Consolidated Canadian Government Finance Statistics, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-11-20

Canadian General Government deficit narrows by half

The net operating deficit of the consolidated Canadian General Government (CGG)—federal, provincial–territorial and local governments combined—was $8.9 billion in 2017, down from $16.9 billion in 2016. That deficit equalled 0.4% of the gross domestic product (GDP) in 2017.

The large decrease in the deficit was supported by strong economic growth, as GDP grew 5.6% in nominal terms and the increased economic activity generated an additional $33.8 billion in tax revenue.

The CGG deficit was mainly the result of the federal government recording a $7.4 billion deficit for 2017, down 2.4% from the previous year. The remainder came from the consolidated provincial–territorial and local governments (PTLG) which saw their combined deficit decrease 84.3% to $1.5 billion.

The net operating balance, also referred to as surplus or deficit, is calculated as revenues minus expenses over a reference period and constitutes a summary measure of the sustainability of government operations.

In 2017, revenues of the federal government (+5.9%) grew faster than expenses (+5.7%). The increase in revenues was primarily driven by higher tax revenues (+6.3%), especially personal income taxes (+$10.1 billion).

The largest increases in expenses (+$5.2 billion) were in social assistance benefits, such as old age security benefits, family allowances and child care benefits, followed by grants to provincial–territorial and other government units (+$4.8 billion) and compensation of federal employees (+$4.6 billion). On the other hand, Employment Insurance benefits paid decreased 4.3% to $17.7 billion, supported by a 0.9% decline in the unemployment rate and a decrease of 13% in the number of regular benefits beneficiaries.

As a percentage of GDP for PTLG, Quebec (1.7%), British Columbia (1.6%) and Nunavut (1.2%) recorded significant surpluses in 2017. Surpluses posted by the local government and the education subsectors in Ontario led to the province's first surplus in 10 years ($3.0 billion).

The largest deficits as a percentage of GDP were in the Yukon (4.0%), Newfoundland and Labrador (3.8%) and Alberta (3.4%). New Brunswick has recorded consistently large deficits in the previous 10 years, but the deficit figure of 2.7% in 2017 was the province's smallest over the course of the decade.

Fiscal burden stabilizes as GDP and government revenues grow at the same pace

Consolidated revenues for CGG were $778.7 billion in 2017, up 5.4% from 2016, mainly the result of increased economic activity. Taxes and social contributions accounted for 83.3% of total revenues or 30.3% of GDP, similar to 2016.

Fiscal burden measures the taxes and social contributions, expressed as a percentage of GDP, paid to governments by individuals, businesses and non-residents.

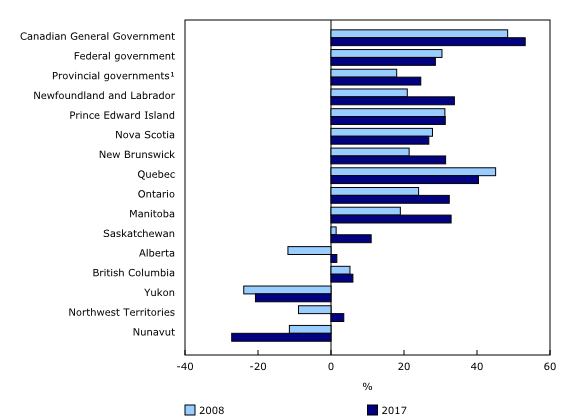

The fiscal burden indicator remained largely unchanged from 2016 for both the federal government (13.8%) and PTLG (16.6%). Among the provinces, the largest movements in 2017 were in Alberta (-0.9%), Ontario (+0.6%) and British Columbia (-0.5%). Quebec still had the highest fiscal burden, at 21.8%, while the lowest remained in Alberta, at 10.4%. Over the previous 10 years, fiscal burden grew the most in Newfoundland and Labrador, rising from 10.0% in 2008, to 15.0% in 2017.

The territories recorded significantly lower fiscal burden than the provincial average, with Nunavut posting the lowest in 2017 at 4.3%. The territories rely heavily on federal transfers to deliver goods and services to the population. In 2017, taxes and social contributions accounted for 12.4% of total revenues in the territories, compared with 74.8% for transfers from the federal government.

Interest expenses decline despite steady increase in debt

In 2017, for every dollar of revenue received, CGG paid 7.7 cents in interest charges, down slightly from 7.8 cents in 2016. Interest expenses totalled $59.7 billion (or $1,619 per capita). Despite an increase of 49.2% in total liabilities in the previous 10 years ($2,189 billion in 2017), the ratio was down from 10.1 cents in 2008 due to historically low interest rates on the outstanding debt.

The federal government paid 7.3 cents in interest for every dollar of revenue received in 2017, compared with 6.6 cents for PTLG. Quebec (10.1 cents), Manitoba (9.1 cents) and Newfoundland and Labrador (8.3 cents) spent the most on interest for every dollar of revenue in 2017.

Net financial worth increases, lifted by the federal government

CGG's net financial worth increased 0.4% in 2017, up $4.2 billion from 2016. Financial assets grew 5.8% to $1,052 billion ($28,524 per capita), while liabilities increased 2.5% to $2,189 billion ($59,347 per capita). CGG total liability to GDP ratio was down 3.1 percentage points, but still above the 100% level (102.4%).

Federal government net financial worth rose by $11.7 billion in 2017, in contrast with a $7.5 billion decrease for PTLG. Large increases recorded in Quebec (+$6.6 billion) and Ontario (+$4.0 billion) were offset by a sharp decrease in Alberta (-$10.4 billion). For the first time in almost two decades, no province recorded a positive net financial worth. Alberta, the last province to record a positive position in 2016, has seen its net financial worth drop by $40.2 billion in the previous 10 years, mostly due to a significant increase (+564.1%) in outstanding debt securities to finance deficits.

Newfoundland and Labrador ($21,221 per capita or 33.8% of GDP) recorded the highest PTLG net liability per capita (liabilities minus financial assets), followed by Quebec ($20,174 per capita or 40.4% of GDP) and Ontario ($18,809 per capita or 32.4% of GDP). Yukon and Nunavut were the only jurisdictions to post a positive net financial worth in 2017. Debt in the territories is low compared with the provinces, since their borrowings are restricted to specific limits set by the federal government.

The federal government net liability to GDP ratio decreased below the 30% level in 2017 to 28.6% (-2.2 percentage points). The ratio is a key measure of the sustainability of fiscal policy. On a per capita basis, net liability declined 3.2% to $16,578. Debt securities and federal employees' pension plans liabilities represented 86.5% of total liabilities ($1,038 billion) in 2017.

The Canada Pension Plan and Quebec Pension Plan continue to post strong growth in financial assets

The Canada Pension Plan (CPP) and Quebec Pension Plan (QPP) are the largest social security funds in the country. Along with Old Age Security (OAS), they are the foundation of Canada's public retirement income system.

In 2017, Canadians paid $63.1 billion (+3.1%) in contributions to CPP and QPP. In turn, they received $58.6 billion (+4.5%) in pensions and benefits. For the year, the funds' net financial worth rose 13.0% to $434.6 billion, compared with an increase of 13.3% in 2016.

The CPP's and QPP's net financial worth measures the current assets (net financial assets) available for future social security benefits. At the end of 2017, net financial worth per capita was $11,781 (+ 11.5%), up from $10,567 in 2016. Over the previous 10 years, the CPP net financial worth posted growth of 231%, while the QPP recorded a 170% gain. This compares with 76% growth for the Toronto Stock Exchange (TSX) index.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development — the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release "Consolidated Canadian Government Finance Statistics, 2017" is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

This release includes revisions to both unconsolidated and consolidated Canadian Government Finance Statistics (CGFS) data for the 2015 and 2016 reference periods as well as the addition of the 2017 reference period.

Annual data correspond to the end of the fiscal year closest to December 31. For example, data for the federal government fiscal year ending on March 31, 2018 (fiscal year 2017/2018), are reported for the 2017 reference year.

Preliminary CGFS data are published eight months after the end of the fiscal year, therefore, estimates were prepared before several public accounts and financial statements were audited and published by government entities.

CGFS data differ from reports published by governments due to differences in institutional coverage, accounting rules, timing and integration with the Canadian macroeconomic accounts.

Consolidation is a method of presenting one overarching statistic for a set of units. It involves eliminating all transactions and debtor–creditor relationships among the units being consolidated. In other words, the transaction of one unit is paired with the same transaction as recorded for the second unit and both transactions are eliminated.

In 2017, the consolidation method removed $353.3 billion in internal revenues and expenses, as well as $413.1 billion related to internal debtor–creditor relationships for the CGG.

Consolidated data are released for the Canadian General Government (CGG), which combines federal government data with PTLG data but excludes data for the Canada Pension Plan and Quebec Pension Plan.

Consolidated data are also released for the provincial–territorial and local governments (PTLGs), which include provincial and territorial governments, health and social service institutions, universities and colleges, municipalities and other local public administrations, and school boards.

The constitutional framework of PTLGs in the territories differs from that in the provinces, leading to differences in the roles and financial authorities of government. These differences, as well as other geographic, demographic and socioeconomic dissimilarities between the North and the rest of Canada, give rise to marked disparities in government finance statistics.

PTLG data can be compared across provinces and territories because consolidation takes into account differences in administrative structure and government service delivery by removing the effects of internal public sector transactions within each jurisdiction.

Because PTLG finance statistics vary significantly across jurisdictions in Canada due to size differences, per capita data are used to facilitate comparisons. Per capita data are based on population estimates as of April 1 for Canada, the provinces and the territories, available in Table 17-10-0009-01.

As a percentage of GDP, calculations are based on GDP at current market prices, expenditure-based, estimates for Canada, the provinces and the territories, available in Table 36-10-0222-01.

Unemployment rate, monthly, seasonally unadjusted is available in Table 14-10-0287-01. Employment insurance beneficiaries who receive regular income benefits, monthly and unadjusted for seasonality, is available in Table 14-10-0010-01. Growth rates are calculated from a March to March period to match the federal government end of fiscal year (March 31).

In this release, revenues, expenses, assets and liabilities are reported in nominal terms.

Net financial worth is defined as the total value of financial assets minus the total value of outstanding liabilities. When financial assets are greater than liabilities the measure is referred to as net financial assets. When liabilities are greater than financial assets the measure is referred to as net liabilities or net debt as per public accounts.

Products

The Canadian Government Finance Statistics 2014 classification structure is now available in the Definitions, data sources and methods module of our website.

Additional information can be found in the Latest Developments in the Canadian Economic Accounts (13-605-X). The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication has been updated with Chapter 9. Government sector accounts in the Canadian System of Macroeconomic Accounts.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: