Natural resource indicators, second quarter 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-09-20

Increase in volume of natural resource production

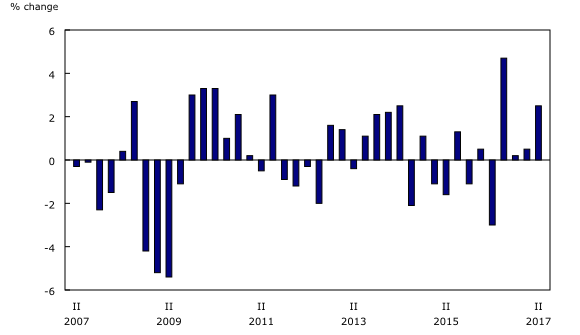

Real natural resource gross domestic product (GDP), or the volume of economic activity attributable to natural resources, increased by 2.5% in the second quarter of 2017, following growth of 0.5% in the first quarter. In comparison, real GDP for the total economy grew 1.1% in the second quarter.

Energy, the largest subsector, was the main contributor to growth for the quarter (+3.7%), with widespread gains across most commodity groupings. The main drivers of the increase were crude oil (+3.5%) and natural gas extraction (+4.0%), with related services also advancing (+5.9%). The hunting, fishing and water subsector was up 2.3%.

The forest subsector declined 0.8%, while the minerals and mining subsector edged down 0.2% on reduced extraction of metallic minerals.

Natural resource activity totalled $215 billion (nominal terms, at annual rates) in the second quarter of 2017, accounting for 10.8% of Canada's GDP. This proportion has remained relatively stable since the third quarter of 2016.

Natural resource prices fall

Natural resource prices decreased 2.4% in the second quarter of 2017. The decrease was led by the energy subsector which saw prices fall 4.7%. The declines were widespread, with services (-8.4%) and crude oil (-6.0%) being the largest contributors. Decreases were also seen in total refined petroleum products (-3.6%) and electricity (-2.1%). Prices in the hunting, fishing, and water subsector also fell (-0.5%).

Price increases were observed in the forest subsector (+4.3%) on the strength of softwood lumber, and in the minerals and mining subsector (+2.6%). Compared to the same quarter the previous year, natural resource prices were 8.0% higher in the second quarter.

Increases in export and import volumes

Real natural resource exports rebounded with an increase of 5.3% after edging down in the last quarter (-0.1%). Strong volume increases in the largest two subsectors were observed. Real energy exports rose 6.7% on the strength of natural gas (+21.0%) and total refined petroleum products (+2.8%). Minerals and mining exports posted a 6.2% increase on the strength of coal extraction (+29.0%), fueled by an increase in demand for exports of metallurgical coal. The hunting, fishing, and water subsector posted a 5.5% gain, while exports in the forest subsector fell 4.1%.

Real natural resource imports climbed by 5.7% in the second quarter, mainly due to the energy subsector (+9.1%), while the minerals and mining subsector grew 1.4% moderated by a reduction in coal imports (-11.0%). The forest subsector decreased 1.7%.

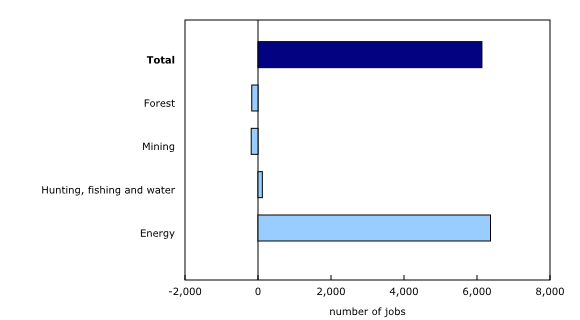

Employment increases in the second quarter

Jobs increased in the natural resources sector by 1.0% in the second quarter of 2017, led by the energy subsector which advanced by 2.4% (+6,400 jobs). These job gains followed a quarter of strong growth (+0.8%) in the first quarter of 2017. Employment in the hunting, fishing and water subsector also increased (+0.5%). In comparison, the number of jobs for the total economy grew 0.3% in the second quarter.

Employment declines were observed in the forest (-0.7%) and minerals and mining (-0.3%) subsectors.

Downstream activities decrease

Secondary and tertiary processing for the forest and the minerals and mining subsectors are identified in the natural resource indicators for analytical purposes.

An additional 1.6% of Canadian GDP is attributable to these downstream activities. The natural resources sector including these amounts represented 12.4% of GDP in the second quarter of 2017, unchanged from the previous quarter.

Real GDP of these additional downstream activities decreased 0.9% in the second quarter of 2017 due to a decline in the largest component, downstream minerals and mining products (-1.0%).

Note to readers

The natural resource indicators provide quarterly indicators for the main aggregates in the Natural Resource Satellite Account, namely, nominal and real gross domestic product, output, real exports and imports, and employment. The estimates from this account are directly comparable to the estimates found in the Canadian System of Macroeconomic Accounts.

The energy subsector accounts for approximately two-thirds of the Canadian natural resource sector, while the mining subsector accounts for just over 20%. The forest (8%) and hunting, fishing and water (4%) subsectors account for the rest.

Next release

Data on natural resource indicators for the third quarter will be released on January 18, 2018.

Products

Additional information can be found in the articles, "The Natural Resources Satellite Account: Feasibility study" and "The Natural Resources Satellite Account – Sources and methods", which are part of the Income and Expenditure Accounts Technical Series (13-604-M).

The System of Macroeconomic Accounts module features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication will be updated to maintain its relevance.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: