Rising prices are affecting the ability to meet day-to-day expenses for most Canadians

Released: 2022-06-09

Over the past year, consumer inflation has steadily increased, reaching a year-over-year increase of 6.8% in April 2022. Heightened consumer demand and challenges to the supply chain are some of the main factors contributing to higher prices.

To understand how rising prices are contributing to financial concerns or influencing the financial decisions of Canadians, Statistics Canada conducted the Portrait of Canadian Society survey from April 19 to May 1, 2022.

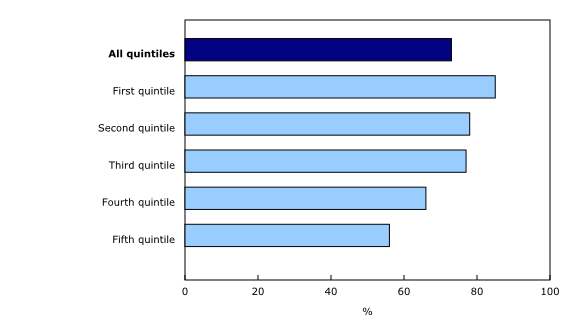

It found that nearly three in four Canadians reported that rising prices are affecting their ability to meet day-to-day expenses such as transportation, housing, food, and clothing. As a result, many Canadians are adjusting their behaviour to adapt to this new reality, including adjusting their spending habits and delaying the purchase of a home or moving to a new rental.

Regionally, there was little variation between provinces—most Canadians are feeling the impacts of inflation. Those in lower income quintiles, however, are more concerned about and affected by rising prices.

More than two in five Canadians report being most affected by rising food prices

During the past year (April 2021 to April 2022), the price of food rose by 9.7%. Canadians had to pay much more for basic food staples, such as fresh fruit (+10.0%), meat (+10.1%) and fresh vegetables (+8.2%). With rising costs in other areas such as shelter and transportation, Canadians have also been less able to budget money for food.

When asked in which area they were most affected by rising prices during the six months preceding the survey, 43% of Canadians answered food. After food, the most affected areas were transportation (32%), shelter (9%) and household operations (8%).

Urban residents reported being most affected by food costs (44%). In contrast, transportation costs were of greater concern for rural residents. More than two in five individuals living in rural areas (43%) reported that transportation was how they were most affected.

Irrespective of province of residence, transportation costs were of great concern for the majority of Canadians who buy gasoline. Among Canadians who buy gasoline, 94% reported they are very (67%) or somewhat (27%) concerned about rising gasoline prices.

One in five Canadians expect they are likely to obtain food or meals from a community organization in the next six months

As a result of rising prices, 20% of Canadians reported that their households are very (7%) or somewhat (13%) likely to obtain food or meals from community organizations, such as food banks, community centres, faith-based organizations, school programs or community gardens, over the next six months. A recent study estimated that fewer than 2% of households used a food bank during a three-month period in the early months of the pandemic. However, the latest statistics from Food Banks Canada indicate that the need for and use of food banks has been increasing since June 2020.

Households with at least one child under the age of 18 were almost three times as likely to say that they are very likely to obtain food or meals from a community organization, compared with households without children (13% vs. 5%).

Younger Canadians are more likely than older Canadians to be very concerned about their ability to afford housing or rent

Another major area of concern for many Canadians is housing costs. Around 56% of Canadians are very (30%) or somewhat (26%) concerned about whether they can afford housing or rent. Shelter prices, including rented accommodation, owned accommodation and water, fuel and electricity, rose 7.4% year over year in April 2022, the largest increase since 1983.

Differences between age groups were particularly significant. Younger Canadians aged 15 to 29 (53%) and 30 to 39 (39%) were more than twice as likely as those 40 and above (20%) to report being very concerned about their ability to afford housing or rent. This could be because older Canadians are more likely to have already purchased and paid off their home.

These concerns have led to changes in behaviour among Canadian youth and younger adults. Over the six months preceding the survey, 39% of those aged 15 to 29 and 38% of those aged 30 to 39 said that they wanted to buy a home or move to a new rental but decided not to because of price concerns, compared with 24% of the overall population.

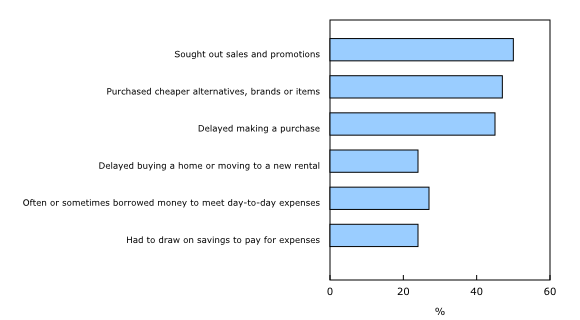

Many Canadians have adjusted their spending habits and lifestyle to cope with inflation

In order to deal with rising prices, half of Canadians said they have sought out sales and promotions in the six months preceding the survey. Meanwhile, 47% have found themselves purchasing cheaper alternatives, brands or items and 45% have delayed making a purchase in response to rising prices.

In addition to making changes to their spending habits, more than one-quarter of Canadians (27%) reported that they have had to borrow money from friends or relatives, take on additional debt or use credit to meet day-to-day expenses in the six months preceding the survey. Several groups were more likely to report borrowing money: those in the bottom two household income quintiles; younger individuals (aged 15 to 39); households with at least one child aged 17 or younger; persons with a disability; and individuals belonging to racialized groups.

Rising prices are also affecting Canadians' ability to save. About 24% of Canadians said they have had to draw on their savings in order to pay their expenses. Another 29% said they were saving less, and 19% reported they are no longer able to save each month.

In the coming months, Statistics Canada will continue to monitor the impacts of rising prices on Canadians.

Note to readers

The data in this release are from the third survey of Statistics Canada's survey series, Portrait of Canadian Society (PCS). The PCS survey series is a brand-new project that consists of short online surveys given to the same respondents over a one-year period. These voluntary surveys use a probability panel based on the General Social Survey – Social Identity and are therefore representative of the Canadian population aged 15 years and older.

The PCS survey series are part of Statistics Canada's modernization efforts and are at a pilot stage. This collection method will be refined over time. For this study, survey weights were adjusted to minimize potential bias that could arise from panel non-response. Non-response adjustments and calibration using available auxiliary information were applied and are reflected in the survey weights provided with the data file. Despite these adjustments, non-response to the panel increases the risk of remaining bias, which may impact estimates produced using the panel data. Users should consult the accompanying guide for data quality guidelines and considerations.

The first survey in the PCS survey series, which looked at perceptions of life during the pandemic, collected data on Canadians' mental and general health, physical activity, life satisfaction and view of the future.

The second PCS survey collected data on employment, employment benefits and training, access to healthcare and intent to vaccinate, perceptions of safety, financial impact of the pandemic and expectations about the future. Respondents are categorized as living in either urban or rural areas based on the population centre/rural area associated with the respondent's postal code.

The third PCS survey collected information about people's perceptions about the impact of rising costs on their lives, and in some instances the lives of their family, friends and community members. Respondents were asked how they thought the rising cost of basic needs such as food, transportation and housing is affecting their ability to meet day-to-day expenses, their ability to save, and their ability to make large purchases, such as a home. More generally, this survey attempts to capture how individuals' perceptions of rising costs (or inflation) is influencing their behaviours.

The aim of the series is to fully understand the experiences and needs of communities in order to implement suitable support measures for Canadians. Statistics Canada would like to thank all Canadians who took the time to answer these questions during this time of crisis.

Products

The infographic "Impacts of rising prices on Canadians" is available as part of Statistics Canada – Infographics series (11-627-M).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: