Survey of Innovation and Business Strategy, 2015 to 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-12-19

Large enterprises are most likely to co-operate with other organizations on innovation activities

Innovation is the introduction of new or improved products or operational methods by enterprises. When innovating, enterprises can benefit from co-operation partnerships—the active participation in joint innovation projects with other organizations—which allow them to access knowledge and technologies from other organizations.

From 2015 to 2017, 17.4% of Canadian enterprises engaged in co-operation partnerships in order to foster their innovation activities.

Larger Canadian firms, those with 250-plus employees, were more likely than their smaller counterparts to co-operate with other organizations to develop or implement innovations.

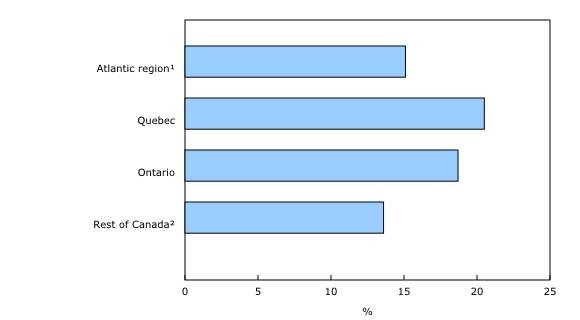

While just over one-quarter of larger enterprises (26.9%) co-operated on innovation, for smaller firms—those with less than 100 employees—that figure was 16.4%. As well, co-operation was more widespread in Central Canada (20.5% in Quebec and 18.7% in Ontario) than in Atlantic Canada (15.1%) or the rest of Canada (13.6%).

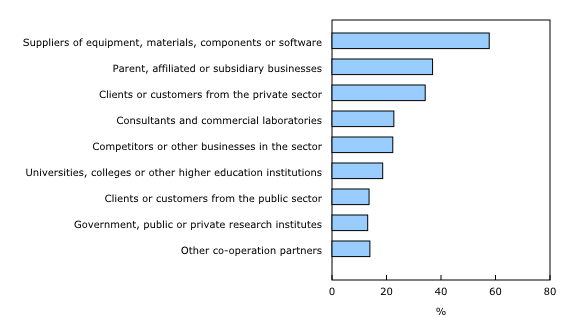

The private sector was the predominant partner of choice for innovation co-operation activities. Suppliers of equipment, materials, components or software were the most frequently reported innovation partners (57.7%), followed by parent, affiliated or subsidiary businesses (36.9%) and clients or customers in the private sector (34.2%).

Universities, colleges or other higher education institutions were the most common partners outside the private sector at 18.6%.

Enterprises were most likely to engage with suppliers and parent, affiliated or subsidiary businesses in joint innovation projects.

The exception was for the professional, scientific and technical services sector. Typically, enterprises in this sector provide specialized services to other businesses. As a result, 42.6% of them reported co-operating with clients or customers from the private sector. Businesses in the sector were also the most likely to identify universities or other higher educational institutions (9.6%) as their key partner compared with other sectors.

Uncertainty and risk continue to be the predominant obstacle to innovation

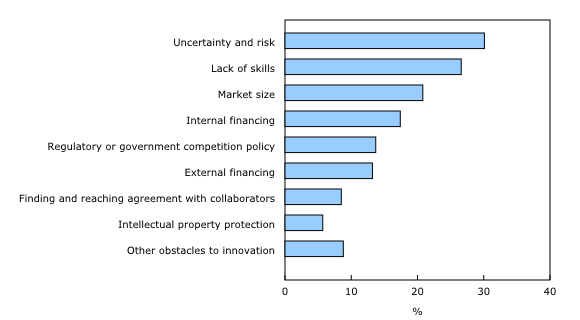

Even though innovation is undertaken to improve a business's position, there can be challenges. Just over half of all enterprises (51.2%) across Canada encountered at least one obstacle to innovation.

Uncertainty and risk, which increased from 22.4% in 2012 to 30.1% in 2017, and lack of skills, which grew from 17.9% in 2012 to 26.6% in 2017, remained the top two obstacles to innovation.

The least encountered obstacles were related to intellectual property protection (5.7%) as well as finding and reaching agreement with collaborators (8.5%).

Virtually all enterprises that encountered obstacles to innovation took steps to overcome them. Measures were most frequently taken to overcome lack of skills (69.5%) and internal financing hurdles (63.1%).

In turn, businesses were least likely to take measures to overcome obstacles related to regulatory or government competition policy (38.6%). They also reported the lowest success rate at overcoming this type of obstacle (40.6%).

Large enterprises are most likely to use government programs to support innovation

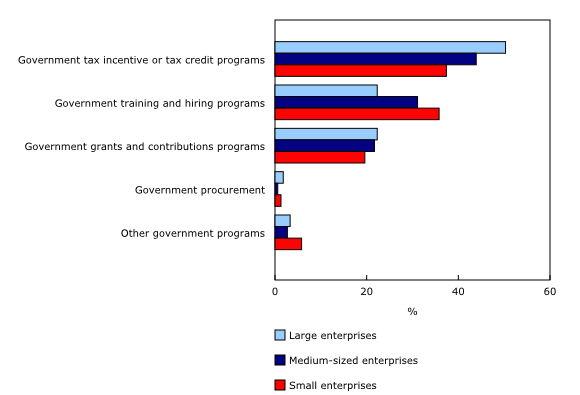

Businesses worked to reduce barriers to innovation by seeking support from government programs. Almost one-third (31.6%) of enterprises overall used such programs to support innovation-related activities, with large enterprises (43.9%) more likely to use government programs than small enterprises (30.0%).

Government training and hiring programs were the most frequently cited programs (17.4%), followed closely by tax incentive or tax credit programs (16.2%).

One-half (50.3%) of large enterprises that used government programs to support innovation considered tax incentive or tax credit programs to be the most critical, compared with 37.4% of small enterprises.

Government training and hiring programs (35.8%) were almost as critical as tax programs for small enterprises. In contrast, government training and hiring programs were less critical for large enterprises (22.3%).

Atlantic Canada focuses on skills development

Atlantic Canada's enterprises were more likely to utilize government training and hiring programs than any other type of government program, with one in five firms choosing this option. They were also the most likely to rank this type of support program as the most critical to innovation (44.2%), whereas enterprises in the other regions ranked government tax incentive or tax credit programs as most critical.

Compared with the other regions, enterprises in Atlantic Canada reported fewer obstacles to innovation related to lack of skills (21.2%). In addition, of those Atlantic region businesses that did report lack of skills as an obstacle, 71.3% attempted to mitigate it. Two-thirds of those attempts were reported as successful.

Note to readers

The 2017 Survey of Innovation and Business Strategy (SIBS) is a joint initiative of Statistics Canada; Innovation, Science and Economic Development Canada; Global Affairs Canada; the Bank of Canada; the Atlantic Canada Opportunities Agency; Institut de la statistique du Québec; and the Ontario Ministry of Economic Development, Job Creation and Trade.

SIBS 2017 provides key information on strategic decisions, innovation activities and operational tactics used by Canadian enterprises. Innovation data are collected for a three-year period. For SIBS 2017, the three-year period was 2015 to 2017. For the previous iterations of the survey, SIBS 2012 and SIBS 2009, the periods were 2010 to 2012 and 2007 to 2009, respectively. While the questionnaires for SIBS 2009 and 2012 were similar, changes in content and design were made to the SIBS 2017 questionnaire.

The SIBS 2017 sample was composed of 13,252 enterprises in Canada with at least 20 employees and revenues of $250,000 or more. These enterprises spanned 14 sectors within the North American Industry Classification Systems (2012). In 2017, the sample was stratified into four regions: the Atlantic region; Quebec; Ontario; and the rest of Canada. SIBS 2012 included Alberta as a separate region and SIBS 2009 was not stratified by region. For Canada, the sample was also stratified by industry groups and by enterprise size: small (20 to 99 employees); medium-sized (100 to 249 employees); and large (250 or more employees). Data collection for the 2017 reference period was undertaken from January 2018 to April 2018.

Despite the changes in content and sampling methodology, data at the higher aggregated levels are comparable between SIBS 2017 and the two earlier SIBS iterations of 2009 and 2012. Caution is recommended in making comparisons at more detailed levels of aggregation.

SIBS 2017 estimates are provided primarily as percentages accompanied by quality indicators. Data quality indicators for percentage estimates are based on standard error and number of observations in the estimates.

Data from SIBS 2012 and SIBS 2009 are available in archived tables (12-604-X).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: