Hours worked and labour productivity in the provinces and territories (preliminary), 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-05-23

$51.10 per hour

2017

2.2%

(annual change)

$70.20 per hour

2017

9.2%

(annual change)

$30.80 per hour

2017

-0.3%

(annual change)

$35.60 per hour

2017

2.3%

(annual change)

$37.20 per hour

2017

1.9%

(annual change)

$44.40 per hour

2017

2.1%

(annual change)

$47.90 per hour

2017

1.9%

(annual change)

$48.00 per hour

2017

0.6%

(annual change)

$59.50 per hour

2017

4.2%

(annual change)

$71.90 per hour

2017

3.2%

(annual change)

$49.00 per hour

2017

1.2%

(annual change)

$38.40 per hour

2017

-11.7%

(annual change)

$74.10 per hour

2017

8.7%

(annual change)

$85.10 per hour

2017

21.2%

(annual change)

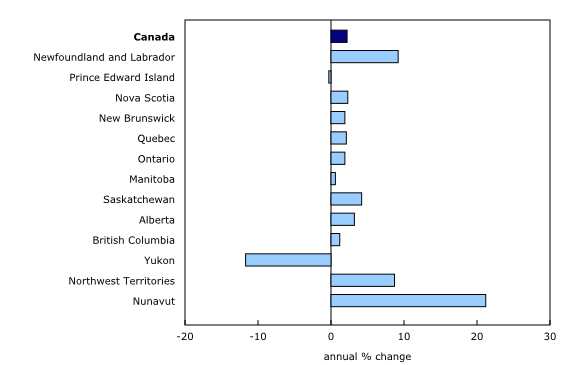

Business productivity rose in every province and territory except Prince Edward Island and Yukon in 2017. In most provinces and territories, productivity grew at a faster pace in 2017 than in 2016. Nationally, business productivity rose 2.2% following a 0.6% increase in 2016.

Against the backdrop of higher oil prices, increases in business productivity in the oil-producing provinces of Newfoundland and Labrador (+9.2%), Saskatchewan (+4.2%) and Alberta (+3.2%) were much higher than the Canadian average. Nova Scotia (+2.3%) was just above the national average, while Quebec (+2.1%), Ontario (+1.9%) and New Brunswick (+1.9%) fell just below.

Nunavut led the way in 2017, with productivity rising 21.2% following the opening of a new gold mine. Conversely, the sharpest decline was in Yukon (-11.7%), due to significant decreases in mining. Prince Edward Island (-0.3%) was the lone province with lower business productivity in 2017, after recording the largest growth nationally over the previous two years.

Real gross domestic product (GDP) of businesses rose in every province and territory in 2017 except Yukon (-3.4%). At the same time, hours worked in the business sector rose in 8 of the 13 provinces and territories. The largest increases in hours worked were in Yukon (+9.6%), Prince Edward Island (+4.4%) and British Columbia (+3.2%), while the biggest decline was in Newfoundland and Labrador (-5.8%). Hours worked were unchanged in Nunavut. At the national level, hours worked rose 1.5% following a 0.5% increase in 2016.

The average compensation per hour worked in the business sector rose in eight provinces, led by Newfoundland and Labrador (+6.2%). Hourly compensation fell for the third year in a row in Alberta (-0.3%) and decreased for the first time in six years in Prince Edward Island (-1.0%). Declines continued in the Northwest Territories (-0.3%) and Yukon (-0.7%), though at a much slower pace, while Nunavut (+7.3%) had the largest increase in the country, following two annual declines. Hourly compensation in Canada rose 2.1% compared with a 0.6% increase in 2016.

Atlantic provinces

Provincially, Newfoundland and Labrador (+9.2%) had the largest increase in business productivity in 2017. Construction, mining, quarrying, oil and gas extraction, retail trade, manufacturing, accommodation and food services, and wholesale trade were the main contributors to this growth. The real output of businesses rose 2.8%, while hours worked (-5.8%) saw the sharpest decline in the country. Hours worked fell in every major industry sector except utilities, real estate, and mining, quarrying, oil and gas extraction.

In Prince Edward Island, business productivity edged down 0.3% in 2017, following large gains the previous two years. Lower productivity in services-producing businesses (-1.3%) more than offset the increase in goods-producing businesses (+1.9%). Real output of businesses rose 4.1%, an acceleration from the previous two years. Hours worked rose 4.4% in 2017, the largest increase among the provinces, following two annual declines. The increase was widespread, with hours worked rising in 14 of the 16 industry sectors.

Business productivity in Nova Scotia grew 2.3% following a 1.5% increase in 2016. Services-producing businesses increased 3.1% and were the main factor behind the growth, while goods-producing businesses edged up 0.2%. Real value added of businesses increased 1.4%, while hours worked fell 0.8% in 2017—the fifth consecutive annual decline. Hours worked in services-producing businesses fell 1.1%, while they were virtually unchanged (-0.1%) in goods-producing businesses.

In New Brunswick, business productivity was up 1.9% following a 1.1% increase in 2016. Productivity rose in both services (+2.0%) and goods (+1.4%) producing businesses in 2017. The increase in real GDP of businesses (+2.9%) was just over twice the gain in 2016, mainly on account of significant increases in the manufacturing, construction and retail trade sectors. At the same time, hours worked increased 0.9% after rising 0.4% in 2016. Hours worked in goods-producing businesses increased 2.2% after falling 2.6% in 2016, services-producing edged up 0.3% after rising 1.8% in 2016. Construction, utilities, agriculture and forestry, and retail trade all contributed to the increase.

Central Canada

Business productivity was up 2.1% in Quebec in 2017, similar to the national average, after edging up 0.2% the previous year. The contribution of services-producing businesses (+2.6%) to growth was almost triple that of goods-producing businesses (+1.1%).

In 2017, real GDP of businesses in Quebec (+3.7%) rose at more than double the pace of 2016, due to widespread growth in output of all goods-producing and services-producing business industries. Hours worked in businesses (+1.5%) rose at a similar pace as in 2016, up 2.3% in goods-producing businesses and 1.2% in services-producing businesses.

Manufacturing productivity in Quebec rose 0.6% following a 2.6% decline in 2016. Manufacturing production (+3.7%) and hours worked (+3.2%) rose at a faster pace than the previous year.

Business productivity was up 1.9% in Ontario following a 1.5% increase in each of the previous two years. The productivity of services-producing businesses rose 2.5%, contributing the most to the province's overall growth. The productivity of goods-producing businesses rose 0.9%.

In 2017, real GDP of businesses (+3.1%) in Ontario rose at a slightly faster pace than in 2016, while hours worked (+1.1%) increased at a slower pace. Hours worked increased at a similar pace in goods (+1.2%) and services (+1.1%) producing businesses.

Productivity growth in Ontario's manufacturing sector fell from 3.1% in 2016 to 0.3% in 2017. Manufacturing production rose 1.5%, the fourth consecutive yearly increase, while hours worked rose 1.2%, after declining the previous three years.

Western provinces

Productivity in Manitoba businesses rose 0.6% in 2017, a much slower rate than the 2.6% increase in 2016. Real GDP of businesses was up 3.3%, while hours worked increased at a slower pace (+2.7%). Both goods-producing (+3.2%) and services-producing businesses (+2.5%) contributed to the increase in hours worked. Mining, quarrying, oil and gas extraction, and real estate had the largest increases.

In Saskatchewan, business productivity rose 4.2% following a 1.1% increase in 2016. Productivity rose in both goods-producing (+5.3%) and services (+3.1%) producing businesses . Mining, quarrying, oil and gas extraction, retail trade, manufacturing, and finance and insurance led the growth in 2017. Real GDP of businesses increased 3.1%, following declines in the previous two years, while hours worked (-1.1%) fell for the fourth consecutive year.

In Alberta, growth in business productivity (+3.2%) resumed in 2017 following declines the previous two years. Mining, quarrying, oil and gas extraction were the main drivers of this growth. Manufacturing, wholesale trade, real estate and utilities also contributed to the increase. Real GDP of businesses (+5.6%) and hours worked (+2.4%) were also up following two annual decreases, mainly due to the resurgence in oil and gas extraction. Hours worked increased in 12 of the 16 major industry sectors, rising in both goods (+3.6%) and in services (+1.7%) producing businesses.

In British Columbia, business productivity was up 1.2% in 2017, twice the pace of the previous year and the fifth consecutive annual increase. Construction rose 7.0%, accounting for just over half of the productivity growth in the province. Wholesale trade, finance and insurance, manufacturing and transportation and warehousing services, also contributed to the gain. In 2017, real GDP of businesses (+4.4%) rose at a faster pace than the previous year (+3.8%), mainly on account of increases in construction, and wholesale and retail trade. Hours worked (+3.2%) increased at a similar pace as in 2016, with comparable increases in goods (+2.9%) and services (+3.3%) producing businesses.

The territories

In Yukon, business productivity fell 11.7% in 2017, after increasing 3.8% in 2016. This was the sharpest decline in the country. The 3.4% decrease in real GDP of businesses mostly reflects a downturn in mining, quarrying, oil and gas extraction activities, following a 62.3% increase in 2016. By contrast, hours worked increased 9.6%.

In the Northwest Territories, business productivity grew 8.7%, the first increase since 2013. After edging up 0.5% in 2016, real output of businesses rose 7.8%, partly on account of increased mining, quarrying, oil and gas extraction activities, following two straight annual declines. At the same time, hours worked fell 0.8%, mainly due to declines in mining, oil and gas extraction, accommodation and food services, and transportation and warehousing services.

Nunavut had the largest growth in business productivity (+21.2%) among the provinces and territories in 2017, after posting the largest decline in Canada the previous year (-13.8%). Growth in 2017 reflects an increase in the real GDP of businesses (+21.3%), while hours worked were unchanged. Real GDP of Nunavut businesses also saw the highest growth in the country, mainly due to a marked increase in mining activities following the opening of the Doris gold mine. Construction, particularly engineering, also contributed to GDP growth, boosted by the development of the Meliadine gold mine.

Note to readers

Revisions

This release incorporates an update to 2017 data on provincial and territorial labour productivity and related measures.

These data are consistent with those incorporated in the provincial and territorial gross domestic product by industry for 2017, released on May 2, 2018. No revisions have been made to data for previous years. Revised estimates of hours worked and labour productivity in the provinces and territories for 2015 to 2017 will be published in February 2019.

Productivity measures

Labour productivity is a measure of real gross domestic product per hour worked. Productivity gains occur when the production of goods and services grows faster than the volume of work dedicated to their production.

Economic performance, as measured by labour productivity, must be interpreted carefully, as these data reflect changes in other inputs, in particular capital, in addition to the efficiency growth of production processes. As well, growth in labour productivity is often influenced by the degree of diversity in the industrial structure. As a result, labour productivity tends to be more volatile in the smaller provinces.

For the purpose of this analysis, as in the national labour productivity releases, productivity measures cover the business sector. It is important to note that real output (used to measure productivity) is based on the value added measured at basic prices, not market prices, which is consistent with the detailed framework by industry.

As well, the real estate, rental and leasing industry, part of the service-producing business sector, excludes the imputed rent for owner-occupied dwellings as there are no data on the number of hours that homeowners spend on dwelling maintenance services.

Products

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The System of Macroeconomic Accounts module features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: