

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication will be regularly updated to maintain its relevance.

The updated Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca)

To enquire about the concepts, methods or data quality of this release, contact Angela Yuan-Wu (613-240-2871; angela.yuanwu@canada.ca) or Ying Di (613-867-2736; ying.di@canada.ca), International Accounts and Trade Division.

- Date modified: