Personal Protective Equipment Survey, January 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-03-31

The onset of the Omicron variant of COVID-19 in the latter part of 2021 prompted provincial governments across the country to tighten public health guidelines, which continued through the first months of 2022, so as to limit the spread of the virus. The Personal Protective Equipment Survey explores the evolution of private sector businesses' demand and supply of personal protective equipment (PPE) in January 2022.

Demand for PPE among businesses declined in January 2022 compared with August 2021. Even so, significantly more businesses were concerned about shortages of essential PPE compared with August 2021. As in August 2021, most shortage expectations were reported by businesses in the educational sector. Among the required types of PPE, businesses indicated an increased need for surgical masks, respirators, and COVID-19 rapid test kits in January 2022.

Need of businesses for personal protective equipment declines in January

In January, over half (55.7%) of the businesses responding to the Personal Protective Equipment Survey reported that they needed or expected to need PPE to operate in accordance with COVID-19-related public health guidance, which is a 4.8% decrease in demand for PPE from August 2021.

Businesses in the educational services (91.8%), accommodation and food services (76.7%), health care and social assistance (77.8%) and manufacturing (68.0%) continued to have the highest demand for PPE. Conversely, businesses in professional, scientific and technical services (38.9%), finance and insurance (32.5%) and agriculture, forestry, fishing and hunting (28.4%) had the lowest demand.

Nearly two-thirds (64.1%) of the businesses that needed PPE in order to operate safely, required at least 3 of the 10 types of PPE that are covered in this survey. The distribution for most of the PPE items demanded by businesses has stayed relatively stable from August 2021. However, this January, there has been an uptick in the demand for surgical masks, respirators, and COVID-19 rapid test kits.

Concerns about personal protective equipment shortages by businesses increase in January

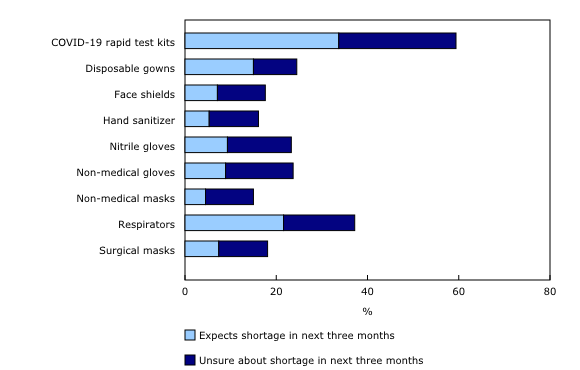

In January, over one-third (34.2%) of the businesses that needed at least one type of PPE to operate in accordance with public health guidelines had concerns about PPE shortages within the next three months. This represents an 11.1 percentage point increase from August 2021.

The businesses in the educational services sector (43.3%) were the most likely to have shortage concerns in any one type of required PPE, while businesses in retail (9.7%) were the least likely. Businesses were most likely to expect shortages in COVID-19 rapid test kits (59.4%) and least likely to report shortage concerns for non-medical masks (15.0%).

Most businesses not using COVID-19 rapid tests

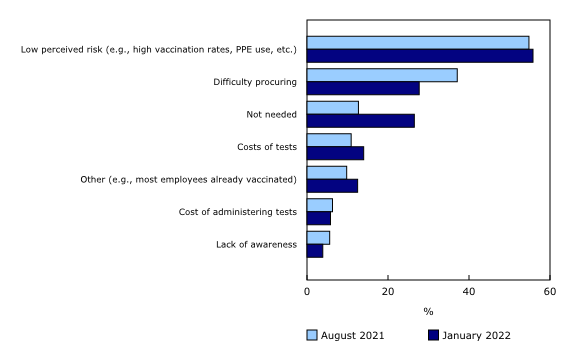

Just under two-thirds (66.4%) of businesses that had employees working on-site did not use COVID-19 rapid test kits to test those employees for COVID-19 infection. Just over one-quarter of businesses (25.8%) indicated having used COVID-19 rapid test kits to test on-site employees, representing a 21.3 percentage point increase in COVID-19 rapid test usage compared with August 2021.

More than two-fifths (44.8%) of the businesses that indicated not using rapid test kits still do not plan to use COVID-19 rapid tests to check for COVID-19 infections among their on-site employees in the next three months. The most commonly cited reasons for not using COVID-19 rapid tests were "low perceived risk" (55.8%), "difficulty procuring" (27.7%) and "not needed" (26.5%).

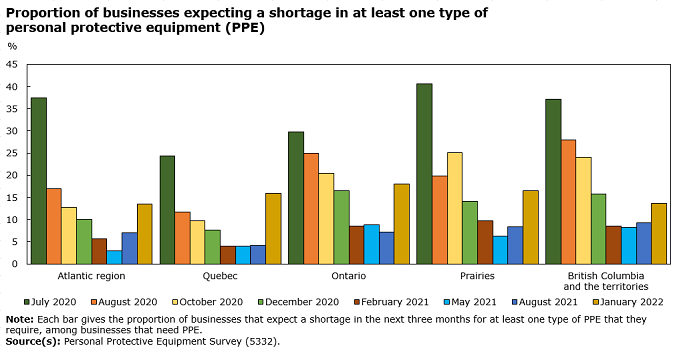

Shortage expectations for personal protective equipment vary across provinces

This January, more businesses indicated being concerned about potential shortages in at least one type of PPE they require in the next three months, with businesses in Ontario (18.0%) being the most likely to have PPE shortage concerns.

Share of businesses involved in the manufacturing or distribution of personal protective equipment increases

In January 2022, nearly 1 in 10 (8.6%) businesses in the manufacturing, retail, and wholesale sectors were involved in the manufacturing or distribution of personal protective equipment. This represents a 3.2 percentage point increase compared with August 2021.

Nearly three-fifths (57.4%) of businesses reported sourcing PPE from domestic retailers. These were followed by domestic wholesalers at just over one-third (34.7%), and then by domestic producers (20.8%). Together, more than four-fifths (83.4%) of businesses indicated using PPE from domestic sources (domestic retailers, domestic wholesalers, and domestic producers).

Note to readers

The 10 types of personal protective equipment (PPE) covered by the survey are COVID-19 rapid test kits, disposable gowns, face shields, hand sanitizer, nitrile gloves, non-medical gloves, non-medical masks, respirators, reusable gowns, and surgical masks.

The results obtained in August 2021 are not directly comparable with the January 2022 survey results due to the exclusion of disinfectants, disinfectant wipes, eye goggles, shoe or boot covers and thermometers.

This release is based on data from the January 2022 Personal Protective Equipment Survey. This voluntary survey collects information on private sector businesses' supply, demand and inventories of PPE. Results from the January survey were based on responses from 5,219 businesses operating in Canada.

Products

The new study "Examining businesses' needs for personal protective equipment" is now available as part of the series StatCan COVID-19: Data to Insights for a Better Canada (45280001). Using data from the January 2022 Personal Protective Equipment Survey, this study examines the evolution of private sector businesses' demand for personal protective equipment since August 2021 and the concerns about lack of supply.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: