Wholesale trade, February 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-04-23

$63.7 billion

February 2019

0.3%

(monthly change)

$381.9 million

February 2019

-0.6%

(monthly change)

$79.0 million

February 2019

-1.2%

(monthly change)

$835.2 million

February 2019

-3.6%

(monthly change)

$557.2 million

February 2019

-4.1%

(monthly change)

$11,873.4 million

February 2019

-0.5%

(monthly change)

$33,094.9 million

February 2019

2.1%

(monthly change)

$1,596.2 million

February 2019

-3.1%

(monthly change)

$2,411.8 million

February 2019

7.5%

(monthly change)

$6,572.4 million

February 2019

-3.4%

(monthly change)

$6,251.1 million

February 2019

-3.4%

(monthly change)

$9.6 million

February 2019

-15.5%

(monthly change)

$52.3 million

February 2019

-9.4%

(monthly change)

$11.0 million

February 2019

7.1%

(monthly change)

Wholesale sales increased 0.3% to $63.7 billion in February, the third consecutive monthly gain. Higher sales were recorded in two of seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector. Excluding this subsector, wholesale sales declined 1.5%.

In volume terms, wholesale sales increased 0.3%.

Sales increase in two of seven subsectors

In dollar terms, the motor vehicle and motor vehicle parts and accessories subsector reported the largest increase in February, as sales rose 9.5% to $11.6 billion. Sales were up in all three industries, led by the motor vehicle industry (+11.0%) following a 4.4% decline in January.

Sales in the miscellaneous subsector rose 0.5% to $8.5 billion in February, entirely on the strength of sales in the other miscellaneous industry (+7.8%).

Following two consecutive monthly gains, the building material and supplies subsector decreased 5.3% to $8.8 billion, the lowest level since January 2018. Declines were recorded in two of three industries, led by the lumber, millwork, hardware and other building supplies industry (-10.2%).

The machinery, equipment and supplies subsector declined for the third time in four months, down 1.3% to $13.1 billion in February. Three of the subsector's four industries decreased in February, accounting for approximately 70% of the subsector's sales. In dollar terms, the construction, forestry, mining and industrial machinery, equipment and supplies industry (-2.4%) contributed the most to the decrease.

Sales up in two provinces

In February, wholesale sales increased in Ontario and Saskatchewan. In dollar terms, Ontario accounted for most of the gain.

Wholesale sales increased for the third consecutive month in Ontario, up 2.1% to $33.1 billion. Sales were up in four of seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector (+11.5% to $8.1 billion), its third increase in four months. Sales were also up in the machinery, equipment and supplies (+1.1% to $6.9 billion) and the food, beverage and tobacco (+0.8% to $4.9 billion) subsectors.

In Saskatchewan, sales increased for the third time in four months, up 7.5% to $2.4 billion. Higher sales in the miscellaneous subsector (+23.0% to $1.1 billion) offset declines reported in others.

In dollar terms, Alberta recorded the largest decline in February, with sales down 3.4% to $6.6 billion. This was the first decrease in three months and the lowest level since August 2017. Sales were down in six subsectors, led by the building material and supplies (-7.5% to $1.0 billion) and the machinery, equipment and supplies (-2.6% to $2.0 billion) subsectors.

The machinery, equipment and supplies subsector led declines in British Columbia, where sales decreased 3.4% to $6.3 billion. The subsector declined for the third consecutive month, down 8.1% to $1.0 billion in February. The miscellaneous (-8.5% to $713 million) and the food, beverage and tobacco (-3.8% to $1.4 billion) subsectors also contributed to lower sales in the province.

Sales in Quebec decreased for the third time in four months, down 0.5% to $11.9 billion. The food, beverage and tobacco (-2.2% to $3.0 billion) and the building material and supplies (-2.7% to $1.9 billion) subsectors contributed the most to the decrease in February. Despite the recent declines, wholesale sales in Quebec were up 4.3% year over year.

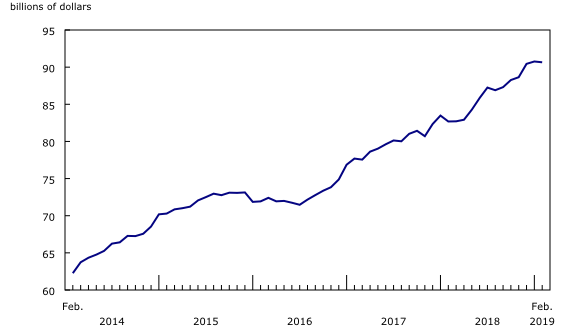

Inventories edge down

Following five consecutive monthly increases, wholesale inventories edged down 0.1% to $90.7 billion in February. Inventories were down in four of seven subsectors, representing about 58% of total wholesale inventories.

Inventories in the miscellaneous subsector decreased 2.5% in February, representing the largest decline in dollar terms. Four of five industries within this subsector decreased, with the agricultural supplies industry (-2.9%) representing the largest decline.

For the second consecutive month, inventories in the machinery, equipment and supplies subsector (-0.8%) declined. The other machinery, equipment and supplies industry fell 2.4%, the largest decrease of the subsector.

Inventories in the personal and household goods subsector (+2.0%) increased for the fourth consecutive month. Five of six industries within this subsector increased, led by the textile, clothing and footwear industry.

The inventory-to-sales ratio fell slightly from 1.43 in January to 1.42 in February. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

Statistics Canada recently unveiled the new Automotive Statistics Portal. Bringing together data from across the agency's various statistical programs, the portal offers users a new one-stop shop for all things automotive-related, from retail trade, wholesale trade and manufacturing to employment and the gross domestic product.

The portal makes it easier for users to find, analyse and use automotive-related data. Visit the portal today and you will find a suite of new dynamic data tables to explore.

Experienced researchers looking for in-depth analyses will find access to more extensive data customisation. Data users looking for interesting statistics will also find them more easily.

Statistics Canada will continue to update and add to the portal as new automotive-related information becomes available.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Effective with the release of the September 2018 wholesale trade estimates on November 21, 2018, wholesale sales estimates disseminated by Manufacturing and Wholesale Trade Division have been converted from a 2007 reference year to a 2012 reference year for its volume and price estimates. Constant price estimates and their associated price index are now using 2012 as their base year. Adopting a new reference year did not affect constant dollars sales estimates growth rates over the period from 2004 to 2011, as it represents a rescaling of the 2007-based data. However, levels and growth rates of the estimates for the period of 2012 to date have been affected by revisions to estimates at current prices and to price indices.

The Monthly Wholesale Trade Survey covers all industries within the wholesale trade sector as defined by the North American Industry Classification System (NAICS), with the exception of oilseed and grain merchant wholesalers (NAICS 41112), petroleum and petroleum products merchant wholesalers (NAICS 412) and business-to-business electronic markets, and agents and brokers (NAICS 419).

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Real-time data tables

Real-time data tables 20-10-0019-01, 20-10-0020-01 and 20-10-0005-01 will be updated on May 6.

Next release

Wholesale trade data for March will be released on May 23.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

For analytical information, or to enquire about the concepts, methods or data quality of this release, contact John Burton (613-862-4878; john.burton@canada.ca), Mining, Manufacturing and Wholesale Trade Division.

- Date modified: