Job vacancies, second quarter 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-10-12

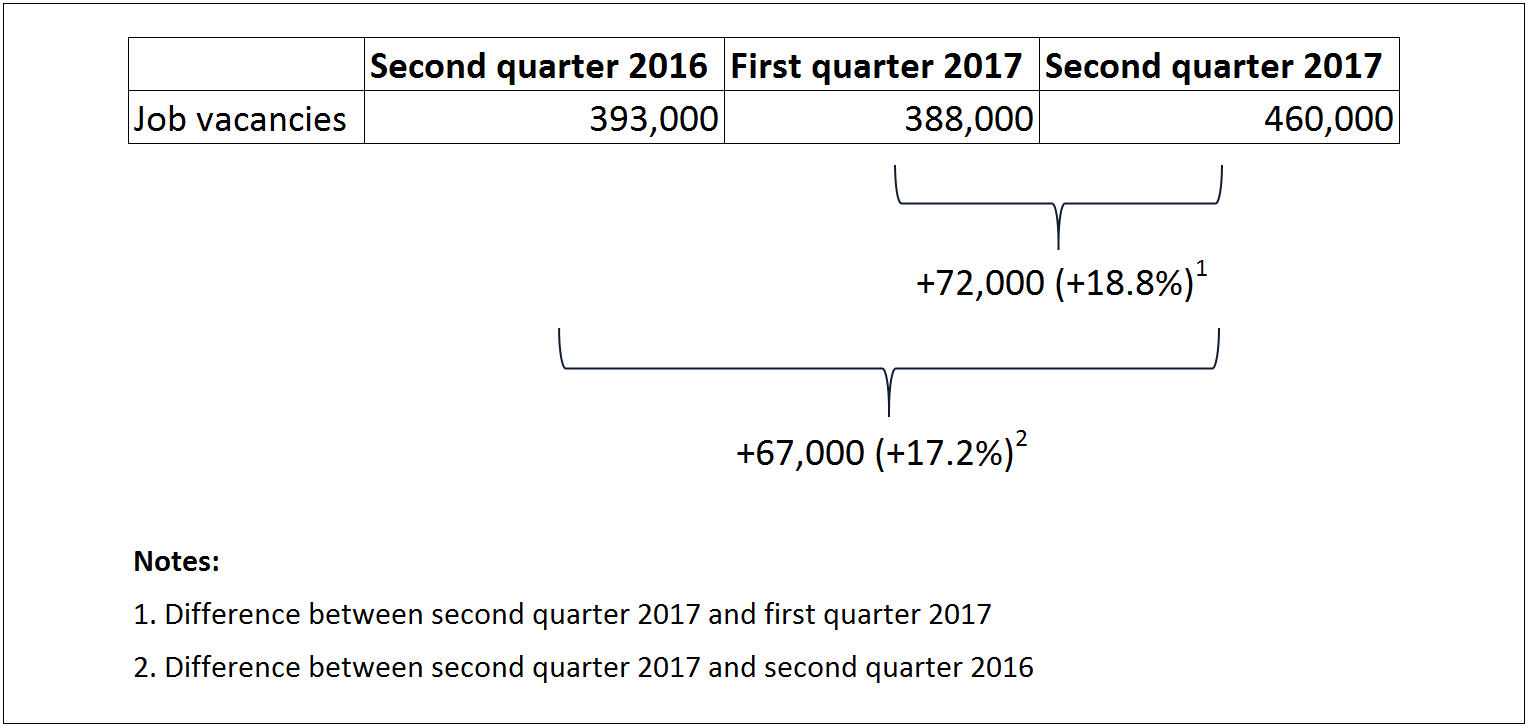

The number of job vacancies totalled 460,000 in the second quarter, up 67,000 (+17.2%) from the second quarter of 2016. The overall job vacancy rate rose 0.4 percentage points to 2.9%. Increases in job vacancies were broadly based across provinces and industrial sectors.

This was the third consecutive quarter with year-over-year increases in both the number of job vacancies and the job vacancy rate.

The job vacancy rate refers to the share of jobs that are unfilled out of all available payroll jobs. It represents the number of job vacancies expressed as a percentage of labour demand; that is, the sum of all occupied and vacant jobs.

The number of job vacancies that were for full-time work rose by 54,000, while job vacancies for part-time work were up by 14,000 on a year-over-year basis. Nationally, the average offered hourly wage was little changed at $19.50.

A number of labour market indicators point to improved labour market conditions during this time. According to the Labour Force Survey, national employment has increased at a relatively faster pace since the second half of 2016 and the unemployment rate has continued to trend downwards.

Compared with the first quarter of 2017, the number of job vacancies (unadjusted for seasonality) in Canada increased 18.8%, while the job vacancy rate rose 0.4 percentage points. These quarter-to-quarter increases may partly reflect seasonal recruitment patterns, as job vacancies were also up notably between the first and second quarters of both 2015 and 2016.

Job vacancies and job vacancy rates rise in most regions of the country

Compared with one year earlier, the number of job vacancies in the second quarter rose in every province except Newfoundland and Labrador, where they were little changed. Ontario, Quebec and British Columbia posted the largest year-over-year increases in the number of job vacancies. Vacancies also rose in the Northwest Territories and Yukon, and were little changed in Nunavut. A similar pattern of increases across provinces and territories was observed for the job vacancy rate.

Ontario had 20,000 (+12.0%) more job vacancies to fill in the second quarter compared with one year earlier. This was the fourth consecutive quarter with year-over-year increases in the number of job vacancies for the province. The rise in the number of job vacancies was spread across the province, with notable increases in the economic regions of Hamilton—Niagara Peninsula, Toronto, and Kitchener—Waterloo—Barrie. At the same time, the job vacancy rate in Ontario rose 0.2 percentage points to 3.0%, with agriculture, forestry, fishing and hunting as well as arts, entertainment and recreation registering the largest increases.

The number of vacancies in Quebec rose by 17,000 (+25.0%) and the job vacancy rate increased 0.4 percentage points to 2.4%. The recent trend of above-average growth in vacancies in the province helped raise Quebec's share of national vacancies to 18.2% in the second quarter of 2017 compared with 15.6% in the second quarter of 2015. The job vacancy rate rose in most sectors in Quebec, notably in construction, information and cultural industries, and in mining, quarrying, oil and gas. Increases in the number of job vacancies were registered in most areas of the province.

Job vacancies in British Columbia were up by 14,000 (+18.8%) in the second quarter compared with one year earlier. The provincial increase was concentrated in two of the seven economic regions of the province: Lower Mainland—Southwest (+10,000) and Vancouver Island and Coast (+1,900). These were also the economic regions where the job vacancy rate increased within the province.

British Columbia continued to have the highest job vacancy rate among the provinces at 4.0%, up from 3.5% one year earlier. In many sectors, British Columbia had a job vacancy rate above the national average, notably in accommodation and food services (6.4%), administration and support services (5.9%) and construction (5.2%).

Job vacancies in Alberta were up 8,500 (+19.9%) compared with one year earlier, a second consecutive quarter of year-over-year increases for this province. At the same time, its job vacancy rate rose to 2.6%, from 2.2% one year earlier. The increase in vacancies was spread across more sectors than in the previous quarter. The largest increases were in mining, quarrying, oil and gas (+1,300), construction (+1,300) and manufacturing (+1,100). Most economic regions in the province reported more vacancies than one year earlier. Notable increases in job vacancies were seen in Calgary, and in Banff-Jasper-Rocky Mountain House and Athabasca-Grande Prairie-Peace River.

The increase in vacancies in mining, quarrying, oil and gas in Alberta was consistent with the recent upward trend in national real gross domestic product and employment in this sector.

In Saskatchewan, employers reported 1,400 (+13.8%) more vacancies than in the second quarter of 2016. This was the first year-over-year increase in job vacancies for the province since the beginning of the series in 2015. Over the same period, the job vacancy rate rose 0.3 percentage points to 2.4%. Job vacancies increased in several sectors, including construction and manufacturing.

Widespread increase in the number of vacancies in the largest industrial sectors

In the second quarter, the 10 largest industrial sectors all had a higher number of job vacancies compared with one year earlier. Within these large sectors, increases in job vacancies were led by accommodation and food services, manufacturing, transportation and warehousing, as well as retail trade.

Among the 10 largest sectors, job vacancies rose the most in accommodation and food services (+8,800 or +15.0%). This was the second consecutive quarter with a year-over-year increase for this sector. At the same time, the job vacancy rate in the sector rose by 0.5 percentage points to 5.0%. The increase in the number of vacancies in the sector was spread across a majority of provinces, led by Ontario, British Columbia and Quebec.

Employers in manufacturing had 7,500 (+24.1%) more vacancies in the second quarter compared with one year earlier. Over the same period, the job vacancy rate rose 0.4 percentage points to 2.5%. Quebec accounted for close to half of the net increase in the number of vacancies in the sector.

The number of job vacancies in transportation and warehousing was up by 6,700 (+42.5%) in the second quarter. At the same time, the job vacancy rate in the sector rose by 0.8 percentage points to 2.9%. Increases in the number of job vacancies in the sector were observed in several subsectors, most notably truck transportation.

Job vacancies in retail trade were up by 6,500 (+13.0%) compared with one year earlier and the job vacancy rate rose to 2.9%, up from 2.5%. Job vacancies in the sector were up the most in Quebec, followed by British Columbia. Within retail trade, food and beverage stores registered the largest increase in job vacancies on a year-over-year basis. In contrast, job vacancies in sporting goods, hobby, book and music stores were down.

Largest number of job vacancies are in sales and service occupations

Among the 10 broad occupational categories, sales and service occupations (166,000) had the largest number of job vacancies, followed by trades, transport and equipment operators (73,000).

The average offered hourly wage is highest for management occupations

The highest average offered hourly wage was for management occupations ($34.45), followed by natural and applied sciences ($30.40). Similar to one year earlier, these occupation groups also had among the highest proportions of job vacancies that required a post-secondary education, that were for full-time work, and that were for permanent positions.

Looking at occupations at the three-digit National Occupational Classification level, 6 of the 10 occupation groups with the most job vacancies were in sales and services. Among the 10 groups, food counter attendants, kitchen helpers and related support occupations had the most job vacancies, with 29,000. Most of the 10 occupation groups with large numbers of vacancies had below-average offered wages. The sole notable exception was computer and information systems professionals, with an offered wage of $35.00.

Among the 10 groups, only harvesting, landscaping and natural resources labourers (76.4%) had a majority of their vacancies in temporary work. Of these, almost all were seasonal.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

Evolution of the Help-wanted Index

From 1962 to 2003, Statistics Canada published the Help-wanted Index, a monthly indicator measuring the changes in the unmet demand for labour. The index was derived from a count of job ads published in 22 metropolitan area newspapers. Details about the type of labour sought were not provided. However, the index was available by region and metropolitan area, and was released within two weeks following the reference month.

Despite its limitations in coverage, decreases in the index in the 1980s and 1990s tended to coincide with increases in the unemployment rate and vice versa, including during the 1981-1982 and 1990-1992 recessions. For example, in September 1982, the index had declined by 58% from its peak in May 1981, while the unemployment rate was up 5.2 percentage points. Similar changes occurred during the 1990-1992 recession.

The index was terminated in the early 2000s, as the Internet became a prevalent method for advertising job openings. See the chart Help-wanted Index and the unemployment rate, Canada, January 1981 to January 2003.

Sources: CANSIM table 277-0002 (data on the Help-wanted index) and CANSIM table 282-0087 (data on the unemployment rate).

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and wages by industrial sector and detailed occupations for Canada, the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly while data on average hourly wages paid are released annually.

JVWS data are not seasonally adjusted. Therefore, quarter-to-quarter comparisons should be interpreted with caution as they may reflect seasonal movements.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

Summary statistics related to the job vacancy time series from the Survey of Employment, Payrolls and Hours are available in CANSIM.

The National Occupational Classification (NOC) is a four-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: 1) 10 broad occupational categories, also referred to as one-digit NOC; 2) 40 major groups, also referred to as two-digit NOC; 3) 140 minor groups, also referred to as three-digit NOC; and 4) 500 unit groups, also referred to as four-digit NOC.

Improvements were made to the occupation coding procedures starting in the second quarter of 2017. This has resulted in a decrease in the number of vacancies for which the occupation is unclassified. The new coding procedures do not affect the total number of vacancies. Caution may be necessary when comparing job vacancy data by occupation from the second quarter of 2017 with previous quarters.

Industrial sectors are classified according to the North American Industry Classification System (NAICS) 2012. The NAICS has 20 industrial sectors at the two-digit level.

Data quality of the Job Vacancy and Wage Survey

The target population of the survey includes all business locations in Canada, with the exclusion of those primarily involved in religious organizations and private households. While federal, provincial and territorial administrations are also excluded from the survey for now, they will be phased in later.

Next release

Job vacancy data from the JVWS for the third quarter of 2017 will be released on January 11, 2018.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Myriam Hazel (613-219-4345; myriam.hazel@canada.ca) or Client Services (toll-free 1-866-873-8788; statcan.labour-travail.statcan@canada.ca), Labour Statistics Division.

- Date modified: