Quarterly financial statistics for enterprises, third quarter 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-11-22

$107.5 billion

Third quarter 2018

3.9%

(quarterly change)

Overall operating profits

Canadian corporations earned $107.5 billion in operating profit in the third quarter, up $4.0 billion or 3.9% from the second quarter and 5.6% higher than the third quarter of 2017.

Non-financial industries

In the non-financial industries, operating profit rose $0.7 billion (+1.0%) from the second quarter to $69.9 billion in the third quarter, as operating revenue increased by $7.0 billion (+0.7%). Overall, operating profit was up in 11 of 17 non-financial industries.

Compared with the third quarter of 2017, operating profit for Canadian non-financial corporations increased 7.5%.

Operating profit up in wholesale trade

In wholesale trade, operating profit increased by $230 million (+2.7%) from the second quarter to $8.6 billion in the third quarter. Overall, operating profit was up in all wholesale trade industries, led by machinery, equipment and supplies merchant wholesalers (up $99 million or +4.3%).

Operating profit down in manufacturing and retail trade

Operating profit for manufacturing industries edged down $68 million (-0.4%) from the second quarter to $15.3 billion in the third quarter, as 7 of 13 manufacturing industries reported declines.

Operating profit for primary metal manufacturing led the decrease in the third quarter, down $660 million (-44.6%) from the second quarter due to lower commodity prices. Wood and paper manufacturing operating profit decreased $159 million (-6.5%) in the third quarter, mainly due to lower lumber prices and, to a lesser extent, the wildfires in Western Canada.

Partially offsetting these decreases was petroleum and coal manufacturing, where operating profits were up by $629 million (+28.2%) compared with the second quarter. The increase was mainly attributable to a rise in production following extended shutdowns in the second quarter.

Operating profit in retail trade decreased by $179 million (-2.9%) from the second quarter to $6.0 billion in the third quarter. Motor vehicle and parts dealers contributed to the decline, down $69 million (-6.8%) on lower car sales.

Operating profits up in the financial sector

Operating profit in the financial industries rose by $3.3 billion (+9.6%) in the third quarter, growing from $34.3 billion to $37.6 billion.

Compared with the same quarter in 2017, operating profit rose 2.3%.

Operating profit for depository credit intermediation decreased by $209 million (-1.4%) to $14.3 billion. Local credit unions were the main driver for this decrease, down $281 million (-22.3%).

Banking and other depository credit intermediation's operating profit edged up by $72 million (+0.5%). Net interest revenue was $438 million, which contributed to higher operating profits.

Operating profit for insurance carriers and related activities rose by $2.8 billion (+83.0%) from the second quarter to $6.2 billion. Life, health and medical insurance carriers led the increase, posting a $2.5 billion gain for the quarter. This increase was the result of fair value adjustments to actuarial liabilities, which decreased related expenses by $4.8 billion.

Net profit for life, health and medical insurance carriers rose from $1.9 billion in the second quarter to $2.3 billion in the third quarter.

Property and casualty insurance carriers' operating profits rose by $256 million (+46.2%) to $0.8 billion.

Financial position: Special analysis

Traditionally, the Daily for the Quarterly Financial Statistics for Enterprises deals with the financial performance results for Canadian enterprises, presenting the operating profits earned by the Canadian corporate sector.

Starting with the third quarter of 2018, our release will also include, from time to time, additional details on the financial position of Canadian enterprises, featuring topics related to specific balance sheet accounts.

Assets held in the real estate and rental leasing industry

The value of total assets on the balance sheet for the real estate and rental leasing industry has grown twice as fast as the non-financial industries as a whole in the past decade. Most of this growth was attributable to the real estate industry, which includes commercial real estate management and holds 90% of assets in the real estate and rental leasing industry overall.

Growth in the industry outpaced other large industries beginning in 2011. In the first quarter of 2015, this rapid growth and a slump in oil prices allowed the real estate and rental leasing industry to overtake oil and gas extraction and support activities as the second largest industry among non-financial industries in terms of assets (see chart 3, Total assets by industry).

Two factors seem to have contributed to this accelerated growth in assets for the real estate and rental leasing industry, particularly at the beginning of 2011: the recovery from the 2008 financial crisis and the adoption of new accounting standards in 2011 by Canadian enterprises.

Recovery from the financial crisis

Some of the growth in assets for the industry may be associated with the recovery from the 2008 recession and measures to stimulate economic growth.

Although the recession ended in 2009, making large investments such as acquiring new properties requires optimism about economic conditions. Growth in the real estate and rental leasing industry's asset holdings accelerated in 2011; that year may have been the point where enterprises felt confident enough to take advantage of low interest rates to increase their borrowing and acquire new assets. Meanwhile, stronger demand likely increased prices of the assets being purchased, requiring enterprises to borrow more.

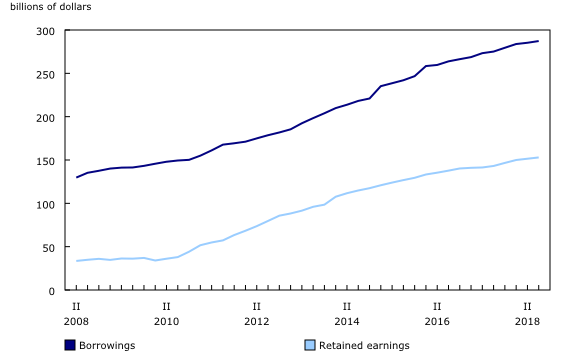

Borrowings grew from $127 billion in 2008 to $287 billion in the third quarter of 2018 (see borrowings in chart 4, in Real estate and rental leasing: Selected liability and shareholders equity accounts).

Adoption of International Financial Reporting Standards

In 2011, publicly traded companies across Canada adopted a new set of accounting standards—International Financial Reporting Standards (IFRS).

With the adoption of IFRS, enterprises were permitted to report on their investment properties using either the fair value method model or the cost model, whereas under Canadian Generally Accepted Accounting Principles enterprises had to use the cost model. Because the real estate and rental leasing companies hold more investment properties than companies in other industries, the changes had greater impacts on their balance sheets.

The new accounting principles allowed enterprises to reflect higher valuations for their investment properties each quarter. With high demand for property and land due to the economic recovery and low interest rates, valuations for these assets increased.

The counterparty entry for these valuations is recorded in the retained earnings section of the balance sheets for the real estate and rental leasing enterprises, explaining some of the growth in this account's balance (see retained earnings in chart 4, in Real estate and rental leasing: Selected liability and shareholders equity accounts).

Note to readers

Data on quarterly profits in this release are seasonally adjusted and expressed in current dollars. Financial data for the second quarter have been revised.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Quarterly financial statistics for enterprises are based on a sample survey and represent the activities of all corporations in Canada, except those that are government-controlled or not-for-profit. An enterprise can be a single corporation or a family of corporations under common ownership and/or control, for which consolidated financial statements are produced.

Profits referred to in this analysis are operating profits earned from normal business activities. For non-financial industries, operating profits exclude interest and dividend revenue and capital gains/losses. For financial industries, these are included, along with interest paid on deposits.

In this release, all profits are operating profits unless otherwise stated. Operating profits differ from net profits, which represent the after-tax profits earned by corporations.

For more details on the concept of actuarial liabilities, consult the page Actuarial Liabilities.

Real-time tables

Real-time tables 33-10-0160-01 and 33-10-0161-01 will be updated on December 10. For more information, consult the document Real-time tables.

Next release

Financial statistics for enterprises for the fourth quarter of 2018 will be released on February 26, 2019.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: