Consumer Price Index, January 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-02-24

January 2017

2.1%

(12-month change)

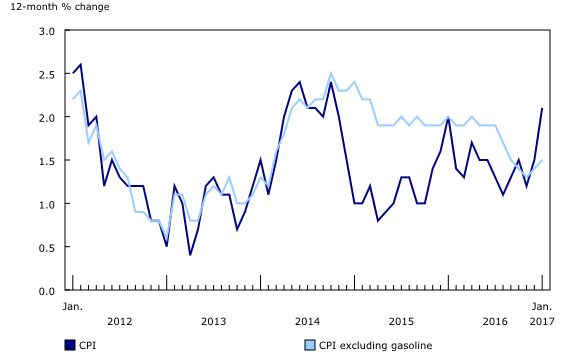

The Consumer Price Index (CPI) rose 2.1% on a year-over-year basis in January, following a 1.5% gain in December.

Excluding gasoline, the CPI was up 1.5% year over year in January, after posting a 1.4% increase in December.

12-month change in the major components

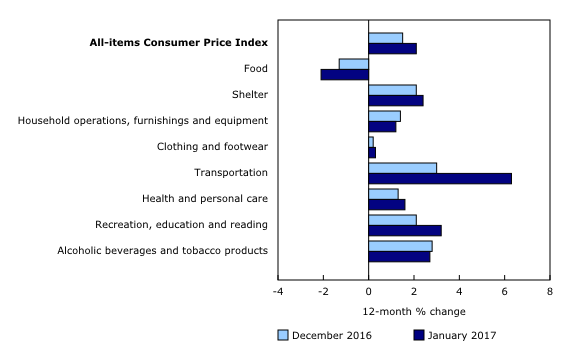

Prices were up in seven of the eight major components in the 12 months to January, with the transportation and shelter indexes contributing the most to the year-over-year rise in the CPI. The food index declined on a year-over-year basis for the fourth consecutive month.

The transportation index rose on a year-over-year basis, up 6.3% in January after a 3.0% gain in December. The gain in January was led by gasoline prices, which posted their largest increase since September 2011, up 20.6% in the 12 months to January. The increase was partly attributable to higher crude oil prices in January, as well as a monthly decline one year earlier. On a year-over-year basis, the purchase of passenger vehicles index rose more in January (+3.8%) than in December (+2.6%). This acceleration was partly attributable to the greater availability of new 2017-model-year vehicles.

The rail, highway bus and other inter-city transportation index was up 3.2% in the 12 months to January. On a monthly basis, the index rose 0.9%. On a year-over-year basis, drivers' licences fees posted no change in January.

The shelter index rose 2.4% in the 12 months to January, with the homeowners' replacement cost index (+4.3%) contributing the most to the gain. The natural gas index increased 15.6% on a year-over-year basis in January, after decreasing the previous month. Fuel oil prices rose 18.3% in the 12 months to January, after increasing 4.2% a month earlier. At the same time, electricity prices (-0.7%) were down year over year for the first time since February 2013.

Consumers paid 2.1% less for food in January than they did a year earlier. The food purchased from stores index decreased 4.0% year over year, with broad-based declines among its components. The fresh vegetables (-15.5%), fresh fruit (-10.8%) and meat (-1.7%) indexes all posted larger year-over-year declines in January than in December. A limited number of food product categories recorded price increases. Prices for food purchased from restaurants were up 2.3% year over year in January, matching the gain in December.

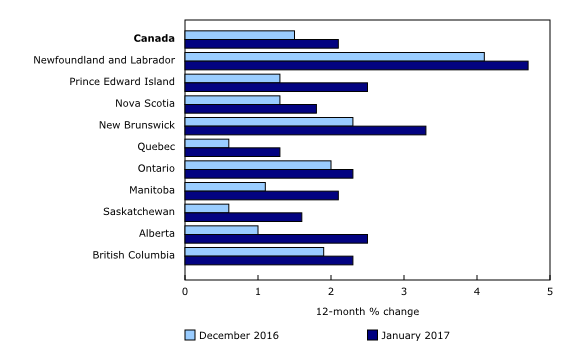

12-month change in the provinces

In all provinces, consumer prices rose more on a year-over-year basis in January than in December. This acceleration was primarily attributable to higher gasoline prices across the country.

In Alberta, the CPI increased 2.5% on a year-over-year basis in January, after rising 1.0% in December. Prices for gasoline rose 33.9% in the 12 months to January, after a 7.9% gain in December. A portion of this increase was attributable to a new 4.49-cents-per-litre carbon levy in the province, implemented January 1, 2017.

Natural gas prices, which tend to be volatile in Alberta, were up 42.3% year over year in January. These prices were also affected by the new carbon levy. Despite rent being flat on a monthly basis in January, consumers paid 1.9% less on a year-over-year basis; this was the largest decline among the provinces. Additionally, in the 12 months to January, the electricity index (-8.2%) declined more in Alberta than at the national level.

In Saskatchewan, the CPI increased 1.6% in January, following a 0.6% gain in December. The electricity index rose 8.8% on a year-over-year basis in January, its largest 12-month increase since May 2010. In contrast, homeowners' replacement cost was down 1.9% in the 12 months to January, compared with a 4.3% national-average gain. This was despite the first monthly increase in Saskatchewan's homeowners' replacement cost index since January 2016.

The CPI in Ontario was up 2.3% year over year in January, following a 2.0% increase in December. As in other provinces, there were year-over-year gains in the gasoline (+20.4%), natural gas (+12.9%) and fuel oil (+16.9%) indexes in Ontario in January. These increases coincided with the Ontario government's introduction of a new cap and trade program, effective January 1, 2017. After rising 11.2% year over year in December, electricity prices were down 3.5% in January. This reflected, in part, the new Ontario Rebate for Electricity Consumers introduced by the provincial government, effective January 1, 2017.

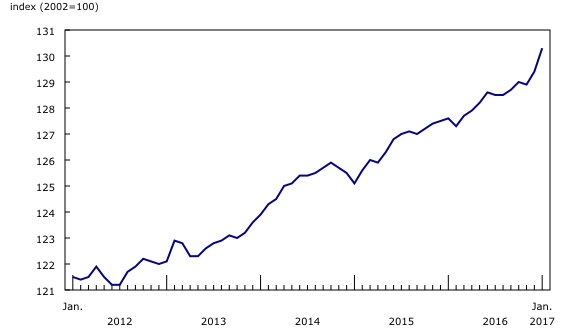

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI increased 0.7% in January, after rising 0.4% in December.

On a seasonally adjusted monthly basis in January, the transportation index (+2.1%) posted the largest gain.

Four other major components increased in January on a seasonally adjusted monthly basis, while the food index (-0.2%) and the clothing and footwear index (-0.1%) declined. The household operations, furnishings and equipment index was unchanged.

The evolution of prices in Canada

As 2017 marks the 150th anniversary of Confederation, we take a look back at an aspect of price movements in Canada.

Electricity has maintained approximately the same basket weight for the past 30 years. Since the basket update in 1986, the basket weight for electricity has ranged from 1.93% to 2.77% of the all-items CPI, and averaged 2.43%.

Since Canada's centennial year of 1967, the largest year-over-year decline in electricity prices (-12.9%) occurred in December 2002, which was partly attributable to a rebate in Ontario, which came into effect that same month. The largest year-over-year increase was 19.2% in March 1977. Since 1967, on an annual average basis, the electricity index has risen 979.3%.

Note to readers

A seasonally adjusted series is one from which seasonal movements have been eliminated. Users employing Consumer Price Index (CPI) data for indexation purposes are advised to use the unadjusted indexes. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Basket update

Every two years, the expenditure weights for the basket of goods and services used in the calculation of the CPI are updated based on new estimates from the Survey of Household Spending (SHS).

On February 24, 2017, with the release of the January 2017 CPI, these expenditure weights have been updated with the 2015 SHS. This new weighting pattern replaces the previous expenditure weights, which were based on the 2013 SHS. CANSIM table 326-0031, Basket Weights of the Consumer Price Index, was updated with 2015 basket weight data on February 20, 2017.

The base year, for which the CPI equals 100, remains 2002.

There are changes to the CANSIM tables as the following two published series have been terminated: rental of digital media, and other home entertainment equipment, parts and services. As such, their assigned vectors within CANSIM tables 326-0020 and 326-0021 will no longer be updated.

For a brief analysis of the 2015 basket weight changes, please refer to the following document: An Analysis of the 2017 Consumer Price Index Basket Update, Based on 2015 Expenditures.

Real-time CANSIM tables

Real-time CANSIM table 326-8023 will be updated on March 13. For more information, consult the document Real-time CANSIM tables.

Next release

The CPI for February will be released on March 24.

Products

The January 2017 issue of The Consumer Price Index, Vol. 96, no. 1 (62-001-X), is now available.

More information about the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: