Survey of Innovation and Business Strategy, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-02-13

Challenges and opportunities faced by Canadian enterprises to connect to global markets

Global markets offer Canadian businesses opportunities to access products (goods or services) to support their activities, as well as expanded opportunities for the sale of their products. The 2017 Survey of Innovation and Business Strategy (SIBS 2017) looks at affiliations with foreign businesses, imports and exports of goods or services as well as at challenges and opportunities faced by Canadian enterprises to connect to global markets.

In 2017, one-quarter of all enterprises exported products, up from 20.8% in 2012 (see note to readers for details on the population of importers and exporters represented by SIBS 2017 and how it differs from the entire universe of Canadian importers and exporters). The propensity for exporting was twice as high (43.9%) for large enterprises (those with 250 or more employees) when compared with small businesses (22.6%) (which have between 20 and 99 employees). In addition, one-third (33.7%) of medium-sized enterprises were exporters.

Enterprises headquartered in Ontario are more likely to export

In 2017, exporters of goods or services were most prevalent in Ontario (28.5%). The somewhat larger proportion of exporting enterprises in Ontario may reflect the fact that manufacturing accounts for a relatively large share of the province's economy and that manufacturers were the most likely to export (64.8%) of any sector. The highest rates of exporters were found among high-technology manufacturing industries. Over 90% of producers of navigation, measuring, medical and control instruments (98.3%), semi-conductors and other electronic component manufacturers (94.2%) and manufacturers of aerospace products (93.1%) sold their goods or services abroad in 2017.

At the other end of the spectrum, few retailers (6.9%) and even fewer real estate and rental and leasing enterprises (2.6%) were engaged in exporting.

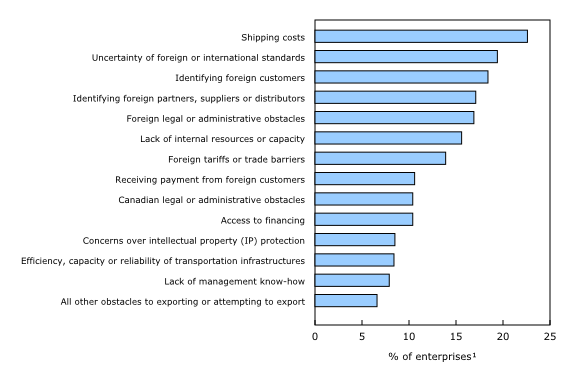

Shipping costs are the most prevalent obstacle to exporting

Enterprises encounter many challenges in either attempting to become an exporter or to expand their export markets or the variety of goods or services sold abroad. Of these challenges, shipping costs were the most frequently reported difficult obstacle (22.6%), followed by uncertainty of foreign or international standards (19.4%) and identifying foreign customers (18.4%).

There was some regional variation with respect to obstacles encountered when exporting or trying to become an exporter. One-third of Quebec enterprises reported having trouble identifying foreign customers as their biggest challenge, while uncertainty about foreign standards (17.0%) was ranked highest in Ontario. Shipping costs were the most common obstacle in both Atlantic Canada (17.0%) and the rest of Canada (31.1%).

There was a large variation in the type of obstacles identified by industry. Enterprises engaged in oil and gas extraction most often rated transportation infrastructures (84.7%) and shipping costs (66.2%) as difficult obstacles. Computer systems design and related services enterprises rated the lack of internal resources or capacity as their biggest challenge (31.9%), while enterprises in scientific research and development services encountered more difficulties related to access to financing (32.2%).

Given these obstacles, attempts to export or to expand markets and goods or services sold abroad may not always be successful. Of the enterprises that exported in 2017, 10.2% unsuccessfully attempted to sell their goods or services to an additional market outside of Canada, while 7.7% failed in their attempt to add goods or services to the ones they were already exporting. Moreover, of the 75.0% of enterprises that did not export in 2017, 1.7% attempted to export and failed.

One in five wholesale trade and manufacturing enterprises are indirect exporters

In addition to exporting goods or services directly, enterprises can also access global markets indirectly by selling their goods or services to other businesses in Canada, which then either export these products "as-is" (indirect exporters) or use them as intermediate inputs in the production of a final good that is exported (intermediary exporters).

About 1 in 10 enterprises reported that in 2017 their goods or services were either exported "as-is" by another business (9.5%) or incorporated into products that were then exported (8.0%). However, almost 20% of businesses did not know if their products were either exported "as-is" (17.5%) by their Canadian purchaser or incorporated into products that were then exported (20.8%).

Enterprises in wholesale trade (20.3%) and manufacturing (19.0%) were the most likely to sell goods that were then exported "as-is." These industries were also the most likely to report sales of goods that were used as intermediate inputs by another business to produce products for export.

Enterprises are more likely to import than to export

In 2017, enterprises were more likely to import goods or services into Canada (38.5%) than to export them (25.0%). Large enterprises (58.4%) were more likely to import than small enterprises (36.3%).

Importers were as likely to resell imported products "as-is" (47.6%) as to use them to produce their own goods or services (46.4%). A further 37.1% of enterprises used imported goods or services to support their business activities, such as the acquisition of imported software to help manage the business or imported machinery for a factory.

Wholesalers were most likely to import products (73.4%), followed by 66.5% of manufacturers and one-half of enterprises in utilities.

Manufacturers that imported did so in large part to get intermediate inputs (87.2%), while wholesalers imported primarily to resell "as-is" (81.1%). The vast majority of enterprises in finance and insurance (excluding monetary authorities) (87.6%) and transportation and warehousing (85.0%) imported to support their business activities.

Enterprises headquartered in Ontario (42.7%) were the most likely to import, while those headquartered in Quebec (31.8%) were the least likely to do so.

Enterprises struggle to find suppliers in Canada

Enterprises can purchase goods or services from other Canadian businesses, from foreign businesses with which they are affiliated or from unaffiliated foreign businesses. Purchasing from unaffiliated foreign businesses may come with more risks, including potentially more complex dispute resolution mechanisms and unfamiliar standards and regulations abroad. Just over one-quarter (26.9%) of enterprises that purchased goods or services did so from unaffiliated foreign businesses in 2017.

In 2017, two-thirds (66.3%) of all enterprises that bought from unaffiliated foreign businesses did so because they could not find a supplier in Canada, while about half of them (49.6%) cited better quality goods or services and reduced costs other than labour (47.5%) as important reasons. Tax or financial incentives was the reason least frequently reported as important (9.9%).

Foreign affiliations increase by size

Foreign affiliations are another conduit to global markets. Overall, 8.7% of surveyed enterprises were affiliates of foreign parents, while 5.3% had affiliates abroad. The likelihood of foreign ownership connections increased with the size of the enterprise. For large enterprises, the comparable figures were 33.6% and 21.2%, respectively.

The concentration of foreign affiliations also varied by region and was most prevalent in Ontario, where 12.7% of enterprises were affiliates of foreign parents, and 6.2% of enterprises had affiliates outside Canada. Foreign affiliations were less common in Atlantic Canada, where 5.4% of enterprises were affiliates of foreign parents, and 2.7% had affiliates outside Canada.

Foreign ownership of enterprises in Canada differed considerably by industry. Wholesalers (18.6%) and enterprises in information and cultural industries (18.0%) were most likely to have foreign parents, while those in retail trade (2.4%) and construction (3.1%) were the least likely.

Retail trade (0.8%) and construction (2.6%) also recorded among the smallest shares of affiliates outside Canada, while enterprises in management of companies and enterprises (18.4%), information and cultural services industries (15.6%) were the most likely to have affiliates abroad.

Note to readers

The 2017 Survey of Innovation and Business Strategy (SIBS) is a joint initiative of Statistics Canada; Innovation, Science and Economic Development Canada; Global Affairs Canada; the Bank of Canada; the Atlantic Canada Opportunities Agency; Institut de la statistique du Québec; and the Ontario Ministry of Economic Development, Job Creation and Trade.

SIBS 2017 provides key information on strategic decisions, innovation activities and operational tactics used by Canadian enterprises. Innovation data are collected for a three-year period. For SIBS 2017, the three-year period was 2015 to 2017. For the previous iterations of the survey, SIBS 2012 and SIBS 2009, the periods were 2010 to 2012 and 2007 to 2009, respectively. While the questionnaires for SIBS 2009 and 2012 were similar, changes in content and design were made to the SIBS 2017 questionnaire.

The SIBS 2017 sample was composed of 13,252 enterprises, representing a population of 66,474 enterprises in Canada with at least 20 employees and revenues of $250,000 or more. These enterprises spanned 14 sectors within the North American Industry Classification Systems (2012), and included more detailed selected industry groups and industries.

In 2017, the sample was stratified into four regions: the Atlantic region; Quebec; Ontario; and the rest of Canada. For Canada, the sample was also stratified by industry groups and by enterprise size: small (20 to 99 employees), medium-sized (100 to 249 employees), and large (250 or more employees). Data collection for the 2017 reference period took place from January to April 2018.

Data users are advised that data covering the entire business sector for imports (Goods and Services), exports (Goods and Services) and foreign ownership of business (Activities of Canadian majority-owned affiliates abroad and Activities of foreign majority-owned affiliates in Canada) are available from other Statistics Canada programs that cover the entire business sector (all sectors, all employment sizes). Given that tendencies to import or export vary by firm size, SIBS survey data for the selected sizes and industries will differ from data covering the entire economy.

SIBS 2017 estimates are provided primarily as percentages accompanied by quality indicators. Data quality indicators for percentage estimates are based on standard error and number of observations in the estimates.

Data from SIBS 2012 and SIBS 2009 are available in archived tables (12-604-X).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: