Retail trade, October 2016

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2016-12-22

$45.0 billion

October 2016

1.1%

(monthly change)

$0.8 billion

October 2016

0.1%

(monthly change)

$0.2 billion

October 2016

-1.1%

(monthly change)

$1.2 billion

October 2016

0.8%

(monthly change)

$1.0 billion

October 2016

1.6%

(monthly change)

$9.6 billion

October 2016

0.5%

(monthly change)

$16.4 billion

October 2016

1.5%

(monthly change)

$1.6 billion

October 2016

0.0%

(monthly change)

$1.5 billion

October 2016

-0.1%

(monthly change)

$6.2 billion

October 2016

0.8%

(monthly change)

$6.4 billion

October 2016

1.8%

(monthly change)

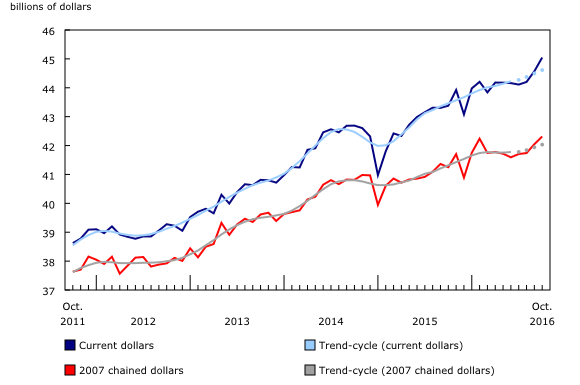

Retail sales rose for the third consecutive month, rising 1.1% to $45.0 billion in October. Higher sales at gasoline stations and general merchandise stores were the main contributors to the gain. Excluding sales at motor vehicle and parts dealers, retail sales were up 1.4% in October.

Sales were up in 9 of 11 subsectors, representing 90% of total retail trade.

After removing the effects of price changes, retail sales in volume terms increased 0.6%.

Most subsectors report higher sales

Receipts at gasoline stations rose 3.8% in October, the largest percentage increase since April 2016. This gain reflected higher prices at the pump.

Sales at general merchandise stores advanced 1.9%, the third increase in four months.

Sales at food and beverage stores increased 1.1% in October, more than offsetting the decline in September. Sales at beer, wine and liquor stores (+3.3%) and supermarkets and other grocery stores (+0.8%) contributed to the gain.

Clothing and clothing accessories store sales rose 1.4% in October. Gains were reported in all store types, led by clothing stores (+1.2%).

Sales at miscellaneous store retailers (+2.4%) were up for the second month in a row.

Following a 2.6% increase in September, sales at motor vehicle and parts dealers were essentially unchanged due to mixed results among store types. Higher sales at automotive parts, accessories and tire stores (+1.7%) were offset by declines in other motor vehicle dealers (-1.4%) and used car dealers (-0.1%). After increasing 3.0% in September, sales at new car dealers were flat in October.

After increasing for five consecutive months, sales at electronics and appliance stores declined 1.1%, offsetting the gain in September.

Sales up in eight provinces

Retail sales were up in eight provinces in October.

Ontario (+1.5%) reported the largest increase in dollar terms, with gains widespread across most store types. This was the largest percentage increase since January 2016.

British Columbia (+1.8%) reported higher sales for the fifth consecutive month, largely attributable to higher sales at gasoline stations.

Retail sales in Alberta (+0.8%) and Quebec (+0.5%) were up for the third consecutive month.

Sales in New Brunswick (+1.6%) increased for the third time in four months.

Following a 0.8% decline in September, retail sales were flat in Manitoba.

Following an increase in the harmonized sales tax effective October 1, retail sales declined 1.1% in Prince Edward Island.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

Retail e-commerce is the combination of sales made over the Internet by non-store retailers in the electronic shopping and mail order houses industry and sales made over the Internet by traditional store retailers.

On an unadjusted basis, retail e-commerce sales in October reached $1.1 billion, accounting for 2.3% of total retail sales in Canada.

Summary tables of unadjusted data by industry and by province and territory are now available from the Summary tables module of our website.

For information on related indicators, refer to the Latest statistics page on our website.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Statistics Canada's retail e-commerce figures are disseminated in unadjusted form. As a result, one must use caution when comparing retail sales that are seasonally adjusted [CANSIM 080-0020] in the Daily with retail e-commerce figures [CANSIM 080-0033].

Statistics Canada's retail e-commerce figures include the electronic sales of two distinct types of retailers. The first is retailers that do not have a storefront. These businesses are commonly referred to as 'pure-play' Internet retailers and they are classified to North American Industry Classification System (NAICS) 45411—Electronic Shopping and Mail Order Houses. The second type of retailer is those that have a storefront and are commonly referred to as 'brick and mortar' retailers. If the online operations of a brick and mortar retailer are separately managed, they too are classified to NAICS 45411.

Although Internet sales represent a high proportion of the NAICS 45411 industry group, sales in this industry also include mail-order and catalogue transactions.

CANSIM 080-0033 represents the Internet sales of Canadian based retailers. The foreign e-commerce purchases from Canadian based retailers are included in the Internet sales totals. Conversely, Internet purchases by Canadians from foreign-based retailers are not included in Statistics Canada's retail trade figures.

Online purchases of goods by Canadian consumers, from foreign located retailers are embedded in Statistics Canada's imports goods data series. In 2015, the value of all Canadian postal imports, which includes imports of on-line purchases, was estimated to be $1.8 billion.

Common electronic commerce transactions, such as travel and accommodation bookings, ticket purchases and financial transactions are not included in Canadian retail sales figures. For more information on individual Internet use and e-commerce, consult the most recent release of the Canadian Internet Use Survey and/or the Survey of Digital Technology and Internet Use.

For more information on retail e-commerce in Canada, see Retail E-Commerce in Canada

Total retail sales expressed in volume are calculated by deflating current dollar values using consumer price indexes. The retail sales series in chained (2007) dollars is a chained Fisher volume index with 2007 as the reference year. For more information, see Calculation of Volume of Retail Trade Sales.

For information on trend-cycle data, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Real-time CANSIM tables

Real-time CANSIM tables 080-8020 and 080-8024 will be updated on January 6, 2017. For more information, consult the document Real-time CANSIM tables.

Next release

Data on retail trade for November 2016 will be released on January 20, 2017.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

For analytical information, or to enquire about the concepts, methods or data quality of this release, contact Xinye Yang (613-951-7541; xinye.yang@canada.ca), Retail and Service Industries Division.

- Date modified: